KULR Technology: 2023 Will Be Pivotal

Summary

- KULR is trying to establish itself as a leading player in the emerging market of thermal management and battery safety.

- The company boasts with customers like US government agencies, Lockheed Martin, Meta, etc.

- However, KULR is generating very little revenue and is burning cash.

- If revenue growth is not seriously ramped up in 2023, dilution looks like a big risk.

- The best KULR’s shareholders could hope for seems a takeover or strategic partnership.

SpyroTheDragon/iStock via Getty Images

With batteries playing a growing role in the economy, their safety and management creates a new market opportunity. KULR Technology (NYSE:KULR) is trying to position itself as a leading provider of thermal management and battery safety solutions in this emerging market. The company is trying to commercialize its know-how in this space and has already attracted some well-known clients like NASA, Lockheed Martin (LMT), Meta Platforms (META), etc. However, revenue is still at a very low base and KULR is burning cash. With only US$10.3M of cash on the balance sheet and expanding team, KULR needs to really deliver on revenue growth in 2023, while maintaining its strong margins, in order to avoid raising equity in an unfavorable market. Still, I find it unlikely that the company will be able to commercialize its product on its own, given its financial health. The best KULR’s shareholders could hope for seems a takeover or strategic partnership.

The market opportunity

The electrification of the economy is one of the reasons why some investors, myself included, are so bullish on metals like copper. However, one side of electrification that is given less attention is its potential to give birth to new industries. As batteries are getting bigger role in the energy supply chain, the issue of their safety arises. Recently, there were a few cases where container ships caught fire, which started from Li-ion batteries from the cargo. As battery powered vehicles/devices are becoming more common, such issues will become more prevalent. This opens the door for a whole new industry concerned with the thermal management and safety of batteries. This is where companies like KULR are trying to position themselves, taking up the challenge of becoming an important part of this emerging market.

KULR overview

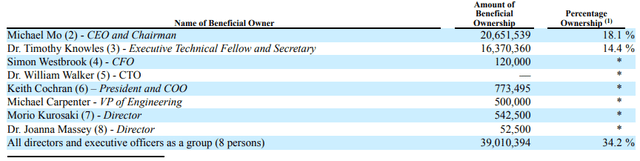

Capital structure

Founded in 2013 in the US, KULR is aiming at the emerging market of thermal management and battery safety solutions. One of the things that I like about the company is that insider ownership is high as the two co-founders Michael Mo and Timothy Knowles own 18.1% and 14.4% of the company, respectively. As of 2022 year-end, there are 113.2M shares outstanding.

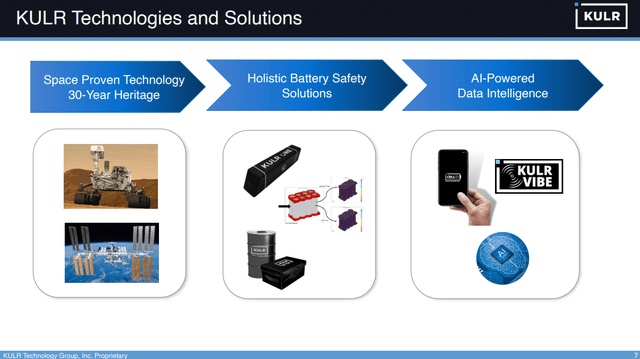

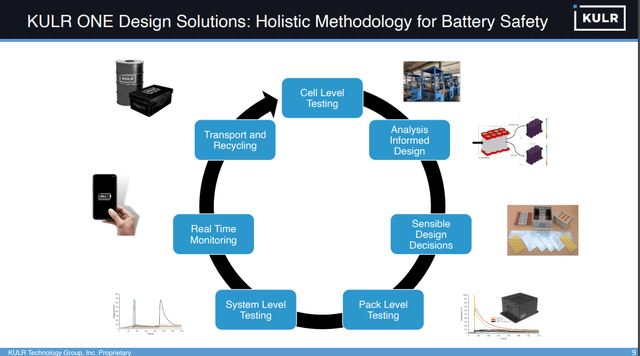

KULR’s products

KULR is offering a mix of products and services based around battery safety and thermal management. The company has made a name for itself, for providing thermal management solutions for the Mars Perseverance Rover. This is truly a testament for the quality of KULR’s products as NASA is surely performing a thorough due-diligence on all components that go into equipment sent into space. Amongst other-well known clients is Lockheed Martin, which has recently expanded its partnership with KULR. The company is also trying to take advantage of the rapid development of AI in the recent years and incorporate AI in some of its products, like the KULR VIBE.

Challenges ahead

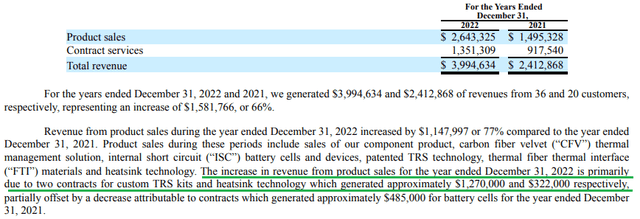

Commercializing this space-proven technology and scaling the revenue is a challenge. Looking at KULR’s 2022 results, revenue is a bit bellow US$4.0M (+65.6% YoY) with a gross margin of 59%. Although the revenue growth figure alone looks impressive, considering the low base and the fact that KULR has more than doubled its R&D expenses to US$4.0M (+139.3% YoY) is worrying. Cash flow from operations was negative US$17.4M (+155.0% YoY), while only US$10.3M (-30.5% YoY) of cash remain on the balance sheet as of 31 Dec 2022, making the cash burn unsustainable in 2023. So the company would rather have to rapidly increase sales, while maintaining strong margins, or dilution is on the way. It has to be noted that in 2022, the company entered into Standby Equity Purchase Agreement (SEPA), which allows for sell up to US$50M of shares.

Also, looking closely in the 2022 annual report, it appears that the revenue growth is primarily based on two large contracts with values US$1,277k and US$322k. I suspect that the bigger one may be related to the order from a subsidiary of Viridi Parente – Volta Energy Products. The deal concerns equipping Volta’s energy storage units with KULR’s thermal management solutions and the initial order of up to 1000 units was estimated at US$1.6M. However, the announcement noted that the quantity may increase to up to 50k units in 2023. Extrapolating the revenue would indicate around US$80M. Unfortunately, since the order announcement in Dec’21, management has been rather tight-lipped about the deal. The last mention of Volta I was able to find was in the Q2’22 earnings call:

As a general practice, we won't comment on any specific customer orders in terms of dollar amount, and timing, and so forth. But for Volta, in other customer engagements that we're working on very closely, we expect the volume to ramp in their business in second half of 2022 and also well into 2023.

So it’s unclear whether this nearly US$1.3M of contract was related to Volta.

What could lie ahead?

The financial situation of KULR is not rosy. To avoid massive dilution, the company has to really deliver on the revenue growth front. According to a recent interview with the CEO – Michael Mo, around US$10M of sales are expected in 2023 from the KULR One product.

Still, even if that happens, and the 2022 margin is retained, the company will likely be burning cash. In my opinion, the best that shareholders could hope for is a takeover. The recent hiring of a new CFO with extensive background as an executive in M&A at Goldman Sachs pints towards that direction. Even the CEO has hinted that the company is eager to participate in consolidation into the battery safety and thermal management market.

Risks

Dilution risk

The most serious risk with KULR is dilution. The financial position of US$10.3M of cash looks insufficient to sustain the 2022 cash burn rate, let alone fund even more rapid expansion. The fact that management holds more than 1/3 of the share outstanding is a positive, as it’s in their best interest to find the least dilutive way to move the company forward. But at the end of the day, there’s only so much one could do in the current risk-off market.

Operational risk

KULR is trying to become a part of the newly emerging market of battery safety and thermal management. Developing such innovative solutions comes with operational risk and failure in one or more of the products may lead to significant reputational damage and loss of future revenue.

Access to talent risk

KULR is a small company with limited financial capabilities. In that regard, obtaining access to the best talent may be a difficult task. Especially considering the intentions of adding AI and more sophisticated analytics to its products, KULR has to compete with some of the leading IT companies for talent.

Conclusion

KULR Technology is trying to establish itself as integral part of the battery safety and thermal management market. The company has high insider ownership and has managed to secure contracts with customers like NASA and Lockheed Martin. At the same time, revenue is still low and insufficient to fund current operations. The balance sheet position is also quite small, compared to the cash burn of the firm. This naturally raises the risk of dilution. KULR is running out of time and management has to really deliver on the revenue growth front in 2023. A positive outcome for shareholders could be a takeover or strategic partnership.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KULR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.