Emerging Markets Banks: Resilient To Headwinds

Summary

- Deposits are the main source of funding for EM commercial banks.

- Some frontier countries still lag in terms of regulatory best practices.

- The volatility seen in the aftermath of recent events created investment opportunities.

tum3123

There has been increasing scrutiny of emerging markets (EM) banks over the past few weeks as the market looks to uncover vulnerabilities to the same issues that hit developed market (DM) banks in the United States and Europe. While EM banks are not immune to the kind of banking stress felt in the United States and Europe, we think it's unlikely that they will face similar issues - meaning the impact should come primarily through second-order effects.

Here are four reasons why.

Leading Banks, Stable Depositor Bases

Deposits are the main source of funding for EM commercial banks. The average share of deposits in banks' funding base ranges from 60% to 80%, depending on the region (Asia, Central and Eastern Europe, Middle East, and Africa, or Latin America). These banks' deposit bases are generally granular and well-diversified. These factors limit the reliance of EM banks on wholesale funding and make them less vulnerable to sudden deposit outflows.

Moreover, banks with leading market positions - those that rank among the top five financial institutions within their respective countries - make up more than 80% of the banking sector market cap within the JPMorgan Corporate Emerging Market Index (CEMBI) Broad Diversified. That is important because large banks with leading market positions tend to be perceived as safe havens, and as such are likely to benefit from a flight to quality in a scenario in which deposits flow out from smaller institutions.

Regulation: They've Got It

Basel III - an international regulatory accord that introduced a set of reforms designed to mitigate risk within the international banking sector by requiring banks to maintain certain leverage, capital, and liquidity ratios - is either in place or underway in most EM countries where banks are based.

More than 80% of the 33 countries in the JPMorgan CEMBI Broad Diversified with issuers in the banking sector are subject to these stricter capital and liquidity requirements. Banks in these countries represent 95% of the index's banking sector exposure.

Some frontier countries still lag in terms of regulatory best practices. However, banks in these countries represent a very small part of the investable universe.

In addition, most EM countries in the JPMorgan CEMBI Broad Diversified have some type of deposit insurance or guarantee system in place. Although coverage varies widely across countries, we believe this supports the stability of deposits.

The only countries with banks in the index that do not have fully established deposit insurance systems are Israel, South Africa, Qatar, the United Arab Emirates, and Panama - but most of these countries are currently in the process of setting up deposit insurance systems.

Exposure to Held-to-Maturity (HTM) Securities: Not Concerning

The developments at Silicon Valley Bank put banks' exposure to fixed-income securities marked as held-to-maturity into the spotlight. These holdings are not marked to market and can negatively impact banks' capital position in the event that the fair value losses are realized.

This risk is likely to be higher in jurisdictions that hiked interest rates more aggressively over the past one to two years, as did most Latin American, Central European, and Eastern European countries. The financial impact ultimately depends on how large HTM portfolios are relative to total capital, the duration of the securities holdings, and the degree of rate increases in each country.

An analysis of EM banks suggests that we will see modest impacts to capital arising from these exposures, mostly limited to less than 100 basis points (bps) of common equity tier 1 (CET1). Among financial institutions for which the impact would be larger than that, we believe the total effect on capital would be largely manageable relative to minimum capital requirements.

Importantly, unrealized losses in HTM securities only become a risk once a bank starts seeing meaningful deposit outflows, requiring it to raise liquidity through investment sales, which, based on our analysis of EM banks' funding profiles, seems unlikely.

AT1s: What Now?

Additional tier one (AT1) bonds have become an important component of banks' capital structures. These bonds, which can be converted into equity or written off if a bank's capital levels fall below a certain threshold, are a cost-effective way to meet regulatory capital requirements. But some controversy arose in Switzerland when Credit Suisse's AT1 holders found themselves lower on the pecking order than equity shareholders.

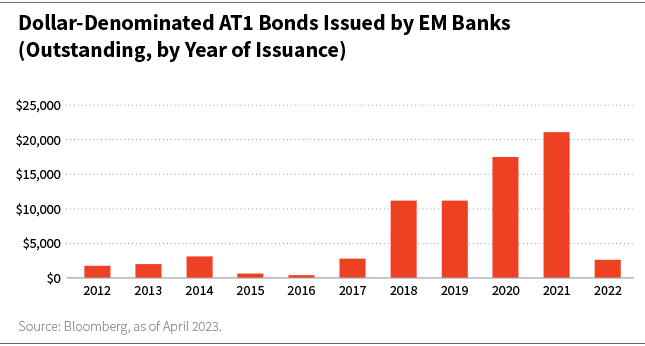

EM banks have been issuing AT1s for the last 10 years, and issuance has gained pace over the past five years amid low-interest rates, as the chart below shows. Still, AT1s represent a small portion of EM corporate debt, making up less than 5% of the J.P. Morgan CEMBI Broad Diversified.

Bloomberg

While we do not believe recent events mark the beginning of the end of AT1s, we acknowledge that these events represent a major shock to this portion of the fixed-income investment universe, as reflected in the pricing of these instruments in the secondary market.

As such, it might take some time for issuers to return to the primary market to issue AT1s at yield levels deemed acceptable. We also believe the recent spread widening in AT1 paper is likely to increase extension (non-call) risk for bank capital instruments, as it becomes more expensive to issue new bonds to replace existing callable instruments.

Although a permanent shutdown of the AT1 primary market is not our base case, we have analyzed the capital positions of 45 issuers whose AT1 bonds are part of the J.P. Morgan CEMBI Broad Diversified to assess their ability to meet Tier 1 capital requirements solely with common equity Tier 1 (CET1). Our analysis showed that only three banks in the sample would not be able to do so. Within those cases, the maximum Tier 1 capital shortfall would be 70 bps, while the median excess capital buffer stood above 300 bps.

There's also been a renewed focus on documentation as the developments in Switzerland raised questions about the priority of AT1s within banks' capital stack in a resolution event. The track record of AT1 write-downs in EMs is limited to one institution in India, making it hard to come to any conclusions. So far, Singapore and Hong Kong regulators have publicly confirmed the seniority of AT1 instruments of equity holders in the event of a resolution.

Conclusion

We believe the recent banking stress in DMs is likely to have a limited direct impact on most EM banks because these institutions benefit from stable deposit bases, are well-capitalized, and are well-regulated. In our view, DM banking stress is most likely to affect EMs and EM banks indirectly, through growth and capital flow channels. The appetite for AT1 instruments has also been negatively impacted, and it's still uncertain whether these effects will be long-lasting.

Moreover, the volatility seen in the aftermath of recent events created investment opportunities. We will continue to assess the market for good entry points to add exposure to banks with strong fundamentals at attractive valuations across the capital structure.

We see the resumption of primary market activity as evidence that investors are, to a certain extent, comfortable with the risk profile of EM banks with solid credit fundamentals - at least in the investment-grade space. Since the last week of March, banks based in Indonesia, Saudi Arabia, and Korea have successfully priced senior debt issuances in the Eurobond market. These transactions had strong demand from investors and were priced at spreads relatively close to secondary market levels.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by