Alibaba Stock Will Remain Cheap One Year From Now

Summary

- Analyst price targets and their implications.

- Does Alibaba's current share price make sense?

- Recent events and implications for Alibaba's near-term performance.

- Risks, opportunities, and considerations for long-term investors.

Geopolitical risks are clearly a factor when investing in Alibaba. MR1805/iStock via Getty Images

BABA Stock Key Metrics

Alibaba Group Holding Limited (NYSE:BABA) is quoted on the New York stock exchange stock exchange as an ADR. Each ADR represents 8 original shares which can be traded on the Hong Kong stock exchange and in smaller volumes on some other international exchanges.

It has a market cap of $262B, a similar EV (since there is a small net cash position), and it trades for roughly 13x forward EPS. During the past 12 months it has traded for as little as 7.5x forward EPS and its highest valuation was 16x forward EPS. That said, its current price of $100 is less than a third of its all-time high in late 2020.

This rollercoaster ride indicates high market uncertainty following the cancelled Ant Group IPO, a series of fines imposed on the company and new sector regulations (summarized by the media as "tech crackdown"). In addition, there are frightening political tensions between China and the U.S., delisting risks, a general slowdown in the global e-commerce sector, recession fears, and, last but not least, the sudden spike of interest rates has sharply reduced valuations of all "promise-today-deliver-later" tech plays, as holding cash today has some value again.

What Is The Short-Term Prediction For Alibaba?

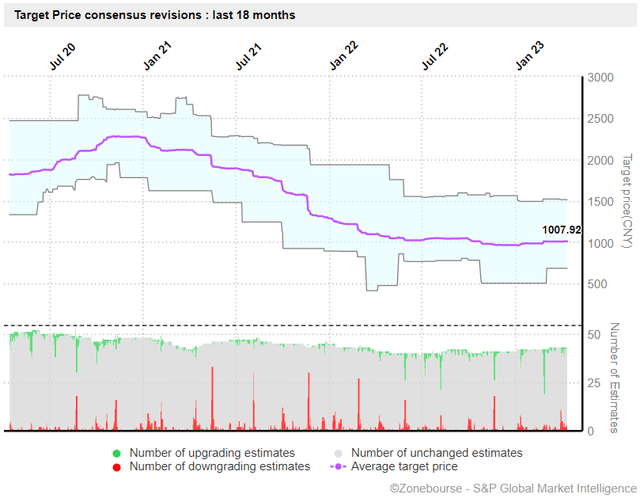

A look at analyst price targets highlights the same dilemma:

Price target overview (Marketscreener.com)

The price targets in the last chart are in CNY and fluctuate between $73 and three times as much. When I see something like this, I take a closer look. Sometimes the reflected uncertainty is only based on short-term issues and with a longer time horizon investors can benefit from higher volatility.

Other recent analyst targets have been mentioned on this site vary between ~$180/ADR and ~$209/ADR, which don't consider any special discounts for political risks or holding companies. I think this is not fair. When markets cheer Jack Ma being able to travel around freely in China, something is definitely wrong and needs to be accounted for.

What Are Catalysts To Watch For?

Clearly, the announcement of the split into six companies and the IPO potential has at least apparently unleashed the bulls. As I have already said in my recent BABA article "Some will get rich before others", this split might create or even destroy value, but a potential series of IPOs has strong effects on trading activity:

Moving towards spin-offs and IPOs means that the stock market's fabulous selling machinery will run at full speed to boost valuations, which in turn will boost the investment banks' net income. This leads investors to conclude that these are not the right conditions to sell BABA short, thus producing a massive short-covering rally. And others jump on the bandwagon.

Hence, maybe the strongest catalyst is already gone: the announcement of the upcoming split. Now it depends on the details, timing, success or failure of these IPOs.

In addition, the world is not standing still waiting for Alibaba's restructuring to run its course. Just yesterday, the announcement of the company's ChatGPT-competitor (available also in English language) at first gave another boost to the stock, but then the market realized that it came with a ton of caveats and regulations and the stock turned south. – So what is a chatbot worth, if it is not allowed to answer the truth? Does the world need it, if it really is telling only what a political party deems appropriate? Could it even become a liability if "wrong answers" cause massive fines, service interruptions etc.?

Therefore, it is difficult to name any "hard" catalysts. My best guess is that the market will be happy about any IPO moving forward, but will be wary about the details: Will existing shareholders be massively diluted? Is demand high? Will the shares be listed mainly in Hong Kong? (There is some concern the split-up might be sneaky way to shift value from U.S. exchanges to Alibaba's home country.) How much of the newly listed company will the central holding keep? What about accounting? Will profits and losses show up in the central holding's accounts and will these become more complex? Are the new companies on track to deliver cash profits quickly or will they go for "promise-today-deliver-later"?

Does Alibaba's Current Share Price Make Sense?

On a SOTP basis, it does not.

The sum of China Commerce, Cloud Intelligence, Cainiao Smart Logistics, Digital Media & Entertainment, Global Digital Commerce, Local Services should be worth more than just $262B, since all business units except China Commerce are not profitable, but will obviously be priced for their potential profits, while the China Commerce unit should enjoy a valuation uplift without the weight of the money-losing divisions on its shoulders.

Basically, without any valuation uplift, China Commerce would trade for less than 10x FCF, which is very unlikely and the other units would need to trade for zero.

This is at least the theory.

In practice, we won't see a stand-alone China Commerce unit for a long time. We will likely see an independent Cainiao relatively soon and probably also an independent Cloud unit, for a combined (rumoured) valuation of ~$70B. Yet the central holding company will keep control of these units and will need to account for their losses, if any, in its P&L statement. And there will be massive restructuring costs. Again, we will need to see the details.

As far as the other units are concerned, any IPO will push for quite optimistic valuations and the narrative-spinning machine will run in high gear for sure. Yet, in the long run fundamentals and uncontrollable risks matter.

Where Will Alibaba Stock Be In One Year?

My best guess is "moderately higher", i.e. in-line with market returns (which results in a "Hold" rating), although I understand that this is a somewhat unsatisfactory answer. In fact, it is probably the thought process behind this answer which is most interesting to understand.

When I say "moderately higher", it is sort of a probability-weighted average result below a multi-input calculation. To some extent it is like picking a random NYC inhabitant and guessing his monthly income. Probably you would opt for the average NYC income per inhabitant: on average it might be correct, but in the specific case most likely it would be the wrong answer.

If one of the key risks mentioned in this article materializes, my price target will certainly be wrong. But it will also be wrong, if there will be at least one successful IPO and no ugly surprises.

In numbers, this is how this valuation looks like:

Total value one year from now | $500B |

Holding company discount | ($100B) |

Various non-controllable risks | ($100B) |

Net value | $300B |

This translates into a target price ~15% above today's price. Personally, I don't think this is attractive, given the risk profile.

Is BABA Stock A Good Long-Term Investment?

Alibaba is cheap, no doubt. Yet the same is true for a true gem like Taiwan Semiconductor Manufacturing (TSM). The company is dirt-cheap, it is of vital importance for the global economy, enjoys huge returns on invested capital and is certain to grow earnings for many years.

Why do I say this? – Well, there is a famous precedent: Warren Buffett bought a large position in TSM last year, which was very surprising. Usually, the Oracle stays on his home turf and in those rare cases when he ventures abroad, his conviction must be extremely high. Yet, just a few months later, he already sold down his position and is probably completely out of it now. So what caused such a sharp turnaround by the most famous long-term investor in the world? – Geopolitics. In other words, Buffett had probably underestimated how far China might go concerning its ambitions on Taiwan.

We have all seen what happened after Russia invaded Ukraine. Shareholders in Russian companies, which had been rightfully trading for ridiculously low valuations for well over a decade, were basically wiped out. Companies lost billions of properties.

Clearly, China is far more important for the global economy than Russia. The usual justification for an investment in China is "They won't be so stupid to invade Taiwan, they need foreign investment." – Well, we can also turn around this argument: "The West won't be able to be tough on China. It needs China for its own growth and can't afford to lose decades of investments."

That said, we don't need an invasion to reduce the valuations of Chinese and Taiwanese companies. We just need the threat – which doesn't look like it is going away anytime soon.

This is why I believe Alibaba will be cheap one year from now and probably even for longer. It won't reach multiples comparable to Western peers unless the perception of political risk vanishes.

As I said in my last article on Alibaba, when appropriately weighing probabilities, the stock looks more like a good trading idea than a good long-term investment. It can both materially outperform and underperform, depending mostly on external factors that cannot be controlled by management.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.