Last Chance For I-Bonds But Better Choices Already Exist

Summary

- The variable rate on Series I Savings Bonds drops to 3.39% on bonds sold beginning in May from 6.47% currently.

- Even compared to current I-Bond rates, CDs and T-Bills are better investments for cash needed in 1 year due to the 3-month penalty for early I-Bond redemption.

- I don't expect the fixed component to go up enough on May 1 to compensate for the lower variable rate.

- If you still want to buy I-Bonds, (for example to save for college tax-free) make sure to buy them by April 30.

DNY59/iStock via Getty Images

It Was Good While It Lasted

Series I savings bonds have gotten a ton of coverage in the past few years as their inflation-indexed variable rate made them one of the highest-yielding safe investments that guarantee to return at least your initial capital. They drew my interest in late 2020 and early 2021, even before inflation heated up, because T-Bill and CD rates had plummeted to near zero in the wake of pandemic-induced Fed easing. Unless you were lucky enough to buy them in the first 5 years of issuance (1998-2002) when their fixed rate component ranged from 2.0%-3.6%, I-Bonds frequently experienced periods where they were uncompetitive with CDs, even with their tax advantages.

I won't rehash all the characteristics of I-Bonds here. You can read more about them on the TreasuryDirect web site. In brief, however, I-Bond interest rates have a fixed component declared by the Treasury every 6 months on 5/1 and 11/1 which remains constant for the life of the bond. There is also a variable rate component which changes every 6 months based on the change in CPI over the period of April to September or October to March. If there is deflation, the bonds never earn a negative overall rate. I-Bonds are exempt from state tax and not subject to federal tax until redeemed, unless they are used for higher education expenses in which case, they are also exempt from federal tax. The guaranteed return of initial investment and tax-deferred income are attractive features even when inflation is not elevated. Because of this, the Treasury limits I-Bond purchases to $10,000 per calendar year per Social Security (or Tax ID) number, plus up to $5,000 that can be delivered in lieu of an income tax refund.

The other drawback of I-Bonds is that once you buy them, they cannot be touched for 12 months, and any redemption between 1 and 5 years incurs a penalty of the last 3 months of interest. This last issue becomes relevant when we look at current I-Bond returns vs. other investments.

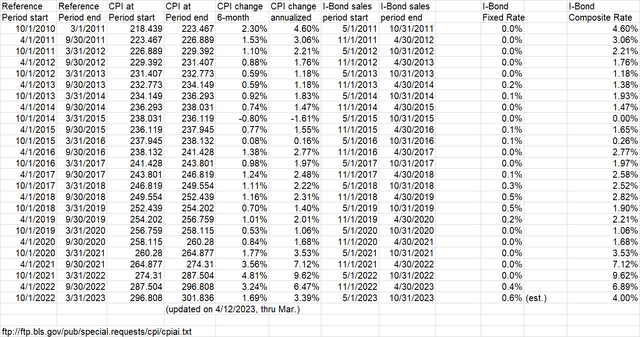

The latest CPI release now sets the variable rate for I-Bonds sold starting on 5/1/2023. The change in CPI over the past 6 months is barely more than half of the change over the prior 6 months, so the I-Bond variable rate will be much lower. This rate will be 1.69% (3.39% annualized) This would also be the same variable rate earned for the second six months on I-Bonds sold on or before 4/30/2023. (The variable rate for the first six months is 3.24% or 6.47% annualized.) I-Bonds sold in April will also still get the 0.4% fixed rate component. We won't know until May 1 what the new fixed rate component will be, but I don't expect it to be significantly higher as I will discuss below.

Author Spreadsheet (Data Source: US Treasury)

With such a large drop in the variable component, anyone wishing to buy I-Bonds should do so before April 30, as I do not expect the fixed component to increase enough to offset this decline. However, it is worth considering if it is economic to buy any I-Bonds this year at all given the attractive CD and Treasury Bill rates available. About the only reason to do so is to defer taxes or avoid them entirely in the case of college savings.

Don't Forget The Penalty

With the variable rate now set for the next six months, we know exactly what I-Bonds purchased in April will return over the next 12 months of interest payments. We simply compound the two 6-month variable rates and the fixed rate:

1.0324 * 1.0169 * 1.004 = 1.0540.

In other words, I-Bonds bought in April 2023 will earn 5.40% after the first 12 months of interest. At first this looks attractive compared to CDs and T-Bills but it is important to consider the 3-month interest penalty if redeeming the bonds before 5 years. If the bonds were redeemed 12 months after purchase, the last 3 months at the new 3.39% annualized rate would be dropped. You would also lose 3 months of the 0.4% fixed rate. Therefore, the actual return after 12 months would be:

1.0324 * (1 + 0.0169/2) * (1 + 0.004*9/12) = 1.0324 * 1.0085 * 1.003 = 1.0443, or 4.43%.

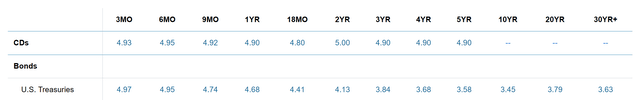

1 year CDs and T-Bills bought in April will mature in April 2023 with no penalty. T-Bills are also exempt from state tax just like I-Bonds. A quick scan of my broker's fixed income page shows that CD's are available paying 4.9% and 1-year Treasuries yield 4.68%. (You may find better CD deals for slightly different terms directly from online banks such as Synchrony Financial (SYF), which is now offering 5.15% for 14 months.) There is also no $10,000 limit on these investments.

Unless one is saving for college, CDs and T-Bills are the better choice at this time. If one is saving for college and really wants to buy I-Bonds this year, they should buy them in April, as the fixed rate on bonds sold starting May 1 has almost no chance of increasing enough to offset the lower variable rate.

Fixed Rate Prediction

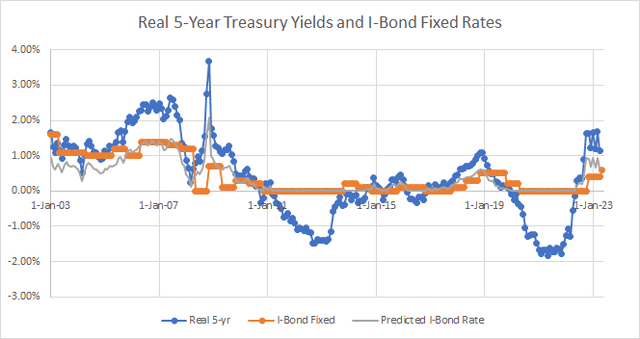

Fixed rates were generous during the first 5 years of I-Bond issuance. Since then, they have trended around 50%-60% of the real 5-year Treasury rate whenever the real 5-year rate is above zero. The real rate was below zero for prolonged periods after the great financial crisis and the start of the Covid-19 pandemic, leading to zero I-Bond fixed rates for much of the last 12 years.

As I mentioned in my last I-Bond article, the 0.4% fixed rate announced in November was below the 1% I expected based on real rates. Since then, the real 5-year rate has fluctuated between 1.1% and 1.7% and now sits at the low end of that range.

Author Spreadsheet (Data Source: US Treasury)

With real rates down at the low end of the recent range, I would not expect the Treasury to get too aggressive with the fixed rate. I am predicting they will increase it to 0.6% on May 1. This would get back to the 50% - 60% of the real 5-year rate we have seen through much of recent history.

A 0.6% fixed rate is far below what would be needed to keep I-Bonds sold after May 1 competitive with CDs or T-Bills.

What To Do Now

If saving for higher education, the tax-free nature of I-Bonds makes them a Buy until April 30. After that, even the tax savings will not compensate for the expected lower overall rate. If not saving for college, I would suggest using CDs or T-Bills to stash excess cash at this time. (These instruments are also easier to add to an IRA to achieve tax deferral.) I would even consider selling some I-Bonds once the 6 months of interest at the 3.24% semiannual rate has been earned and putting the proceeds in CDs or T-Bills. For example, in my case that would mean after August 1 for bonds issued in May of 2020 and 2021, and after October 1 for bonds issued in January 2022. This may not apply to holders of very old I-Bonds with much higher fixed rates.

If you wish to preserve maximum flexibility in case my fixed rate estimate turns out to be too low or inflation picks up again in the next 6 months, consider 6-month T-Bills yielding around 5% or a money market fund like the ones available at Schwab. For example, their taxable prime money fund (SWVXX) now yields 4.69%. Either of these options would still allow you to purchase I-Bonds for calendar 2023 at the time of the next rate reset in November.

Conclusion

I have written regularly about I-Bonds over the last couple years because they were clearly the highest returning safe investment that guarantees return of at least original capital. In an environment where interest rates are still high and inflation seems to be falling, that is no longer the case. If using the tax break to save for higher education expenses, I-Bonds are still a decent deal if bought by April 30. Starting May 1, the variable rate will drop by around half and I don't expect much improvement in the fixed rate. That would make I-Bonds unattractive for everyone. If not saving for college, consider CDs and T-Bills for your spare cash this year.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SYF, SWVXX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Also long Series I US Savings Bonds, Synchrony Bank High Yield Savings Account and Synchrony Bank CD.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.