Northern Trust: Buy The Drop On This Undervalued Asset Manager

Summary

- Northern Trust is a trust bank that benefits from deep asset management and custodial relationships with clients.

- J.P. Morgan recently upgraded the stock with a price target higher than where shares are trading now.

- I also highlight the dividend, valuation, and other important points.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

Market volatility is not a bad thing for value investors, as it creates a lot of bargaining opportunities. In the words of Warren Buffett, "I'd be sitting on the street with a tin cup if markets were efficient". Such may be the case with many financial institutions at the moment since the implosion of Silicon Valley Bank among others a month ago.

It's important, however, to separate the wheat from the chaff, and identify high-quality players, in which negative market sentiment is not entirely justified. Such I find the case to be with Northern Trust (NASDAQ:NTRS) which I last covered in January here. In this article, I highlight recent developments and provide an updated valuation, so let's get started.

Why NTRS?

Northern Trust has been in existence for well over a century. While it may not be a household name, it's a leading provider of wealth management and corporate and institutional banking, with a presence both domestically in the U.S. and internationally. At present, it has $13.6 trillion in assets under custody and $1.2 trillion in assets under management.

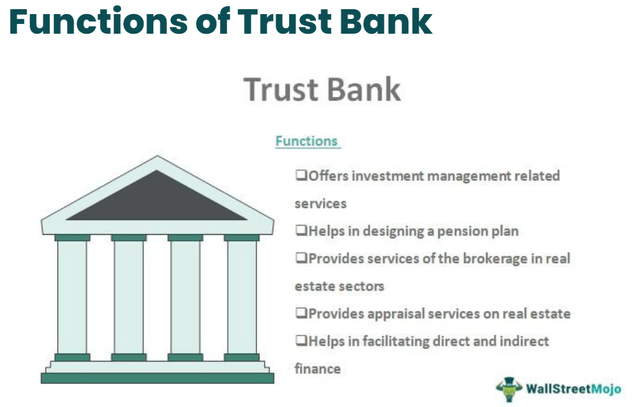

Banks have seen plenty of headline risk in recent weeks, and NTRS hasn't been immune, with its share price falling from the near $100-level to $88.55 at present. However, negative market sentiment may be undeserved as NTRS is a trust bank that benefits from deep asset management and custodial relationships with clients. As shown below, Trust Bank offers a lot more than simple deposit and lending transactions with clients, by providing more holistic services that result in a stickier client base.

In fact, JPMorgan Chase (JPM) recently upgraded NTRS to Neutral with a $97 price target, citing that it should actually benefit from the recent banking turmoil, gaining deposits in its wealth management business as customers flee from some regional banks. Moreover, the analyst cited that "Deposits should hold up relatively better, but with some continued impact from quantitative tightening. Trust banks should also benefit from money market fund inflows."

Meanwhile, NTRS appears to be navigating economic uncertainty well, with full year 2022 revenue growing by 5%. This includes trust fee growth of 2% and a respectable return on average common equity of 12.7%. While ROACE was down from 13.9% in the prior year, it would have been 14.9% when excluding for one-time charges related to cost restructuring and repositioning in the securities portfolio.

Also encouraging, NTRS is seeing strong demand for its integrated trading solutions offering, with the number of clients on the platform growing by 20% last year. NTRS enjoys a sterling reputation and entrenched position with ultrawealthy clients, and this could be another way to retain sticky client relationships.

It's worth noting, however, that NTRS isn't immune to higher expenses, as it grew by 13% YoY in the last reported quarter. However, management is taking the initiative to rein in costs through analytics, as noted during the recent conference call:

Through this [expense management] initiative, we expect to leverage data and analytics to help us better understand the efficacy of our spending so as to optimize our cost base and drive greater efficiencies throughout the organization. We'll update you on our progress in the coming quarters as appropriate.

Nonetheless, NTRS maintains a strong A+ rated balance sheet with a safe common equity tier 1 capital ratio of 10.8%, sitting higher than the 4.5% regulatory requirement and 70 basis points higher on a sequential basis. It also pays a respectable 3.4% dividend yield that's well covered by a 41% payout ratio and comes with a 5-year CAGR of 12.5% (although the dividend growth was flat in 2020-2021).

The stock also trades solidly in value territory at $88.88 as of writing with a forward PE of 12.9, sitting well below its normal PE of 17.9. Analysts have a conservative price target of $96, and that could still produce a total return in the low-teens over the next 12 months.

Investor Takeaway

Overall, Northern Trust is a well-regarded trust bank with a strong balance sheet and attractive dividend. While it may not have the brand recognition of some of its peers like JPM or Bank of America (BAC), it enjoys a sterling reputation among its wealthy client base and offers a slightly higher dividend yield. It's also trading at a value price that could potentially produce decent returns for investors over the next 12 months.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.