Hertz: The Turnaround Looks Promising, But Be Cautious

Summary

- It looks like Hertz has performed quite well since filing for bankruptcy.

- There is a lot of potential growth on the horizon, and the management’s focus on efficiency is admirable.

- The financials show a completely different company even from the pre-pandemic era.

- A simple DCF analysis suggests the company has room to grow, however, caution is advised because of uncertainty in the economy still lingering.

tupungato

Investment Thesis

The most recent annual report caught my attention of Hertz Global (NASDAQ:HTZ) because I was curious about what has happened to it since it filed for bankruptcy. It seems that they managed to come out stronger than ever by trimming the fat and by focusing on efficiency going forward. With the demand for rental cars picking up quite considerably from the lows and the worst year for the company in 2020, I wanted to see how the company's financial health has changed since the 2nd IPO. Has the company managed to turn the ship around and is better protected from the slowdown in demand that we may see in the future, as a lot of economists are predicting a downturn in the coming months?

In this article, I will briefly talk about the potential of the company in the future, talk in a bit more detail about its financial health and perform a 10-year DCF valuation with conservative assumptions to see what the company could be worth.

The company seems to be in a good position to perform quite well in the future if management is to be believed, however, what is stopping me from investing in the company is the economic uncertainty. I'm going to be patient.

Outlook

2020 hit many businesses all over the world. Many have shuttered and never came back, especially the small ones. Hertz was one of these companies that experienced a serious shock and could not climb out of the hole without declaring Chapter 11 and without restructuring in place soon after the peak of the pandemic, and filed for bankruptcy in May of 2020. After a little over a year, the company was back in the game and IPO'd for a second time with revenues coming back to almost pre-pandemic levels.

With the new CEO taking over the reins of the company in February 2022 and the demand for their services coming back up to pre-pandemic levels, the company seems to be much more organized and profitable now than ever before. The management is looking to continue this momentum going forward, so let's look at what kind of initiatives could keep the company efficient, profitable, and away from another bankruptcy.

As it is with many if not all companies, the management is looking to make the company more efficient by increasing margins. Trimming the fat is bound to be cost-effective and makes the company much stronger financially. One way management can improve margins and that is one of the main focuses is the migration of their business onto the cloud. They have been migrating for a while now and are looking to fully complete the transition from server-based operations to the cloud by 2024. This will certainly cut costs in a meaningful way.

The management has been active in renewing contracts with big players like AAA and Delta Airlines. What is also important to note here is that contract renewals have been near 100% on corporates and at higher prices than before according to the transcript.

What I also found interesting is how quickly the ridesharing program grew y-o-y, up 98%. I don't think this revenue is very high yet because I believe the company only runs this partnership in a select few cities in the US, however, it can become quite a big revenue machine if expanded into more cities or even countries. The announcement of partnering up with Uber to bring up to 50,000 Tesla (TSLA) vehicles via the rideshare program is a testament to the company's vision to upgrade most of its fleet with EVs. The most recent filing also announced that the partnership will extend to Europe with up to 25,000 EVs available for the drivers to rent. EVs are cheaper to maintain, and another big thing that the company is going to do is it's forecasting over 2m EV rentals in 2023, which is about 5 times more than in 2022.

In terms of prices of EVs, these have been coming down, but I believe this is a good thing for Hertz. The company will be able to buy at cheaper prices. In the earnings transcript mentioned earlier, the management said the company only purchased around 20% of the EV fleets it is looking to buy, so it is still looking to buy many more vehicles over time. This also means that when it comes to selling these cars once the utility has been reached, they will be cheaper to sell too which isn't good, however, the depreciation time on EVs is longer than on regular ICE vehicles and with the advancements in the EV space, the length of keep might even increase in the future.

The last initiative I wanted to mention that the management is going to focus on quite aggressively is the revitalization of the Dollar and Thrifty brands. These are well-known RAC brands in the US, and these have been underwhelming in their operations recently. These brands seem to be not operating at their full potential right now and the management is looking to make them much more cost-effective in the near future by facilitating the growth of their EV fleet.

Lots of potential for the management to turn the ship around, and become much more profitable and efficient which will lead it to become the top player in the RAC space once again.

Financials

I am curious to see how the company has turned around since the bankruptcy, so let's look at the balance sheet and how it has evolved in the last 5 years.

The company has a little less than $1B on the books as of Dec 31st '22, with a whopping $13.7B in debt. This is what killed the company in the first place. The company couldn't handle the debt load once the demand for its services plummeted. Since the demand has picked up and the company has very promising ventures as mentioned above, is the company still too exposed to debt? It could be. Around 3/4s of the debt is fixed, but the other quarter is a variable interest which exposes them to interest rate risk, so it's not the worst. If we don't see lockdowns again in the near future, which I don't think we will, the debt levels are sustainable because it's been doing fine before the pandemic with such high debt levels. It's just the nature of the business. Most if not all RAC companies are in debt. EBIT and cash from operations more than cover the interest expenses.

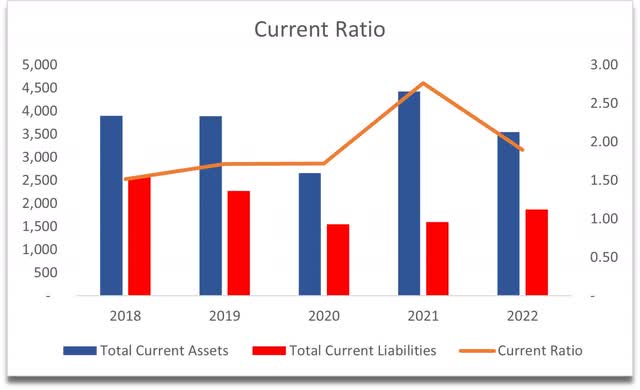

Right now, the company has a solid current ratio, however, it did have a solid current ratio when it went bankrupt also, so it's not going to help if the debt becomes unmanageable.

Current Ratio (Own Calculations)

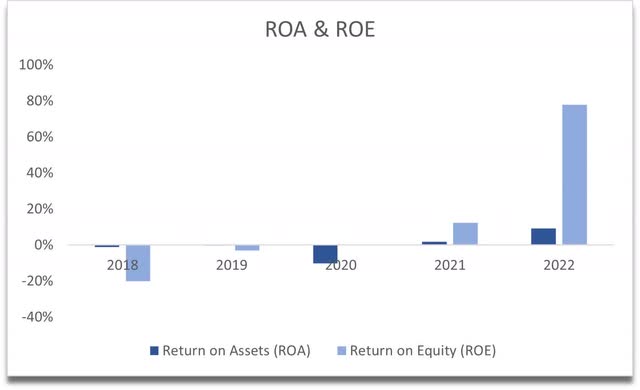

The management mentioned return on assets as the main measure, so it is good to see that ROA went up 7% y-o-y, to 9% as of Dec 31st '22. The elevated ROE is due to a large amount of debt. Also, note that ROE was -1,800% in 2020 so I took it out as the diagram wasn't looking very pretty, not that it looks any better right now, however, it seems like the new management is doing much better than the company did before the pandemic even hit. Looks like it is turning around.

ROA and ROE (Own Calculations)

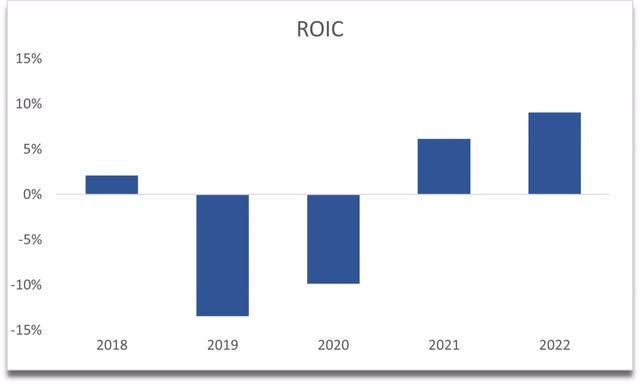

Ever since emerging from bankruptcy, the company managed to invest in positive NPV projects for the last two years which brought up ROIC into positive territory. The company's getting back its competitive advantage and its moat. Let's just hope it lasts.

These are the most important metrics in any company in my opinion, and it seems that the turnaround has been successful, but I'd need to see a couple more earnings to see where the company is headed. Overall, it is looking better than the company was performing even before the pandemic, which is a good sign that the management is doing something right.

Valuation

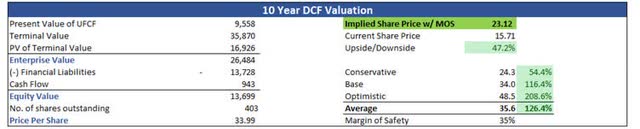

I decided to go with a simple DCF calculation where in the base case I left margins as at the end of FY2022 for the whole DCF model, for the conservative case I decreased margins by 100bps in all periods and increased margins by 100bps on the optimistic case.

For the revenue assumptions, the company saw an 18% increase y-o-y, which slowed down by quite a bit from the year before which was up 40%, so I decided to linearly decrease the growth from 5% to 3% by '32, which gives an average growth of 4%. The optimistic case average growth ends up being 6%, and 2% for the conservative case.

I also added a 35% margin of safety to the final intrinsic value calculation because even if the company does seem to have a strong balance sheet, it still managed to go bankrupt because of that large debt position in place. With everything accounted for, the intrinsic value of Hertz is $23.12, implying there is around 47% of upside from current valuations.

10-Year DCF Valuation (Own Calculations)

Closing Remarks

According to my assumptions, the company is a buy at these levels. What does keep me from opening a position right now is the looming uncertainty of the economy. The Fed is still increasing interest rates and is projected to have a few more rate hikes coming up. We still haven't seen the recessionary downturn in the economy that many economists have been predicting. In the next 6 months or so, I still expect a lot of volatility in the stock market which will bring down many stocks in the short run. I'm not rushing to buy any shares right now mainly because of that reason. There may be a better entry point in the next couple of months at which I may open a small position only, as I think the company is still quite risky for now. I need the management to prove to everyone that they did indeed turn the company around and going forward will be a profitable and efficient company. In my opinion, the bankruptcy was a blessing for the company. It jolted the company into restructuring with aggressive cost-cutting efforts which seem to have paid off right now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.