Fusion Pharmaceuticals: Early Stage Targeted Radiopharmaceutical Therapy Developer

Summary

- Fusion Pharmaceuticals counts JNJ among its founding funders.

- They have an early stage pipeline of interesting targeted radiopharmaceuticals.

- Once they have data, I will probably be more interested.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Olga Tsyvinska

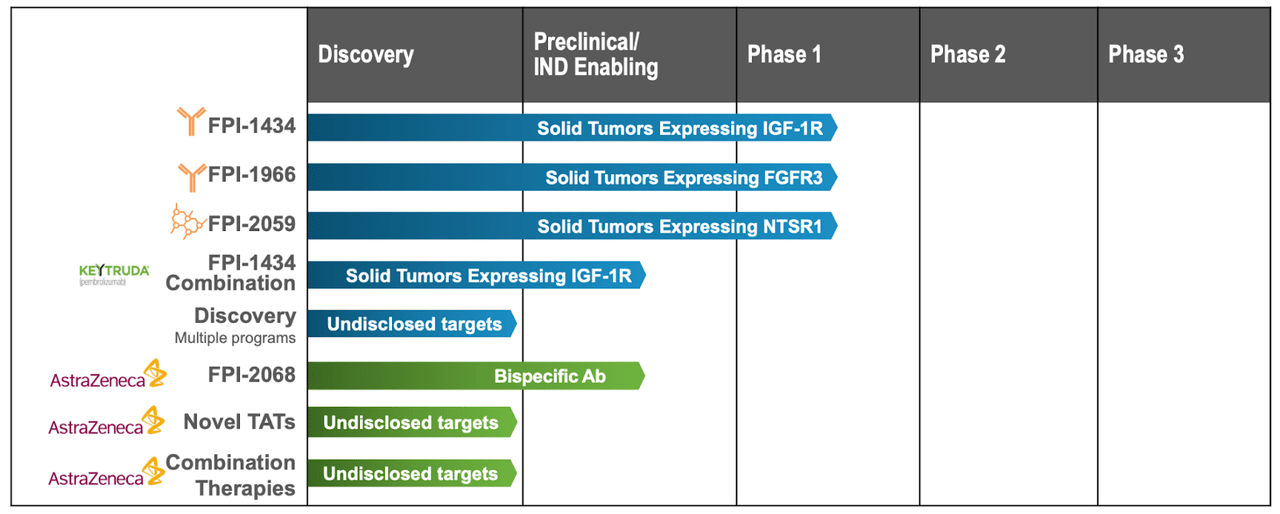

Fusion Pharmaceuticals (NASDAQ:FUSN) delivers an alpha emitting payload to cancer cells using its proprietary linker technology that uses IGF-1R, an established cancer biomarker. They call the platform TAT, short for Targeted Alpha Therapy, and the linker technology is called Fast-Clear. Lead candidate is FPI-1434, which is in a phase 1 trial targeting solid tumors expressing IGF-1R. Here's the pipeline:

The other major candidate, which came through a recent acquisition, is FPI-2265 which is in a phase 2 trial targeting metastatic castration resistant prostate cancer or mCRPC. FPI-1966 targets Head & Neck and Bladder cancer expressing FGFR3. There's also FPI-2059 targeting solid tumors targeting NTSR1. These are in the clinic and the company has announced dosing of patients. The rest of the pipeline is preclinical.

FUSN uses actinium-225 isotopes to deliver alpha particles. Alpha particles have a number of advantages over beta particles. They can deliver a high amount of radiation over a short distance of 1 to 3 cells. They can deliver a much higher amount (1500x) of linear energy than beta particles. These properties make alpha particles both more potent and more specific, i.e. safer and more effective. The company's linker technology also helps increase clearance of ac-225 once its work is done. The company has shown in preclinical models that there's a 3x difference in this respect between other commercial linkers and Fusion's proprietary linker.

The company has a supply agreement with the US Dept of Energy for their actinium 225 isotopes. Like in a few other pharma niches, a working supply chain is very essential in radiopharmaceutical companies. The company has multiple other supply chain agreements with other providers as well. They also have the largest dedicated TAT manufacturing facility, which will be operational in 2024.

Their nearest term catalyst is phase 1 data from FPI-1434, which is anticipated in Q2 2023. FPI-1434 uses IGF-R1 merely to identify cancer cells (on which IGF-R1 is overexpressed), but the mechanism of action does not involve blocking the IGF-R1 pathway. IGF-R1 is 100% overexpressed in bladder and ovarian cancer, 90% in sarcomas, and to a high degree in many other solid tumors. The molecule has completed the SAD part of the study, and the MAD part is now ongoing. SAD = single ascending dose and MAD = multiple ascending doses.

I read through the company material. There's really not much to say about their programs right now. They are all running phase 1 trials, and there's no data yet. The company does not specifically discuss preclinical data. The targets are authenticated, the linker validated, the payload well-established as a potent cancer killer. There's no proof of concept yet. So we have to wait until the end of the current quarter to hopefully get the POC from 1434. Then next year for POC for the next candidate, which is 1966.

There's some preclinical data for 2059. Fusion acquired the small molecule 177Lu radiopharmaceutical, IPN-1087, from Ipsen, and then switched 177Lu for 225Ac. This new molecule, 225Ac-IPN-1087, showed that a single dose was able to kill tumor cells in preclinical models, and that tumor regression with actinium-based FPI-2059 was achieved at doses 1500x-lower than the lutetium-based compound.

Fusion has multiple big pharma collaborations. In 2020, it entered into a collaboration with AstraZeneca to develop and commercialize novel TATs. There was a $5mn upfront payment and $40mn in potential biobucks. Besides this, they have deals with ImmunoGen, Roche and Ipsen, among others.

Financials

FUSN has a market cap of $263mn and a cash balance of $186mn. Research and development expenses for the fourth quarter of 2022 were $17.6 million, while general and administrative expenses were $6.9 million. At that rate, they have a cash runway going into 2025.

In February, the company raised $60mn through a private financing in order to fund its acquisition of 2265 from RadioMedix.

The company IPO-ed in 2020. They have a very low trading volume. Their holding structure shows a decent retail involvement as well as institutional ownership. Among key owners, founding venture investor Johnson & Johnson (JNJ) holds a solid 6% chunk. There are a few insider buys and a large number of insider sales by the CEO.

Bottomline

Targeted radiopharmaceutical therapy is an area of interest for me. Existing approved therapies are mostly beta emitters, although there is at least one alpha emitter as well. However, these therapies have not found a lot of traction in the market, because of off target effects, among other issues. Although FUSN stock is too early for me to invest, I will keep tracking this name.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.