Google's AI-Powered Products And Services Offer Investment Opportunities

Summary

- Alphabet's advertising business and cloud division are key generators of revenue for the company.

- Despite a deceleration in the digital advertising market, Google is expected to post an increase in top-line revenue for Q1 2023.

- Alphabet's Tensor Processing Unit and generative AI technology position the company as a competitor in the AI chip market.

pixdeluxe/E+ via Getty Images

Thesis

In an era of rapid technological evolution, Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) persistent strides in its advertising and cloud divisions are solidifying its standing as a titan in the industry. The flourishing advertising business and the unwavering growth in its Cloud division place Alphabet in a prime position to seize the opportunities presented by the burgeoning markets. While the hurdles of a slackening digital advertising market and potential regulatory obstacles in the AI realm may present challenges, the company's dedication to innovation and strong financial results highlight the prospects for enduring success. Thus, for investors looking to reap the rewards of Alphabet's growth and cutting-edge capabilities, the tech giant emerges as an alluring prospect.

Alphabet's Advertising Business and Cloud Division Growth

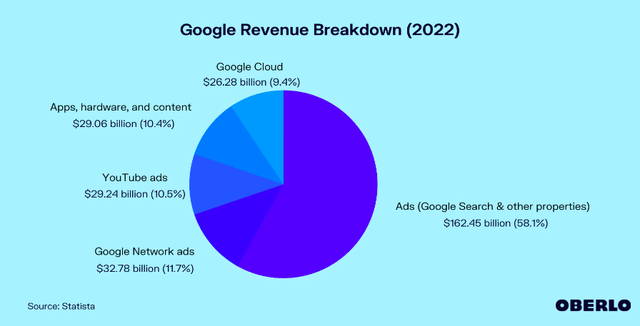

Alphabet's fundamental advertising operations continue to be a vital generator of free cash flow for the enterprise. In the concluding quarter of 2022, search ads accounted for a remarkable 56% of Alphabet's $76 billion in revenue.

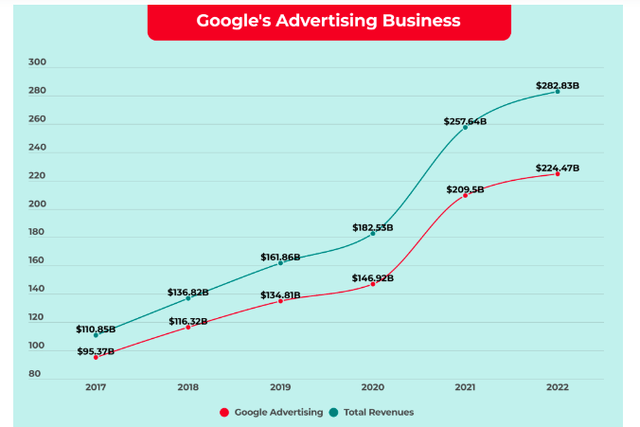

Despite the deceleration in the digital advertising sphere, it is anticipated that Google will post a 1.2% elevation in the top line for Q1 2023, with revenues approximating $68.83 billion.

Last year, Google's advertising segment produced a substantial $224.47 billion in revenue, encapsulating nearly 80% of the total income. As far as I'm concerned, this statistic undeniably emphasizes the importance of the advertising business to Google's overall financial health.

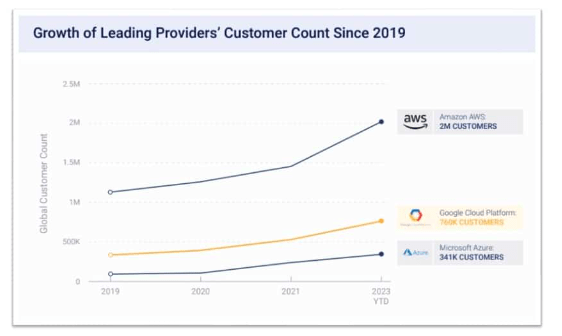

Moreover, Alphabet's Cloud division has been demonstrating noteworthy performance, generating a commendable $7.3 billion in revenue during Q4 2022, signifying a 32% YoY expansion. The growth rate of GCP has maintained an average of 27% since the previous year. This upward trajectory is anticipated to persist in Q1 2023 at a stable rate of 28-30%. My assessment is that as a growing number of enterprises transition to cloud-based solutions and depend on Alphabet's infrastructure, products, and services, the company is well-positioned to capitalize on the mounting demand for cloud offerings.

HG Insights

So in the span of the past five years, GCP's market share has nearly doubled, surging from 6% in 2017 to 11% in 2022. The way I see it, this development further underscores Alphabet's cloud division's promising prospects.

Stock Buyback

A testament to its financial aptitude, Alphabet has been steadily implementing a share buyback at an admirable 5% annual rate made possible by the company's extraordinary $16 billion in quarterly free cash flow. As disclosed in their latest accounts, Alphabet possesses an impressive $113.76 billion in cash and liquid assets - further solidifying the firm's already remarkable monetary situation.

Tensor Processing Unit and Generative AI

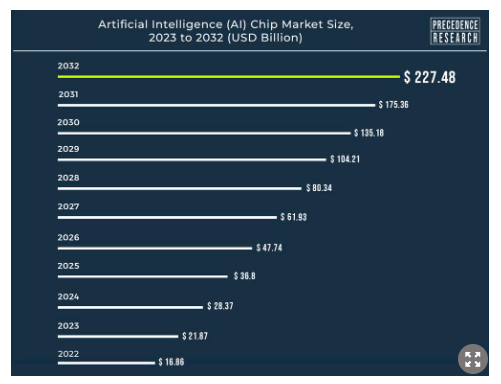

Alphabet's fourth-generation Tensor Processing Unit (TPU) has put pressure on Nvidia, as the TPU boasts a 60% increase in speed and uses 60% less power than its Nvidia counterparts. Upon further examination, in comparison to the Nvidia A100, TPU v4 consumes 1.3x-1.9x less energy consumption. This development sets Alphabet as an impressive competitor within the AI chip market - essential for fueling Generative AI applications.

Precedence Research

Predictions indicate the worldwide AI chip sector will be worth $227.48 billion by 2032, and Alphabet is right on track to overthrow Nvidia's supremacy in the industry - allowing it to become one of the premier powerhouses when it comes to AI chip technology today.

Google Search, Google Cloud, and EBIT Margin

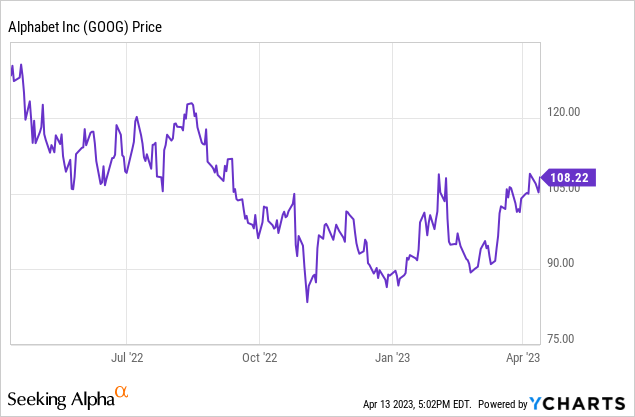

In the midst of Alphabet's stock price experiencing a temporary dip under $100, to my mind, it's vital to acknowledge the resilience of the company's linchpin - Google Search - in maintaining an ascending revenue trajectory.

Alongside this, the Google Cloud division is witnessing a notable expansion, adding further fuel to the corporation's growth engine.

The progression in Alphabet's EBIT margin is indicative of a flourishing profit landscape. According to my understanding, with the company's announcement of forthcoming reorganization and optimization endeavors, there lies potential for an augmentation in cost efficiency and, consequently, heightened profitability.

Forecasts from the analytical community propose a modest yet steady double-digit growth for the company within the half-decade to come. In light of these factors, I believe it becomes apparent that Alphabet's present stock price decline may merely be a momentary blip in its otherwise promising financial narrative.

AI-Powered Products and Services

By allocating resources to Alphabet's stock, investors, like myself, gain the opportunity to ride the wave of AI-driven breakthroughs and their subsequent applications. The company has made considerable strides in devising AI-infused offerings across a diverse array of industries, spanning from autonomous vehicles to healthcare and retail landscapes.

So even if Alphabet's success is limited to a single sector or a couple of areas within this vast technological spectrum, the resulting revenue influx could act as a catalyst for the company's stock to regain its footing. A testament to AI's impact on Alphabet's financial performance, the fourth-quarter revenue report features contributions from AI-enhanced initiatives, such as Performance Max, among other products.

Alphabet's Generative AI Platform Bard

In the race for AI supremacy, Alphabet's introduction of its generative AI platform, Bard, can be seen as a strategic countermove to Microsoft's integration of OpenAI's ChatGPT within the Bing search engine that boasts an impressive user base of over 100 million and driving a monthly traffic of 1 billion visitors. Given the generous market potential - expected to skyrocket from USD 8.2 billion this year up to an estimated USD 126.5 billion in 10 years - Alphabet is poised for tremendous success as it expands into generative AI within the foreseeable future.

Peer Evaluation

In my opinion, Alphabet Inc seems to be fairly valued in comparison to its peers, and I'd like to present the key reasons supporting my viewpoint:

When examining valuation ratios, I notice that Alphabet's P/E [FWD] ratio of 20.66 is more favorable than Meta's (22.13) and PINS' (35.21), albeit slightly higher than TCEHY's (19.48) and significantly above BIDU's (13.94). Alphabet's PEG Non-GAAP [FWD] of 1.26 is also more appealing than Meta's (1.61) and PINS' (1.19), which leads me to believe that Alphabet's growth is priced more sensibly. Moreover, Alphabet's EV/EBITDA [FWD] and EV/Sales [FWD] ratios lie within the middle range when pitted against its peers, suggesting a fair valuation.

As for growth metrics, Alphabet's revenue growth YoY of 9.78% and its 3-year revenue CAGR of 20.45% outperform those of TCEHY, BIDU, and PINS, although they trail behind KUASF. Additionally, Alphabet's EBITDA growth [FWD] of 7.52% surpasses most of its peers, indicating that the company is potentially poised to grow its earnings at a healthy pace.

Turning to profitability ratios, Alphabet boasts an impressive gross profit margin of 55.38% and an EBIT margin of 26.46%, both of which outshine most of its peers, with Meta being the sole exception. Furthermore, Alphabet displays a robust return on equity (23.62%) and return on assets (17.47%) when compared to its competitors, illustrating efficient resource utilization.

Although Alphabet's valuation may not be the most competitive among its peers, I maintain that its solid growth and profitability metrics warrant a fair valuation.

Risks and Headwinds

In the midst of a digital advertising market downturn, Alphabet finds itself grappling with the consequences of decelerating top line growth. The company has recently seen over a dozen downgrades in earnings per share [EPS] forecasts within the last few months, prompting caution from investors as they await Alphabet's Q1'23 earnings release.

The key to unlocking any positive growth for Alphabet lies in its Cloud business. But even with a thriving Cloud division, growth rates are anticipated to decline from 32% YoY in Q4'22 to a range of 28-30% in Q1'23. Compounded by the pressures of persistent inflation on advertising budgets, the ad market slowdown may deepen, jeopardizing Google's core operating performance and free cash flow and placing investors at significant risk.

The proliferation of AI technology has ignited debates over its potential impact on employment and various industries, particularly medicine. Some countries, even the United States, have either stated their reservations or taken measures to ban ChatGPT, signaling the unease surrounding AI's disruptive potential. As AI-driven text generation delves into natural languages and human communication, it may become increasingly imperative to tighten regulatory oversight to avert the technology's weaponization, particularly in the sphere of image generation. For example, as of this writing, an AI-generated Joe Rogan podcast was just released.

Furthermore, Alphabet's growth trajectory has been flagging since 2019, and the boost from COVID-related revenue growth is no longer a factor. The consensus among analysts is that the company's growth rate will decline in 2023 before recovering in 2024 after a restructuring phase, only to diminish again until 2031. Should Alphabet fail to reinvigorate its revenue growth rate and protect its market share, it risks disappointing investors and enduring further stock price depreciation.

Meanwhile, as aforementioned, in response to Microsoft's announcement, Alphabet has launched its generative AI platform Bard, and to play the devil's advocate, it appears to be a hasty move. The platform seems undercooked, and while some improvements to margins are expected on a quarter-over-quarter basis, earnings and free cash flows are likely to exhibit a sluggish uptick.

So, my overall fear is that despite Google's enduring brand strength and long-standing search engine market dominance, the advent of ChatGPT has compelled the company to reassess its expectation that Google Search will retain supremacy for an extended period.

Takeaway

In light of my research concerning Alphabet's flourishing advertising enterprise and burgeoning cloud division, I could confidently posit that GOOG shares are a prudent investment and worth a "buy" rating, given the substantial revenue and auspicious growth exhibited by both segments. Furthermore, Alphabet's commitment to repurchasing its own stock, coupled with its extensive suite of AI-driven products and services, as well as the avant-garde generative AI platform Bard, serve as compelling harbingers of the company's robust future prospects.

Nevertheless, investors ought to remain vigilant and cognizant of the potential perils that lurk, such as the unsettling specter of decelerating top line growth and the ever-looming possibility of regulatory scrutiny in the realm of AI technology.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.