BHK: 8% Yield By Holding Over 43% AAA Assets

Summary

- BHK is a fixed income CEF.

- The fund is composed of Treasuries, Agency MBS bonds and investment grade corporate names.

- The fund represents a leveraged take on a portfolio of investment grade securities, overweight treasuries and Agency MBS.

- The fund has a very high leverage figure of 40%.

- The fund is an aggressive bet on a decreasing rates view.

Torsten Asmus

Thesis

BlackRock Core Bond Trust (NYSE:BHK) is a fixed income closed end fund that has current income as a primary objective. The CEF was started in 2001 and it seeks to achieve its primary objective by investing primarily in a diversified portfolio of Treasuries, Agency MBSs, investment grade bonds and junk securities. At least 75% of its total assets will be invested in investment grade bonds. Up to 25% of its total assets may be invested in bonds that at the time are rated Ba/BB or below.

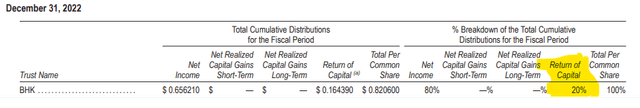

In its current portfolio format the vehicle has an allocation exceeding 30% to Treasuries and Agency MBS, with the Securitization segment of the fund having greatly increased its allocation in the past year. By the nature of the collateral involved, yields here are always going to be fairly muted compared to other funds. The current yield on this CEF is 8%, but it is not entirely supported. Looking at the 2022 Annual Report we can see that 20% of the distribution was return of capital:

Section 19a Annual (Annual Report)

This translates into the fund having a true yield closer to 6.5%, which makes sense given the asset class involved here.

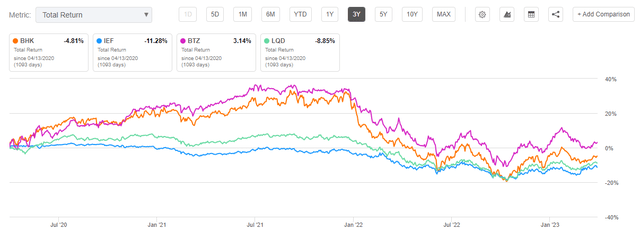

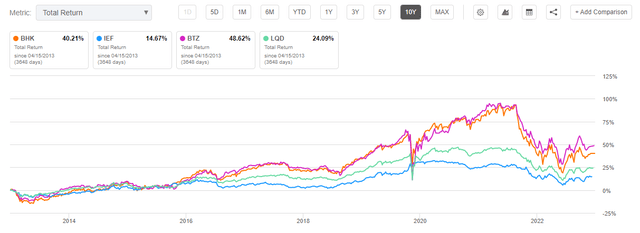

BHK is more of a leveraged play on rates rather than a true dividend extractor. As rates move down this fund is set to experience a substantial increase in NAV, on the back of the assets inverse correlation to rates. We saw this explosive performance in 2019 when the Fed started decreasing rates:

Annual Performance (Morningstar)

Although the portfolio managers have steered the fund more towards AAA securitizations as of late, the portfolio allocation is dynamic. Expect more Treasuries and Agency MBSs as rates peak.

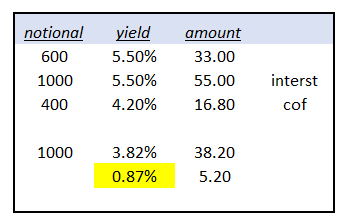

As mentioned above BHK is more of a NAV play rather than yield one. If we do a rough back of the envelope calculation, we come up with a mere 0.87% or 87 bps yield enhancement from the 40% leverage ratio:

Actual Fund Yield (Author)

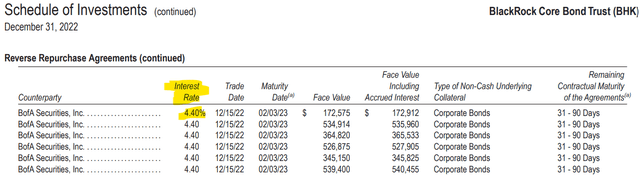

This is due to the low all-in yield on the assets purchased and the high cost of the leverage (done via repos with banks):

Looking into the details in the 2022 Annual Report we can see that all Repos had costs above 4% as of that date. So if you buy a Treasury with call it 5% yield but you pay 4.4% on your Repo (even if done with a haircut so not full notional), in effect you don't get an enormous portfolio yield enhancement.

We think of BHK as a nice leveraged play on Treasuries that will benefit from NAV accretion in 2024/2025 as rates do eventually come down. It is leveraged, hence quite volatile, so not a low standard deviation play.

CEF Holdings

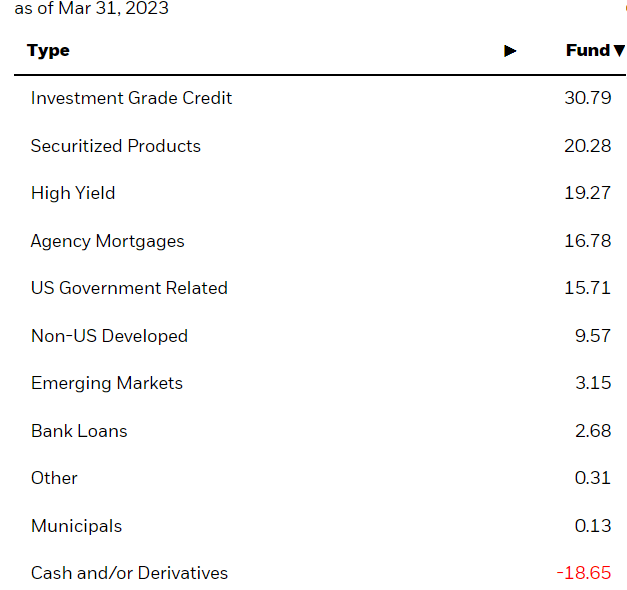

Currently the collateral allocation looks as follows:

Holdings (Fund Website)

'US Government Related' are U.S. Treasuries, and they decreased in allocation from December 2022:

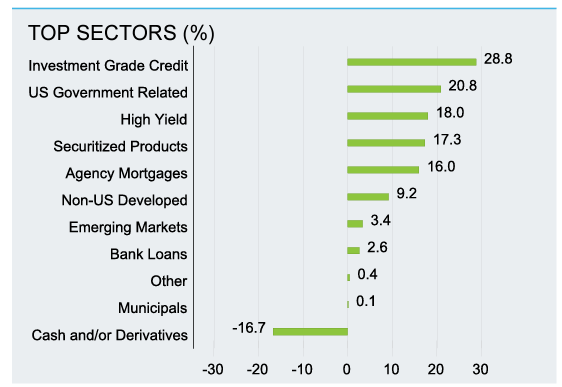

December 2022 Fact Sheet (Fact Sheet)

The above graph is from the December 2022 fact sheet. We can see the portfolio managers decreased the Treasuries allocation in favor of securitized products. The 'Securitized Products' bucket is usually highly rated senior tranches:

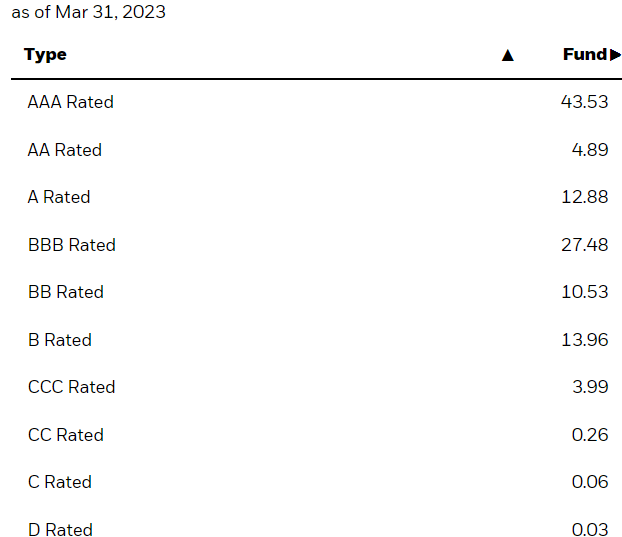

Ratings (Fund Website)

We can see the fund runs only its maximum 25% limit in terms of junk bonds. The CEF is overweight AAA paper.

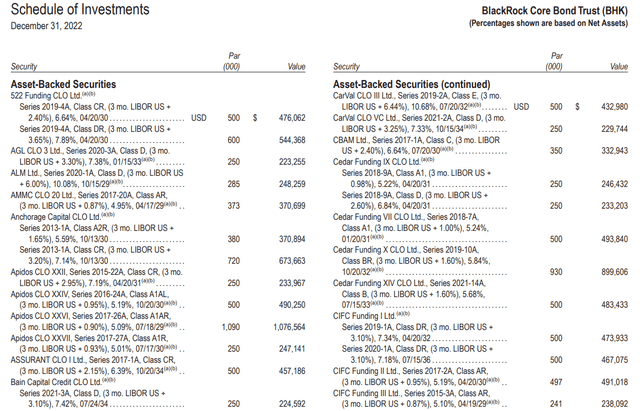

The Securitized bucket contains a very high number of AAA and AA CLOs:

Securitizations (Annual Report)

We recently wrote about a new ETF that packages solely AAA CLOs, and we were asserting a AAA/AA CLO CEF is not too far away. This fund has a blended allocation to this asset class, together with other pure corporate plays.

Historic Performance

This fund has a high sensitivity to rates (it is sporting a 9.3 years duration):

We are comparing BHK with the 7-10 Year Treasury ETF (IEF) and with the unleveraged investment grade corporate ETF (LQD) and the leveraged version (BTZ). We can see how the CEFs outperformed in the 0% rates environment in 2020/2021, but also had a massive drawdown in 2022.

Longer term, in a normalized rates environment, they tend to outperform but more modestly:

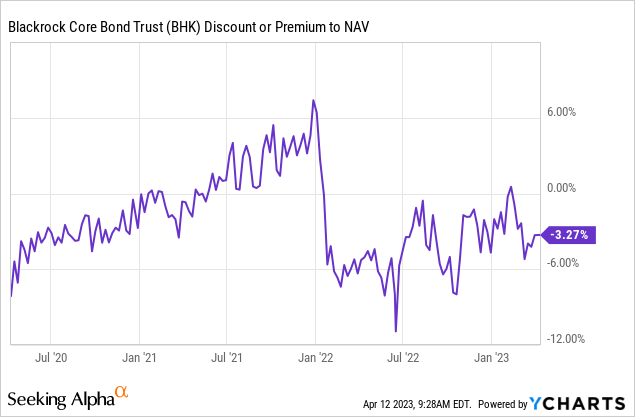

Premium/Discount to NAV

The fund's discount to NAV has a high beta to rates and risk-on / risk-off environments:

The discount widened significantly once the market started pricing in higher rates, and then again in October when the entire market was selling-off. Expect the discount to persist as the Fed keeps hiking rates.

Conclusion

BHK is a fixed income CEF. The fund has historically had a very high allocation to Treasuries and Agency MBS, but has reduced those figures since December 2022 in favor of more AAA CLO paper. The vehicle has a very high leverage ratio of 40%, which makes it more volatile than other similar vehicles. The fund pays an 8% dividend yield, which is only 80% supported, the rest coming from ROC utilization. We estimate the true yield of the underlying collateral here to be more around 6.5%. We think of BHK as a leveraged take on rates, with the fund posting eye watering results every year after the Fed started lowering rates. The 'meat on the bone' so to speak is via NAV accretion when rates collapse rather than clipping the coupon.

The fund is actively managed, but even if over 75% of the current portfolio is investment grade, do expect sectoral allocations to change. To that end we have seen the portfolio manager navigate away from Treasuries and into floating rate AAA CLOs since December 2022. BHK is going to be an interesting play once the Fed is done hiking and the market will start bidding up significantly Treasuries and other fixed income rates plays currently in the portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.