North America Construction Outlook: Banking Woes Trigger Risk Of A Hard Landing

Summary

- The rising interest rate environment was already weighing on the outlook for construction activity, but the recent stresses in the US and European banking sectors have added to fears that lenders will increasingly step back.

- The US looks especially vulnerable given the outsized role of small and regional banks.

- We expect overall US construction value-added to fall 7.5% in 2023.

ANNVIPS

Higher borrowing costs are already having an impact

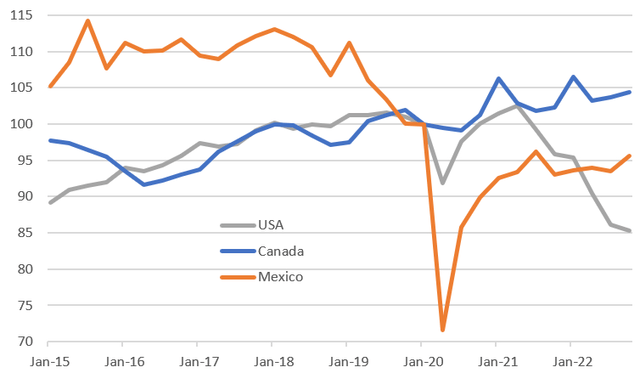

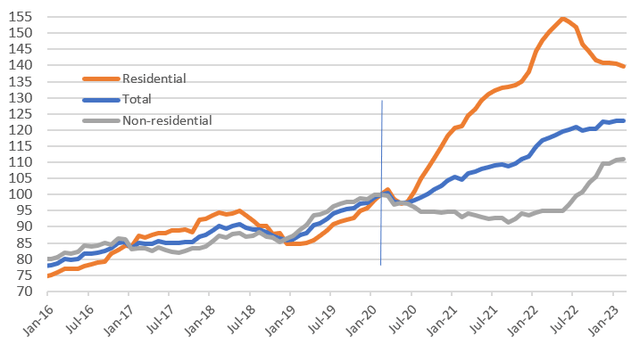

Central banks around the world have been hiking interest rates aggressively in response to the inflation threat. This has resulted in sharply higher borrowing costs for households and businesses, which has in turn weakened demand growth, particularly for both residential and commercial property. Transactions have slowed and property prices are under downward pressure, translating into weaker construction activity, most notably in the US.

Construction value added (GDP measure) - constant prices 1Q 2020 = 100

Banking stresses will restrict credit availability

The recent banking turmoil is now adding to the downside risks for the construction sector. There is concern that the failure of Silicon Valley Bank and Signature Bank in the US and Switzerland’s Credit Suisse is symptomatic of broader stresses in the banking sector that could lead to a deterioration in the flow of credit to the economy, which is vital for many projects to go ahead.

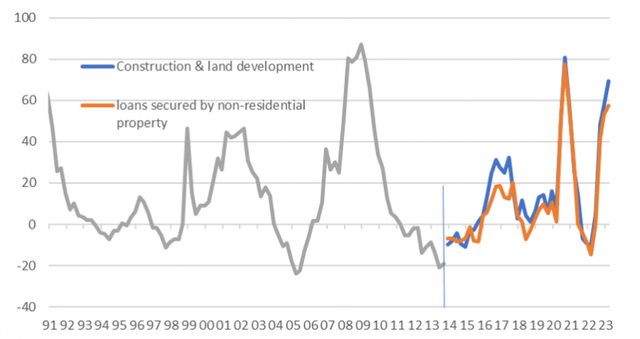

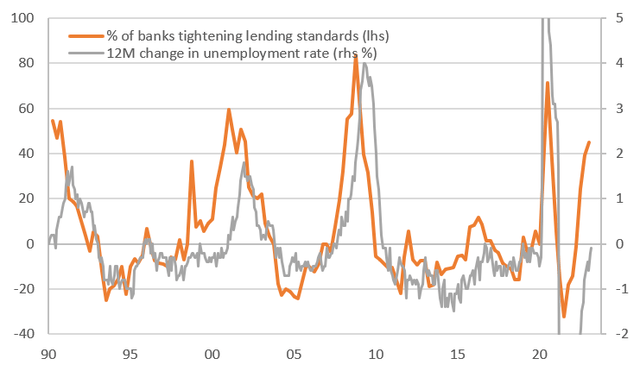

Even before these events, the Federal Reserve’s Senior Loan Officer survey noted a significant increase in the number of banks that were tightening their lending standards i.e. being far more cautious regarding who they lend to, how much they lend and at what rate. This is being seen across mortgage lending and corporate and industrial loans. The chart below shows that, as of the very beginning of 2023, banks were particularly nervous about their exposure to construction and non-residential property – the blue and orange lines moving higher show the proportion of banks that were restricting lending to the sector. We suspect that nervousness about lending is only going to have increased in the wake of recent events.

US Senior Loan Officer survey: lending standards for property and construction related loans

US small banks are critical for commercial real estate and construction lending

With the Federal Deposit Insurance Corporation (FDIC) only insuring deposits of up to $250,000 in the event of a bank failure, many wealthy individuals and corporate clients have been shifting their money out of small and regional banks and putting them in safer havens such as the big banks and government money market funds. This will inevitably make the impacted banks much more conservative in their lending practices, while heightened anxiety and the prospect of regulators taking a more proactive approach to dealing with banks will make the broader sector more cautious about lending.

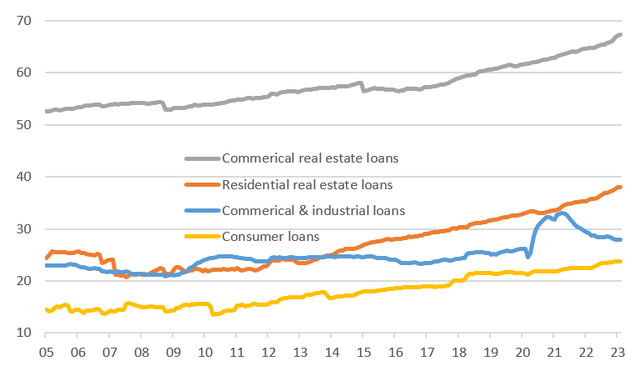

What makes this so problematic for the property market and construction sectors is that small banks account for such a high proportion of commercial bank lending to both residential and commercial property. As the chart below shows, banks with less than $250bn of assets account for two-thirds of the stock of all commercial lending to commercial property and more than a third of residential property lending by all banks.

Stock of outstanding US commercial bank lending by small banks (% of total)

Tough times ahead for construction and real estate

The non-bank sector (alternative lenders) have become an increasingly big player in the lending market (think Quicken Loans which owns Rocket Mortgage or Kabbage, for example). In fact, according to the Consumer Financial Protection Bureau, these types of lenders accounted for around two-thirds of mortgages originated. However, we doubt these lenders will avoid the stresses seen in the banking market and will likely be bracing for greater regulation in the wake of recent events. This is potentially a big hole for the large banks to fill. We doubt they will be able to do that even if they had the appetite.

Given both property ownership and construction tend to be such highly leveraged industries, the combination of higher borrowing costs, reduced credit availability and the potential for price falls means the outlook for the sector is very challenging – with the US in a particularly exposed position.

Residential outlook: downside risks everywhere

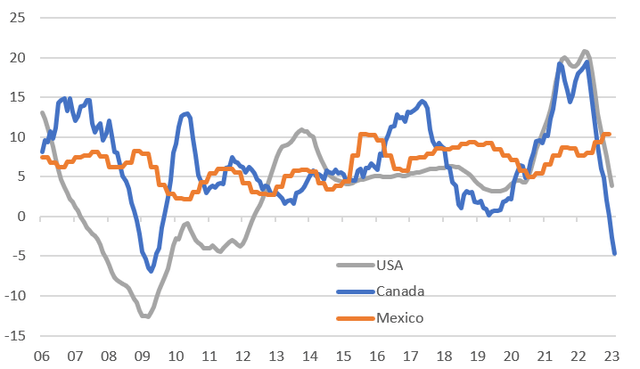

The combination of ultra-loose monetary and fiscal policy as governments attempted to support their economies through the Covid-19 pandemic created the perfect conditions for property prices to boom. Cash-rich buyers that could also access cheap borrowing came face-to-face with a dearth of supply and prices jumped everywhere; including 42% increases in both the US and Canada, while the average price in Mexico is up 24%, according to the Federal Mortgage Company.

Residential property prices (YoY%)

Macrobond, ING

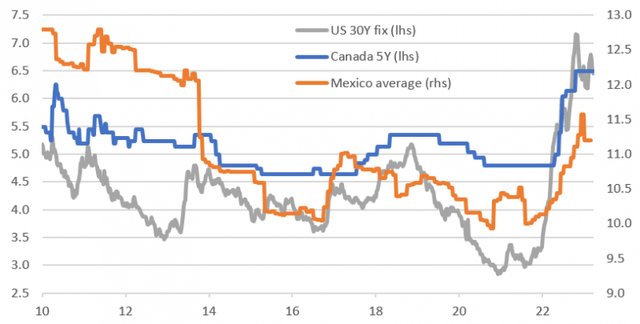

The chart below shows that mortgage rates have jumped over the past year in response to central bank actions. In January 2022, borrowers could take out a $400,000 30Y fixed-rate mortgage and their monthly payment would be $1,750. Based on today’s US mortgage rates, if that person were to pay the same $1,750 monthly payment, they would typically only be able to borrow $280,000.

Typical mortgage rates for a new home purchase (%)

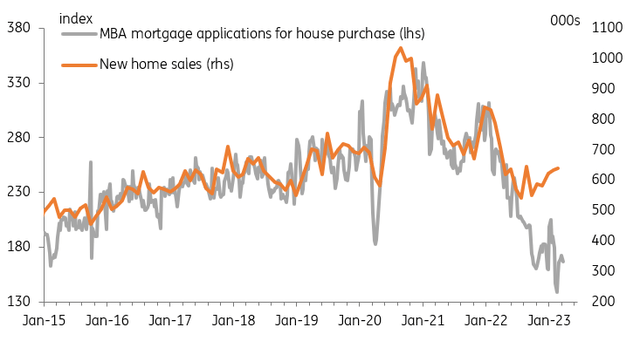

This means that affordability has been hit hard with demand for mortgages for new home purchases halving and property transactions collapsing. Existing home sales are down 30% from their October 2020 peak, while new home sales are down 38% from August 2020. While there has been a recent uptick in new home sales we see this more of a reflection of the lack of existing homes to buy – note the chart below showing the recent breakdown in the relationship between new home sales and mortgage applications for home purchases.

US mortgage applications for home purchase and new home sales

Building permits and housing starts follow a similar pattern to new home sales, but we are not hopeful that these recent improvements are sustainable. The chart below shows that tighter lending conditions invariably have a damaging impact on the economy with unemployment likely to rise through the second half of the year. Lending conditions will tighten further through the first half of this year, which will intensify pressure on struggling businesses throughout the economy and implies that the unemployment rate could rise substantially.

Tighter US lending conditions points to surging unemployment

The combination of higher borrowing costs, reduced access to credit, and the threat of rising unemployment means a greater chance of a hard landing for the US residential property market and the economy more broadly. Rising unemployment has historically been associated with rising default rates and therefore the rising supply of homes for sale, which will hurt the outlook for residential construction considerably. Falling property prices at a time when construction costs and labour remain elevated (price rises have at least slowed back to more normal rates of increase) also means squeezed profit margins, which is another disincentive for construction.

We see housing starts, which averaged 1554k in 2022, slowing to around an annualised 1200k rate by the end of this year, before rising back to around 1400k by the end of 2024. This is based on the assumption that slowing inflation allows the Federal Reserve to reverse course later this year and start to cut interest rates, that this stimulus works and also lending conditions improve. The consensus forecast is currently 1271k and 1350k respectively.

Canadian price and construction risks are mounting

Canadian house prices are already down 11% from their peak in response to rising borrowing costs and housing affordability that is even more stretched than in the US. The average Canadian home price hit C$817,000 last year – nine times the average household income, making the US property market look almost cheap, where the median home price is a “mere” 5.5 times household income.

There is a greater risk of forced sellers in Canada vis-a-vis the US though. The standard mortgage in Canada isn’t the 30-year fixed, as it is in the US, but a five-year mortgage amortised over 25 years, which means that more households are exposed to changes in interest rates via a mortgage rate reset once the five-year period is over.

On the other hand, Canada is less exposed to the strains that have emerged in the US banking sector. The largest six banks in Canada provide around two-thirds of newly extended mortgages, according to the Canada Mortgage and Housing Corporation. Canada’s banking sector looks relatively healthy and so we are less concerned about banks pulling back in their willingness to lend.

Moreover, the Canadian jobs market has outperformed that of the US with employment 4.3% above the pre-pandemic peak, whereas in the US it is only up 2% on February 2020 levels. Demand should be further supported by rapid population growth, which is currently the fastest in the G7 at 5.2% between 2016 and 2021 versus 2.6% in the US. Mexico’s population grew 5.6% over the same period.

We do expect to see a slowdown in the Canadian economy, reflecting the lagged effects of monetary policy tightening, but healthy fundamentals and strong exposure to commodities provide some insulation. We look for Canadian housing starts to slow to 225,000 in 2023 from 2022’s 263,000 before rebounding to 270,000 in 2024.

Mexico should be more resilient

In Mexico, house price rises have been far less extreme than in the US and Canada. This is likely because the majority of Mexican homes are either bought with cash or self-built or inherited given the high proportion of multigenerational homes. The number of home purchases financed by a conventional mortgage from a private financial institution is less than 10% in Mexico versus 70% in the US. Consequently, low interest rates have less of a direct stimulus regarding Mexican residential property transactions and construction.

Around two-thirds of Mexican homes are built with the household's own resources while 18% of people resort to a loan from Infonavit (the Mexican federal institute for worker's housing) with the remainder using family loans. Therefore the jobs market is a more important driver of Mexican residential real estate construction. Employment is at record levels domestically, while the number of Mexicans employed in the US also hit a new high, allowing worker remittances to hit $59bn in 2022 versus $51.6bn in 2021, already up from $40.5bn in 2020.

Consequently, higher mortgage costs and reduced credit availability that will hit the US residential market hard are far less of a hindrance in Mexico. Nonetheless, the high cost of building supplies has acted as a brake while a weakening in the US jobs market and the strong Mexican peso may slow the growth of remittances back to Mexico. Our view is that while Mexican residential real estate is likely to be relatively insulated from the US’s troubles, it is not going to be completely immune to the headwinds coming from the States. We expect Mexican residential construction to fall by around 5% between 2022 and 2023, versus 15% plus declines in the US and Canada.

Non-residential: governments in the driving seat as credit dries up

Over the past 12 months, non-residential US construction strength has been able to offset weakness in residential construction, but we are doubtful that this will continue to be the case given funding issues arising from the banking turmoil. As already highlighted, banks were becoming increasingly cautious about funding both property purchases and construction activity and we see this situation deteriorating further.

Office spaces are particularly vulnerable given small banks are so heavily exposed already, while persistently high vacancy rates are likely to mean prices remain under pressure. In a recession with rising unemployment, there is the likelihood that demand will fall further.

US construction spending levels (Feb 2020 = 100)

Furthermore, US CEO confidence has collapsed since early 2022 and small business optimism has fallen below pandemic lows. Both signal recession and in this environment the private sector will be increasingly focused on cost containment rather than business expansion and capital expenditure.

Higher borrowing costs, reduced credit availability and very weak business sentiment suggest the private sector will not be an engine of growth. Indeed, capex intentions surveys offer a gloomy outlook. Given the economic and financial interlinkages, Canada and Mexico are experiencing similar phenomena and this leads us to be pessimistic about the outlook for North American non-residential construction through 2023 and the first half of 2024.

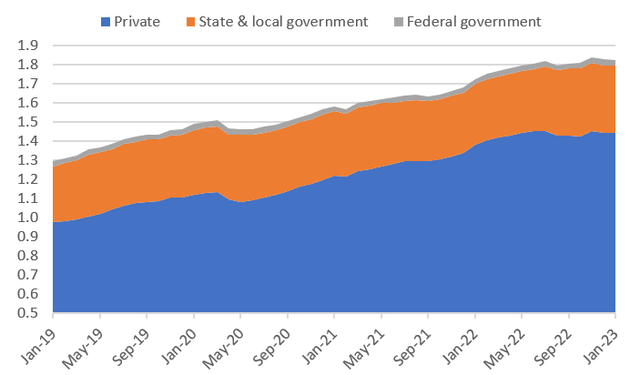

This means that government-financed and supported construction is likely to be the sole growth contributor in the US. The chart below of US non-residential construction highlights that government construction is barely a quarter of the total, and with the plans announced this won’t be enough to prevent a contraction in overall US spending.

US non-residential construction $tr

The Infrastructure Investment and Jobs Act totals around $1.2tr of spending over the next five years. It contains substantial funding for projects that range from public transport to the power system, and from climate resiliency to emerging technologies that can accelerate the country’s energy transition.

This has now been followed up with President Biden’s Inflation Reduction Act which sets aside $260bn for energy transition tax incentives with money allocated for nuclear energy, renewable energy, and home energy efficiency and improvements. However, the Act also includes significant tax revenue-raising measures and in any case the allocated expenditure is over several years.

As such, the government sector is unlikely to offset to the steep decline in private sector construction activity and we look for overall US spending to be down 7% this year.

Canada and Mexico set to follow the US’s lead

Infrastructure spending is also a key plank of the Canadian government’s growth strategy, having promised more than C$180bn of funding over the next 12 years. Projects include public transport links, and improving broadband and energy infrastructure. The recent Canadian budget affirmed the intent to continue with these projects with additional money for the clean energy transition and freshwater protection.

Long term, we remain upbeat on the Canadian construction outlook given population growth and a heavy emphasis on commodities, but it is difficult to see Canada avoiding a similar diagnosis as the US non-residential construction sector. Weak sentiment, an uncertain economic outlook and high borrowing costs will weigh on private activity and offset any spending increases from the government sector.

In Mexico, there have been positive headlines generated by automakers, including Tesla and BMW, committing to new facilities, but the general economic uncertainty is going to remain a headwind for construction activity. Private construction may not be as hard hit as in the US or even Canada given the trend for nearshoring production for the US – the hit from Covid on global supply chains and geopolitical concerns is incentivising investment and construction activity in Mexico away from more distant trade partners. However, there appears to be little support from the government sector given the reluctance to increase debt levels. Moreover, concerns regarding government interference and the weakening of independent regulatory bodies and the associated worries surrounding transparency and accountability are also likely to be a hindrance for non-residential construction.

Conclusion: US construction to underperform

Central banks around the world are trying to get a grip on inflation. They all acknowledge that for this to happen borrowing costs need to rise and economic activity slow. Highly leveraged sectors such as property and construction are therefore going to struggle.

The banking stresses mean that borrowers are not only going to have to pay more but are also going to be restricted in terms of the amount they can borrow as caution among lenders is heightened. The problem is particularly acute in the US, but there is a ripple effect in Canada and Mexico. With consumer and business confidence at recessionary levels, this paints a gloomy picture for the sector as a whole.

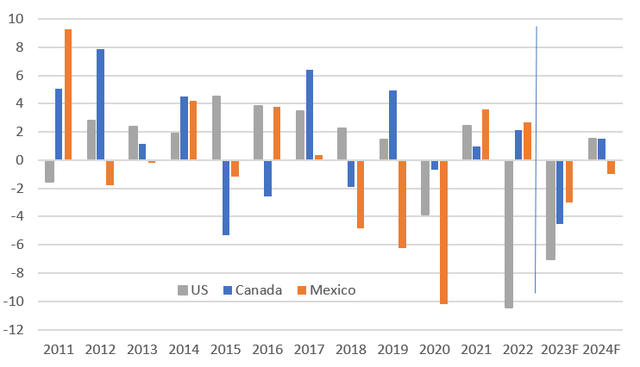

The hope is that inflation will fall quickly through the second half of the year and this will open the door to interest rate cuts before year-end. We look for Canadian and US policy interest rates to head to 3% next year and this easing of monetary conditions and a gradual return of confidence in the banking system can allow for a more positive outlook in late 2024 into 2025. We expect overall US construction value added to fall 7.5% in 2023, with falls of 4.5% for Canada and 3% for Mexico (all in constant prices). Stimulus may allow for stabilisation in 2024, but meaningful growth may not happen until 2025.

Forecasts for construction constant priced value added (YoY%)

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This article was written by