Tianqi Lithium: Chinese Player Strengthens Hold On Global Supply

Summary

- Tianqi Lithium is a Chinese lithium behemoth with global reach, world class assets and sizable processing fire-power.

- Until recently, the firm controlled nearly 50% of global lithium supply.

- A strategic company for China's administration the firm's sales and profits have skyrocketed.

- But any investment in the battery mineral giant is accompanied with mammoth geo-political risk and commodity prices under pressure.

Photon-Photos/iStock via Getty Images

Company Overview

Tianqi Lithium corporation (OTCPK:TQLCF), previously known as Sichuan Tianqi Lithium Industries, is the world’s third largest hard-rock lithium producer behind Gangfeng Lithium and US lithium juggernaut Albermarle (ALB). Championing a diverse portfolio of assets across Australia, China, and Chile, the Shenzhen-listed battery minerals behemoth is a darling of Chinese national lithium supply. The company employs just under 2,000 employees and at one stage controlled almost half of global lithium production.

The lithium giant has garnered reprieve from Beijing due to its noteworthy control of battery mineral supply, a significant strategic resource in China’s plight to electrify its vast transport network.

Just 3 years ago, the China CITIC Bank (OTCPK:CHCJY) granted the Sichuan-based lithium miner an uncustomary one-month let-off enabling the firm to belatedly meet bond payments of $1.9B dedicated to its minority stake in Chilean rival Sociedad Quimica y Minera (SQM). The miner has curried favor across the ruling administration, not only in favorable management of its debt but also in support afforded for its strategic ploy for its Chilean rival.

Tianqi Lithium possesses an interest in Greenbushes, Western Australia which boasts a 30-year life of mine and 13.1 million tons of lithium carbonate equivalent.

It’s a political balancing act for Tianqi Lithium - juggling Chinese state interests in recovering capital deployed with its interest in securing lithium supplies around the globe. Washington’s unwavering determination to challenge Beijing’s hold over strategic commodities such as lithium is a crucial risk for any investor interested in staking money.

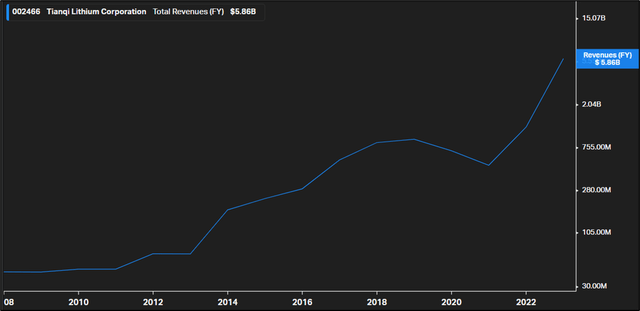

At ZMK Capital, we believe meaningful upside remains for the $17.5B lithium miner. Sales increased 4x during the period FY21 to FY22. Over the same period, net income increased tenfold, from $327M FY21 to $3.4B! Despite eye-watering financial performance the company trades at only 6x forward, emphasizing the key risk here – geo-politics.

While we remain extremely upbeat on the company’s future, we also meaningfully emphasize the risk surrounding deploying capital on a Chinese controlled exchange or even in the ADR market, in a company heavily linked to battery mineral ascendency when the United States is pushing for strategic containment. Buy (but fully understand the big risk and caveats)

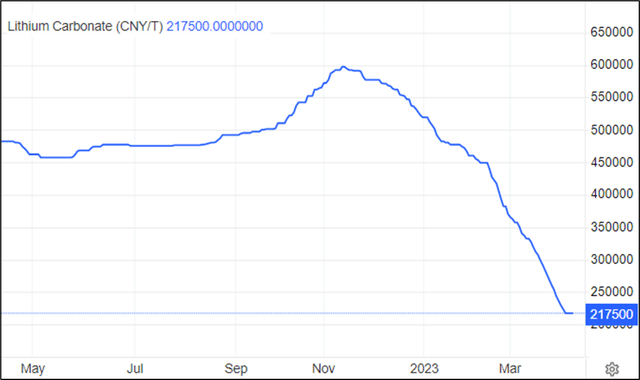

Current Lithium Prices

Lithium carbonate prices have collapsed by ~50% since the start of the year, slumping to 217,500 RMB ($31,660 USD) – a new low in the past 16 months. Increased production coupled with increasingly defeated demand, particularly driven by an EV price war, continues to put pressure on prices.

Cash subsidies provided by the Chinese government for the purchase of electric vehicles have been slashed, accentuating pricing pressures. A spike in battery inventories at the back end of 2002 driven by Chinese subsidies has wreaked chaos with prices as producers scrambled to up production before an end to the incentive schemes.

Discounts have since ensued with State interventionism creating anomalies in supply/ demand dynamics. Agreement on a price floor between major Chinese battery manufacturers will likely provide some support to prices. Yet, expect more near term price volatility to play out before normalization and a more long-term bullish trend to prices moving forward.

Lithium carbonate prices have continued their move to the downside on the back of dampened economic sentiment and a slowing of automotive sales.

Portfolio of Assets

Tianqi Lithium’s asset portfolio has greatly advanced over the past years. Under favorable credit terms allocated by state-run banks, the miner strategically acquired a 27% stake in Chilean lithium powerhouse Sociedad Quimica y Minera. Since then, the firm also sold a 25% stake in Greenbushes, Australia’s largest lithium mine for a $1.4B consideration in a scramble to shore-up finances following a period of substantial over-leveraging.

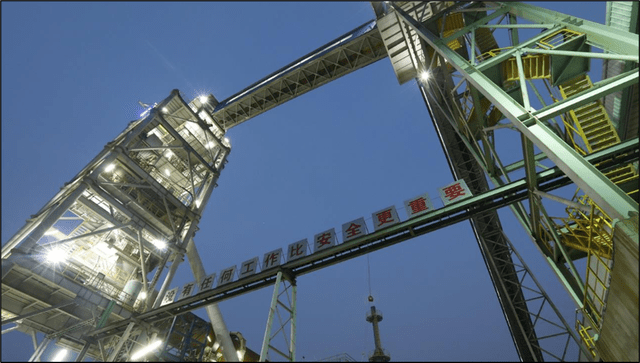

The Zhangjiagang Processing Facility in Jiangsu, China is capable of producing 20kt of lithium carbonate annually.

Subsequently, Aussie miner IGO built a stake in Greenbushes, the massive open-pit hard rock lithium operation, in which Albermarle already had minority control. Greenbushes, boasting a capacity of 1.2m tons per year, is the largest and lowest-cost producer of spodumene concentrate.

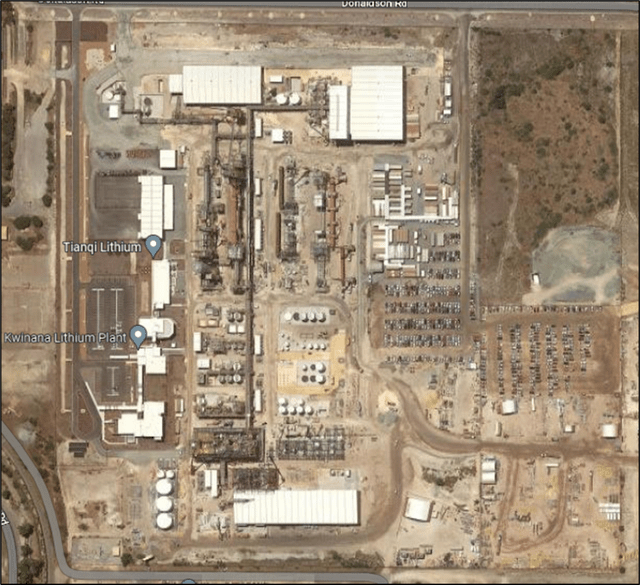

Despite diplomatic headwinds linking Canberra and China, the Sino-Australian joint-venture has garnered success, now close to producing battery-grade lithium hydroxide out of its flagship Kwinana, Western Australia refinery. In a first for Australia, the battery mineral refinery is now the largest outside of China and has since opened talks with several EV manufacturers looking to safeguard battery supply.

This milestone will be the first time Tianqi Lithium produces battery-grade lithium hydroxide outside of China with the Asian giant being by far the world’s biggest refiner, accounting for 80% of the highly lucrative lithium processing market.

The Kwinana Lithium Plant is the biggest outside of China.

Financials & Risk Profile

Tianqi Lithium’s secondary listing raised $1.7B in Hong Kong’s biggest IPO of 2022. The Chengdu-based company sold 164M shares at approximately $10.45 in a fund-raising rush to bolster its capital structure. It was a relatively difficult showing for the mining giant given the volatile market environment in 2022.

Since then, the company has made progress despite pricing headwinds for lithium on weakened demand and increased supply. Approximately 40 ETFs hold a position in Tianqi Lithium equating to roughly 1.1% US ETF ownership. Biggest holders include VanEck Vectors ETF Trust – VanEck Green Metals where Tianqi Lithium represents 4% of total ETF value and Global X Funds – Global X Lithium and Battery Tech ETF making up roughly the same.

The stock is actively covered by the analyst community with most pitching bullish outlooks – of the 18 analysts following it, 8 rate a strong buy, 7 rate a buy, 2 rate a hold and 1 analyst rates a strong sell.

The 12-month average target for the equity is 115.14 CNY roughly a 53% increase on current prices. FY23 sales are forecast at $6.2B with numbers moderating thereafter (FY24 $5.2B and FY25 $5.1B) on slowing demand and weaker lithium prices. As described earlier, lithium prices are presently coming under significant pressure.

Tianqi Lithium’s revenues have rocketed following a steep increase in lithium prices from 2020.

FY22 saw bumper sales ($5.86B) a four-fold increase on FY21 sales numbers. The company’s market capitalization has doubled since 2020, from $8.4B to just North of $17B. During that period, record net income levels allowed the firm to bolster cash and equivalents (from $313M to $1.8B) while essentially halving the level of debt. Selling, general and administrative expenses have plateaued impressively at $70M despite an almost 5x increase in sales. The company is also generating substantial amounts in interest and investment income ($1.14B FY22) given the current strong cash position on the balance sheet.

Cash flows are equally strong – the firm posted FY22 cash flows from operations at $2.9B, up from $300M a year earlier. Tianqi also continues to roll debt, issuing $1.8B will extinguishing $3.7B over the same period. The 2022 floatation on the Hong Kong stock exchange allowed the firm to bring in an extra $1.6B.

The company is comparably cheap – 3.1x price to sales, only 3.9x EV to EBITDA and a next 12-month price earnings ratio of just 6x. However, these multiples reflect the inherent risk in Chinese equity investments. Country risk remains extremely high, supported by Sino-American tensions over Taiwan. Chinese government influence on the company is another important risk factor warranting increased risk premiums and substantial consideration before deploying capital. Chinese equity markets remain highly controlled, lack transparency, and represent a financial minefield for foreign money. Big rewards are possible, but risk is ever present with minimal protections afforded to foreign investors.

For investors looking for some interesting battery mineral yardsticks, we invite you to review our posts regarding Liontown Resources (OTCPK:LINRF), Galan Lithium (OTCPK:GLNLF), Alkem (OTCPK:OROCF), Standard Lithium (SLI), Snow Lake Resources (LITM), Leo Lithium (OTCPK:LLLAF), and Lake Resources (OTCQB:LLKKF).

Key Takeaways

Tianqi Lithium is one of the world’s largest lithium players with sizable investments in China, Australia, and Chile. A local darling of the ruling administration, the company has deleveraged, firmed up its balance sheet, successfully completed Hong Kong’s biggest IPO in 2022, and strategically right sized its sprawling portfolio of assets.

Its rock-star financials have given it a pedigree few battery mineral juggernauts share. But risk remains ever present, particularly as the United States and China battle for strategic commodity supremacy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.