Infosys and TCS have warned of further subdued demand amid macro uncertainties in the US and Europe.

While the underwhelming earnings of India’s top two IT services firms have disappointed the street, some more pain may be on the cards as the management of both companies warned of further subdued demand amid macro uncertainties plaguing the US and Europe.

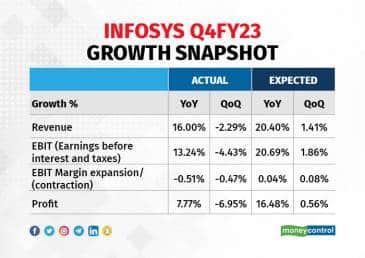

On April 13, Infosys reported a 7.8 percent year-on-year (YoY) growth in its consolidated net profit of Rs 6,128 crore, while revenue increased 16 percent to Rs 37,441 crore. The company saw a quarterly de-growth of 4.4 percent and 2.3 percent in profit and revenue, respectively.

The company's US-listed shares fell 10 percent in New York trading, while it closed 3 percent lower on the National Stock Exchange (NSE) on April 14. Meanwhile, its peer and the country’s largest IT firm, TCS, closed 2 percent down.

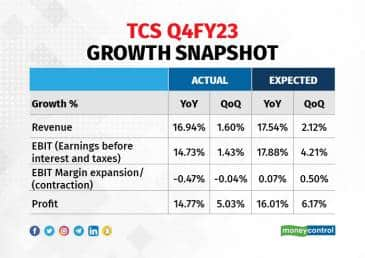

TCS also reported lower-than-expected numbers with revenue from operations increasing 16.9 percent YoY at Rs 59,162 crore, and profit growing 14.8 percent to Rs 11,392 crore. Sequentially, growth came in at 1.4 percent and 5 percent for revenue and profit, respectively.

“The March quarter has been weaker than anticipated, primarily due to North America," said TCS CEO Rajesh Gopinathan, adding, "We were expecting a comeback after a seasonally-weak third quarter, but that didn’t happen."

While the March quarter was expected to be seasonally weak, with analysts also anticipating and factoring in additional subdued growth due to weakness in the financial services segment resulting from liquidity concerns in the US and Europe due to the collapse of SVB and Credit Suisse, the performance was weaker than anticipated and is especially concerning at a time when talks of recession are also trickling in.

“I think in the near term there are challenges. Analysts have assigned a 30-35 percent probability that the US might be going through a recession, so yes, there is a bit of a risk in the near-term, because of which the TCS management has been a bit cautious in its guidance,” said Sumit Jain of ICICI Securities in an interview to ET.

TCS management has not indicated when it expects growth to pick up and whether it will be front- or back-loaded in FY23-24, said Girish Pai, Head of Research at Nirmal Bang, a broking firm, adding that he suspects that growth will be broadly weak across all quarters and possibly turn weaker in the second half, since he thinks that the adverse impact of a weak macro lies ahead and not behind us.

Meanwhile, Infosys has given a USD CC (constant currency) revenue growth guidance of 4-7 percent YoY, citing increased macro uncertainties.

“The 4Q revenue growth was surprising and is likely to have a dampening effect on the company’s FY23-24 growth, particularly since it suggests a significant impact on growth from Infosys’s discretionary business, which has been facing pressure in the recent few months due to the macroeconomic slowdown. We expect FY23-24 revenue growth to be around 5.2 percent YoY in CC terms, which is near the lower end of the guidance band, as it takes time for mega deals to convert into orders and revenues,” said analysts at Motilal Oswal.

For TCS, they said that management commentary on near-term demand was among the weakest in recent history (excluding the initial months of the pandemic), with the management indicating weakness in the US on account of deferrals in clients’ discretionary spends with the BFSI (banking and financial services) vertical being the most affected.

Foreign brokerage firm Nomura reduced its Buy rating for Infosys to Neutral, while also cutting its target price (TP) to Rs 1,290 from Rs 1,660 earlier. It said that the guidance and deal wins indicate a weak outlook and the growth differential with TCS will narrow.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.