Why Healthcare Stocks Are A Prescription For Investors In Q2 2023

Summary

- The White House's announcement on drug price caps caused a significant drop in biopharma stocks during Q1 2023.

- The impact of drug pricing-related caps and pressure will likely be limited, and the industry is expected to adapt and find new revenue streams.

- The market's overreaction to the announcement presents a buying opportunity for investors in the biopharma industry.

- Historical market trends suggest that biopharma stocks are expected to outperform the general market during periods of stagflation.

- We believe the Health Care Select Sector SPDR Fund would be the best fit for generalist investors based on its broad exposure (across MedTech, healthcare service, and biopharma) with a large cap bias.

Sean Anthony Eddy

Why the biopharma sector sold off

The recent announcement from the White House on March 7th regarding drug price caps has caused a significant drop in biopharma stocks during Q1 2023.

The announcement is summarized below:

President Biden's proposed FY 2024 Budget aims to extend the solvency of Medicare's Hospital Insurance (HI) Trust Fund by at least 25 years while simultaneously lowering costs for beneficiaries. The budget proposes a modest increase in the Medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent, closes loopholes in existing Medicare taxes, and dedicates the Medicare net investment income tax to the HI Trust Fund. Additionally, the budget strengthens the Inflation Reduction Act (IRA) by allowing Medicare to negotiate prices for more drugs and extending the rule that requires drug companies to pay rebates to Medicare when they increase prices faster than inflation to commercial health insurance. These proposals would extend the solvency of Medicare's HI Trust Fund by at least 25 years, according to the Medicare Office of the Chief Actuary.

The proposed budget also aims to lower costs for beneficiaries. One way it does this is by lowering out-of-pocket costs for drugs subject to negotiation, which would save billions of dollars for beneficiaries. It also proposes a $2 cost-sharing for generic drugs used to treat chronic conditions like hypertension and high cholesterol. The budget would also eliminate cost-sharing for three mental health or other behavioral health visits per year and requires parity between physical health and mental health coverage in Medicare.

These proposed changes not only extend the life of Medicare Trust Fund without benefit cuts but also lower costs for beneficiaries. The proposed changes align with President Biden's plan to invest in America, protect and strengthen Social Security and Medicare, reduce the deficit, and lower costs for families. The budget would be funded through modest increases in taxes on the highest earners in the US. Overall, the proposed budget would help ensure that millions of Americans who have paid into Medicare throughout their working lives can count on the program to be there for them when they turn 65.

Why we think Q1 2023 represents a buying opportunity

However, I believe that the market's reaction is an overreaction, and the impact of drug pricing-related caps and pressure will be limited.

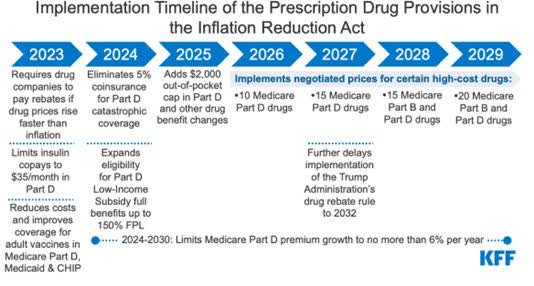

Firstly, it is important to note that the proposal is not yet binding and will need to pass through Congress to become law. Given the current political climate and a slim majority in Congress, it is unlikely that the proposal will pass as it is. The pricing provision of the IRA (Inflation Reduction Act) may be subject to changes if the Republicans win the White House in 2024, as they have been more favorable to drug makers historically. Although a full repeal of the act is unlikely, the Republicans can make adjustments to undercut the bill and alter its implementation, such as extending the time before a drug becomes eligible for negotiations or removing the tax penalty on companies that refuse to negotiate. Therefore, we expect that the pricing provision of the IRA will continue to evolve in the next several years.

Furthermore, the proposed drug price caps are limited to Medicare Part D and would not affect the overall pricing strategy of the biopharma industry (i.e., private payers, rare disease/orphan diseases, drugs that are not part of the target list for price negotiation). Also, the cap on out-of-pocket payments, a 2,000$ pocket cap for medicare part B, can perhaps increase the volume of prescriptions. Additionally, the biopharma industry is known for its ability to adapt to changes in the regulatory environment and has a history of successfully navigating policy changes. Therefore, it is likely that the industry will continue to innovate and find new revenue streams to offset any losses caused by drug pricing-related caps and pressure.

IRA drug price impact (KFF)

Biopharma and healthcare is the place to be during the stagflation

The US economy is set to slow down due to the lagged effects of the Fed's tightening, leading to a three-quarter recession in 2023 with only 0.6% GDP growth over the year. The euro area will also experience a real GDP contraction of 0.1% due to elevated inflation and still-modest growth in wages. Although China's GDP growth forecast has been raised to 4.8%, it remains below the market consensus due to the rapid accumulation of household debt, a fragile housing market, and a concentration of savings among the rich. Albeit analysts are projecting the inflation rate to drop in 2023, it will likely remain above the central bank's 2% target, suggesting that stagflation is looming.

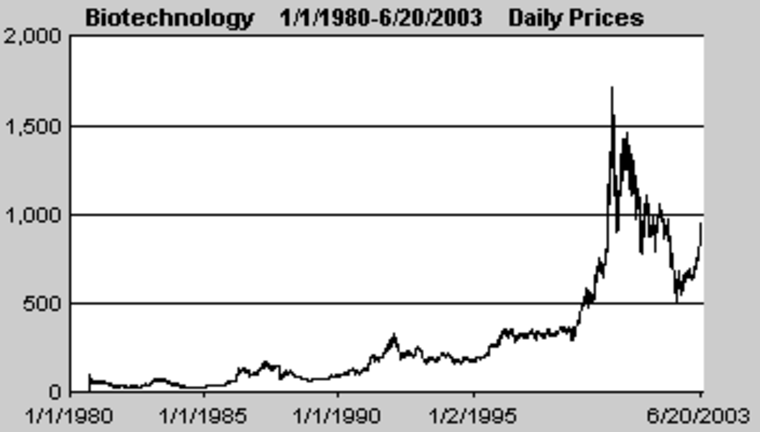

We believe the market's overreaction to the White House's announcement presents a buying opportunity for investors in the biopharma industry, particularly as we move into stagflation. Based on our analysis, historically, biopharma stocks have outperformed the general market during periods of stagflation. For example, between 1980-2010, the S&P 500 had an average annual return of 7.3%, while biopharma stocks had an average annual return of 12.6%. During the stagflationary period of the 1970s, biopharma stocks (a basket of major biopharma companies) also performed well compared to the general market. From 1973 to 1975, the S&P 500 had an average annual return of -5.5%, while biopharma stocks had an average annual return of 2.1%. Similarly, from 1977 to 1981, the S&P 500 had an average annual return of 6.8%, while biopharma stocks had an average annual return of 13.8%.

Biopharma basket performance (Science Org) Nbc News (Nbc News)

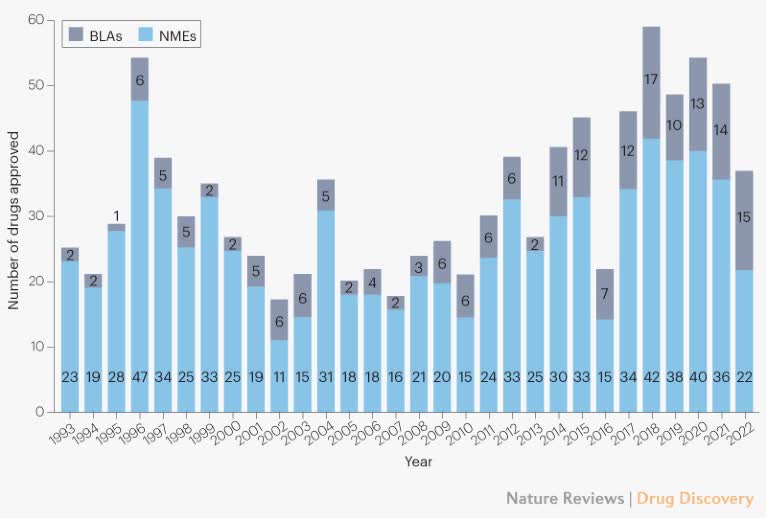

This outperformance can be attributed to the industry's ability to generate stable revenue streams through long-term contracts, consistent demand for its products, and relatively inelastic demand for healthcare. Moreover, the biopharma industry is poised for long-term growth due to demographic trends. As the population ages, demand for healthcare and pharmaceuticals is likely to increase. Furthermore, the industry's focus on research and development and innovative treatments is expected to drive growth in the future.

Biopharma R&D has been consistently leading to innovative new drug launches (Nature Biotechnology)

Furthermore, in a stagflationary market and economic downturn, healthcare sector stocks may be a good investment strategy because healthcare is not discretionary spending and is paid for by government and insurance companies. This means that healthcare companies can transfer costs to end-users at a rate of inflation, making it an excellent inflation hedge. While the inflation reduction act (IRA) caps the max increase in drug prices to the rate of inflation, it still allows healthcare companies to increase prices, unlike other sectors that may not be able to match the price increase to the inflation rate, which should be only positive in a high inflationary environment that we expect.

Healthcare ETFs

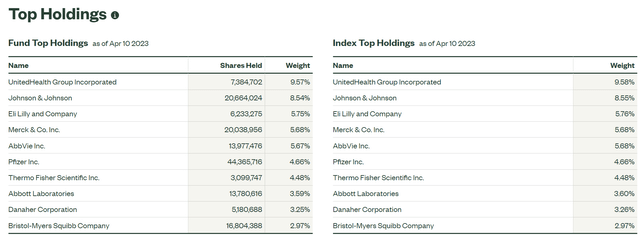

We believe the Health Care Select Sector SPDR Fund (NYSEARCA:XLV) would be the best fit for most investors, based on its wide exposure with a large cap bias, across MedTech, healthcare service, and biopharma.

We maintain our previous recommendation regarding other healthcare ETFs:

... for investors who don't have the expertise to pick individual stocks to buy a diversified broad biotech index like iShares Nasdaq Biotechnology ETF, SPDR S&P Biotech ETF (XBI), First Trust NYSE Arca Biotechnology Index Fund (NYSEARCA:FBT), and VanEck Vectors Biotech ETF (BBH). We highlight that XBI includes more mid-cap (perhaps speculative companies such as (BHVN), (CYTK), (TPTX), and IBB includes safer big pharma/healthcare services (i.e., (AMGN), (GILD), (BIIB), (REGN), (IQV), (VRTX), (ILMN)) with multiple approved candidates and solid cash flows. As such, if the market bounces, we view XBI may show a larger return, but down is also greater. We also like companies like Lonza (OTCPK:LZAGY) (OTCPK:LZAGF) (LONN), Samsung Biologics, WuXi Biologics (OTCPK:WXXWY) that are the key backbone to biotech/pharma R&D without any clinical risk (binary risk of stock going to zero if the trial fails). Other low-risk options would be going for drug royalties, Royalty Pharma (RPRX) may offer low-risk and non-correlated dividends for investors who want to avoid volatility. Tekla Healthcare has few actively managed funds available for investors interested in active stock picking. Source: Our previous article.

Conclusion

In conclusion, the recent drop in biopharma stocks due to the White House's announcement on drug price caps presents a buying opportunity for investors. The proposed caps are limited to Medicare Part D and would not affect the overall pricing strategy of the biopharma industry. Furthermore, the biopharma industry has a history of successfully navigating policy changes and generating stable revenue streams through long-term contracts, consistent demand for its products, and relatively inelastic demand for healthcare. The industry is also poised for long-term growth due to demographic trends and its focus on research and development. Additionally, in a stagflationary market and economic downturn, healthcare sector stocks may be a good investment strategy as healthcare is not discretionary spending and is paid for by government and insurance companies, making it an excellent inflation hedge. We believe the Health Care Select Sector SPDR Fund (XLV) would best fit for most generalist investors, based on its broad exposure with a large cap bias, across MedTech, healthcare service, and biopharma.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.