GLQ: Global Equity Fund With Abysmal Performance

Summary

- The GLQ fund aims to deliver high total returns from a portfolio of global equities.

- The GLQ fund is managed by star manager Charles Clough.

- Unfortunately, the GLQ fund has perennially underperformed, with negative 3 and 5Yr average annual returns.

- Instead of the GLQ fund, I would recommend investors looking for global equity exposure consider the EXG fund from Eaton Vance.

Gizem Gecim/iStock via Getty Images

The Clough Global Equity Fund (NYSE:GLQ) aims to provide high total returns via a portfolio of global equities. Unfortunately, I find the GLQ fund to be a poor performer that does not earn its distribution. I would avoid this fund.

Fund Overview

The Clough Global Equity Fund is a closed-end fund ("CEF") that seeks to provide a high level of total returns through portfolio of global equities. The fund will flexibly invest in U.S. markets or international markets depending on the manager's outlook.

The GLQ fund may use leverage and short-sales to enhance returns. As of February 28, 2023, the fund had approximately $260 million in total assets and $132 million in net assets.

Betting On A Star Manager

The GLQ fund is lead managed by Charles Clough, an all-star investment strategist who was formerly Chief Global Investment Strategist for Merrill Lynch & Co. Mr. Clough has over 50 years of market experience.

Portfolio Holdings

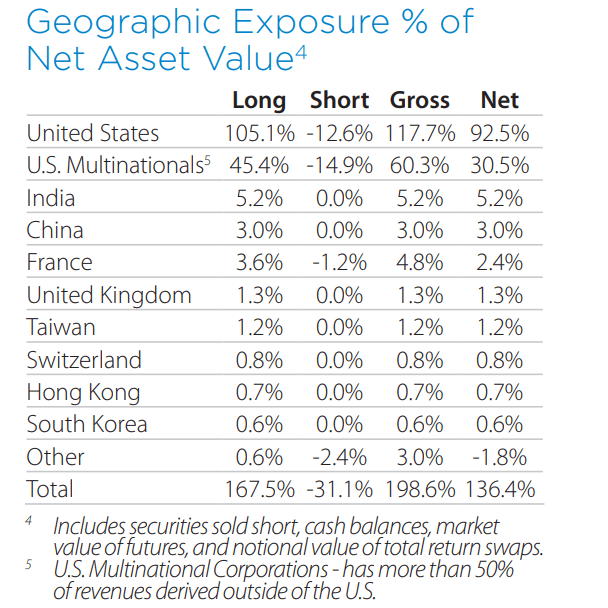

Figure 1 shows the gross and net exposures of the GLQ fund relative to the fund's net assets. As of February 28, 2023, the fund is 167.5% long, primarily in U.S. equities (105.1%) and U.S. Multinationals (45.4%), and short 31.1% via 12.6% short in U.S. equities and 14.9% short in U.S. Multinationals.

Figure 1 - GLQ geographical allocation (cloughcapital.com)

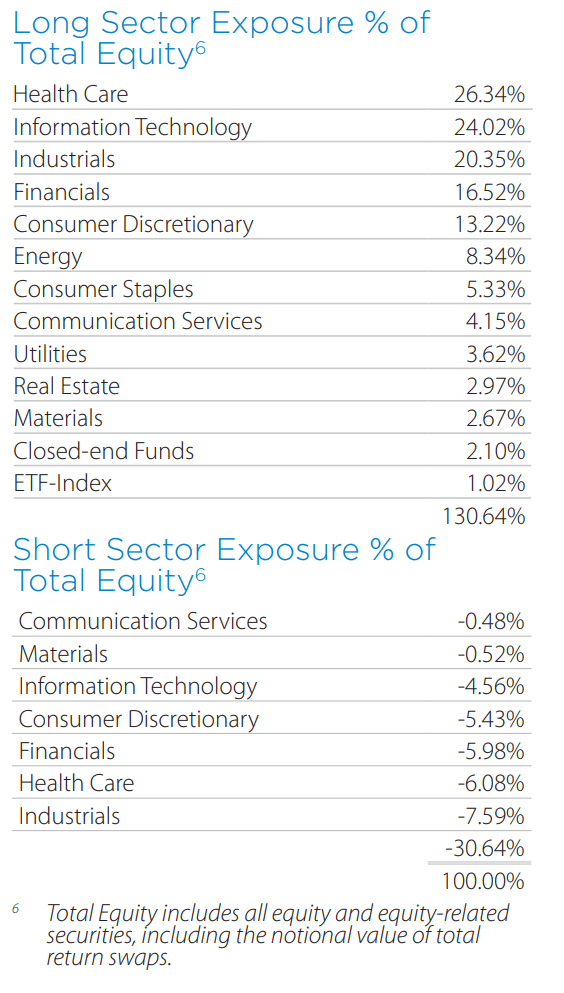

The GLQ fund's long and short sector allocations are shown in figure 2, with the biggest long exposures being Health Care (26.3%), Information Technology (24.0%), Industrials (20.4%), and Financials (16.5%).

Figure 2 - GLQ long and short exposures (cloughcapital.com)

Shorts are concentrated in Industrials (7.6%), Health Care (6.1%), and Financials (6.0%) and Consumer Discretionary (5.4%).

Returns

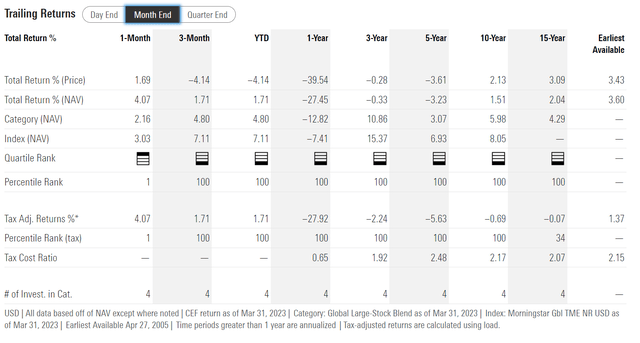

Figure 3 shows the GLQ fund's historical returns. Performance for the GLQ fund has been poor, with 3/5/10/15Yr average annual returns of -0.3%/-3.3%/1.5%/2.0%, respectively, to March 31, 2023.

Figure 3 - GLQ historical returns (morningstar.com)

Investors should note that GLQ's 3Yr performance is especially poor given that the beginning period, March 2020, coincides with the market lows experienced during the COVID pandemic.

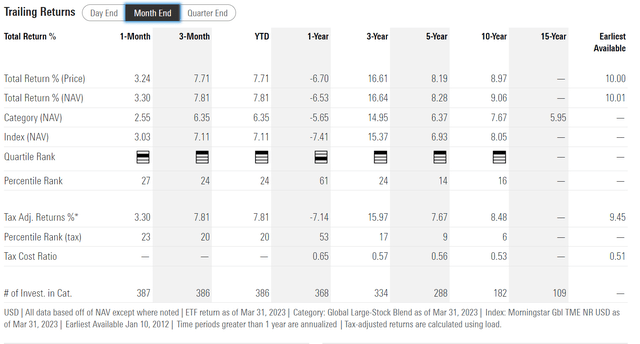

In fact, figure 4 shows the historical returns of the iShares MSCI World ETF (URTH) for comparison. Note that the URTH ETF delivered 16.6%/8.3%/9.1% average annual returns on a 3/5/10Yr basis to March 31, 2023.

Figure 4 - URTH historical returns (morningstar.com)

Distribution & Yield

The GLQ fund pays an attractive $0.0599 / share monthly distribution that annualizes to a 11.8% forward yield. On NAV, the GLQ fund is paying a 10.1% distribution yield.

While the distribution rate is attractive, with the fund earning negative average annual returns on a trailing 3 and 5Yr time horizon, the distribution rate is clearly unsustainable. Therefore, it is little wonder that GLQ's distribution was recently cut from $0.1162 / month in 2022 and $0.1341 / month in 2021.

If GLQ's investment performance does not improve, unitholders should expect another distribution cut in 2024.

Fees

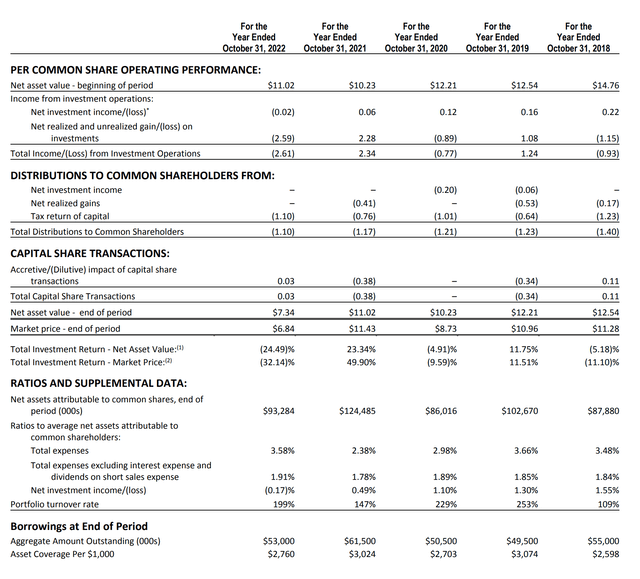

While the fund has delivered an abysmal performance in the past few years, that has not deterred the star manager from collecting fat fees from the GLQ fund. In fact, due to rising interest rates on leverage employed, the GLQ fund's total expenses as a % of net assets have jumped to 3.58% in 2022 (Figure 5).

Figure 5 - GLQ financial summary (GLQ 2022 annual report)

Another point worth mentioning is that the GLQ fund is an incredible turnover machine, with a 199% portfolio turnover in 2022. Unfortunately, this turnover of the portfolio by the manager has not resulted in any alpha for investors.

GLQ vs. EXG

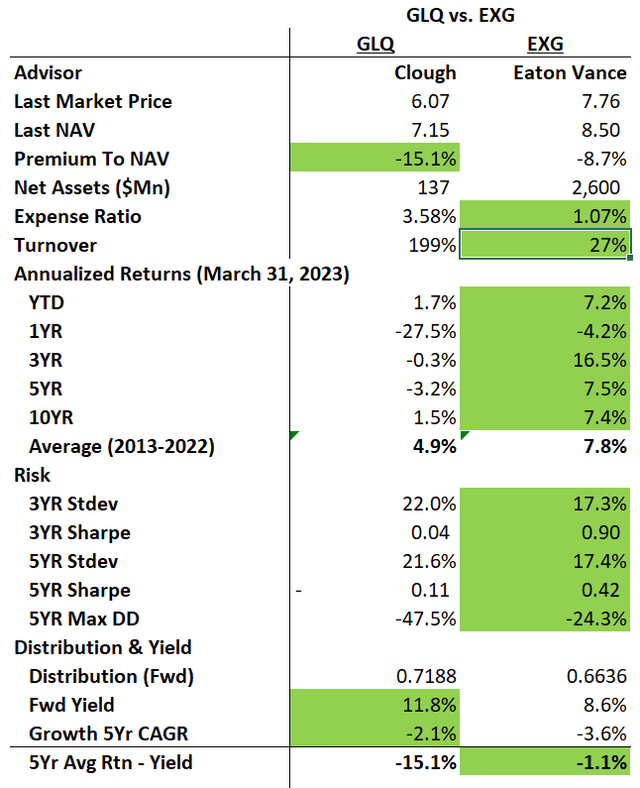

Recently, I wrote a positive review of the Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG), a global-equity focused fund from Eaton Vance. How does GLQ stack up against the EXG? Figure 6 compares the two funds side-by-side.

Figure 6 - GLQ vs. EXG (Author created with data from Seeking Alpha, Morningstar, and fund websites)

First, in terms of fund structure and operations, the EXG fund is much lower cost at 1.07% net expense ratio vs. 3.58% for the GLQ fund. EXG also has far lower turnover.

However, in terms of returns, Eaton Vance's steadier hands (lower turnover) did not result in lower returns. In fact, the EXG fund had an order of magnitude better performance across all time frames measured.

The EXG fund also had much better risk metrics including lower volatility and smaller maximum drawdown.

The only area where the GLQ fund is superior is in the distribution yield, where the GLQ fund is yielding 11.8% vs. EXG at 8.6%. However, readers should notice that GLQ's distribution rate far outpaces its total returns, which is clearly unsustainable. On the other hand, EXG's distribution appears sustainable as it is roughly the same as the fund's 5Yr average annual total returns.

Conclusion

In summary, I recommend investors looking for global equity exposure to avoid the GLQ fund. In my opinion, it is a volatile underperformer that does not earn its distribution. Instead, I would recommend investors take a look at the EXG fund from Eaton Vance, as it delivers solid performance with an attractive distribution yield.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.