Jump In Tech Layoffs Bad For People, But Good For XLK

Summary

- Layoffs surged last year and have yet to slow down, but the tech sector might be poised for a comeback based on how it’s performed so far this year.

- When looking through a 3-5 year lens, current restructuring, which happens to involve layoffs, could better prepare tech companies for the next bear market.

- This year is already being characterized by widespread digitalization and the emergence of revolutionary technology like generative artificial intelligence, which could create numerous opportunities for future profit.

- I rate XLK a Buy, as I believe technology could gain serious momentum in the coming periods after strongly emerging from a bearish 2022.

XH4D

The technology sector is renowned for its aura of innovation and money-making potential for those who work in it as well as those who invest in it. During the heat of the 2022 bear market, technology securities quickly went from being prime choice to being resented by many, as rate hikes hit their profit margins hard. However, this down may have been temporary as the tech sector emerged back above the S&P in February and since then has been accelerating quickly. In this article, the Technology Select Sector SPDR Fund ETF (NYSEARCA:XLK) is representative of the technology sector. My long term view on tech is bullish and I believe this year could be one for important technological innovations and market changes that could boost XLK's price. For these reasons, I rate XLK a Buy.

The ongoing bear market has been so tough on big tech companies that these juggernauts have laid off tons of employees for purposes of enhancing business enough to stay afloat. Layoffs surged last summer and got worse during the fall when aggressive rate hikes hit the tech sector hard. Since then, mass layoffs have not let up. However, the traction that XLK gained after layoffs got worse shows how these measures could be a crucial part of this positive momentum looking forward. Furthermore, I don't believe these layoffs signal an imminent recession.

Tech Layoffs: Adapting To A Rough Environment While Not Sacrificing Future Returns

Layoffs within the technology sector remain a serious problem and a critical implication for tech investors. If layoffs proceed as they have recently, the tech sector could incur a loss of over 900,000 jobs by the end of the year.

Mass layoffs are likely in the future to escalate negative publicity and reduce worker morale. What is unique about the current wave of layoffs is how many of them involve fairly recent college graduates. These students worked hard enough to attain their positions at big name companies, only to get fired shortly after they started.

Layoffs may be detrimental for both the individuals losing their jobs as well as the companies doing the firing, but they're also nothing less than the appropriate and necessary action by these firms. The economic downturn hit technology companies particularly hard in 2022 because rate hikes made it hard for these institutions to fund their generally expensive operations. Furthermore, many of these firms sell expensive electronics that are considered luxuries by many, and therefore put secondary to more essential items when prices increase. These factors alike reduced the profits of big tech names and put greater pressure on wages, thus forcing layoffs.

This cost-cutting within tech companies is an ultimate aspect of business restructuring that revolves around unfavorable macroeconomic conditions and the possibility of a recession or further monetary policy tightening. Therefore, mass layoffs since the onset of the current bear market were mainly a consequence of endeavors taken to improve profit margins and enhance cost-efficiency.

Technology May Be Back For Redemption This Year

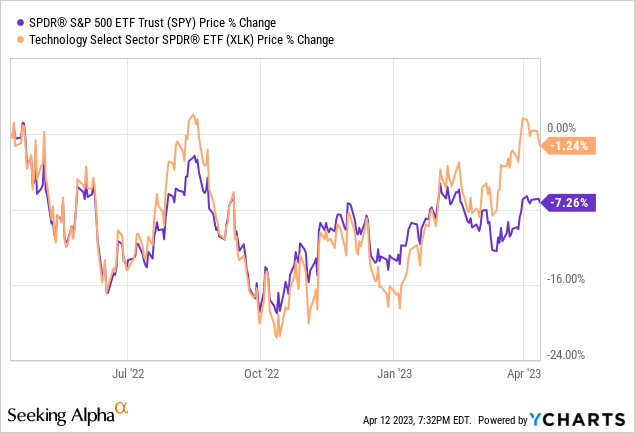

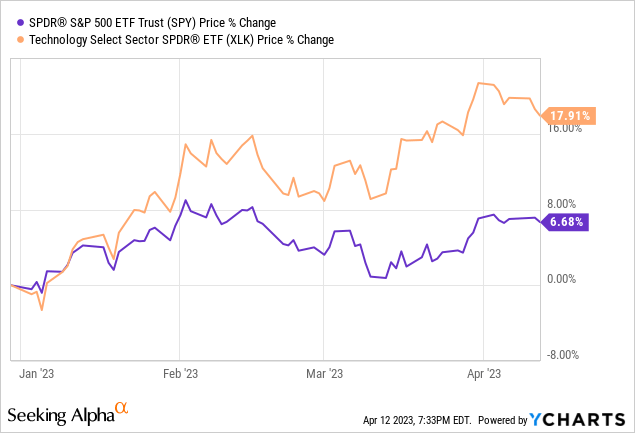

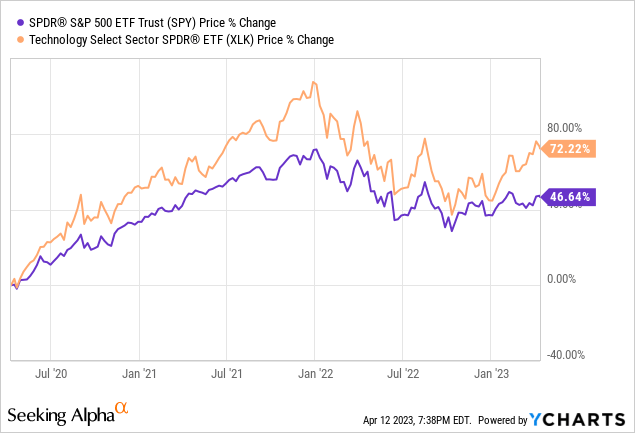

The desired effects of layoffs and general restructuring are already showing, as the tech sector has mostly outperformed the market so far this year despite the still struggling economy. Ultimately, more layoffs might be what's needed for the tech sector to make a strong comeback amid a market reversal.

Evidently, as layoffs are up, so are XLK's returns. Since its most recent emergence, the gap between XLK and SPY has widened as this ETF appears to be pulling further ahead of the rest of the market as the year progresses.

Past Performance And Future Implications

XLK vs. SPY: Technology Against The Broader Market In The Past

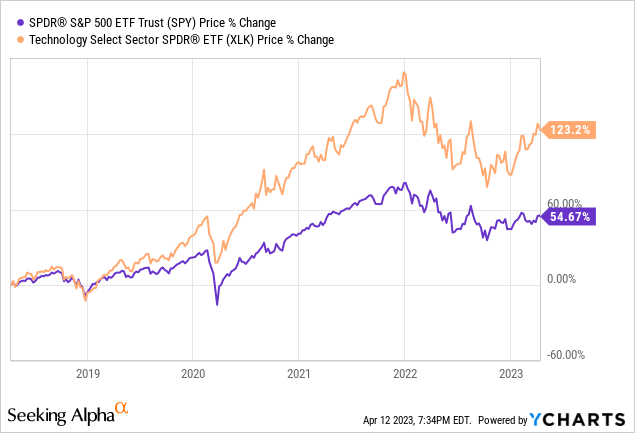

Dating back five years, XLK has consistently outperformed the renowned SPDR S&P 500 ETF Trust (SPY) while reaping more than 107% higher profits.

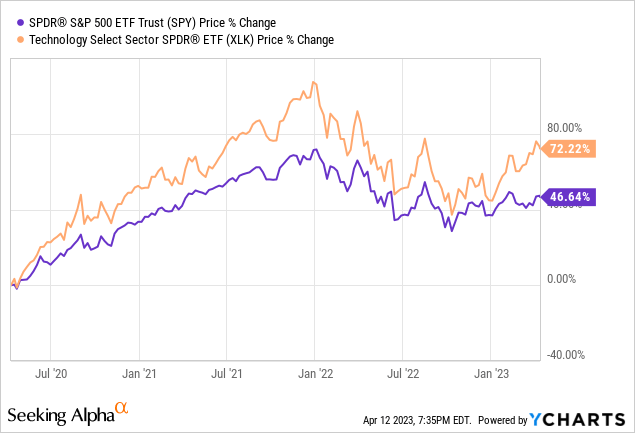

The same trend has persisted during the past three years, as seen in the chart below.

Though past performance is not indicative of future potential, XLK may have some underlying advantages over the rest of the market that could serve it well in the long term. Though its volatility might be greater, the room for long-term profit in XLK in particular is notable and what makes it the mother of technology ETFs.

XLK vs. QQQ: The Power Of Technology

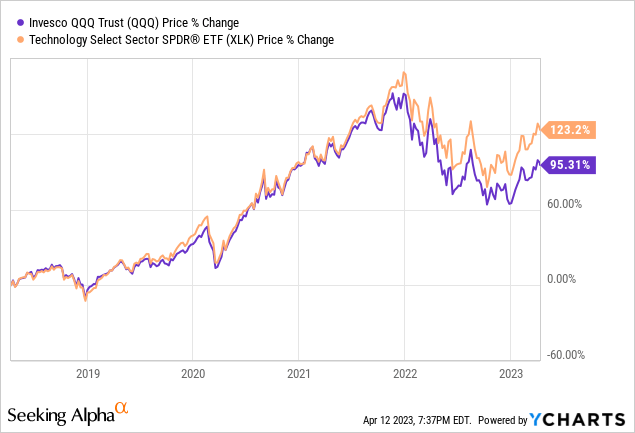

XLK's exclusive focus on technology could give it a significant edge over potential alternatives in the long term. On the topic of big ETFs, XLK's outperformance against the Invesco QQQ Trust ETF (QQQ) during the past five years could reflect this advantage.

When looking back three years, QQQ appeared to be performing on par with XLK until the onset of the 2022 bear market. In the chart below, the gap between the trend lines appears to progressively widen from last January until the current moment.

Even when the market declines, XLK might be a better alternative over its large-cap counterparts. Though the tech sector is not recession proof and still vulnerable to macroeconomic headwinds, its general capabilities for profit continue to impress. More specifically, this trend may shed light on just how big of a boost is provided by that extra half of technology exposure, as tech companies account for just under half of QQQ's portfolio.

QQQ sector composition (Seeking Alpha)

Spotting Momentum: Emerging Tech Trends In 2023

The tech sector has encountered numerous emerging trends so far in 2023, and these trends could gain traction as the world continues to digitize and generally become more tech-oriented. As the next step in my analysis, I've divided technology in the few subsectors that I believe could most significantly catalyze its growth in the coming periods.

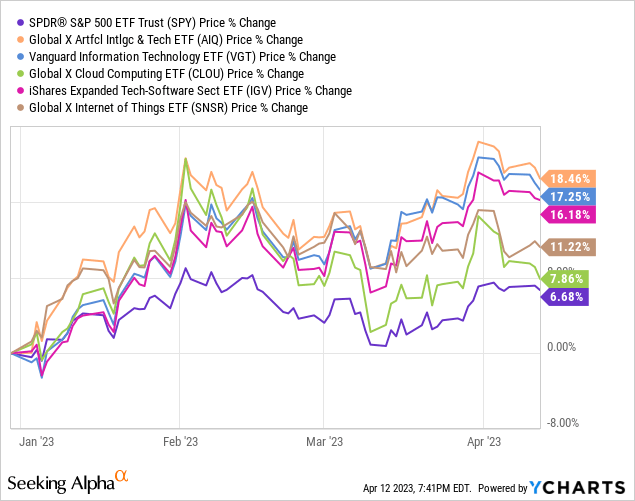

The industries I've chosen to represent the core of the technology sector are artificial intelligence ('AI'), information technology ('IT'), software, cloud computing, and the internet of things (IoT). Based on the chart below, all of these industries have outperformed the market so far this year.

Artificial Intelligence

Investors who have been following technology at even the most basic level recently have likely read about artificial intelligence (AI). More specifically, they have probably read about how fast it exploded in popularity last year and how quickly it's becoming a central part of our lives and the workforce alike.

I mention the AI industry first because of the potential it has to facilitate growth in numerous other technological industries, including the ones I touch on later in this piece. Potential enhancements include but are not limited to personalizing services within fintech and cybersecurity, improving the efficiency of industrial robots, and improving data analytics and code generation within software operations.

Recent developments have strengthened the AI market's growth forecast. At a CAGR of 38%, the artificial intelligence industry could exceed $1.5T by 2030. From looking at the YTD chart previously depicted, the AI market has also reached greater heights than its alternative industries so far this year with a price gain of almost 20%. I have covered artificial intelligence on numerous occasions within my past articles, but dive really deep into the AI market in my recent piece on the Robo Global Artificial Intelligence ETF (THNQ).

Information Technology

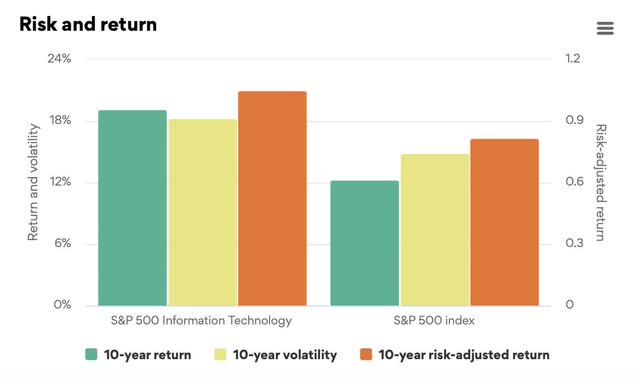

Information technology (IT) is a staple of the technology sector and is also responsible for roughly a fifth of XLK's total industry allocation. The IT industry has also been historically profitable compared to the S&P, as seen in the chart below.

The IT industry could see many opportunities for growth in the future and could generally be one of the industries that benefits most from the ongoing societal digitization. Such opportunities might include advancements in cloud computing and cybersecurity that could demand more secure, cost-efficient IT infrastructure.

The global IT market is forecasted to grow to over $1.5T by 2027 at a CAGR of 7%.

Software

Software is responsible for over a quarter of industry allocation in XLK. The software industry could benefit in the future from the increasing need for automation services within non-technology fields like finance, healthcare, and industrials.

As macro digitization continues, more and more companies could start to use their software to distinguish themselves from peers. In this regard, certain non-technology institutions may take on developing their own unique software in an attempt to gain an edge over their competitors. This trend could eventually lead to more software integrations into traditional services as well as software taking up a larger majority of these companies' net value.

AI is also likely to benefit the software market down the road. Artificial intelligence has already shown to be efficient in repetitive but necessary tasks like code generation and data management within software firms. Therefore, AI integration could allow software engineers to devote more time to product development and more profound innovation plans that might be beyond the current grasp of AI. This could ultimately increase the efficiency of many software companies, which could increase profits and investor returns alike.

The global software market could reach almost $860B in revenue by 2028, growing at a CAGR of roughly 5.5% between now and then. I investigate the software industry's potential in greater depth in my piece on the SPDR S&P Software & Services ETF (XSW).

Cloud Computing

Cloud computing has made a monumental impact on the workforce in recent years. Some of its more notable feats include mobilizing a larger remote workforce after COVID-19 as well as enhancing the scalability, security, and cost-efficiency of business operations.

For example, cloud computing has made mergers and acquisitions (M&A) within banks a more seamless process, which is quite salient now as an economic turnaround could boost M&A activity. Other industries which could benefit from cloud migration in the future include, but are not limited to, fintech, insurance, and cybersecurity. This could ultimately drive the prices of cloud computing companies as more businesses become increasingly reliant on their services for both everyday endeavors as well as larger transactions and deals. I address future implications in greater depth in my article on the WisdomTree Cloud Computing Fund ETF (WCLD).

At a rate of roughly 14%, the United States cloud computing market could grow to over $1.4T by 2030.

Internet of Things

The internet of things (IOT) industry refers to the remote management of smart devices which are connected to the internet. Such devices include mobile phones, autonomous vehicles, and industrial robots. The IoT subsector manages the wireless network between said devices, allowing them to more freely exchange data with the goal of improving the efficiency and fluidity of their operations.

The IoT industry is well-positioned for future growth, as adjacent markets like those of e-commerce, healthcare, and communication are likely to make greater use of their services as the world becomes increasingly dependent on smart technology. Furthermore, social media has also become somewhat crucial for marketing as it allows businesses to more efficiently reach a wider audience. On this note, the internet's momentum is strong and profitability could rise in the coming periods as more rely on it to generate revenue from their own businesses. I go into this in greater detail in my piece on the Invesco NASDAQ Internet ETF (PNQI).

The IoT industry could grow to over $1.7T by 2030 at a CAGR of 20%.

Spotting Potholes Down The Road: Threats To Tech

Talent Shortages: Is Tech Moving Too Fast For Its Own Good?

Innovative systems like generative AI are great, but are also extremely complex and not getting simpler anytime soon. For this reason, the talent shortage in the technology industry is an ongoing threat that could get much worse in the future. Therefore, tech companies might eventually find themselves demanding a unique skill set from employees while also not being able to assure them that they won't get fired right after they start. This could make technology careers an overall uncompelling career choice which in the long run, could threaten both profits and public image.

Monetary Policy Tightening: What Hit Tech Hard In 2022 Still Looms

The idea of a market reversal and economic recovery could push sentiment in a positive direction, but one should remember that individual investors don't always choose rationality over optimism. Even if the Fear and Greed Index were to shift farther right, I don't believe this to be all clear. Therefore, even with the positive momentum that tech has seen so far this year, investors should not rule out the possibility of further rate hikes or even a recession. Price increases hit technology hard last year, and they could do it again, so best not succumb to irrational speculation.

Technology Race Against China: Who Can Innovate Faster?

Believe it or not, technological innovation and the lucrative aura that surrounds it is not all sunshine and rainbows, especially when there's overseas competitors trying to do the same thing. This case manifests in the ongoing tech race between the United States and China, which has been making headlines recently. This competition is mainly centered on developing the most innovative technology, particularly in more nascent domains like generative AI and quantum computing.

Intensifying competition could facilitate geopolitical tensions between both nations as well as China's urge to commit cyberattacks and espionage against the United States. As hacking and cyberbreaches in general are becoming easier to commit, the threat of cybercrime is not to be ignored. Furthermore, adversities like the current semiconductor shortage have made this situation worse and could continue to add fuel to the fire.

Conclusion

I rate XLK a Buy. I believe this ETF harnesses the long term growth potential of technology, and I think now is an optimal time to invest as XLK could be rebounding from its most recent decline at the end of last year. Furthermore, innovations like AI could drive XLK's price in the medium to long-term as its capabilities continue to shock the public.

Tech layoffs might be a short-term problem for many large institutions' talent base and worker morale, but also a medium to long-term solution for these same institutions' profitability and resilience to economic downturn. Keeping this in mind, this could well-position the tech sector for long-term growth and allow them to more effectively capitalize on increasingly profitable innovation opportunities. However, though my view is bullish, technology is not recession proof and investors should still consider volatility and other predispositions before investing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.