Crown Holdings Looks Fairly Valued

Summary

- Crown Holdings, Inc. will look towards improved margins this year as it recovers from inflationary pressures in 2022.

- A fairly heavy debt load and potential economic headwinds are risks.

- Crown Holdings stock looks fairly valued at this time.

retouchman

Crown Holdings, Inc. (NYSE:CCK) is a solid company, but it looks fairly valued given its debt load and potential economic headwinds.

Company Profile

Crown Holdings, Inc. is a global supplier of rigid packaging products for consumer goods companies, as well as transit and protective packaging products. Within rigid packaging, it primarily sells aluminum and steel cans to the food and beverage industry, and to a lesser extent the personal care and household industries.

Its transit and protective packaging products, meanwhile, include steel and plastic consumables & equipment, plastic film consumables & equipment, and paper-based protective packaging.

The company operates in five segments. Its Americas Beverage segment manufactures aluminum beverage cans and ends, glass bottles, steel crowns and aluminum caps. It has facilities in U.S., Brazil, Canada, Mexico and Colombia. Its European Beverage segment, meanwhile, makes aluminum beverage cans and ends in Europe, the Middle East and North Africa.

Its Asia Pacific segment largely consists of its beverage can operations in Cambodia, China, Vietnam, Thailand, Indonesia, Malaysia, Myanmar, and Singapore. It also manufactures food cans and specialty packaging. Its Other segment makes food and aerosol cans in the U.S. as well as includes its beverage tooling and equipment operations in the U.S. and U.K.

CCK’s Transit Packaging segment manufactures industrial products such as steel straps, plastic straps, and industrial films. It also makes transit protection products, such as airbags, edge protectors, and honeycomb products. In addition, it produces equipment and tools that are chiefly used in end-of-line operations to apply consumables such as straps and films.

Opportunities and Risks

As the 2nd largest beverage can manufacturing in the world, global beverage demand is one of the biggest drivers for Crown Holdings, Inc. Being attached to strong, growing customers also helps. On that end, the company is benefiting from the outsized growth of sparkling water and energy drinks that many of its customers make. For 2023, CCK is looking for its North American segment to grow volumes by 10%, despite overall market volumes being flat.

On its Q4 earnings call, CEO Timothy Donahue said:

“I think the upside or downside to the 10% projection revolves around what the market is going to do. As we said, we are confident with the 10%, assuming a flat market in '23. If the market is up, we'll do a little better. If the market is down, then our customers may not pull as many cans. But the entirety of our growth centers around those customers who have continued to grow principally in the carbonated soft drink and sparkling water categories as well as some of the energy and other nutritional type drinks. That growth for us is principally centered on their growth and/or Crown gaining a greater percentage of that customer's volume from where we stood last year.”

Going hand-in-hand with volume growth is capacity expansion. The company is adding a good amount of additional capacity this year and next, particularly in North America and Europe. This will help support further growth in areas like sparkling water and energy drinks this year and beyond.

It plans to spend $900 million in CapEx this year and $500 million in 2024. It opened a new plant in Virginia in November, and opened a 2nd line for the plant in February. It’s also looking to start production at a Nevada facility, with line one in June and a 2nd line in October. In addition, it’s increasing capacity with high-speed production lines being added to facilities in Italy and Spain this year.

Outside of beverages, the company is also seeing good growth in pet food. As such, it is expanding pet food can capacity at a plant in Minnesota, and installing a pet food can line at a facility in Iowa.

As with most manufacturing heavy companies, improving efficiencies is important. CCK actually benefits in two ways, as it makes its own automation equipment, which it also sells to other companies. Thus, CCK is riding a nice trend in automation not only with its own plants, but by also selling this equipment to customers.

When looking at risks, the commodity costs associated with aluminum, and to a lesser extent steel, can play a big role. In 2022, aluminum represented 44% of its costs of goods sold, while steel was 9%. The company tries to match purchase obligations with its sales agreements to help mitigate risk, but there is often a lag.

This hurt 2022 results, but Crown Holdings, Inc. should get a boost in 2023 as its contracts allow it to recover inflationary costs. Nonetheless, it still only expects to recover half the margins it lost.

Energy costs also hurt the company in 2022, and the company had to change its contracts in Europe to make energy more of a pass-through. With lower prices in natural gas, the company has also gone and hedged a good amount of its energy exposure.

Discussing energy prices on its Q4 call, CFO Kevin Clotheir said:

“Largely, this is rightsizing the contracts that required energy recovery within the contracts. The lower prices that we're seeing now in energy, we've gone out and we've hedged a fair amount of the energy exposure that we had this year to eliminate any volatility. So embedded in the numbers that we've given you, takes that into consideration. So if you think about the lower energy prices, a potential upside, probably -- maybe on a minor level, but if you think about it, by the time we get into '24, we're rightsizing the rest of the contract, so we could get that as a pass-through. So, if it stayed at a lower level, that would pass through to the customers, but allow us to get back to our income level that we like.”

The global economy can also impact beverage and other food can volumes, so CCK is not totally immune from an economic recession. This also isn’t a high margin business, so less throughput through its facilities can further hurt margins and really be blow to its results if there is a meaningful decline in beverage can volumes.

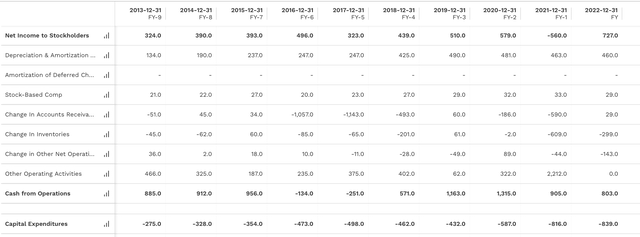

At the same time, it also has a decent amount of debt (net debt f $6.4 billion) and leverage of 3.7x. The company generally produces solid free cash flow, but during periods of economic weakness this isn't always the case.

Valuation

Crown Holdings, Inc. stock currently trades around 8.7x the 2023 consensus EBITDA of $1.89 billion and 8.1x the FY25 consensus of $2.03 billion.

It trades at a forward P/E of 12.5x the 2023 consensus of $6.28.

It’s projected to growth revenue by 2-4% each of the next several years.

It trades towards the middle of its peer group in terms of valuation.

CCK Valuation Vs Peers (FinBox)

The stock is trading around where it historically trades.

CCK Historic Valuation (FinBox)

Conclusion

Crown Holdings, Inc. is a solid company with a long track record. I like how it’s been able to take its tooling business and really add additional growth through the sale of automation products. Meanwhile, its core business is solid, and should benefit from some margin recovery this year.

That said, given potential economic headwinds, to go along with a fair amount of debt, I think Crown Holdings, Inc. stock looks fairly valued at current levels. Activist Carl Icahn revealed an over 8% stake in the fall, and called for the company to sell non-core assets and buy back stock. I’m not sure that’s the best idea at the moment given where the economy is and its balance sheet. Yes, in good years CCK can generate a lot of cash, but it can also burn cash during poor years. As such, I think the stock is a “Hold” for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.