FIW: This Water ETF's Looking To Make A Big Splash

Summary

- FIW provides dedicated exposure to 36 companies that derive a substantial portion of their revenues from the potable and wastewater industry. The ETF was launched in May 2007.

- FIW has outperformed SPY since its May 2007 launch. It also has a higher earnings growth rate and a smaller valuation premium compared to my July and October 2022 reviews.

- Fundamentals are improving, but the industry faces challenges like shutoff moratoriums imposed during the pandemic that might also occur in a recession. The consensus probability for that event is 65%.

- More concerning is FIW's low 6.46/10 profitability score, which I believe will disproportionately hurt the fund in a market downturn. I like the direction the fund is moving in, but these risks limit my rating to a hold.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

vitapix

Investment Thesis

The First Trust Water ETF (NYSEARCA:FIW) is for investors requiring dedicated exposure to companies that derive a substantial portion of their revenues from the potable and wastewater industry. This 36-stock fund is generally expensive using traditional valuation metrics like price-earnings and price-cash flow, and the ETF itself has a rich 0.53% expense ratio. For these reasons, I've remained cautious on FIW, though it slightly beat the SPDR S&P 500 ETF (SPY) since my coverage began in July 2022.

FIW's fundamentals have improved on key metrics like estimated earnings growth and forward earnings valuation. The industry has some significant headwinds, including obtaining the necessary funding to replace aging infrastructure and acquiring new talent to replace an aging workforce. While I've maintained my "hold" recommendation on FIW, the fund has developed a solid-enough track record that warrants merit, and it's worth adding to your watchlist to diversify away from broad-based funds. I look forward to taking you through the reasons why next.

ETF Overview

Strategy Discussion and Key Exposures

FIW tracks the ISE Clean Edge Water Index. The following is a description of the Index sourced from this link.

The ISE Clean Edge Water Index "HHO" is a modified market capitalization-weighted index designed to track the performance of companies that derive a substantial portion of their revenues from the potable water and wastewater industry. Industry exposure includes water distribution, infrastructure (pumps, pipes, and valves), water solutions (purification and filtration), and ancillary services such as consulting, construction, and metering.

The weighting scheme described is tiered, and in this case, securities are weighted based on their relative market capitalizations at each semi-annual rebalancing in March and September. The weighting categories are as follows:

- Securities 1-10: 4%

- Securities 11-15: 3.5%

- Securities 16-20: 3%

- Securities 21-30: 2%

- Securities 31-36: 1.25%

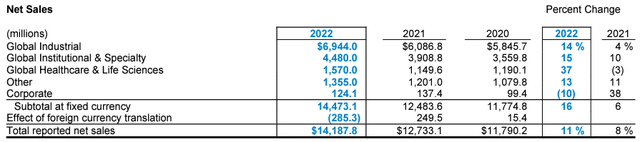

As a reminder, selected companies only need to derive a "substantial" portion of their revenues from the potable water and wastewater industry. For example, Ecolab's Global Industrial segment, which includes water and three other sub-segments (food and beverage, downstream, and paper), comprised half the company's 2022 net sales.

2022 Ecolab Annual Report, Page 40

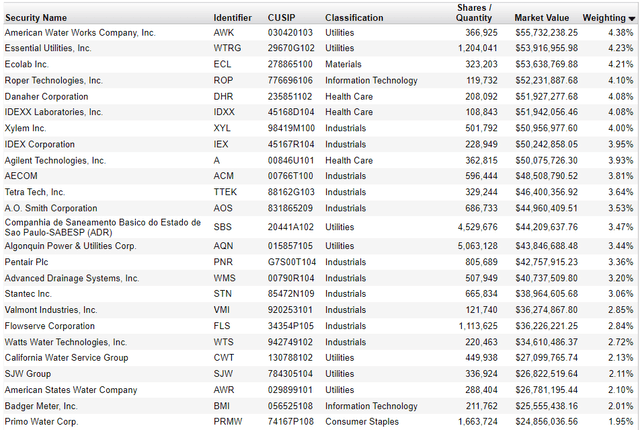

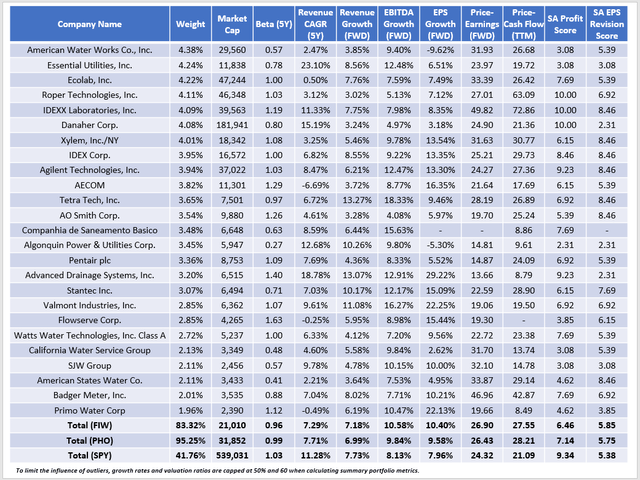

FIW's top 25 holdings are listed below, comprising 83% of the portfolio. Along with Ecolab (ECL), American Water Works (AWK), Essential Utilities (WTRG), Roper Technologies (ROP), and Danaher (DHR) round out the top five. At the March rebalance, companies in the top ten were initially weighted 4% and have since changed due to performance differences.

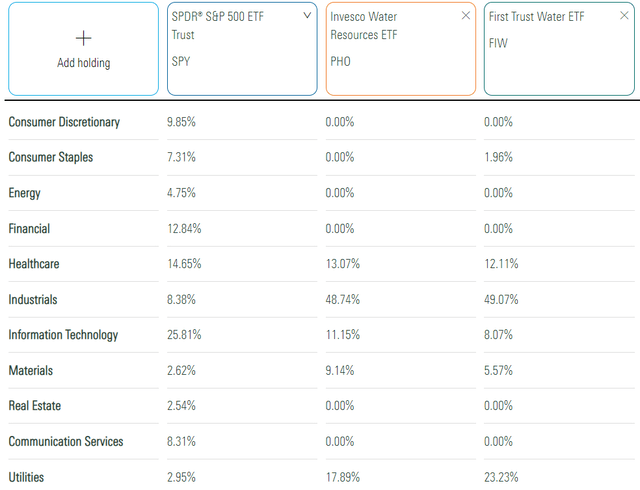

The Invesco Water Resources ETF (PHO) is an alternative investors should consider. The sector exposures table confirms the similarities. FIW and PHO each have 49% exposure to Industrials, and FIW overweights Technology and Materials, with Utilities as the offset.

Performance History

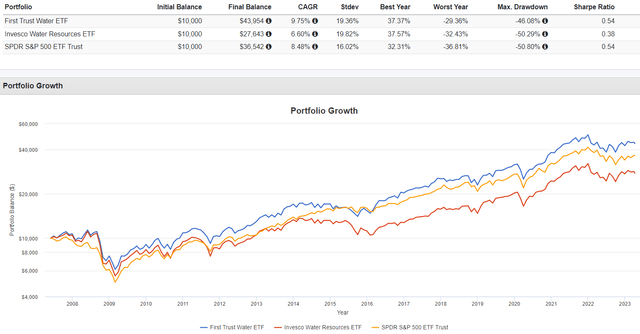

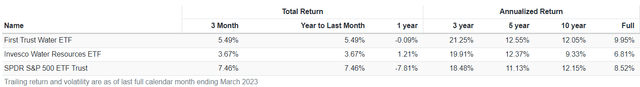

FIW launched in May 2007 and has gained an annualized 9.75% through April 10, 2023. This gain was far superior to PHO's 6.60% and even outpaced SPY by 1.27% per year. The downside was higher volatility, but FIW still matched SPY on risk-adjusted returns (Sharpe Ratio).

I used a logarithmic scale in the graph above to highlight significant increases in decreases over such a long period. FIW pulled away from SPY in 2016 when it outperformed by 20%. Except for a 5% lag in 2018 and a 4% lag YTD, FIW also performed well over the last five years. The following table summarizes annualized returns for multiple periods, and readers can click on this link to examine the underlying data further.

FIW Analysis

The Case For Investing In Water

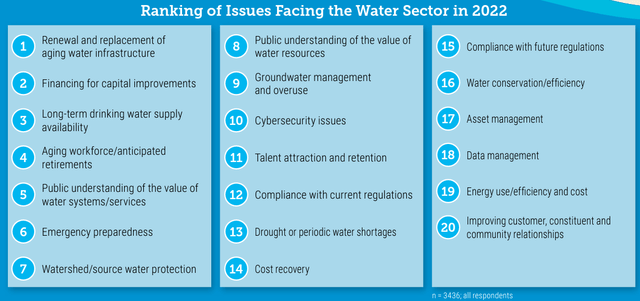

The American Water Works Association, a lobbying organization representing over 50,000 members, published a list of 20 issues facing the water sector in its 2022 "State of the Water Industry" report. The primary issue was the renewal and replacement of aging water infrastructure, which is not a new problem. A decade ago, the AWWA's "Buried No Longer" report estimated that the U.S. requires a $1 trillion investment over 25 years to service a growing population. Another headwind is an aging workforce, ranked the fourth-most pressing issue, up from #8 in the 2021 report.

American Water Works Association

Water is essential, and the AWWA successfully lobbied the Biden Administration in November 2020. The U.S. Infrastructure Investment & Jobs Act was signed into law one year later. According to Wastewater Digest, approximately $55 billion over five years relates to water, wastewater, and stormwater sectors. Key elements include:

- Drinking Water State Revolving Fund: $11.7 billion

- Drinking Water State Revolving Fund For Emerging Contaminants: $4 billion

- Drinking Water State Revolving Fund For Lead In Water: $15 billion

- Clean Water State Revolving Fund: $11.7 billion

- Clean Water State Revolving Fund For Emerging Contaminants: $1 billion

- EPA Sewer Overflow & Stormwater Reuse Municipal Grant: $1.4 billion

For now, lawmakers understand the need for additional funding, and it's hard to imagine a world where water demand plummets. Instead, one of the most pressing issues, according to the AWWA, is a moratorium on the disconnection of water services for non-payment. If service providers are expected to absorb these losses without financial relief, they may cease operations. The linked letter relates to pandemic relief, but the concerns also apply to a depressed economy. Goldman Sachs recently noted that the probability of a U.S. recession over the next twelve months was 65%. There's no guarantee that additional funding will be granted beyond five years, so high political risk will likely remain, leading to higher volatility that some investors dislike.

A recession would disproportionately impact high-growth, richly-valued companies. Unfortunately, that applies to some FIW constituents, so I urge caution. Still, FIW's overall fundamentals have improved since my October 2022 analysis. Let's look closer at those numbers next.

FIW Fundamentals By Company

The following table highlights selected fundamental metrics for FIW's top 25 holdings. I also included summary metrics for PHO and SPY. As a reminder, FIW traded at a 4.80-point premium to SPY in October 2022 and had a 2.06% lower estimated earnings growth rate.

FIW trades at a 2.58-point premium to SPY today, and its earnings growth is 2.45% better. It's great news on both fronts, as the premium decreased by 2.22 points, and the growth differential improved by 4.51%. Other key features, like the portfolio's five-year beta, remain similar (0.96 vs. 1.00). The ETF also sports a relatively strong 5.85/10 EPS Revision Score, which I use to gauge market sentiment.

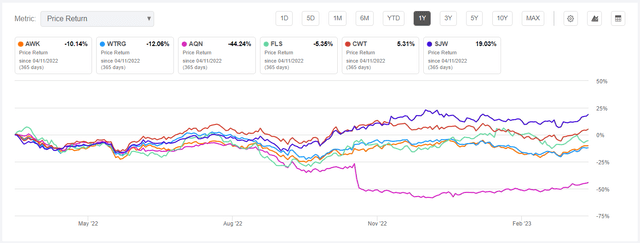

FIW's most problematic feature is low profitability, indicated by its 6.46/10 profitability score. Unfortunately, 12/36 constituents have scores below 5/10 and have declined by 11.99% on average over the last year. Here are the top six examples by weight:

FIW's top holding, American Water Works, is down 10.14%, followed by 12.06% and 44.24% declines for Essential Utilities and Algonquin Power & Utilities (AQN). There are always exceptions like SJW Group (SJW), up 19.03% over the last year. However, the scores work best when applied to groups of stocks rather than individual ones. This way, the impact of outliers is reduced, and we get a better picture of the metric's value.

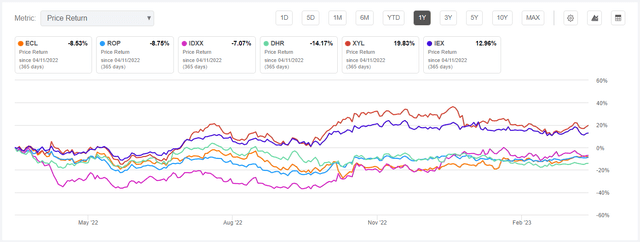

The 24/36 constituents with profitability scores above 5/10 gained 3.75% on average. Again, several declined over the last year, including the first four below. Still, the data taken together suggest that more profitable stocks are safer in down years like 2022, which is also a logical conclusion.

Investment Recommendation

FIW has a solid track record against SPY and PHO, its closest ETF competitor. Its expense ratio is high at 0.53%, but there's a clear opportunity here based on the necessity of water itself. The AWWA previously estimated that a $1 trillion investment over 25 years is required to maintain water service to an expanding population. For the government's part, the bipartisan U.S. Infrastructure Investment and Jobs Act partially addressed these concerns by appropriating $55 billion to the industry over five years. More funding is required long-term, and several problems remain, but it's a great start.

FIW has a 10.40% estimated earnings growth rate and trades at 26.90x forward earnings. Both these metrics have improved since October, and since FIW's earnings momentum remains strong, it's now on my watch list. However, my conservative side gives more weight to FIW's poor 6.46/10 profitability score. In addition, many of FIW's constituents could experience a substantial decline in a recession, especially if governments implement water shutoff moratoriums without a clear plan to compensate service providers. These unknowns lead me to limit my rating to a "hold," but it's a fascinating ETF to watch, and I look forward to covering it again over the next few months. Thank you for reading.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.