Taiwan Semiconductor: Buffett Apparently Fears The Politics

Summary

- Recently, Warren Buffett said that political risk was a factor in his unexpected decision to sell Taiwan Semiconductor Manufacturing Company Limited stock.

- He also called Taiwan Semiconductor the strongest company in the chip industry.

- Taiwan Semiconductor has the largest market share in the global semiconductor foundry industry (60%).

- In this article, I explain why I continue holding Taiwan Semiconductor stock.

Warren Buffett Paul Morigi

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) got some negative publicity this week when Warren Buffett said in an interview that geopolitics "was a consideration" in his decision to sell the stock. The fact that Buffett sold some TSM was known months ago, as it was revealed in the latest Berkshire Hathaway Inc. (BRK.B) 13F. However, Buffett's statement that he sold partially due to geopolitics was new information.

Investors have been worried about China/Taiwan relations for some time. The possibility of a Chinese invasion of Taiwan is a major sticking point for U.S. officials, who have pledged to defend the island if invaded. China/Taiwan relations have been a concern even for mainland Chinese stocks, as investors worry that they will be suspended from trading if China invades. These concerns are even more serious when it comes to Taiwanese stocks, as Taiwanese companies could be directly in the line of fire if China invades.

These concerns are not new, but the fact that Buffett shares them is. Buffett historically hasn't shied away from Chinese stocks, having scored a big win with BYD Company Limited (OTCPK:BYDDY) shares back in 2008. It's interesting, then, that Buffett would say he was concerned about China/Taiwan geopolitics, as that factor didn't hold him back in the past. It also didn't change much over the course of Buffett's holding period: the world has known about China's designs on Taiwan for several years.

In this article, I make the case that Buffett's comments on Chinese geopolitics do not diminish the case for owning Taiwan Semiconductor stock. Drawing on Buffett's comments as well as some fundamental factors about TSM stock, I make the case that it was probably valuation, not geopolitics, that was the main reason for Buffett selling. Finally, I'll explain why I remain bullish on TSM at today's prices, despite Buffett having sold.

What Exactly Buffett Said About Taiwan Semiconductor

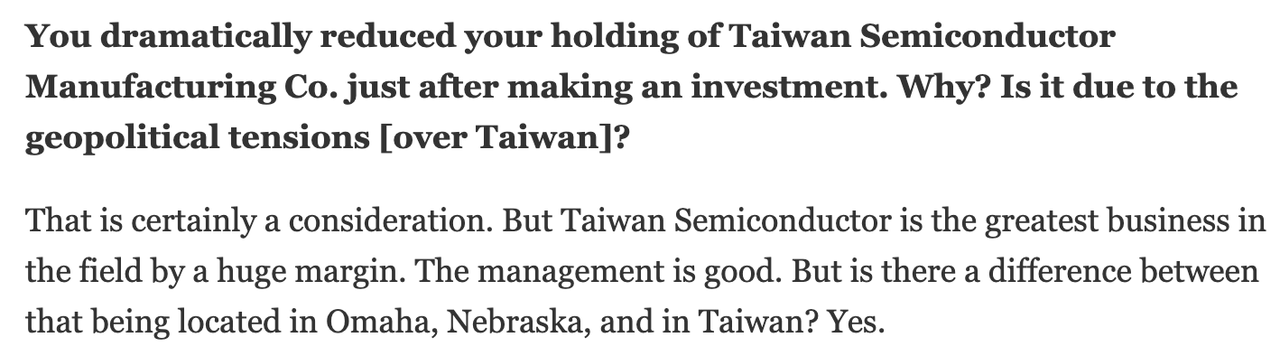

Before thinking about the ramifications of Buffett's comments on TSM stock, we need to know exactly what it was that he said. News stories about Buffett's TSM comments highlighted the geopolitics angle, but in fact, there was a broader context, most of which did not involve politics in any way. You can see the full quote in the image below:

Buffett interview excerpt (Nikkei Asia)

There are three things to note here:

Buffett was asked whether geopolitics was a consideration, he didn't simply offer it as one.

He called TSM the best business in the semiconductor industry.

He highlighted TSM's good management.

There were more positive comments about TSM in here than negative ones, and the only negative one was explicitly elicited by the interviewer.

So, then, why did Buffett sell?

It might seem obvious, but because he had what he thought were better opportunities elsewhere. In the Nikkei interview that yielded the now-infamous quote about TSM, Buffett said that he was very excited about Japanese trading houses. He pledged to increase his investments in them, which he initiated back in 2020. Given that Buffett has another Asian investment he's very interested in right now, TSM may simply not look as good in comparison. In fact, when we look at TSM's valuation, we can see that there is a good chance that's the case.

Taiwan Semiconductor's Valuation

By the standards of semiconductor stocks these days, TSM stock is not particularly expensive, trading at:

13.24 times earnings.

Six times sales.

4.61 times book value.

8.43 times operating cash flow.

It's a pretty modest valuation. However, in his Nikkei interview about the Japanese trading houses, Buffett says he was able to buy them below book value, at prices he found "ridiculous." TSM stock is no NVIDIA Corporation (NVDA), but it's not exactly a bargain by every single metric. The P/E ratio is low, but the price to book ratio is fairly high. It's definitely cheap compared to most U.S. tech stocks, but it's far from a Ben Graham-style net-net opportunity. For a value investor like Buffett, the Japanese trading houses may have simply looked more appealing.

"Strongest In Its Industry"

One of the most flattering things Warren Buffett said about Taiwan Semiconductor in his Nikkei interview was that it was "the strongest in its industry." Buffett is well known for rigorously analyzing companies' competitive positions before investing, so it pays to know what he's thinking here.

Here's what we know about TSM's competitive position:

It controls nearly 60% of the foundry industry.

It sells to most of the world's semi companies (i.e., it has deep industry relationships).

None of its competitors have anywhere near the same market share.

So, Buffett is correct: Taiwan Semiconductor is the best company in its industry. It is mathematically the biggest company in the foundry sub-sector, and it is arguably the strongest semi company period, as nearly every other company in the industry depends on it. There's nothing like being indispensable for locking in high margins, and Taiwan Semiconductor is one of the most indispensable companies around.

Growth Still Positive

One of the best proofs of TSM's strong industry position is its continued positive growth. Positive growth is not typical for semiconductor companies in the 2022/2023 period, which has seen many semi names flip to negative growth or even net losses. Examples of companies with this dubious distinction include:

Basically, tech companies accumulated large amounts of chip inventory back in the bull market in 2021/2022, leaving them with little need for more. So, they stopped buying. It led to negative growth. However, in its most recent quarter, TSM delivered:

42.8% growth in revenue.

78% growth in profit.

26.7% growth in revenue when adjusted from Hong Kong dollars to U.S. dollars.

Not only was the growth positive, but it was well into the double digits - even after the currency adjustment!

Additionally, the company (which reports revenue monthly) showed further revenue gains in January and February, albeit a slight decline in March. It looks like there'll be at least one more quarter of positive revenue growth from TSM this year, although the growth will be more muted than that of Q4 2022.

Risks and Challenges

As we've seen, TSM is a great company, with the best competitive position in its industry and a lot of growth. Buffett may have sold, but the stock still has many attractive characteristics. Still, there are many risks and challenges to watch out for, including:

China invading Taiwan. If China invaded Taiwan, then there would likely be negative repercussions for TSM stock. First, there would be a chance of TSM's manufacturing facilities being directly attacked. Second, China might decide to shut down TSM's facilities in that country if doing so made sense from the perspective of whatever military operation it conducted. Over the last year, investors have been concerned about the effects of China invading Taiwan on their Chinese stock holdings. The possible effects on Taiwanese companies are even more severe. It is unlikely that there will ever be a Taiwan invasion of mainland China, any war would be defensive from its side, which means its companies' facilities could find themselves in the line of fire. So, arguably the geopolitical risk with Taiwan Semiconductor is even greater than that with mainland Chinese stocks.

Continued weakness in demand for chips. Taiwan Semiconductor's revenue has held up much better than that of most semiconductor companies. Partially that's because it sells chips to almost all the players in the industry, so it can make money even if one or two specific chip sub-sectors do poorly. For example, we know that memory demand is rather weak right now, as evidenced by falling prices. However, we also know that demand for car chips is still pretty strong. There are still places for TSM to make money, unlike a RAM/NAND company like Micron, but if the chip slowdown gets even worse, then the company will struggle.

The Bottom Line

Taking all relevant factors-valuation, growth, profitability, and risks-into account, Taiwan Semiconductor stock looks like a decent buy at today's prices. Trading at only 13.24 times earnings, it is much cheaper than names like NVIDIA, which (unlike TSM) is seeing their revenue decline.

However, the possibility of a Chinese invasion of Taiwan remains a real risk. If China were to invade Taiwan, TSM facilities could find themselves in the line of fire. There is even more risk here than there is with mainland Chinese stocks, because most of those companies would at least be able to operate normally during an invasion. That wouldn't necessarily be the case with TSM, which is headquartered on a small island nation.

Personally, I'm comfortable holding my Taiwan Semiconductor Manufacturing Company Limited shares for now. I do not see a Chinese invasion of Taiwan happening any time sooner than 2025, and I'm not entirely convinced there will ever be one. In the meantime, Taiwan Semiconductor is the strongest chip company on the planet. Very much a stock worth investing in.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.