La-Z-Boy: A Strong Buy For Conservative Investors

Summary

- The quarterly results showed promise; however, a slight slowdown in demand is possible.

- The balance sheet is showing some inefficiencies appearing; however, it is still very solid.

- I decided to stress test the company by modeling revenue declines in the next 2 years and slight margin contractions to see if the company is a good buy.

- The 10-year DCF model suggests the company is a buy even under very conservative estimates, and analysts seem to agree.

onurdongel/E+ via Getty Images

Investment Thesis

With quarterly earnings beating estimates by a long mile that sent shares up over 16% on the day, I wanted to see if La-Z-Boy (NYSE:LZB) is still worth it as a long-term investment. In this article I will talk briefly about the outlook of the economy, look at the company's financials, and present a very conservative DCF model that will take into account very slow revenue growth and slight contractions on margins, as I would like to see how the company can withstand such a stress test, taking into account a slowing down economy and further contraction in the margin in the short run.

A healthy balance sheet and conservative estimates suggest the company is still undervalued in the long run and presents a buying opportunity for the patient, long-term investor, as I believe in the short run, the company might experience a drop in share price as will the rest of the markets, which can present a better entry point.

Furthermore, the company’s financial health suggests that even with such little prospect of revenue growth, it is chugging along just fine, with great free cash flow generation and an efficient business model.

Outlook

LZB saw very good quarter sales, which sent the stock soaring. It has retreated since but is still above where it was previously. So why did LZB stock start to retreat since the beat? The outlook in the global economies is very uncertain, in terms of supply chain issues, elevated commodity prices, and inflation still well above the Fed's target rate which means the Fed will raise interest rates. These in my opinion attributed to the slow grind down since the beat.

However, a lot has happened since February and the outlook doesn't seem to be as bad anymore, with the latest producer inflation figures unexpectedly slowing down, coupled with CPI that also came in lower, it seems that everything is going to be ok. Right? Well, the Fed in the minutes did mention that the banks may put the economy into a mild recession, so we have that to balance out the good I guess. Easing prices may not necessarily bring higher margins because the customers will also end up paying less for the product.

If we do fall into a recession, I would expect stock prices to come down slightly, as the major indexes have seen quite a rally YTD, especially the beaten-down Nasdaq composite (QQQ), which as of the writing of the article is up over 20% this year, outpacing other indexes by a long mile.

Major Indexes returns YTD (Seeking Alpha)

Let's look at La-Z-Boy's outlook also. The company has been working hard on its Century Vision strategy, which aims to expand the company's store galleries to 400 by 2027. In the latest quarter, the management said that the company will have added 5 new stores, acquired 8 from independent dealers, and either renovated or relocated 16 of their existing stores in this fiscal year. So, the company is going strong in that strategy. The company also said that Joybird, which they acquired in 2018, will post a loss for the full year. As it is a smaller company, the management is going to work on correcting that going forward and return it to profitability in the future.

I don’t see anything major that would propel the company’s revenues in the future, and the analysts that do cover the company, which are not many at all, predict -2% growth next year, so the company is going to keep chugging along and sell their products at the same rate.

Financials

The company has around $280m in cash and no debt on its hands, which is a very good position to be in if we see a downturn coming up. No obligations to keep paying interest on loans, which is great because a slower economy means less demand for the products and lower sales. The company is also able to produce a very healthy cash flow from operations.

Speaking of liquidity, the current ratio as of the latest quarter has gone up slightly since the last full-year report. It is well over 1, which means the company doesn't have any liquidity problems and can cover all its short-term obligations.

Current Ratio (Own Calculations)

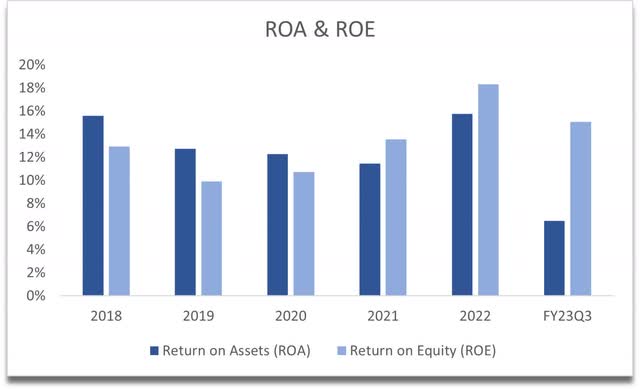

ROA and ROE as of last year were improving and quite healthy, however as of the last quarter, the numbers have come in lower, with ROE at around 12% and ROA at around 6.5%. This suggests the management is not allocating the capital as efficiently and as profitably as before, which can be attributed to the tough environment we saw in 2022, so I would have to see a full fiscal year’s picture and beyond to come to conclusions.

ROA and ROE (Own Calculations)

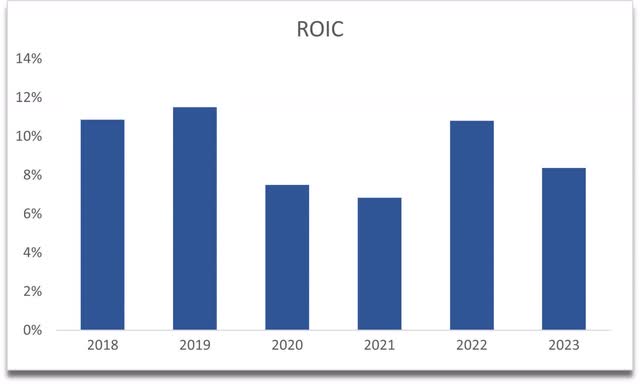

I also project that ROIC will subsequently come down too, which suggests the management has not been able to invest in consistently high NPV projects and the company may start to lose its competitive advantage and its mote. It isn’t too worrying as ROIC is still acceptable at around 7%.

ROIC (Own Calculations)

Overall, the company seems to have a decent balance sheet with no leverage to weigh it down. The slight dips in efficiency and profitability metrics are not too worrying yet. We just need to wait a little longer to see how everything develops in the near future.

Valuation

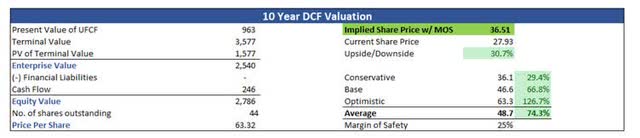

As I said at the beginning of the article, I would like to see what would happen to the company if it saw revenues go pretty much nowhere for the next 10 years, with slight revenue and margin declines in the short run. This model will act as a stress test and if the company is still a buy at these levels, then it is going to perform relatively well in the future in my opinion.

In the base case scenario, I went with a 6% decline in revenues for the first year of the model and around 50bps contraction to net margins. For the 2nd year, revenue declines by another 2% while margins stay relatively the same, with slight improvement. For the rest of the periods, revenue will linearly decline from 3% growth to 2% by ’32. Revenues will go from $2.26B to $3.24B by ’32, while margins will gradually improve by around 100bps by ’32. So, it's about a 50% increase in total revenues over the 10 years, while the company managed to almost double its revenue in the previous decade. In my opinion, this is quite conservative.

For the optimistic case, revenue in every period is 200bps better while margins are 75bps better, and in the conservative case is opposite to the optimistic case.

The declines in revenue are more than enough I believe because, in the last 10 years, the company hasn't experienced larger than -2.3% y-o-y in revenues. My reasoning for margins is that, with time, supply chain issues, inflation, and other factors will subside, and the company will become more efficient in the long run.

The balance sheet, as I mentioned before, is relatively healthy, so a margin of safety of 25% on the intrinsic value is sufficient. The 10-year DCF model with conservative estimates suggests that the company is still undervalued and is a good buy at these prices. The intrinsic value of the company is $36.51 a share, implying around a 30% upside to current valuations.

10-Year DCF Valuation (Own Calculations)

Conclusion

It seems like the company survived my so-called stress test. The low revenue growth is not a big factor in the company’s potential performance. Margins on the other hand are and I think I was still on the conservative side with how the margins are going to develop over time. The strong balance sheet and good free cash flow generation will prove to be quite resilient in a downturn in my opinion and the company will be able to reward shareholders in the future if they are patient. However, like in many of my other analyses in the past month or two, I suggest waiting it out a little longer as the economic uncertainty may bring a better entry price for long-term investors like me, and I will pay close attention to the economy for the next few months.

The average price of analysts is $43 a share which implies a 53% upside. These analysts are more optimistic than me, but they are on the right track also, I just like to keep it safe with all my investment decisions.

Analysts' Price Target (Seeking Alpha)

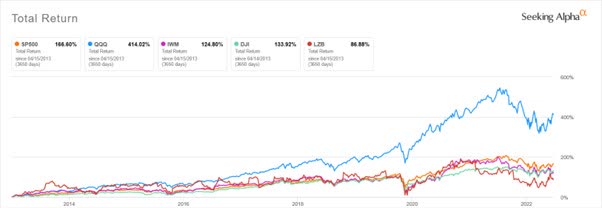

What this price means for the company is that it might award shareholders with a decent upside, however, has that been the case in the past? If we look at the last 10 years, the stock has underperformed all major indexes, especially the QQQ. This doesn’t mean it will underperform again, but I’m just giving you the opportunity cost of owning this instead of a diversified option like an ETF. If you believe there is a good upside for you, then go for it. I will certainly keep this stock on my watchlist and follow how it will perform in the next couple of months.

10 Year performance comparison to major indexes (Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.