Rio Tinto Stock: Net Zero Is A Huge Tailwind

Summary

- We start this article by discussing the implications of net zero on commodity demand, as expectations are that spending could reach up to $10 trillion in the next few decades.

- Rio Tinto Group is a fantastic net zero play thanks to its commodity exposure in the right areas, its expansion plans, its healthy balance sheet, and its focus on shareholder distributions.

- RIO stock is fairly valued and poised to deliver satisfying capital gains and dividends in the years and decades that lie ahead.

Petmal

Introduction

I'm frequently accused of being against any measures that protect the environment. After all, one of my favorite topics is my long-term oil and gas bull case. However, I'm not against environmental protection - the opposite is true. The only thing that bothers me a lot is the forced energy transition. As we're currently finding out, it's very inflationary and almost impossible to execute on a big scale. That said, there are plenty of ways to benefit from that. One way is by buying mining companies.

In this article, I will present a compelling argument for considering a long-term investment in the renowned mining conglomerate Rio Tinto Group (RIO). With its strategic positioning to capitalize on a projected surge in global metal demand over the long run, coupled with its robust financials, including a strong balance sheet and impressive free cash flow generation, Rio Tinto offers a promising opportunity for investors seeking attractive dividends.

So, let's get to it!

Net-Zero Means Buying Miners & Equipment

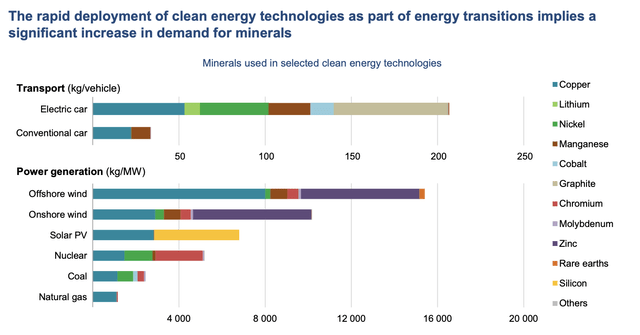

In January, I wrote an article explaining why Caterpillar Inc. (CAT) is one of the best stocks to benefit from the global rush toward net zero. One of the charts I used can be seen below. Below, we're looking at the increased demand for metals per net zero application.

An electric car uses more than 200 kilograms of minerals. A conventional car doesn't even use a quarter of that. The same goes for power generation like wind and solar, which require significantly more metals than traditional energy sources like coal and natural gas. I'm fully aware that coal is far from perfect, but my takeaway here is the increase in metal demand to transition away from coal.

One can imagine what this means in terms of costs. It's why I am against the forced energy transition. We're basically in a situation where governments decide which energy sources are the future. I believe this is toxic for innovation.

That said, one can imagine what will happen to metal and mineral demand when multiple nations pledge to become carbon neutral by 2050. As reported by the Wall Street Journal (emphasis added):

As countries roll out targets for "net zero" carbon emissions by 2050, it's becoming clear how difficult it will be to source this huge increase in minerals. The U.S. and Japanese governments, the European Union and a host of multilateral organizations have issued alarming reports about the magnitude of the challenge. The International Monetary Fund warns that striving to achieve net zero by 2050 will "spur unprecedented demand for some of the most crucial metals," leading to price spikes that "could derail or delay the energy transition itself."

According to a recent study by S&P Global (mentioned by the Wall Street Journal), the energy transition towards electrification, a key component of achieving net zero goals by 2050, will significantly increase the demand for copper. As shown by the graph I used in this article, copper is essential for various technologies such as electric vehicle batteries, charging stations, offshore and onshore wind farms, solar panels, and battery storage. The study predicts that by the mid-2030s, the need for copper will double to meet the requirements of the energy transition.

The worst part is that it's not just copper.

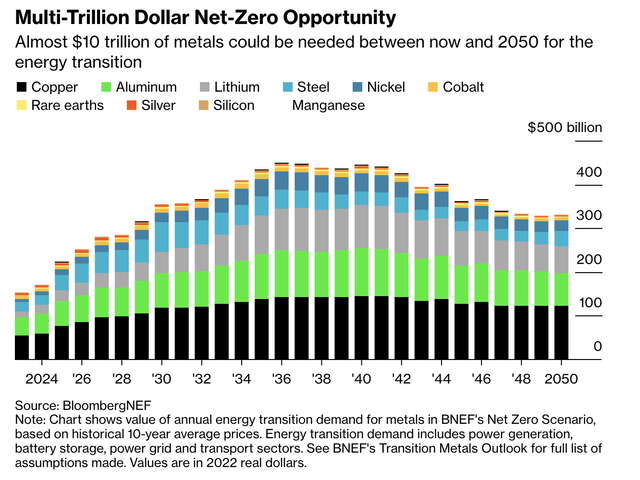

BloombergNEF found that getting to net zero could require almost $10 trillion worth of metals between now and 2050. Peak demand could be in the mid-2030s, with annual spending of almost $500 billion. While I believe that net zero isn't possible at all and the fact that these models rely on a lot of variables (like prices), I believe this data perfectly shows the headwinds facing the energy transition.

Some of the most valuable commodities are steel (iron ore), aluminum, and copper, which are the cornerstone of Rio Tinto's business.

Furthermore, let me quote BloombergNEF (emphasis added):

The supply challenges extend beyond mining, and there are also risks that western economies will fall short in their efforts to boost local metals refining and processing, Weir said.

I highlighted Western economies for two reasons.

- Western nations are the biggest supporters of net zero, while most emerging markets are mainly focused on growing their middle classes.

- We're seeing an increasing divide between Western nations and nations supporting China and Russia, which will make it harder to source materials needed for net zero.

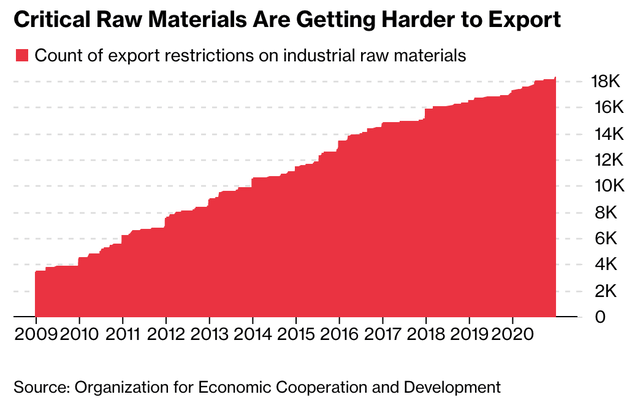

As written by Bloomberg on April 11, we're witnessing increasing export restrictions and related geopolitical issues.

The Organization for Economic Co-operation and Development (better known as OECD) has highlighted that the sharp rise in export restrictions imposed by countries like China and India on raw materials essential for green technologies could have a significant impact on the global economy and pose challenges in achieving climate goals.

This is what these restrictions look like:

China, India, Argentina, Russia, Vietnam, and Kazakhstan have emerged as the top six countries that have implemented new export restrictions over the past decade, according to the OECD.

The worst part is that these are also the very countries that many OECD member nations rely on for their supply of critical raw materials.

Why Rio Tinto Is A Great Net Zero Play

Between temporary cyclical headwinds and long-term demand tailwinds.

Multiple roads lead to Rome. This also applies to the energy transition. One way to play this is by buying equipment producers like Caterpillar. While Caterpillar is prone to competition, it erases the risks that come with running mines. These risks mainly apply to miners. Mark Twain once said that, in a gold rush, investors should invest in shovels.

That said, investing in miners has benefits. When dealing with miners who have mature operations and subdued capital expenditures, investors can benefit from high dividends on top of expected capital gains.

Rio Tinto is such a miner. It's a cash cow with the right assets for the energy transition.

Founded in 1873, Rio Tinto is headquartered in London and Melbourne. The company has a $112 billion market cap. It releases its earnings twice per year. It has four operations updates per year.

Rio Tinto operates through a decentralized structure with a diverse portfolio of mining assets, including mines, refineries, processing plants, and infrastructure.

The company is a major supplier of raw materials to the global manufacturing industry and plays a significant role in the global supply chain for commodities such as aluminum and iron ore.

In 2022, the company generated revenue in the following segments:

- Iron ore (used in steel production): 56%

- Aluminum: 25%

- Minerals: 12%

- Copper: 12%.

Please note that the total is 105%. Reconciliation and inter-segment transactions are the reason it's not 100%.

54% of its sales are generated in Greater China. 16% of sales are generated in the United States.

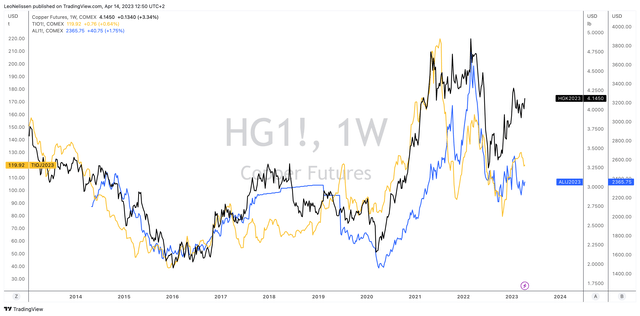

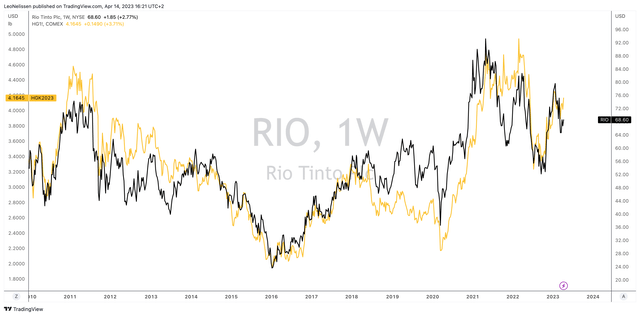

The chart below shows the prices of three key commodities.

- COMEX Copper (black)

- COMEX Chinese iron ore (yellow)

- COMEX Aluminum (blue).

Prices have come down after peaking in 2022. However, they are still elevated versus pre-pandemic levels.

Essentially, the decline in key commodity prices was caused by cyclical weakness.

The company reported lower-than-expected profits and has slashed its dividend due to weak demand for the three aforementioned commodities, iron ore, aluminum, and copper, from China, which has been impacted by lockdown measures.

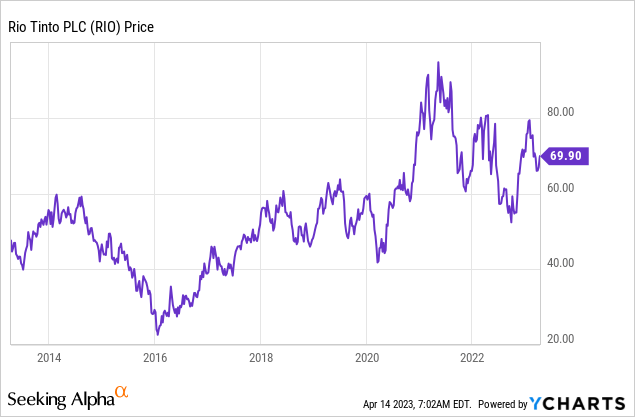

This is also the reason why NY-listed RIO shares are 26% below their highs.

However, investors are starting to look beyond these cyclical risks. China's economy is reopening and governments are doubling down on net zero initiatives.

In its 4Q22 earnings call in February, the company highlighted its role in the energy transition.

According to Rio Tinto, the importance of mining in achieving the energy transition and strengthening supply chain security is increasingly being recognized by governments and customers, as per conversations held with them.

After all, Rio Tinto combines three major benefits:

- It is a Western company with great relationships and a large footprint in various supply chains.

- It delivers the metals needed to support the energy transition.

- Its biggest customer China will remain dependent on its exports for its own geopolitical and economic targets.

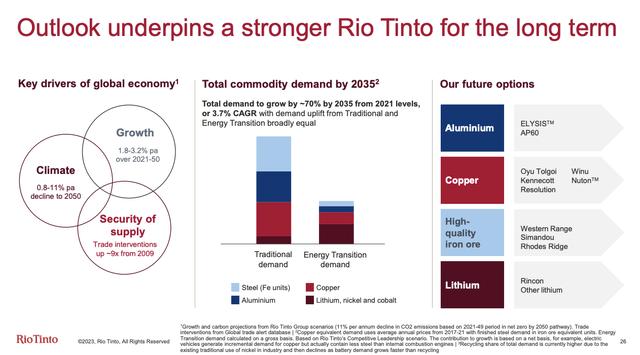

The company estimates that demand for its products will grow by 3.7% per year through 2035.

All the materials we provide are needed for today's world. And looking to the future, the demand will only grow driven by ongoing urbanization and the energy transition. The demand we will face through 2035 will grow around 3.7% per annum with around half stemming from the energy transition. That is why our strategy is about growing in the materials needed such as copper, lithium, aluminum and high-quality iron ore.

Essentially, this means we could face a 70% increase in total commodity demand, which is absolutely wild, as it's a mix of the energy transition, consistent growth in developed nations, and urbanization in emerging markets like India.

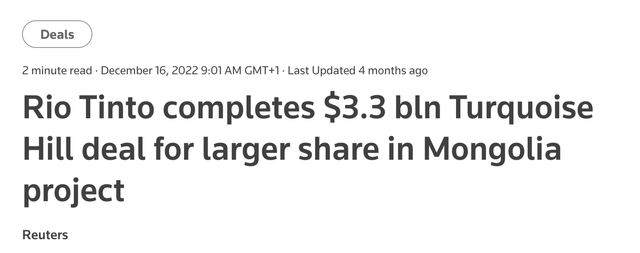

Related to this surge in demand, Rio Tinto has expanded its footprint in major projects. At the end of last year, Rio Tinto acquired the remaining 49% stake in Turquoise Hill Resources ("TRQ"), giving the company a 66% stake in Mongolia's Oyu Tolgoi, which is the world's largest known copper and gold deposit.

With this larger stake in Oyu Tolgoi, Rio Tinto aims to compete more effectively with BHP Group (BHP) in the production of battery metals as the world shifts towards a greener economy. BHP Group had recently made a $6.5 billion play for copper miner OZ Minerals, potentially allowing them to consolidate their copper assets in South Australia.

In other words, the company's commodity mix will shift even more in favor of the energy transition.

According to the company:

Delivering the TRQ acquisition and the underground mine is part of our strategy to grow in copper. We have an ambition to double annual copper out by end of the decade and have an interest in 2 of top 5 copper assets globally by 2030, according to Wood Mac. With the energy transition in the U.S. and the U.S. being short on copper cathode, we are well placed to provide U.S. domestic supply. Kennecott is 1 of 2 operating smelters and is an important strategic asset to us.

Moreover, with regard to independence from Asian sellers (China):

We have approved investment to start underground mining and expand our copper production and provide critical minerals such as tellurium. Resolution in the established Arizona copper triangle is vital to the U.S. to bringing on more copper supply and critical minerals to support its energy transition.

The RIO Dividend & Outperformance

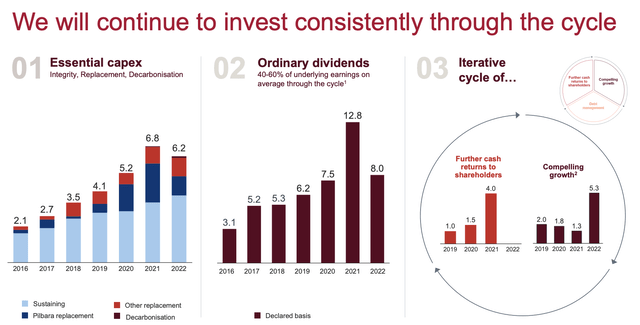

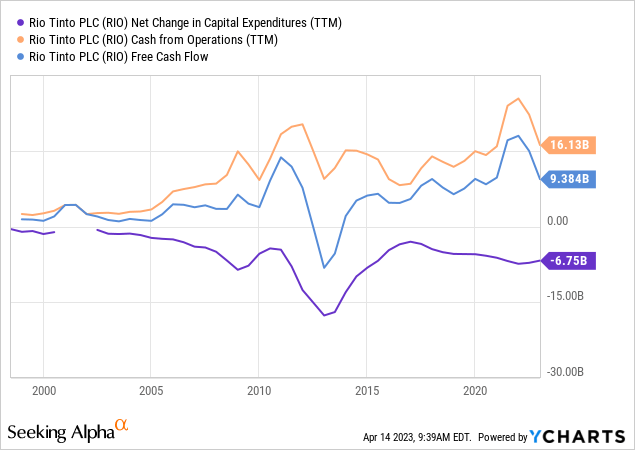

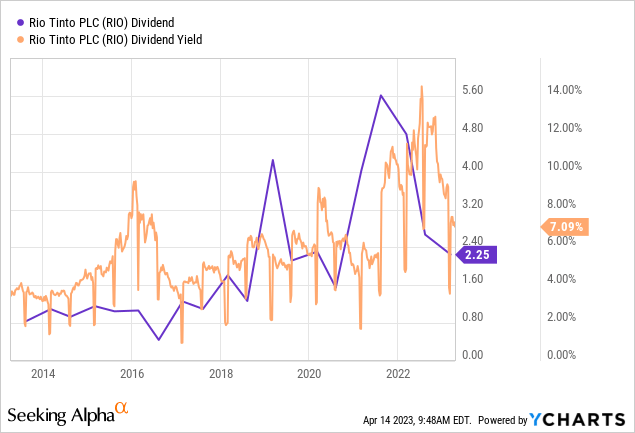

RIO's cash flow is highly volatile. After all, its operations are dependent on the price of the commodities it mines. The company aims to distribute between 40% and 60% of its earnings to shareholders.

As the graph below shows, the company consistently generates free cash flow to support shareholder distributions. Even during the Great Financial Crisis, the company was profitable.

Related to this, RIO maintains a healthy balance sheet. This year, net debt is expected to fall from $4.2 billion to $2.6 billion, which is just 0.1x EBITDA. Thanks to these factors, the company enjoys an A-rated balance sheet.

Based on this context, surging commodity prices provided the company with serious firepower.

With that said, RIO pays a dividend twice per year - instead of every quarter.

In 2022, the company paid $4.92 in dividends, which translates to a yield of 7.0%.

Going forward, we will continue to review whether additional returns are appropriate in line with our policy of supplementing the ordinary dividend in periods of strong earnings and cash generation. We have remained very consistent with our shareholder returns policy, which has now been in place for 7 years. The dividend remains a core part of our equity story, which we see as paramount for maintaining discipline. Our financial strength means that we can accelerate our decarbonization, reinvest for growth and continue to pay attractive dividends through the cycle.

This year, the company is expected to generate $12.6 billion in net income. It would suggest that the dividend would remain close to 7%.

On a long-term basis, I expect the dividend to significantly increase due to pricing and volume benefits.

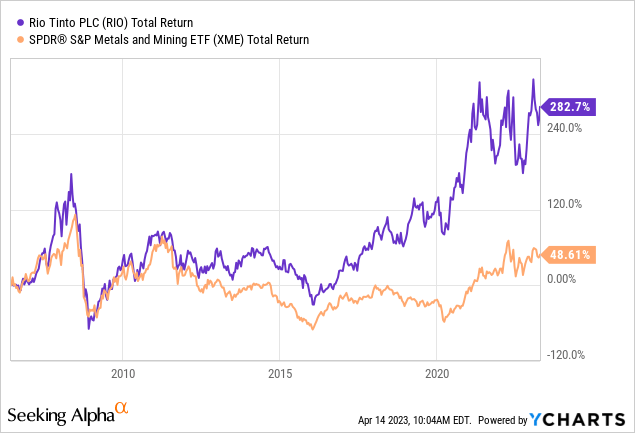

I also expect RIO to keep outperforming the SPDR® S&P Metals and Mining ETF (XME).

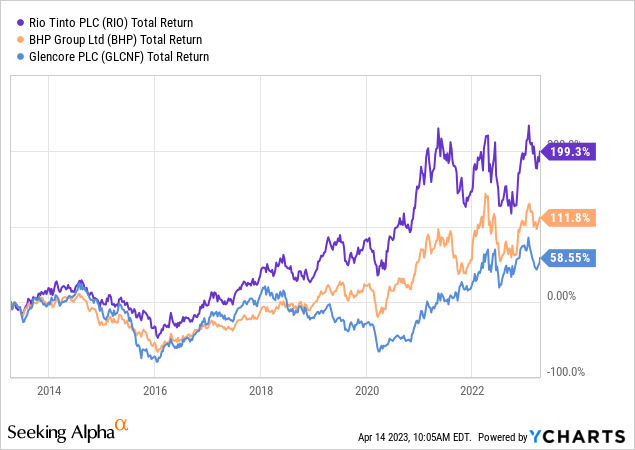

Rio has also outperformed its peers BHP and Glencore (OTCPK:GLCNF) over the past ten years.

That said, let's discuss the valuation and upcoming earnings.

Rio Tinto Stock Valuation & Upcoming Operations Review

RIO is trading at 4.8x 2023E EBITDA based on its $112 billion market cap, $1.2 billion in pension liabilities, $2.1 billion in minority interest, and $2.6 billion in 2023E net debt.

This valuation is fair. That makes sense, as RIO is highly correlated to commodity prices.

TradingView - RIO (black) & copper (yellow)

On April 19, the company will update its investors on its operations. While I do not expect that it will have a major impact on its stock price, we will get valuable intel with regard to production volumes, CapEx guidance, and related.

Takeaway

In this article, we discussed the energy transition. While most major metals currently trade below their 2022 highs, cyclical economic weakness is hiding a strong secular long-term trend. We can assume that investments in net zero will come with at least $10 trillion in metals demand. This implies at least 3.5% physical commodity demand growth per year until 2035.

As this is inflationary, I believe investors benefit from adding at least some exposure to beneficiaries to their portfolios. One of these companies is Rio Tinto. The British/Australian miner is a major producer of key net zero materials, including steel (iron ore), aluminum, and copper. Moreover, the company is increasing exposure to key metals through its operations in Mongolia.

Furthermore, the company is a great source of dividends. I expect the dividend yield to remain high and improve in case my long-term commodity bull case comes to fruition.

I also expect Rio Tinto Group to outperform its peers.

The Rio Tinto Group valuation is fair and dependent on commodity prices. While the stock could experience some short-term downside due to cyclical macro fears, I believe Rio Tinto Group investors are in a good spot to benefit from high long-term capital gains and juicy dividends.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.