Marqeta: Too Cheap To Ignore

Summary

- Marqeta is now trading near its historical low.

- The fear from Block's short report is largely overblown and Block has already made a plausible response.

- The company's reliance on Block should continue to drop as it expands into other markets through acquisitions and new products.

- Current valuation is extremely discounted compared to peers.

- I rate the company as a buy.

damircudic

Investment Thesis

Marqeta (NASDAQ:MQ) has dropped nearly 40% since my last coverage in December, as the recent short report regarding Block (SQ) has weighed heavily on the stock price. However, I believe the fear is overblown and the market is overreacting. Block has addressed the allegations and Marqeta is also trying to reduce its reliance on Block through acquisitions. The company’s current valuation is extremely cheap with multiples significantly lower compared to fintech peers. The current risk-to-reward ratio looks very compelling and I reiterate my buy rating on MQ stock.

Short Report On Block

Hindenburg Research released a short report on Block last month, claiming that some transactions on Cash App are fake and fraudulent, and the company artificially inflated its user count. The full report is here for anyone interested in reading it. Marqeta dropped nearly 10% after the news was announced, as Block is by far its largest customer accounting for roughly 70% of total revenue. However, I believe this is an overreaction as the company recently announced its response which addressed the allegations from the short report.

The company said that it is possible for one person to have multiple accounts for different purposes, and this is disclosed in the 10-K form and compliant with the SEC. All accounts must also have at least one financial transaction in order to be claimed as “transacting active”. Out of 51 million monthly transacting activities, 44 million accounts are verified through the company’s Identity Verification program, and 39 million accounts are connected to a unique Social Security number. There it is almost impossible for these accounts to be fake and fraudulent. These 44 million accounts currently account for 97% of Cash App’s inflow.

Block's response clearly proves that the claims from Hindenburg Research are purely speculations with no real substance behind them, and the short report is likely just a tactic for the research firm to benefit from its short position. I believe both Block and Marqeta should not be in trouble because of this and the fear is likely overblown.

Block’s Response:

Cash App is built to support customers who may want to maintain multiple accounts. For example, customers can maintain a separate business and personal account or can also maintain multiple personal accounts (e.g., one for everyday personal use and one to set aside funds for budgeting). We disclose in our current 10-K filing with the SEC, that one customer may be associated with one or more accounts. We also disclose that a “transacting active” is a Cash App account that has at least one financial transaction using any product or service within Cash App during the specified period. We reported that as of December 2022, Cash App had more than 51 million monthly transacting actives.

Expansion Through Acquisition

As mentioned in my previous article, Marqeta has been expanding into new markets in order to grow its customer base and reduce its reliance on Block. The company has made its move into the banking segment last year through its new solution Marqeta for Banking, a portfolio of seven banking products that provide bank account and money movement features including bill pay, direct deposit with early pay, fee-free ATM, and more. It is also now expanding into the credit card market with the $275 million acquisition of Power Finance announced earlier this year.

Simon Khalaf, on Credit Opportunity

Our first priority is Power integration. Credit represents a huge addressable market that is currently held back by the constraints of legacy technology that has not kept up with how companies engage their consumers.

Similar to Marqeta, Power Finance offers white-label credit card issuing services through its cloud-based platform. It enables various card customization options and also provides risk management and credit decision services. I believe the acquisition should be highly accretive. Power vastly improves Marqeta’s product breadth by providing a comprehensive credit card issuing toolbox. The expansion into the credit card space will also increase its addressable market and attract new customers, which should help reduce the dependence on Block over time.

Discounted Valuation

After the massive drop in share price, Marqeta’s current valuation is extremely discounted. The company is trading at an EV/sales ratio of just 0.96x, which is unjustifiably cheap for a company with solid prospects and growth.

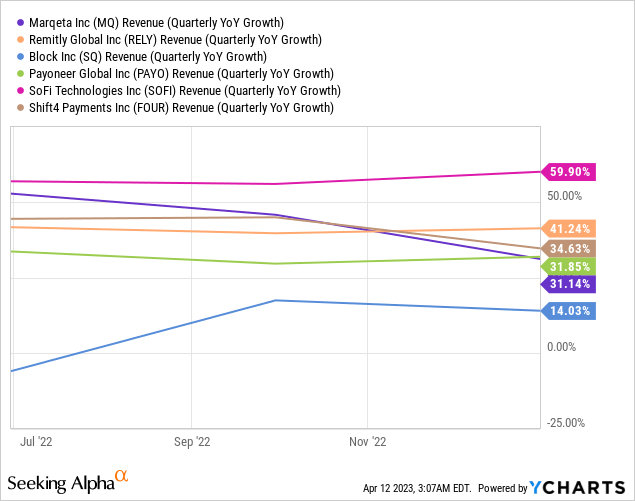

The first chart below shows a snapshot of different companies’ valuations in the high-growth fintech space, and you can see that Marqeta is an outlier among peers with a substantially lower multiple. The company is currently trading at a massive discount of at least 50%+ compared to payment peers such as Block, Payoneer (PAYO), and Shift4 Payments (FOUR), which have an EV/sales ratio of around 2x. Despite the pessimistic sentiment, the company continued to perform and the revenue growth of 31% in the latest quarter remain in line with peers, as shown in the second chart below.

Even if we assume Block really gets into trouble and revenue from Block declines by let's say 50%, the company’s annual revenue will still be at roughly $483 million. This translates to an EV/sales of 1.6x, which is still significantly lower than all its peers. I believe a lot of pessimism is already priced in and the current valuation offers a great margin of safety.

Investor Takeaway

I believe the massive drop presents a great bottom fishing opportunity for "risk-tolerant" investors. The response from Block proves that the short report is largely inaccurate and the price action is exaggerated. Customer concentration is a notable issue but the company is actively expanding into new markets through acquisition and new products to diversify its revenue stream. The company’s current valuation is also extremely cheap with multiples significantly below peers, which should present meaningful upside potential. Therefore, I rate the company as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.