Coal-fired power stations are the world’s biggest source of electricity. (Source: Bloomberg)

Coal may be unloved by most, but it’s still consumed by many. Can that demand be parlayed into a newly formed company worth billions of dollars, attracting institutional shareholders that, for the most part, are under pressure to burnish their green credentials?

If you’d have asked me a few weeks ago, I would have said “no way.” But Glencore Plc, the world’s biggest commodity trader, is willing to risk $8 billion of its money to prove everyone — including me — wrong. And having run the numbers, I admit Glencore has a chance — so long as coal prices remain sky-high.

Even today, coal-fired power stations are the world’s biggest source of electricity. Last year, nearly four-in-10 megawatts were produced burning the dirtiest of all fossil fuels. Measured in metric tons, global coal demand has done nothing but increase since the world started to get serious about global warming, up 75 percent from 1997 (Kyoto Protocol), and 5 percent from 2015 (Paris Agreement).

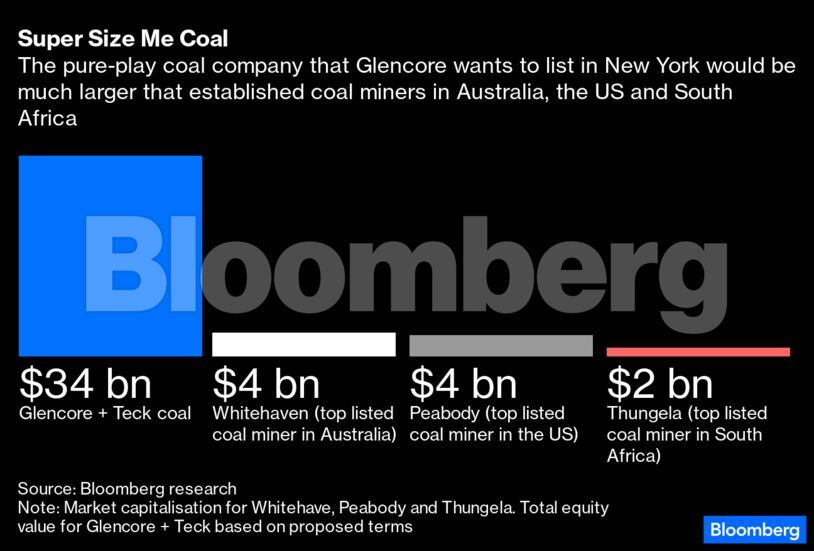

To be sure, Glencore’s coal ambition remains on the drawing board. It’s part of its battle to buy Canada’s Teck Resources Ltd, with the world’s biggest commodity trader proposing to spin off their combined coal-mining businesses on the New York Stock Exchange. As some Teck shareholders have balked at the idea of owning a chunk of the new coal company, Glencore has offered to buy their 24 percent out for $8.2 billion in cash. If the plan goes ahead – a big if — the new coal company would be worth about $34 billion, based on Glencore’s latest proposal to Teck’s holders.

Is that a lot? Yes: It exceeds the combined market value of the top 15 pure-play coal companies listed in New York, London, Johannesburg, and Sydney. The biggest publicly listed American coal miner is Peabody Energy Corp, worth $3.6 billion, excluding debt. At $34 billion, the new super-sized coal business would be larger than Walgreens Boots Alliance Inc, the smallest member of the Dow Jones Industrial Average.

First, it believes that while most institutional investors hate coal, many others would still love the fat dividends the coal miner would probably pay — not unlike their relationship to Big Tobacco. (Altria Group Inc maker of Marlboro cigarettes, trades at a yield of about 8 percent.)

Second, it sees that the mining companies that have stuck with coal despite pressure to divest are making a killing. Demand is rising, while supply is constrained because institutional investors, led by the likes of BlackRock Inc, have convinced every publicly listed miner to stop opening new pits. The arrangement is so good that from the outside it almost looks like a cartel. Coal prices last year jumped to an all-time high as Europe bought more than before to offset the loss of Russian natural gas and China upped consumption after suffering power blackouts last summer. Even after falling nearly 50 percent in early 2023, they remain at levels that, barring 2022, would be historically high.

Thanks to those prices, the new coal miner would deliver underlying earnings of about $16 billion in 2023, according to the investment bank TD Cowen. With little in capital expenditures, as the company would downsize over time to meet climate change pledges of reducing coal production, shareholders could expect lots of free cash flow for at least two decades. As long as coal prices remain high — and that’s the key — investors seeking yield would enjoy the ride. Carrying no debt, those underlying earnings of $16 billion would equate to an enterprise value to EBITDA ratio of 2.2 times. That’s in line with Peabody and Whitehaven Coal Ltd, a big Australian miner, but more than the 1.3-to-1.7 times of other coal miners.

If Glencore is going to triumph, it requires coal prices to remain as high as they are today, around $200 a ton for the benchmark Australian material, compared to an average of $75 a ton between 2000 and 2020. The more investors hate coal — limiting production — the more likely that coal prices remain high. Ironically, ESG is key to a downsizing coal industry remaining profitable and keeping diehard investors along for the ride. Crudely, that’s Glencore’s play.

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg