FIG: One ETF Holds Multiple ETFs From Simplify

Summary

- The Simplify Macro Strategy ETF provides investors exposure to multiple futures and other strategy funds from the Simplify manager, plus a gold ETF.

- The ETF expands beyond these ETFs with the use of an options strategy. All of this is discussed in detail.

- FIG only started in May 2022, and many of the held Simplify ETFs have limited history too. They also hold the non-Simplify IAU ETF, which at least has history.

- With limited histories of FIG and the ETFs held, FIG's results as it approaches one year in existence warrants a pass at this time. More history could give a better story.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

Lcc54613

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Investment managers have caught the bug! Launch a new ETF whose main or even only holdings are other ETFs managed by the same firm. Investors benefit from the simplicity this provides; the managers by increasing their AUM, and of course they collect a double set of fees. Here, I review an ETF, the Simplify Macro Strategy ETF (NYSEARCA:FIG), which is from an investment manager I was not that familiar with.

Who is Simplify Asset Management?

This is how they explain themselves and investment philosophy:

Simplify Asset Management was founded in 2020 to help advisors tackle the most pressing portfolio challenges with an innovative set of options-based strategies. By accounting for real-world investor needs and market behavior, along with the non-linear power of options, our strategies allow for the tailored portfolio outcomes clients are looking for.

At Simplify we focus on identifying the most critical portfolio challenges today, both market-based and client-based, and how to directly address them by intelligently deploying options. The non-linear behavior of options allows us to extend common betas like equities and duration into much more nuanced market exposures. We provide innovative yet simple solutions that can help advisors build better portfolios.

Source: simplify.us/investment-philosophy

Simplify has over 20 ETFs with a combined $1.3b in AUM; seven of those ETFs are held by FIG.

Simplify Macro Strategy ETF review

Seeking Alpha describes this ETF as:

The fund invests in public equity, fixed income, currency and commodity markets of the United States. For its equity portion, it invests through other funds and through derivatives in stocks of companies operating across diversified sectors. It uses derivatives such as futures to create its portfolio. For its fixed income portion, the fund invests through other funds in debt securities of any credit quality or maturity. For its commodity portion, it invests through other funds in commodities. For its currency portion, it invests in foreign exchange futures contracts. FIG started in May 2022.

Source: seekingalpha.com FIG

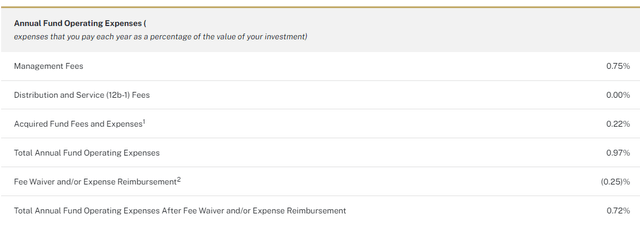

FIG has just under $40m in AUM. While that AUM makes ETFs vulnerable to closure, it really isn't a risk for this ETF. The TTM Yield is listed at 3.9%. The fee schedule comprise the following sources, including a current 25bps waiver until November of 2023. The Fund's adviser has contractually agreed, until at least October 31, 2023, to waive its management fees and/or pay certain expenses, in order to limit specified expenses to 0.50%.

The manager provides the following benefits on why investors should add this ETF to their portfolio.

The Simplify Macro Strategy ETF is a modern take on the balanced portfolio, built to help navigate today's toughest asset allocation challenges. With strong potential headwinds to bonds, stretched equity valuations, continued inflationary pressures, and increasingly fragile market structure, the classic balanced portfolio may have challenging years ahead. FIG addresses these concerns by creating a robust portfolio comprised of equities with positive convexity, diversified and inflation-hedging managed futures, and a suite of income sources with low sensitivity to duration. The fund will also opportunistically invest in equity, credit, interest rate, and FX derivatives (listed and OTC) to capitalize on attractive idiosyncratic market dislocations.

Source: simplify.us/etfs

Holdings review

Here is a brief description of each ETF held as describes on each ETF's homepage. All the Simplify ETFs used are limited in their history as many started in 2022; the oldest in 2021. They also use options, as is shown below.

Simplify High Yield PLUS Credit Hedge ETF (CDX) seeks to maximize current income by investing primarily in high-yield bonds while mitigating credit risk. The credit risk premium is an attractive return source that may provide significant income. But credit spreads can turn swiftly, wiping out years of gains quickly. CDX is designed to provide core high yield exposure, with its attractive income, while simultaneously deploying a host of compelling credit hedge techniques to alleviate the blowup risk.

Simplify Short Term Treasury Futures Strategy ETF (TUA) seeks to provide total return, before fees and expenses, that matches or outperforms the performance of the ICE US Treasury 7-10 Year Bond Index on a calendar quarter basis. The Fund does not seek to achieve its stated investment objective over a period of time different than a full calendar quarter.

Simplify Volatility Premium ETF (SVOL) seeks to provide investment results, before fees and expenses, that correspond to approximately one-fifth to three-tenths (-0.2x to -0.3x) the inverse of the performance of the Cboe Volatility Index (VIX) short-term futures index while also seeking to mitigate extreme volatility.

Simplify Managed Futures Strategy ETF (CTA) seeks long term capital appreciation by systematically investing in futures in an attempt to create an absolute return profile, that also has low correlation to equities, and can provide support in risk-off events.

Simplify Commodities Strategy No K-1 ETF (HARD) seeks long term capital appreciation by systematically investing in commodity futures in an attempt to create commodity exposure that performs strongly during inflationary periods while still performing well in more typical market environments.

Simplify Intermediate Term Treasury Futures Strategy ETF (TYA) seeks to provide total return, before fees and expenses, that matches or outperforms the performance of the ICE US Treasury 20+ Year Index on a calendar quarter basis. The Fund does not seek to achieve its stated investment objective over a period of time different than a full calendar quarter.

Simplify Interest Rate Hedge ETF (PFIX) seeks to hedge interest rate movements arising from rising long-term interest rates and to benefit from market stress when fixed income volatility increases. The fund holds a large position in over-the-counter (OTC) interest rate options intended to provide a direct and transparent convex exposure to large upward moves in interest rates and interest rate volatility.

iShares Gold Trust (IAU) seeks to reflect generally the performance of the price of gold.

For more on the Simplify ETFs, visit simplify.us/etfs.

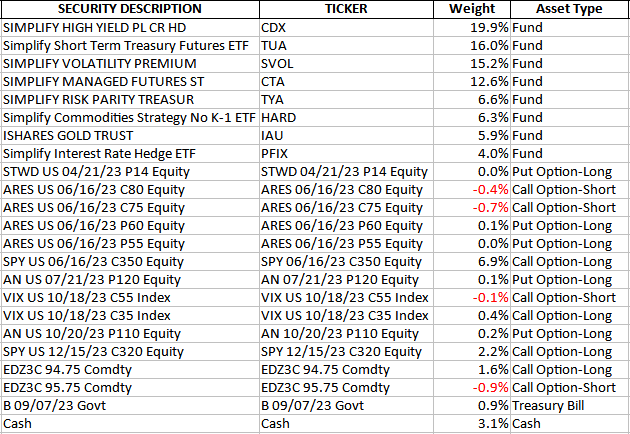

Holdings list

simplify.us/etfs; compiled by Author

The option strategy currently contains both Long and Short Call positions and Long Put positions, with a combined net weight of 9.4%. Except for the STWD Put, the others go out 2-8 months. Also, they multiple different options on some tickers: 4 on Ares Management Corporation (ARES). I read their holdings as negative on this stock, with two short Calls which will expire OTM below $75/$80 but Puts that require a price below $55/$60 to be ITM at expiration in June. As of this writing, ARES was $78, a losing price on 3 out of 4 option positions. Ideally, the premiums on the Calls sold covered the cost of buying the Puts.

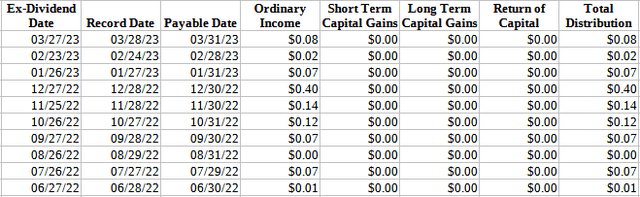

Distribution review

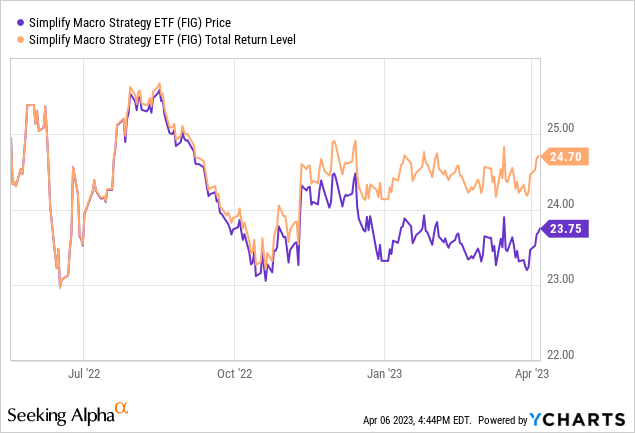

Payouts are declared monthly, and so far 100% has come from Ordinary income. The FIG ETF is too new to be assigned a Seeking Alpha grade for its payout history.

Performance review

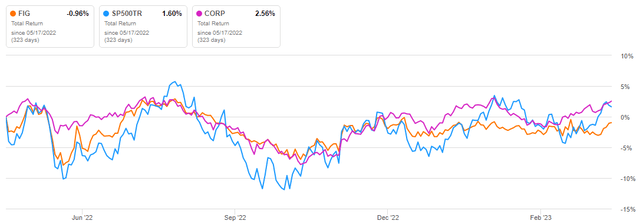

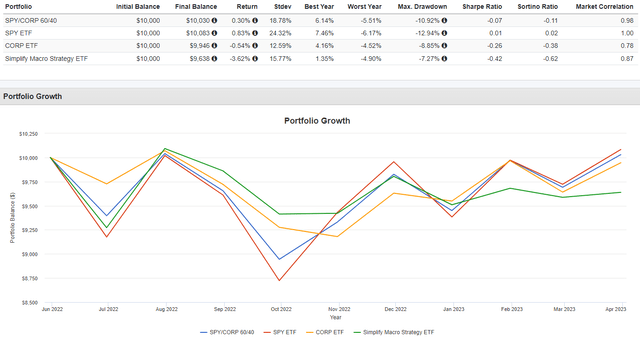

With under 11 months of data, it is hard to draw any conclusive opinion on FIG but during the tumultuous 2022, it did well against the SPDR S&P 500 ETF (SPY), but the PIMCO Investment Grade Corporate Bond Index ETF (CORP) had a better return and less volatile performance.

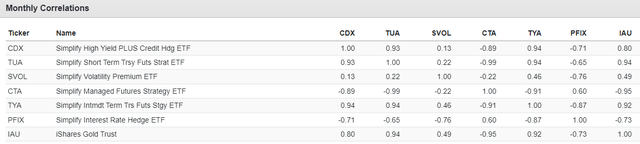

I was planning on showing long histories of the underlying ETFs but only IAU existed prior to 2021; most started in 2022. Data for HARD was not available and the rest starts with 12/22 when TUA started, but here is how the ETFs have correlated since that time.

The CTA ETF and PFIX ETF have the most negative correlations to the other ETFs. The TYA ETF is the most interesting. It is highly correlated to two ETFs (CDX, TUX) and highly negatively correlated to two (CTA, PFIX). While that should help damped the movement in FIG, it would also limit its upside returns.

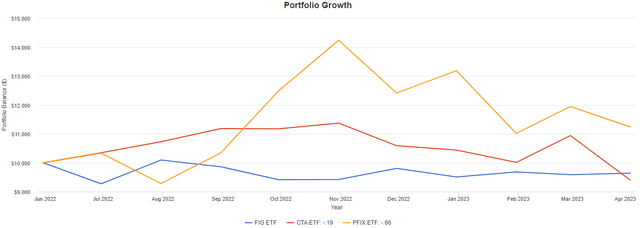

Using just the ETF that existed when FIG started, CTA (-.19) and PFIX (-.66) have the biggest negative correlations to FIG (and most of the others since 2022). Since FIG started, that negative correlation has paid off.

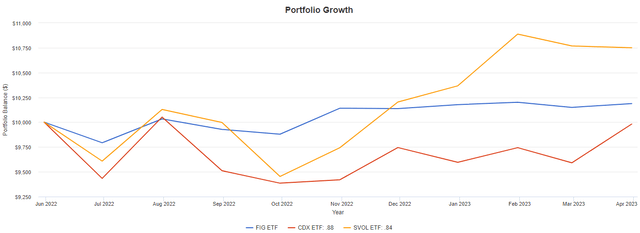

I did the same analysis for using the two most correlated ETFs with very informative results.

Most important is the fact correlations, both positive and negative have different effects over time. Second, two ETFs with almost the same correlation to FIG, show drastically different CAGR movements.

Portfolio strategy

Since investors can own each of these ETFs separately and do their own options trading, why pay a manger to do it for you is a great question readers should be asking. Here is one reason; a steady return compared to 100% stocks or bonds, plus a 60/40 portfolio.

Of these four strategies, FIG only has the top results in Max Drawdown. Of course, the caveat is FIG's short history, most of which is in 2022, a "black swan" market environment.

Final thought

With the FIG ETF and many of its ETF components having under one year of history, I would give this all-in-one ETF strategy a pass for now. The individual Simplify ETFs are worth investing by themselves and many are frequently covered by others on Seeking Alpha.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.