USCI: Here Are Some Better Options To Consider

Summary

- United States Commodity Index Fund, LP ETF is a commodity exchange-traded fund that seeks to replicate the performance of an index consisting of 14 futures contracts.

- The ETF's performance depicts a significant tracking error, with a trend suggesting it will only get worse.

- A comparison to other commodity ETFs reveals there are better options for both low-volatility and high-returns seeking investors.

- Its expense ratio is among the highest of what commodity ETFs charge, and I don't think it's reasonable.

- In this post, I refer interested investors to examine some alternatives I have covered in the past.

Nomi2626/iStock via Getty Images

Thesis

The United States Commodity Index Fund, LP ETF (NYSEARCA:USCI) tracks an index in an effort to provide exposure to commodity markets using a rules-based methodology. However, since it was launched, it has failed to capture the price changes of the index by a wide margin.

Additionally, comparing it to other commodity exchange-traded funds, or ETFs (both passive and active), USCI's returns are underwhelming, deeming it unfit for a long-term holding period. With that being said, its volatility has been relatively low, and it's less correlated to the market than most of the other options.

As for its expense ratio, it's too high for its prospects based on what we can say so far about it. There are cheaper commodity ETFs that have performed better, and there is actually one that has been even less correlated to the market than USCI (mentioned below).

What does USCI do?

USCI is a U.S.-based commodity ETF that was issued by United States Commodity Funds LLC on August 10, 2010, and is co-managed by the same and SummerHaven Investment Management LLC. Its objective is to track the performance of the SummerHaven Dynamic Commodity Index Total Return SM (owned by SummerHaven Index Management, LLC), which aims to reflect the performance of various commodities through futures contracts.

More specifically, the index will track the performance of a futures basket consisting of 14 equally-weighted contracts that are selected each month out of a total of 27 potential ones. The sectors these futures include are the following:

- Petroleum (heating oil, crude oil, etc.)

- Precious metals (gold, platinum, silver, etc.)

- Industrial metals (e.g., zinc, nickel, aluminum, copper, etc.)

- Grains (wheat, soybeans, corn, etc.)

- Non-primary sector (coffee, cocoa, sugar, cotton, natural gas, lean hogs, live cattle, feeder cattle)

The ETF will attempt to track the index by trading its underlying futures contracts as much as it's possible. However, because of regulatory requirements and changes in market conditions, USCI may trade different contracts on the same commodities.

Performance

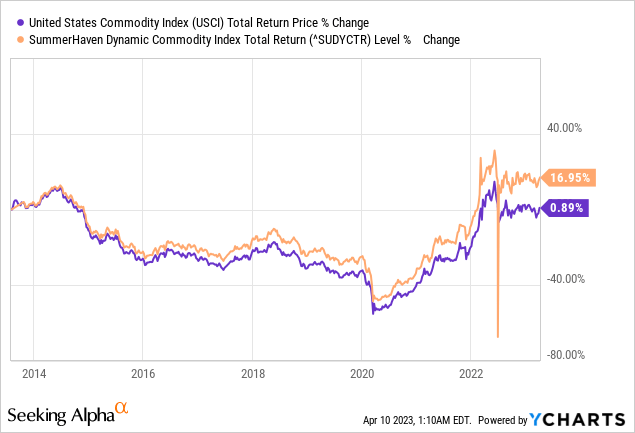

Since its inception, USCI produced an annualized return of 0.96% (market price). In contrast, the index it tracks returned 2.46% per year. As a consequence, its overall growth since it was launched was underwhelming:

Evidently, it failed to track the index by a wide margin. And by looking at the chart, it seems that this margin will only continue to widen, making this ETF unreliable when it comes to replicating the index.

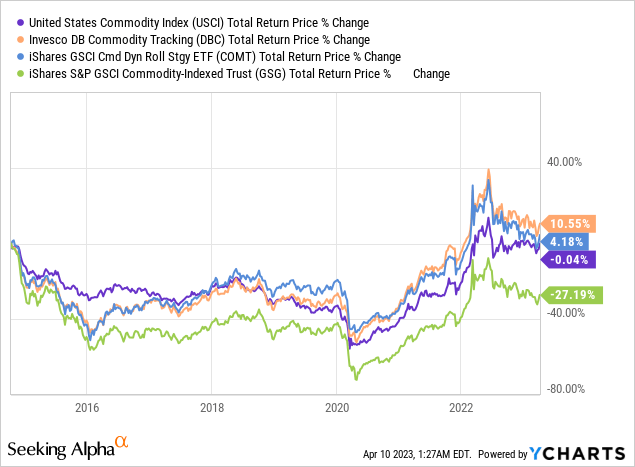

As expected, its relative performance to competing ETFs doesn't look good either:

Since iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT) was launched, which is the youngest commodity ETF of the above, USCI shrank by 0.04%. Compared to the others, it had a more steady decline up to 2020 when it started marking its upward trend, hinting at a lower volatility.

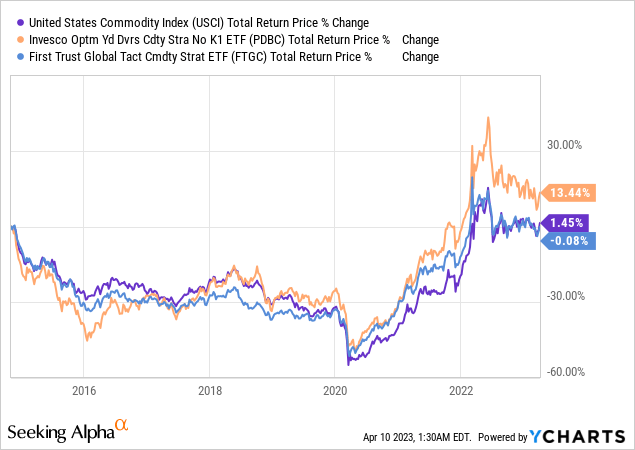

Only iShares S&P GSCI Commodity-Indexed Trust ETF (GSG) performed worse than USCI, with the other two ETFs significantly outperforming it. Keep in mind that I have excluded actively managed ETFs from this comparison. For a more complete idea of its performance, let's also look at how it fared against two actively managed commodity ETFs:

Since the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) was launched, it outperformed USCI by an even greater margin than other index commodity ETFs. However, USCI did better than First Trust Global Tactical Commodity Strategy Fund ETF (FTGC), which I recently covered and found it being even less volatile than USCI, but not a relatively good option either.

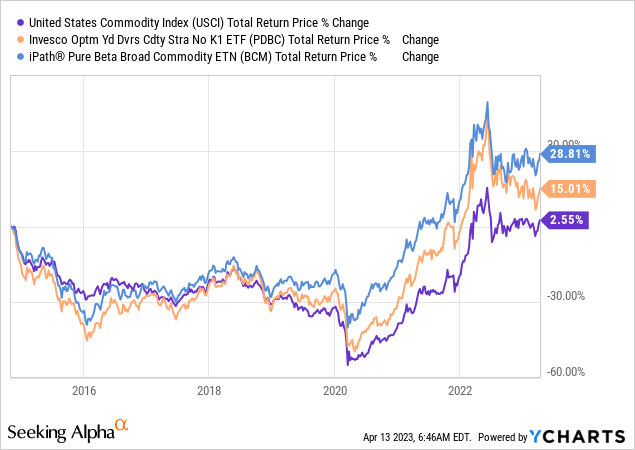

Now, for those looking for the best historical performance possible from a commodity ETF, the above comparison naturally leads to a need for examining PDBC. But if you are looking to hold such an ETF for a very long time, iPath Pure Beta Broad Commodity ETN (BCM) is, in my opinion, an even better choice:

BCM's performance is not the only reason I think this is a better fit for a long-term diversified portfolio. Take a moment to check my review of it to learn more.

Last but not least, if you're most interested in volatility and correlation, USCI is the most attractive option out of both the active and index ETFs we looked at above.

| Ticker | Max. Drawdown (%) | Standard Deviation (%) | Correlation (SPY) | Beta SPY |

| USCI | -55.05 | 15.52 | 0.41 | 0.41 |

| PDBC | -49.52 | 17.66 | 0.46 | 0.52 |

| DBC | -50.84 | 18.05 | 0.46 | 0.52 |

| COMT | -51.03 | 18.41 | 0.48 | 0.56 |

| FTGC | -51.67 | 13.34 | 0.49 | 0.42 |

| GSG | -71.09 | 23.39 | 0.44 | 0.65 |

Since PDBC was launched, USCI had a standard deviation of 15.52. FTGC was even less volatile, but it was more correlated to the market, with a significantly higher beta.

However, to have the longest possible time frame for the above comparison, I excluded a more recently issued commodity ETF, the Direxion Auspice Broad Commodity Strategy ETF (COM).

As I said in my recent coverage of this ETF, its risk-adjusted returns are superior to all of the above, and it's the least correlated to the market, deeming it a better equity hedge.

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| USCI | 1.01% | $205.43M | 08/10/2010 |

| COM | 0.81% | $294.36M | 03/30/2017 |

| COMT | 0.48% | $894.36M | 10/15/2014 |

| GSG | 0.75% | $1.11B | 07/10/2006 |

| DBC | 0.85% | $2.20B | 02/03/2006 |

| FTGC | 0.95% | $2.97B | 10/21/2013 |

| PDBC | 0.59% | $5.71B | 11/07/2014 |

I am also having trouble justifying an investment in USCI because of its 1.01% expense ratio. After all, it's an index fund. One could argue, of course, that I cannot judge its expense ratio on the basis of its relatively passive approach.

With that being said, the ETF failed to track its index and looks like it will continue to do so. I would be willing to ignore the cost if its historical performance looked good, but as we've seen above this isn't the case.

Sure, its relatively small size of assets under management ("AUM") prevents me from confidently declaring that the fees are "simply wrong." But that doesn't change the fact that compared to its peers that I listed above, USCI has the highest expense ratio and its returns were underwhelming. That's more than enough for me to at least put it into the "unreasonably expensive" category.

Risks

For the complete list of risks that the issuer has mentioned in regard to investing in USCI, take a look at the related prospectus. Below, I will list the two risks that I think are the most relevant when it comes to investing in ETFs like USCI:

- Counterparty Risk: USCI trades futures contracts and is, therefore, subject to counterparty risk, which entails the other party in a futures transaction becoming unable to fulfill its obligation.

- Commodity Risk: Naturally, investing in USCI exposes you to commodity prices which can be affected by various factors such as regulatory changes, political developments, market events, war, etc.

Verdict

In conclusion, USCI is not an attractive commodity ETF, given both its underperformance to its benchmark and competitors. In addition, its expense ratio is too high to justify its underwhelming returns over such a long period and its wide tracking error.

I believe that there are better options for both, those who are looking for low-volatility exposure to commodities and decent long-term commodity returns. But even if there weren't any, I would still not find any reason to invest in USCI.

What do you think? Please, take a moment to share your thoughts in the comments below. Also, consider following me as there are more posts on the way. Thank you for reading.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.