SRVR ETF: How Data Center REITs Revive The Commercial Real Estate Market

Summary

- Commercial real estate may have formed a short-term bottom, and data center REITs like Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF appear to offer good value.

- The supply-demand mismatch could support rental rates.

- Given the challenging financing conditions, growth may largely depend on asset sales.

- Looking for higher risk/reward options trading ideas? I offer this and much more at my exclusive investing ideas service, The Lead-Lag Report. Learn More »

piranka

Data is the new raw material of business. - Craig Mundie

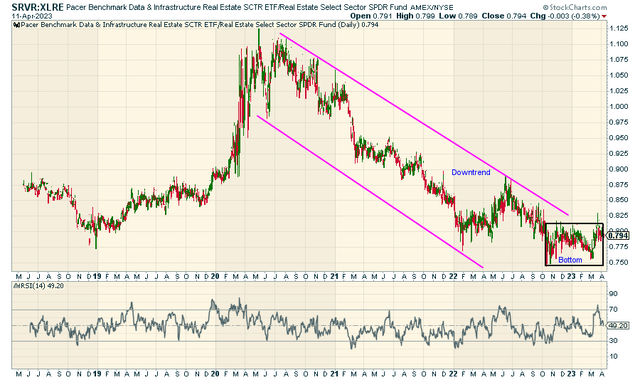

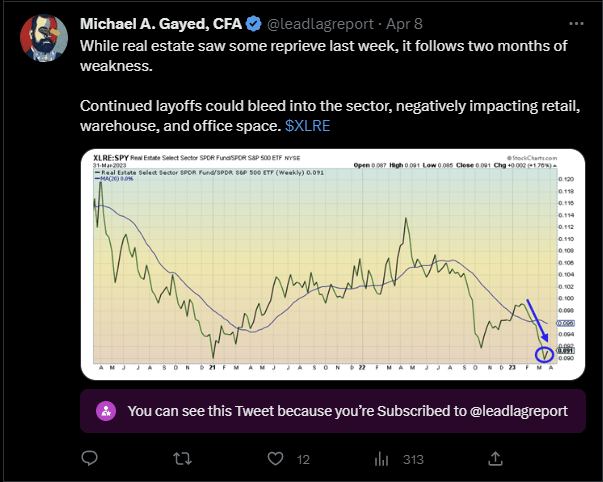

If you're a subscriber of The Lead-Lag Report or have been tracking developments on the associated Twitter account, you'd note that I'd recently put out an intriguing chart highlighting the scope for a short-term bottom for real-estate stocks.

Twitter

For the sake of additional clarity, note that a ratio measuring the strength of the real estate sector as a function of the S&P 500 (SP500) recently dropped to a level last seen at the start of 2021, an area from where one had previously witnessed a reversal. Could we see a recurrence of the same? Over the long term, things are still looking fairly ambiguous for the real-estate sector, but over the short term, things may be looking up after two straight months of selling.

If you're curious to explore this space and are looking for beaten-down options with promising long-term prospects, you may consider making a beeline for the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSEARCA:SRVR).

As noted in the image below, SRVR's clout relative to the broader real estate sector had been declining since mid-2020, but in recent months, things appeared to have stabilized with the downtrend coalescing into a bottom-formation of sorts. This could provide SRVR with a nice foundation to try and make up for lost ground.

Nonetheless, coming back to SRVR's profile per se, it's worth noting that this product focuses on 23 companies that generate a majority (at least 50%) of their revenue or profits from owning or managing real estate which is used to store, compute, or transmit a huge volume of data (aka, data centers, communication towers). These real estate investment trusts, or REITs, help keep servers and data safe, provide uninterrupted power supplies, air-cooled chillers, and also facilitate deeper greater thresholds of communication.

As noted in a tweet on the timeline of The Lead-Lag Report, vacancy rates in a lot of commercial real estate avenues, particularly the office and industrial sectors, are quite high, and this has impacted sentiment towards this sector.

Twitter

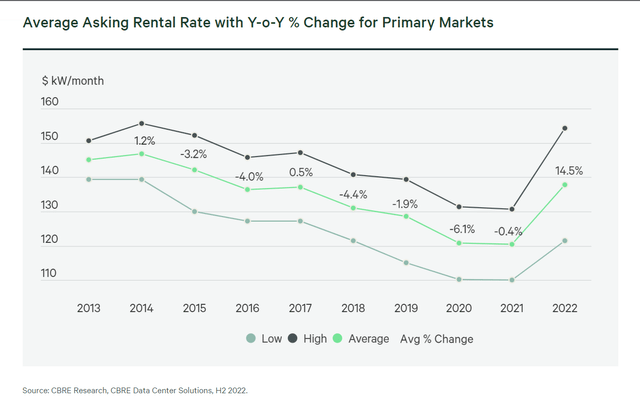

However, that is not quite the case with data center REITs. Data from CBRE show that vacancy rates at the end of FY22 stood at record lows of 3.2%, and this is just a function of the demand-supply mismatch.

Fundamentally, people need to recognize that the data age is unlikely to slow down any time soon. If anything, with the growing proliferation of 5G, IoT, AI, VR, blockchain, etc. the demand for data centers is only expected to grow. For instance, the number of globally connected IoT devices is poised to more than double to levels of over 27 billion by 2025, from the levels seen in 2021.

Meanwhile, supply chain disruption and higher prices of materials still continue to dampen construction momentum and the overall supply side. It is believed that lead times for something like substations, which are integral to data center functioning are now over 2x what they were during H1-22. With limited supply and solid demand, rental rates remain solid enough, growing at double-digit rates.

Risks

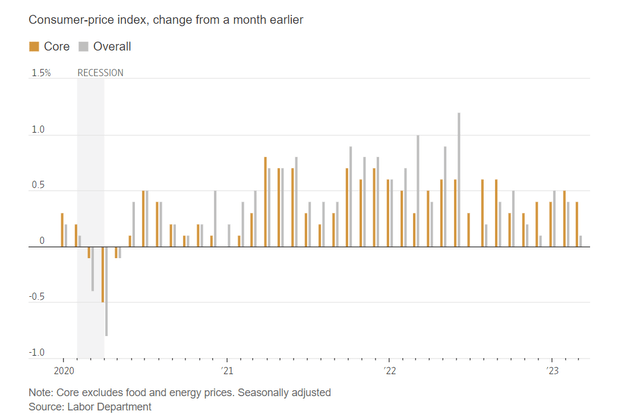

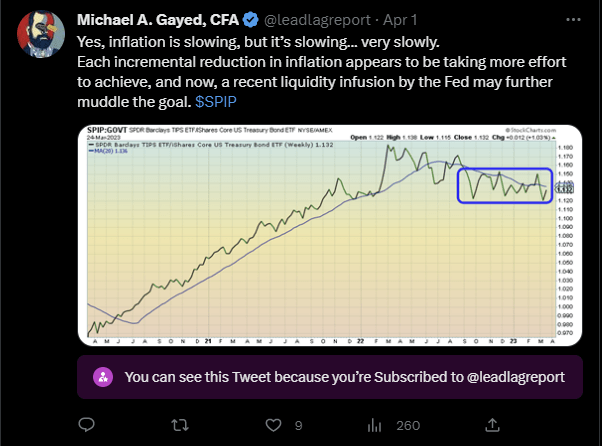

At the other side of the equation, one can't but help wonder when inflationary trends will get to a point where the Fed would feel comfortable with shedding its rate hike plans. As noted in The Lead-Lag Report, inflation has been coming down at a very slow pace, and even if the most recent March number came in at 5%, it is still a good 300bps away from the Fed's comfort range.

Twitter

Crucially, core inflation, The Fed's preferred measure which excludes the capricious effects of food and energy, still continues to stay elevated, coming in at 5.6% vs 5.5% in the previous month.

Last week, I flagged how the Fed Funds futures were signally increasing odds of a May rate hike, and the recent inflation report is unlikely to do anything to dampen that narrative. I suspect investors may need to wait till the end of Q2 to see the inflation base effect leave a mark. With debt getting more expensive and lending conditions becoming more stringent, expansion plans for these REITs would be hampered with much of the growth potential heavily linked to asset sales, which is not ideal.

Investors should also note that of late, a number of major cloud companies such as Microsoft (MSFT), Amazon (AMZN), Google (GOOG), etc. have also begun initiatives to build their own data-center facilities, which would only make the market even more competitive going forward.

Finally, I also want to reiterate what I've been stating on The Lead-Lag Report Instagram page. Recent intermarket relationships have been suggesting that conditions for risk assets look wobbly, and we could see an accident soon enough. During risk-off conditions, highly levered plays such as commercial real estate may find few takers and this may dampen sentiment towards Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF as well.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.