Caterpillar: Why I'm Looking To Buy The Dip

Summary

- CAT shares are down by 7.65% on a year-to-date basis.

- This is a dividend aristocrat with 29 years of consecutive dividend increases.

- My entry level price target on shares is $207.

- This idea was discussed in more depth with members of my private investing community, The Dividend Kings. Learn More »

MikeyGen73

Prologue: I began writing this piece on Sunday because I thought that I might be purchasing Caterpillar (NYSE:CAT) shares early in the week. Since the start of April, CAT shares had fallen from recent highs of $232 down below the $210 threshold. This sell-off nearly triggered my entry level price target for CAT and I wanted to get a head start on writing the article. Well, shares have experienced a massive rebound early this week, pushing shares away from my target level. However, I wanted to publish the article anyway because despite the recent rally, my analysis and fundamental evaluation of the company remains the same. I’m still looking to buy shares at my prior target ($207), regardless of their recent rally. Now, for me, it’s just a waiting game.

April has been a tough month for industrials thus far.

Today, the names that I follow from this sector are rallying (which is a bummer, because the reason for this article is their recent weakness), but overall, the financial sell-off inspired by the banking crisis has bled into other economically sensitive/cyclical sectors. At the end of last week, the industrials had fallen into negative territory on the year. Now that sector’s year-to-date performance has risen to 1.05%; however it’s still the 5th worst performing S&P 500 sector on the year.

This week we saw headlines regarding global GDP expectations being lowered to the lowest level since 1990 have popped up. I find it interesting that the industrials are rallying in the face of this news; however, I suppose a bounce back may have been in order due to the lopsided selling that occurred last week. Regardless, the International Monetary Fund, which released the report, highlighted financial stability concerns (banking crisis), ongoing market deterioration and fragmentation (largely due to the Russia/Ukraine war), and unexpectedly slow job growth in large emerging economies.

If the broader economy continues to suffer then I suspect that the bearish cloud hovering over cyclical stocks like industrials will be here to stay (for the short-term, at least).

Throughout much of 2023 thus far, we’ve seen a risk-off mindset from markets when it comes to more economically sensitive stocks and yet, as a contrarian investor, that’s where my focus now lies.

Even with this week’s rally in mind, CAT’s year-to-date price returns are still poor, at -7.65%.

However, despite the poor macro environment, this sell-off has occurred in the face of strong consensus growth estimates for 2023, which means that on a forward looking basis, CAT’s valuation has fallen significantly.

Shares are already priced at a discount to their long-term average premium.

After last week’s sell-off from the $215 area down to the $209 area, Caterpillar was closing in on my $207/share price target. That’s been an area that I’ve had my eyes on ever since missing out on the stock’s sell-off late last year. I regretted missing out on the opportunity to buy CAT then and I’ve vowed not to do so again.

The market isn’t cooperating with me right now, but I’m sticking to that level. To me, it’s where the numbers best line up and at the end of the day, I do my best to ignore market sentiment and make disciplined decisions based upon fundamental analysis (rather than momentum).

Why CAT?

First of all, I should be clear that CAT isn’t my highest conviction pick in the industrial sector.

Deere & Co. (DE) remains my favorite stock in the space due to my belief that the automation of the industrialized farming process is a massive secular tailwind that DE is going to benefit from for years. Furthermore, while the agriculture industry has certainly proven to be cyclical over the years, I like it more than construction because of the simple fact that humans need to eat to survive. I also think that ongoing climate change, which is reducing the amount of arable/productive land globally, alongside ongoing population growth worldwide are a couple of other mega-trends that are going to require farms to continue to become more efficient. This ties directly into my automation thesis. Over the decades, DE has done a wonderful job with innovation that makes farmers’ lives easier. I don’t think that’s going to change anytime soon and therefore, if I could only own one name in the sector over the long-term, it would be Deere.

Furthermore, I should also note (to avoid confusion) that I believe that Cummins (CMI) is a much better value than Caterpillar right now (with arguably higher quality metrics as well).

This is why it shouldn’t come as a surprise to anyone that I’m already long both DE and CMI. This is also why subscribers have seen me highlight those shares numerous times recently, as opposed to CAT.

But, the fact is, I don’t have to own only 1 or 2 industries. I can own as many as I please. And, anyone who follows my portfolio management process knows that I like to stay diversified.

Being that I already have sizable positions in DE and CMI, I’m happy to look elsewhere (especially since a stock like CAT yields roughly 1% more than DE).

You see, right now, during relatively volatile times in the market, I’m happy to shift my focus towards higher yielding blue chips in each area of the market that I follow.

When it comes to the yield that my portfolio produces, I sleep well at night knowing that my passive income stream consists of payments from dozens of blue chips.

This means that an unforeseen dividend disruption has minimal impact on my passive income.

I do a tremendous amount of work on dividend safety scoring and I have a great history of picking winners and avoiding losers (dividend cutters); however, no one is perfect, no one has a working crystal ball, and due to the importance of my passive income stream, I’m happy to hedge my bets a bit by staying diversified across all of the industries that I’m bullish on long-term.

With that in mind, I am strongly considering adding CAT to my dividend growth portfolio right now. I believe that CAT is a wonderful company. I wouldn’t consider owning it if it wasn’t. Caterpillar is the global leader in its space, it carries an A-rated balance sheet, and it’s a dividend aristocrat, with 29-years of consecutive dividend growth.

CAT's 5-year dividend growth rate is 8.66%. The stock's most recent dividend raise came in at 8.1%. And looking at the stock's relatively low payout ratio combined with strong forward growth prospects for 2023, I think another high single digit raise is likely when the stock announces its 2023 increase in June.

Give me a ~2.3% yielder compounding its dividend at an 8-10% clip and I'm going to be more than happy to hold shares over the long-term.

In short, CAT’s dividend is certainly one that would allow me to sleep well at night. And like Deere, I think CAT benefits from long-term tailwinds which should result in ongoing dividend growth for years and years to come.

The global shift towards renewables is going to require large scale mining operations to produce massive amounts of copper, lithium, cobalt, and other rare earth metals…and these mines are essentially powered by CAT-type equipment.

Furthermore, ongoing global urbanization trends and the need for incredible infrastructure investments across the world should continue to drive demand for the construction equipment that Caterpillar sells (even if we see a near-term economic slowdown).

Lastly, the demand for EVs/lower emission fleets in the construction space has the potential to drive long-term demand for CAT as well. The electrification progress that CAT has produced in recent years has been astounding. We’re still in the early innings of the electrification of large scale equipment like CAT produces, but I’ve been pleased to see the company’s innovation in this area (see here).

With all of that in mind, I think CAT’s sales/earnings trajectory over the coming decades will remain positive (with the typical cyclical bumps in the road accounted for).

From a quality standpoint, CAT checks all of my boxes; now I’m just waiting for the valuation to go lower/the dividend yield to rise higher.

Fair Value Estimate

After its recent sell-off, Caterpillar shares are approaching a fundamental level which, in my opinion, represents a wide margin of safety.

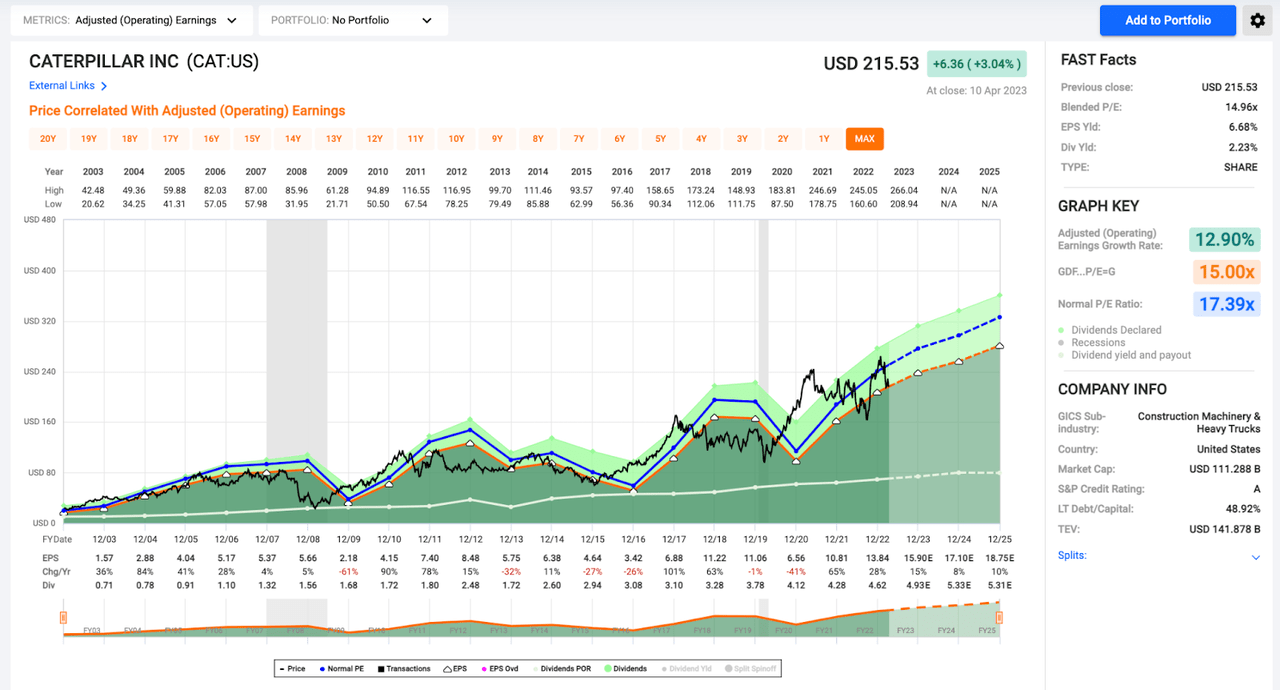

Historically, CAT shares have traded with an average P/E ratio of approximately 17.4x (20-year average).

FAST Graphs (FAST Graphs )

I like using this long-term average when looking at a potential fair value multiple because it encompasses several economic cycles.

But, using shorter periods of time, we see somewhat similar average P/E multiples as well…

CAT’s average 5-year and 10-year average P/E ratios are 18.2x and 17.3x, respectively.

With that in mind, it seems like a ~17x multiple is about right, when thinking about a potential fair value estimate and possible mean reversion moving forward.

So, if we were to slap at 17x multiple on CAT’s 2022 EPS of $235.28 then we arrive at a fair value estimate of approximately $235.00.

If we were to use the stock’s current blended EPS of $14.40 then we arrive at a price target of approximately $245.00.

And, if we are willing to use forward earnings and put a 17x multiple on CAT’s current consensus 2023 EPS estimate of $15.90 then our FV estimate rises to $270.00.

I typically use forward estimates when calculating my price targets; however, due to the uncertainties associated with forward projections, I like to use a discounted multiple (relative to historical/peer averages) to account for the event that CAT misses analyst estimates (I should note that this is a fairly rare occurrence; CAT has beaten analyst estimates during 15 out of its last 20 quarters).

Even though CAT has beaten estimates 75% of the time during the last 5 years, I think a 15x forward multiple is also a sensible premium to pay due to the high growth rate that is currently baked into the forward earnings estimates.

Right now, analysts are expecting CAT to post 15% EPS growth during 2023. CAT isn’t alone when it comes to strong double digit growth expectations this year. Other blue chip industrials are expected to post similar results. However, we are looking at a fairly bearish macroeconomic picture right now and therefore, I think there’s a higher than average likelihood that CAT disappoints.

With that being said, a 15x multiple represents a ~12% discount to that 17x level that history deems fair.

15x CAT’s 2023 consensus EPS of $15.90 is $238.50.

Since this matches up fairly well with that ttm 17x multiple, I’m content to stick with this level when it comes to my fair value estimate.

Therefore, my fair value estimate for CAT currently sits in the $235-$240 area.

My Ideal Price Target

Due to CAT’s extremely high quality, I suspect that patient investors who buy shares at fair value and hold them over the long-term will do just fine.

This harkens back to the Warren Buffett idea that it’s better to buy a wonderful company for a fair price than a fair company for a wonderful price.

Often, I adhere to that mantra. This is especially the case when we’re talking about stocks with strong, secular growth prospects. But, being that CAT is a cyclical stock, I’m going to be a bit greedy here, hoping to pick up shares of this wonderful company at a wonderful price because of the fact that their earnings are likely to be more volatile than many of the companies that I own and I want to give myself extra cushion, from a margin of safety standpoint, to account for the potential of significant negative cyclical swings.

I should also note that while CAT holds a market leading position and pays out reliably increasing dividends, the stock has underperformed the S&P 500 over the last 5 and 10 year periods.

That isn’t to say that the company will continue to underperform moving forward. But, since we’re not looking at a stock that is known for significant alpha, I think it makes sense to stay patient and only purchase shares when they’re trading at a significant discount to fair value.

I suspect that the combination of a wide margin of safety (meaning, eventual mean reversion), fundamental growth, and CAT’s growing dividend will generate long-term outperformance.

Locking this in just requires patience…which I have in spades these days since my cash is yielding roughly 4.6%.

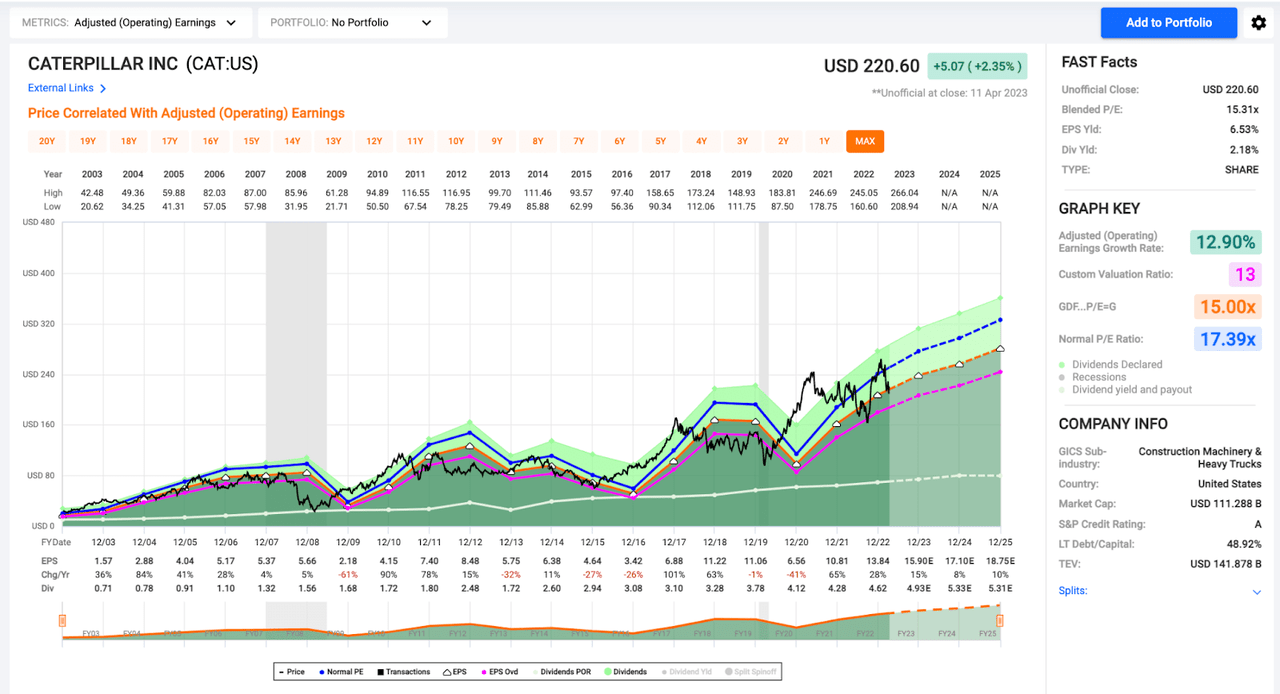

With all of this in mind, we arrive at my aforementioned $207.00/share price target.

FAST Graphs (FAST Graphs )

Here’s how I arrived at this figure and why I like that level so much…

On the chart above, you’ll notice that the black line is below the blue line (CAT’s 20-year average P/E) and in-line with the orange line (the 15x P/E level)...which it has rarely breached since the COVID-19 pandemic.

However, I worry about inflated equity prices in the post-COVID rally period and therefore, I’m looking for longer-term support when attempting to reduce risk on my stock purchases.

Looking back through CAT’s 20-year history for a stronger support level, I arrived at the 13x threshold. This is represented by the pink line on the chart below and while it’s not perfect, you can see on the chart below, from 2000-2008, from 2014-2017, and most recently in late 2022, that 13x level served as very strong support for CAT shares.

Yes, CAT has fallen below it several times in history with shares dipped down into the mid-single digits during the Great Recession and fell as low as 10x earnings during the last two Fed inspired crises during 2011 and 2018; however, 10x seems like a nice area to fill up my position (in other words, I don’t feel the need to wait that long for an entry level purchase) and I’m certainly not going to hold my breath while I wait for a blue chip like CAT to trade for 5x earnings (frankly, I wouldn’t be surprised if shares never sink that low ever again).

So, while that 13x level isn’t as strong as some of the other historical support levels that I’ve highlighted recently, it’s a nice enough level for me to start building my position.

And getting back to that $207 level…13x 2023 earnings estimates of $15.90 is $206.70.

I’m content to round up here, so $207 it is.

Conclusion

The market isn’t working with me here. CAT is up about $10.00 a share since its close last Friday. However, the $209 area was the lowest lows that CAT has made since it rallied off of its 52-weeks in the $160 area last October and that leads me to believe that the rally could be sputtering out a bit here.

The fact that shares were trading that low so recently gives me hope that the rally will crack, giving me a chance to make up for missing that dip.

But, if that doesn’t occur and CAT never makes lows below $210 again…well, I’m not going to be too upset.

There are always bargains to find in the stock market and being that my money market funds are yielding roughly 4.6% right now, I’m in no hurry to allocate cash to equities.

These high yields allow me to be patient (while still bolstering my passive income stream), which is a pretty unique occurrence for someone like me who has spent their entire investing careers compounding money in a zero-interest-rate-policy (ZIRP) environment.

I welcome this change. It feels great to have little to no pressure to allocate cash to equities (risk assets) to meet my monthly compounding goals.

Now I can do that by sitting back and doing nothing.

So, don’t be surprised if you see me trading less in the near-term.

These days I’m sitting back, building my cash position, and watching the markets closely for can’t miss opportunities.

13x forward on Caterpillar is one of those opportunities. At that level, I think 13-15% annualized total returns would be in order over the medium term. Strong double digit results like that alongside a reliably increasing dividend is a recipe for success, in my book.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

University of Virginia, class of 2011 B.A English

Senior Investment Analyst at Wide Moat Research.

Contributor for Safe High Yield, The Dividend Kings, iREIT, and The Forbes Real Estate Investor.

I am also the former editor-in-chief and portfolio manager at The Intelligent Dividend Investor.

Check out my youtube channel for other investing ideas: https://www.youtube.com/channel/UCP7AhF_TqJSE7fN7CFwxKlg?view_as=subscriber

Ranked #18 overall blogger by TipRanks for 2014.

Former contributor at TheStreet.com (where I cover stocks held in Jim Cramer's Action Alert PLUS Charitable Trust Portfolio), Investing Daily, and Sure Dividend.

Former Editor-in-Chief of The Dividend Growth Club and The Income Minded Millennial.

I am a young investor focused primarily on dividend growth stocks. Seeking Alpha, and more specifically, the dividend and income community that exists here, has played a significant role in my development as a portfolio manager. I am not a professional, though I do manage my family's finances. I enjoy the process; the research, the decision making, the strategic planning...and not paying a financial adviser to do the work for me.

I've built what I believe to be a conservative, diverse, and balanced dividend growth portfolio currently consisting of ~60 positions. At the end of every month I break down the portfolio in my Nicholas Ward's Dividend Growth Portfolio Updates.

Thus far, I've been able to meet by goals from income, income growth, and capital appreciation standpoints. I use a wide variety of metrics, both fundamental and technical, when establishing fair value when doing my due diligence on an individual company. All of my methods are discussed in my work here.

I hope this work inspires debate, conversation, and education - this is why I write for Seeking Alpha, to give back to the community that has helped me so much and to hopefully contribute, in some way...even if its by posing a question, to the growth of others.

*I should note that all articles that I write here are done so for my personal informational/educational purposes only. Any purchases that I make or opinions that I express are not meant as recommendations for anyone else. Please perform your own due diligence before following my lead into or out of a position. I am not a professional. I am not a financial adviser of any sort. I enjoy investing and the open discussion that articles on this site inspire - this is why I write, not to influence anyone else's decisions, but to enhance my own ability to make sound financial choices. That being said, I wish the best of luck to everyone. May we all meet our own financial goals.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DE, CMI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I don't currently own CAT; however, I hope to buy shares in the near future if they sink down to the price target discussed in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.