Westport Fuel Systems: Lack Of Catalysts And Potential Reverse Stock Split Should Keep Investors Sidelined

Summary

- Last month, the company reported disappointing fourth quarter and full year 2022 results with both revenues and margins down year-over-year.

- Adjusted for one-time cash proceeds from the sale of intellectual property and the company's stake in the Cummins Westport joint venture, free cash flow was negative $46.1 million.

- The company ended the year with $86.2 million in cash, down from $124.9 million at the end of 2021. Total liquidity amounted to $94.5 million.

- While management pointed to strong growth in the company's hydrogen components segment, the business remains very much in its infancy and won't be a leading revenue contributor anytime soon.

- With no real near-term catalysts in sight and the company potentially being required to conduct a reverse stock later this year, I would advise investors to remain on the sidelines until progress becomes more visible.

Tramino

Note: I have covered Westport Fuel Systems (NASDAQ:WPRT) previously, so investors should view this as an update to my earlier article on the company.

A little over twelve months ago, I projected an ugly 2022 for Westport Fuel Systems or "Westport" with sales, margins and cash flows pressured by a host of internal and external factors.

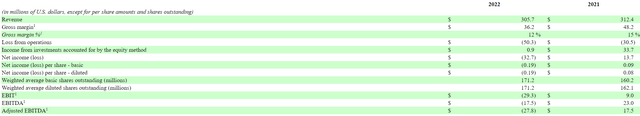

In March, the company indeed reported disappointing fourth quarter and full year results with both revenues and margins down on a year-over-year basis:

That said, 2022 revenues were heavily impacted by the weakening Euro. On a constant currency basis, sales would have increased by 9% but this is not an apples-to-apples comparison either as Westport benefited from a full year of revenue contributions from the former Worthington Industries' fuel storage business acquired in late May 2021.

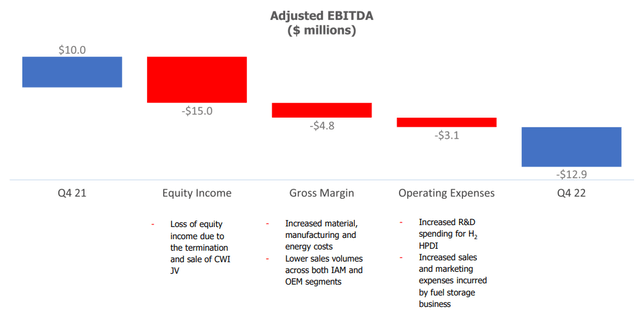

Adjusted EBITDA decreased by a whopping $45.3 million year-over-year to negative $27.8 million:

Adjusted for one-time cash proceeds from the sale of intellectual property and the company's stake in the Cummins Westport joint venture, free cash flow was negative $46.1 million.

The company ended the year with $86.2 million in cash, down from $124.9 million at the end of 2021. Total liquidity amounted to $94.5 million:

Total debt and royalty payables decreased from $79.3 million to $58.5 million at the end of 2022.

Westport's fourth quarter performance was particularly disappointing with gross margins in the company's OEM segment turning negative due to decreased sales volumes, elevated warranty costs and the annual contractual price reduction agreed with the company's main OEM partner Volvo (OTCPK:VOLVF, OTCPK:VOLAF, OTCPK:VOLVY).

In the Independent Aftermarket ("IAM") segment, the company managed to overcome lower sales volumes to Russia, Turkey and Egypt as demand in Western Europe recovered and business in Eastern Europe and Asia Pacific gained traction.

On the conference call, management also pointed to strong growth in the company's hydrogen components business (emphasis added by author):

Touch quickly on our hydrogen components business. This business grew revenue by over 60% in ‘22, as a result of increased volumes to our key customers. As a reminder, we work with the likes of Ballard and Plug Power and have been invited to participate in many more RFQs for OEM Tier 1 programs. Also, there’s a strong sign of further growth in the coming years with an announced pipeline of potential revenue totaling a $100 million.

Just recently, the company announced plans to invest up to $10 million over the next ten years in domestic hydrogen components manufacturing capacity in China.

The new Westport facility is planned to be in operation in 2024 supporting Westport’s current and growing customer base with key hydrogen components for a variety of applications including commercial vehicles, buses, high-speed trains, material handling, stationary power generation and more.

That said, even with the strong year-over-year growth rate, the business is not yet a material contributor to revenues as admitted by management on the conference call after being poked on the issue by an analyst:

Jeff Osborne

(...) But what’s the percent of revenue that hydrogen components made up in 2022? Is there a rough number you can give for that 60% growth?

David Johnson

(...) We don’t specifically call that out. (...) It’s sub-10% for sure.

But the growth rate’s been really strong, right? So it will not be sub-10% forever. We definitely see that as increasing part of our sales mix and looking forward to having that showing up more clearly in the financials in the future.

In addition, even after almost five years since signing the initial agreement, Westport's Chinese joint venture with Weichai Power has yet to commence the eagerly-awaited commercial launch of the company's advanced high pressure direct injection systems ("HPDI 2.0") despite a contractual commitment to purchase proprietary components from Westport for no less than 25,000 (!) 12-liter engines operating on the HPDI 2.0 fuel system until the end of next year.

Looking ahead, management expects both sales and margins to improve this year despite a number of ongoing headwinds with more tangible progress in 2024:

2023 is a year of change for Westport, as we continue to deliver sustainably in our existing markets while unlocking new and emerging markets through the delivery of our cleaner, affordable transportation solutions. Though headwinds still remain for our industry, including the Russia/Ukraine conflict, supply chain issues, and inflationary concerns, we remain confident in our ability to execute on our plans for 2023, focusing on what we can control, driving margin and revenue expansion and developing technology for the future.

(...)

In 2024 and beyond, we expect improved profitability and growth as we begin to benefit from the changes made in 2023, in addition to demonstrated growth in our core business. Adoption of alternative fuels for transportation applications continues to accelerate and is expected to experience a step change increase as the regulatory requirements become increasingly more stringent beginning in 2025 in many of our key markets, including Europe, India and China.

Based on these expectations and the company's 2023 capex guidance of $12 million to $15 million, I would estimate negative free cash flow of $30 million to $35 million this year which should leave Westport with total liquidity of $60 million to $65 million at year end which should be sufficient to carry the company well into 2025.

Bottom Line:

After a disappointing 2022, management expects some moderate improvement on both the sales and margin front this year with more tangible progress in 2024.

While cash burn is likely to remain material, the company should have sufficient liquidity well into 2025.

From a valuation perspective, Westport Fuel Systems looks cheap with shares trading at just 0.35x EV/Revenue based on the current 2023 analyst consensus.

That said, with no real near-term catalysts in sight and the company potentially being required to conduct a reverse stock later this year, I would advise investors to remain on the sidelines until progress becomes more visible.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.