Global Payments: A Growth Company On Sale

Summary

- Global Payments is a global business that operates in an environment supported by strong tailwinds in digital payments and growth in e-commerce.

- The EVO Payments acquisition will further GPN's ambitions in Europe and the Americas and will be accretive to the top and bottom line by the end of 2023.

- The company has a robust cash flow and a strong balance sheet, and together with its undrawn credit facility, GPN has sufficient cash to make more acquisitions if opportunities appear.

- GPN is trading at an attractive valuation; its blended P/E of 11.04 is just half of its normal P/E even while its adjusted operating earnings continue to grow in the past 20 years, even through the pandemic.

B4LLS

Introduction

There are many things to like about Global Payments Inc. (NYSE:GPN).

GPN boasts of having over 50 billion transactions annually and the soon-to-be-added 4.9 billion annual transactions from EVO Payments means that every time someone makes a transaction at a point-of-sale machine or keys in their transaction information online when they purchase something, GPN is likely to be there to take a cut of the transaction - and that makes me a happy man.

Despite strong and established competitors like Fiserv (NASDAQ: FISV) and Fidelity National Information Services (NYSE: FIS), GPN's services are in demand and it has proven that it can be a successful competitor.

GPN business is strong. The BBB- rated company continued to grow its adjusted operating earnings in the past 20 years, even throughout the pandemic years when the whole world was on lockdown.

Although it is an "old" company, founded in 1996 after being spun off from National Data Corporation, GPN is keeping up with the times. Many may not know that GPN is also a software-as-a-service company. Its Issuer Solutions segment offers B2B payment services and other finance-related solutions marketed to corporations, and the 2022 10K further states that these solutions include:

software-as-a-service ("SaaS") offerings that automate key procurement processes, provide invoice capture, coding and approval, and enable virtual cards and integrated payments options across a variety of key vertical markets.

Furthermore, according to the CEO in the Q4 2022 earnings call, GPN is:

collaborating with fintech software-as-a-service platform, Mondu, to provide next-generation capabilities for financial services customers across a number of strategic use cases, including credit cards BNPL, prepaid cards and a range of deposits and lending solutions

It is no wonder that GPN continues to show its relevance in today's digitalized economy and recently snagged new accounts with the Atlanta Hawks and the Atlanta Braves, both of which chose GPN as their official commerce technology provider for State Farm Arena and Truist Park to provide frictionless payment solutions experiences to increase fan engagement, drive loyalty, and improve operational efficiency. GPN also won new businesses with international restaurant chains like A&W Restaurants, Jack in the Box, and Panda Express.

Apart from growing businesses organically, GPN is also well-known for growing revenue through acquisitions. GPN became one of the largest players in the US with its Total System Services acquisition in 2019, which is set to continue with the multiyear extension that TSYS signed with Bank of America, one of GPN's largest customers with businesses in the consumer and commercial card portfolios in both North America and the United Kingdom.

And with the acquisition of EVO payments, GPN has its eyes set on Europe and the Americas. TSYS already extended its successful partnership with Deutsche Bank, GPN's largest client in the DACH region but to grow faster in Europe and the Americas, the EVO Payments acquisition makes sense.

Acquiring EVO Payments Makes Sense

EVO Payments' business model is similar to GPN's, which makes the resulting merger of the operations much more assured and seamless. The EVO Payments segment of 2022 10K states that EVO Payments is:

... a global merchant acquirer and payment processor servicing more than 700,000 merchants and processing approximately 4.9 billion transactions annually.

Our Americas segment includes our operations in the United States, Canada, Mexico, and Chile... For the year ended December 31, 2022, we processed approximately 1.1 billion transactions in the Americas, and segment revenue represented 59.1% of total revenue.

Our Europe segment includes our operations in Poland, Germany, Ireland, the United Kingdom, Spain, and the Czech Republic, as well as our support of merchants in surrounding markets... For the year ended December 31, 2022, we processed approximately 3.8 billion transactions in Europe, and segment revenue represented 40.9% of total revenue.

EVO Payment acts as an intermediary between merchants and card networks. It makes money by collecting fees based on three factors: (1) the number of transactions, (2) the type of transactions, and (3) the value of transactions processed. These merchant service fees are divided into three components: (1) fees remitted to the financial institution that issued the card (interchange), (2) fees remitted to the card networks, and (3) fees retained by EVO.

Assuming the EVO Payments acquisition consummates by the end of Q1 2023, GPN expects EVO Payments to contribute around $475 million of adjusted net revenue by end of FY 2023.

How GPN makes money is this:

Like EVO Payments, Global Payment is also a merchant acquirer, processing card payments on behalf of merchants. GPN has relationships with multiple companies to enable more than 140 different payment options for their customers - and their customer's customers.

Screen Grab from GPN video on Unified Commerce Platform

Briefly, the bulk of GPN's revenues is generated by services priced as a percentage of the transaction value (0.5%) or a specified fee per transaction, and that depends on (1) the type of payment or (2) the market in which the payment occurs. GPN also earns software subscription and licensing fees, plus other fees for standalone value-added services not tied to the value of the transactions.

Now, 0.5% seems minuscule but when GPN processes more than 50 billion transactions in a year, every bit adds up. And with EVO Payments' 4.9 billion yearly transactions, the new entity will be even stronger together with more reach and clout.

Two Strong Tailwinds: Digital Payment and E-commerce

Both GPN and EVO operate in a space with a massive total addressable market totaling $155 trillion. GPN's $9 billion revenue in 2022 is just a drop by comparison, pointing to the opportunities the soon-to-be-merged company and its peers have in this space. In other words, there is plenty of room for every player to grow.

Now, I am always a little skeptical of bullish forecasts and outlooks that all management would almost always showcase - it is their job to be bullish and there is nothing wrong with that.

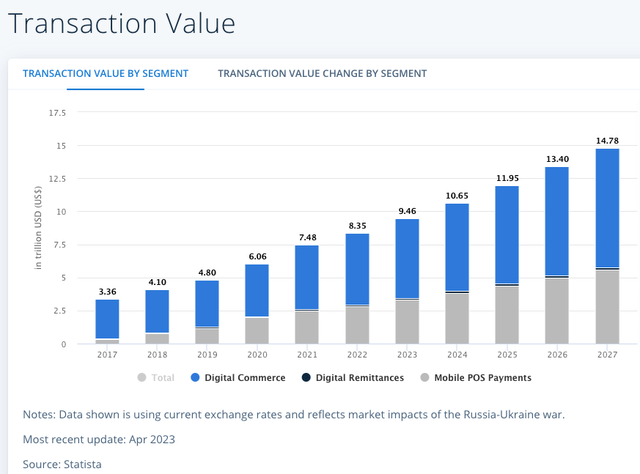

However, to be more conservative, I turn to a third-party data source for information. Statista valued the total Digital Payment market to be worth $8.35 trillion in 2022, a figure that is expected to grow to $14.78 trillion by 2027.

And that growth in digital payments is strongly driven by retail e-commerce.

Statista Retail E-commerce Sales Growth

The global expected e-commerce sales growth CAGR from 2023 to 2027 is a robust 10.92%, and GPN is well positioned to capture this growth.

GPN captures this growth through three separate lines of business.

3 Business Segments

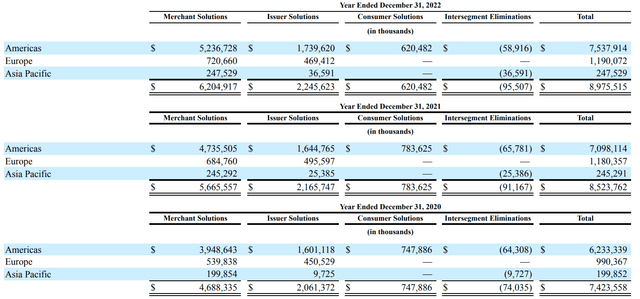

There are three reportable segments: Merchant Solutions, Issuer Solutions and Consumer Solutions.

Investors should note that due to the pending divestiture of GPN's consumer business (Netspend B2C and Gaming Solutions) and changes in its business, the previous segments of Business and Consumer Solutions will include the B2B portion together with its Issuer Solutions segment, while the consumer portion forms its new Consumer Solutions segment. The largest segment is in the Americas, followed by Europe, and then the Asia Pacific.

What I found interesting is the smallest slice of the business, the Issuer Solutions segment in the Asia Pacific. Although it generated the least revenue in all three geographical regions, it is also the only region that grow revenue in the Issuer Solution by an impressive 276% over 3 years. Most other segments and regions show modest growth, with the exception of the Issuer Segment in Europe and the Consumer Solution segment (more on this later).

Strong Balance Sheet & Operating Cash Flows

For GPN to grow, it has to grow organically as well as through acquisitions. To make acquisitions, it needs to be able to pay for these acquisitions.

GPN's businesses brought in $8.975 billion in revenue in 2022 and generated $1.977 billion in operating income. It currently has $1.997 billion in cash, cash equivalents, and short-term investments, so that means GPN has around $4 billion to deploy. And if the $5.75 billion revolving credit facility, which is currently undrawn, is included, GPN has close to $10 billion to tap on if good opportunities come its way.

Investors should note that GPN does not acquire companies just for growth. It acquires companies with the technology to enable it to serve customers better. The following is a list of GPN's more recent acquisitions. Each of these companies has its own technology stacks, communications, and productivity systems, and GPN adopted several generations of these communication and collaboration technologies.

Screen Grab from Google Cloud YT Video

Although I do not have concerns that GPN can handle the current interest payments on existing loans or its ability to make another acquisition, I would prefer if GPN takes steps to reduce its leverage more and fully assimilate EVO Payments in 2023 before making further acquisitions.

Risks and Considerations

Investors may be concerned with the sharp rise in operating expenses from 84.1% as a percentage of revenue in 2021 to 92.9% in 2022.

This is likely to be a one-off occurrence. According to the footnotes in the 2022 10K:

For the year ended December 31, 2022, consolidated operating income included an $833.1 million goodwill impairment charge related to our former Business and Consumer Solutions reporting unit.

Investors may also be concerned about the sharp fall in net income in 2022.

The company had $207 million in net income in 2010 on the back of $1.6 billion in revenue but only $111 million in net income in 2022 with $9 billion in revenue. That decline has to be taken into the context of the $833.1 million goodwill impairment charge related to GPN's previous Business and Consumer Solutions reporting unit.

Like the rise in operating expenses, this fall in net income is expected to be a one-off event, and net income growth should normalize in 2023.

Valuation

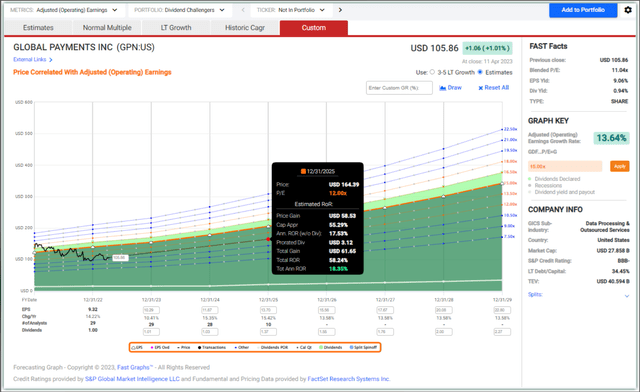

GPN's adjusted operating earnings of 18.79% for the past 16 years between 2003 and 2019 (pre-pandemic) had been impressive. The market has priced GPN at a premium with a normal P/E of 21.92 over this time period.

Clearly, this growth rate is not sustainable. Although the management is still bullish about GPN's growth prospects in 2023, after excluding the divested businesses and including EVO's contribution from Q2 2023 onwards, management expects GPN to grow adjusted earnings per share by 10-11%, which is almost half of the growth rate it enjoyed in the past.

That 10-11% of adjusted earnings growth rate is in line with FactSet analysts' expectation of a 13.64% adjusted earnings growth rate.

GPN now trades at a blended P/E of just 11.04, half of its past normal P/E. Assuming an extremely modest P/E expansion from 11.04 to 12, GPN could potentially offer a total annualized rate of return of 18.35% or a 55.2% capital gain in 3 years. And if the stock trades up to a P/E of 15, assuming the adjusted earnings forecast is accurate (FactSet analysts have a 100% accuracy rate for their 2-year forecast), investors may see a 2x in three years.

Conclusion

Global Payments Inc. is a BBB- rated company with a strong balance sheet, and robust cash flow, and operates in an industry supported by strong tailwinds. Its business operations are deeply intertwined with the daily lives of ordinary people in over 100 countries around the world. Every time someone makes a transaction at a point-of-sale machine or keys in their transaction information online when they purchase something, GPN is likely to be there to take a cut of the transaction. And GPN processes more than 50 billion transactions in a year, and with their acquisition of EVO Payments, that figure - and revenue - is set to grow.

GPN is trading at an attractive valuation; its blended P/E of 11.04 is just half of its normal P/E even while its adjusted operating earnings continue to grow in the past 20 years, even through the pandemic. With adjusted operating earnings expected to grow another 10-11% in 2023, and FactSet analysts expect the long-term adjusted earnings operating growth rate expected to be 13.58%, even with a modest blended P/E expansion from 11.04 to 12, GPN could potentially return 55.2% in capital gains in just three years.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GPN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.