Beleaguered Pakistan crawls closer to IMF bailout as UAE doles out another $1 billion

The IMF, earlier this week, lowered its forecast for Pakistan's economic growth rate from 2 per cent to just 0.5 per cent for the current fiscal year

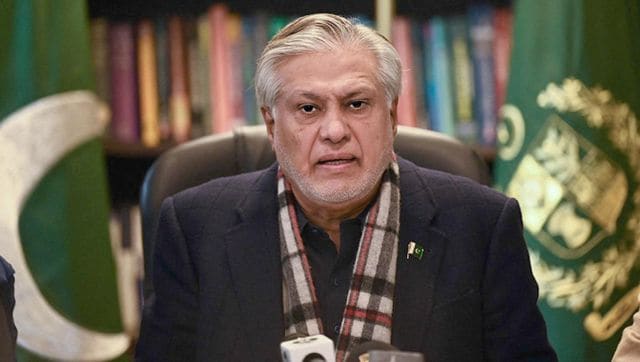

Pakistan’s Finance Minister Ishaq Dar. AFP.

Islamabad: Pakistan has got one step closer for securing a deal with IMF which could avoid it from defaulting as the UAE has approved $1 billion in financial support to the cash-strapped country.

Pakistan’s Finance Minister Ishaq Dhar on Friday said, “State Bank of Pakistan (SBP) is now engaged for needful documentation for taking the said deposit from UAE authorities.”

Earlier, UAE had rolled out the first tranche of USD 2 billion in January this year, providing critical support to cash-starved Pakistan’s depleting foreign exchange reserves.

IMF program — 9th Review Update:

UAE authorities have confirmed to IMF for their bilateral support of US $ One billion to Pakistan.

State Bank of Pakistan is now engaged for needful documentation for taking the said deposit from UAE authorities.

AlhamdoLilah!

— Ishaq Dar (@MIshaqDar50) April 14, 2023

Pakistan has been battling a major economic crisis and awaits a much-needed USD 1.1 billion tranche of funding from the International Monetary Fund (IMF), part of a USD 6.5 billion bailout package the global lender approved in 2019.

In another tweet, Dar announced that SBP is getting the third and last disbursement from the Industrial and Commercial Bank of China (ICBC), worth $300 million, out of its USD 1.3 billion loan.

The ICBC approved a rollover of a USD 1.3 billion loan for Pakistan on 3 March and made the first payment of USD 500 million on the same day, while the second payment of the same amount was made on 17 March.

Out of Chinese Bank’s #ICBC approved facility of $1.3 billion (which was earlier repaid by Pakistan), State Bank of Pakistan would receive back third and last disbursement today in its account amounting to $ 300 million.

It will shore up forex reserves of Pakistan.

AlhamdoLilah!— Ishaq Dar (@MIshaqDar50) April 14, 2023

Pakistan's growth forecast

The IMF, earlier this week, lowered its forecast for Pakistan's economic growth rate from 2 per cent to just 0.5 per cent for the current fiscal year amid high inflation and a growing unemployment rate in the cash-strapped country.

The new development brought debt-struck Pakistan closer to signing the staff-level agreement with the IMF and getting access to multilateral loans.

Pakistan is tethering on the verge of default with just over USD 4 billion in reserves as it grapples with high external debt and a weak local currency.

All its hopes are tied to the IMF reviving the USD 7 billion bailout programme and releasing a USD 1.1 billion tranche, originally due to be disbursed in November last year.

The IMF programme, signed in 2019, is due to expire on 30 June, 2023, and under the set guidelines, the programme cannot be extended beyond the deadline.

Pakistan and the IMF have been negotiating the programme's resumption for months but have yet to reach an agreement.

With inputs from PTI

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

also read

Pakistan has to normalise ties with India if it wants to climb out of the hole it finds itself in

Pakistan might think that it still has nuisance value that it can deploy against India. But this nuisance value will become redundant as the gap between the comprehensive national power of the two countries widens

Inflation 'bites' Pakistan: Nine out of 10 Pakistanis can't afford to eat outside anymore

The consumer price inflation in Pakistan jumped to a record 35.37 per cent in March compared to the same period last year, as at least 16 people were killed in stampedes for food aid

WATCH: Shehbaz Sharif govt duping hungry Pakistanis, doling out rotten wheat flour from ex-Prez Zardari’s warehouse

Several people expressed anger over Shehbaz Sharif and ex-President Zardari for holding on to stocks at their storages while people of the country face hand-in-mouth situation due to high food prices