Qantas Airways: Still Discounted

Summary

- Qantas has rebounded over 50% since July last year.

- The Australian airline is benefiting from the tailwinds of China's reopening and the dovish stance of the RBA.

- The company's current valuation remains significantly discounted compared to other airlines.

- I rate the company as a buy.

BeyondImages/iStock Unreleased via Getty Images

Investment Thesis

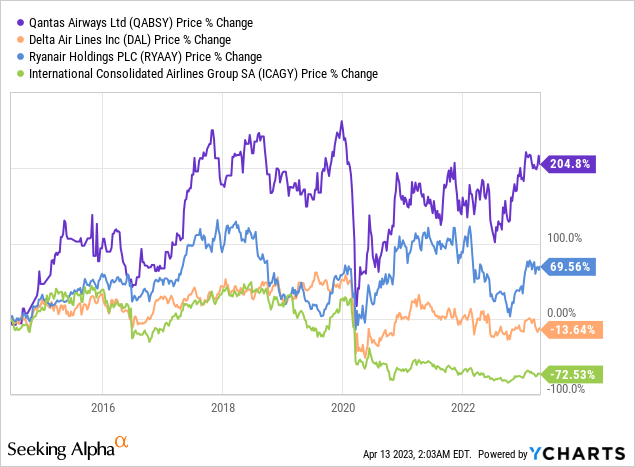

Qantas Airways (OTCPK:QABSY) has been one of the best-performing passenger airline companies in the past decade, with shares up over 200% despite facing the unprecedented pandemic which shut down the whole industry. The company has quietly rebounded over 50% since last July but I still believe it presents a great investment opportunity.

The reopening of China has substantially boosted demand and the ongoing recovery in capacity should continue to drive growth. The recent dovish stance from the RBA should also be another meaningful catalyst that fuels demand in the near term. The company's current valuation remains extremely cheap with multiples significantly discounted compared to peers. I believe there is still solid upside potential, therefore, I rate the company as a buy.

China Reopening Tailwind

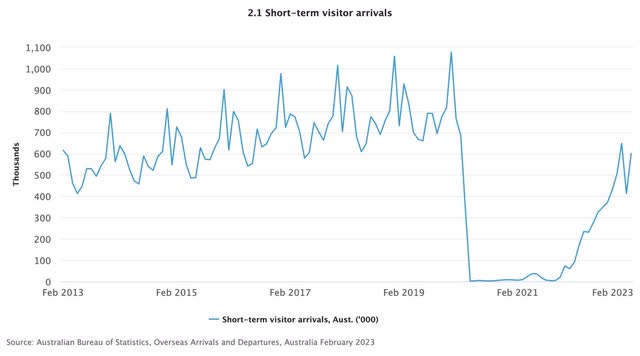

The reopening of China should continue to be the strongest growth catalyst in the near term for Qantas, and I believe there is still ample room for recovery. China is a significant market for Qantas. Prior to the pandemic, China was the world's largest outbound travel market with over 150 million trips annually, accounting for roughly 15.3% of Australia's inbound tourism in 2019.

Since the reopening announcement, flight demand from Chinese Visitors has rebounded significantly in the past few months but is still meaningfully below pre-pandemic levels due to constraints around flight capacity. According to the Australian Bureau of Statistics, short-term visitors from China have increased 424% from 7,720 in Feb 2022 to 40,430 in Feb 2023, but this is still 80% below the 206,280 recorded back in Feb 2019.

The company's latest earnings indicated that the latest flight capacity from China/Hong Kong is only at 28% compared to pre-pandemic levels, and it expects the figure to improve to 56% in the coming year, as the company continues to take action to expand its capacity. For instance, they are expected to receive three new 787s in the coming months, after a two-year delay. As the company continues to grow its capacity to accommodate rising demand, I expect revenue growth to remain superb throughout the coming year.

Australian Bureau of Statistics

A Dovish RBA

Unlike the Federal Reserve and the ECB (Europe Central Bank) which continue to be hawkish and raise interest rates, the RBA (Reserve Bank of Australia) took a much more dovish stance in the latest meeting earlier this month and decided to pause and leave its cash rate unchanged at 3.6%.

After the surprising dovish decision, the AUD (Australian Dollar) continues to weaken against other major currencies such as the US Dollar and the Chinese Yuan. This should serve as a tailwind for companies like Qantas that have a meaningful presence in the international markets, as a lower AUD will boost the purchasing power of foreigners with their relatively stronger local currencies, which translates to higher demand.

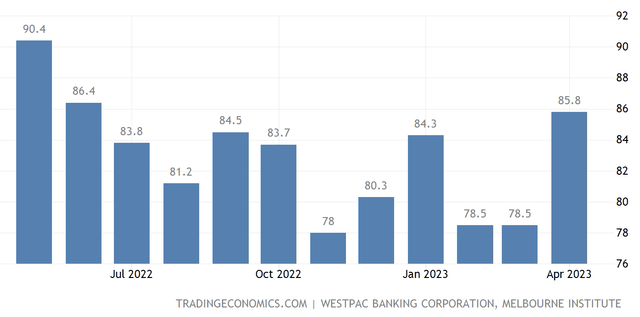

The decision is also fueling a huge spike in local consumer sentiment, as financial condition eases. As shown in the chart below, the Australia Consumer Confidence Index jumped 9.5% month over month from 78.5 to 85.8, back to levels not seen since June 2022. The 9.5% increase is significantly above the consensus increase of just 1.5%. The rebounding consumer sentiment should also be another major tailwind that continues to drive demand.

Valuation

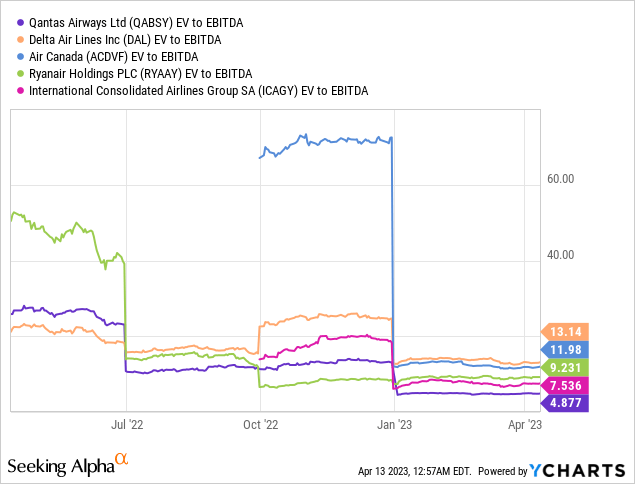

Despite the huge rebound in share price, Qantas' valuation remains highly compelling. The company is currently trading at an EV/EBITDA ratio of just 4.9x, which is extremely cheap. From the chart below, you can see that its multiple is substantially lower than other large airline companies such as Delta Air Lines (DAL) and Air Canada (OTCQX:ACDVF). The peer group has an average EV/EBITDA ratio of 10.5x, which represent a whopping premium of 114%.

The premium is not justified in my opinion as Qantas' latest earnings reported revenue growth of 222%, much higher compared to peers' average of 50.8%. The company's balance sheet is also one of the healthiest in the industry with a net debt to EBITDA ratio of just 1.3x, vastly below Delta Air Lines' 5.6x and Air Canada's 5.1x. I believe the company's valuation will revert to peers' average which should present great upside potential.

Risks

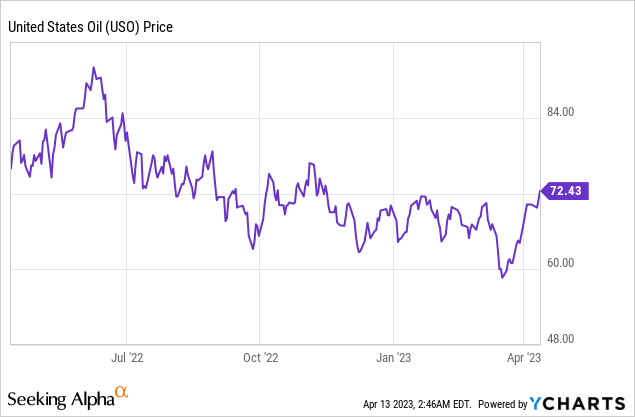

One of the most notable near-term risks is the volatility in oil prices, as it significantly impacts the company's cost of operation. Oil prices have been trending down since last year but OPEC+'s recent announcement of a surprising production cut has spurred a rebound in oil prices, as shown in the chart below. According to Reuters, the cut is estimated to be 3.66 million BPD (barrels per day) or 3.7% of global demand. While the current oil price remains well below the highs last year, the ongoing spike will likely put meaningful pressure on Qantas' bottom line.

Investor Takeaway

I believe Qantas presents an attractive investment opportunity as the company is still in the early innings of recovery. The domestic segment has almost fully recovered but the international segment is still lagging due to flight capacity constraints, especially in China. As flight capacity continues to expand, revenue should also see a meaningful bump. The dovish stance from the RBA is another overlooked tailwind that could drive growth, as it boosts local consumer sentiment and foreign customers' demand. Oil prices may be a potential concern if it continues to rise but I am not too worried right now. I believe the catalysts alongside its significantly discounted valuation should present great upside potential, and I rate the company as a buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.