Crescent Point Energy: More Growth Where That Came From

Summary

- Another small acquisition adds to Crescent Point Energy Corp.'s growth prospects.

- The company now returns 50% of free cash flow to shareholders.

- The combination of secondary recovery with unconventional makes for an overall low corporate decline rate.

- The Crescent Point Energy Corp. Shell acquisition from 2021 is probably fully assimilated at this point.

- Low debt is still a priority for this Crescent Point Energy Corp. management.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

imaginima

Crescent Point Energy Corp. (NYSE:CPG) is a Canadian company that is listed on both the NYSE and the Toronto Exchange. The company reports in Canadian dollars. This management has taken a zombie corporation and turned it into a growth story. Management is now at the point where about 50% of free cash flow will go to shareholders through a combination of dividends and stock repurchases. With the growth story really just getting started, there is likely to be a lot more good news for shareholders "down the road."

Management recently acquired some acreage from Paramount Resources (OTCPK:PRMRF). At the time of the announcement, the base dividend was increased 25%. Later, when the year-end results were announced, the company also declared a small special dividend. The company also repurchased about 5% of the outstanding shares in fiscal year 2022.

Management recently followed up that purchase with an offer to purchase some acreage from Spartan Delta (OTCPK:DALXF). This one was an all-cash offer. Therefore, even though it is accretive, management is likely to prioritize debt repayment if commodity prices weaken from current levels.

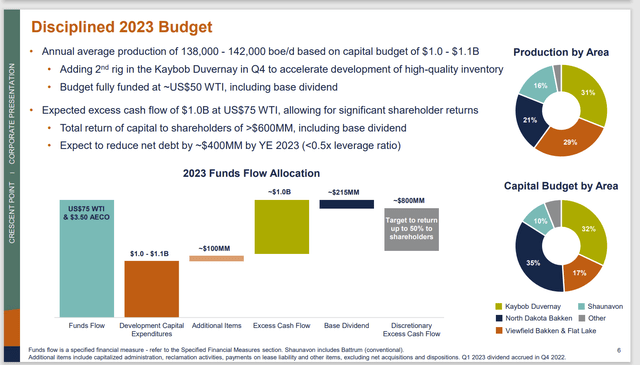

Crescent Point Energy Fiscal Year 2023 Budget (Crescent Point Energy March 2023, Corporate Presentation)

The budget would strongly imply that management sees another decent year ahead for the price of oil. This management is conservative, so that WTI price of oil is likely a low estimate for the fiscal year. (Note that current details in future presentations will be provided for the Spartan Delta acquisition after it closes). The Spartan Delta acquisition will raise that production guidance to 160K BOED at least and will likely change a lot of figures. But the main idea of the presentation about leverage will not change.

Nonetheless, the implied free cash flow is pretty decent. This company has a combination of secondary recovery (on the low end) and unconventional (for relatively high decline rates) to average a fairly low production decline by industry standards. The creates a low need for maintenance capital during the boom times while making it easier to survive industry downturns.

The acquisitions made by management appears to be the primary growth engine for the fiscal year and probably into the future as long as management believes that this is cheaper than organic growth. Back in fiscal year 2021, this company made a large C$900 million acquisition from Shell. An acquisition that large takes time to optimize and fully assimilate. So, this may be the fiscal year where investors see the full advantage of that acquisition.

As can be seen from the slide, there is still a debt reduction goal. As long as debt needs to come down, then there will likely be a minimal amount of organic growth until the balance sheet is where it should be.

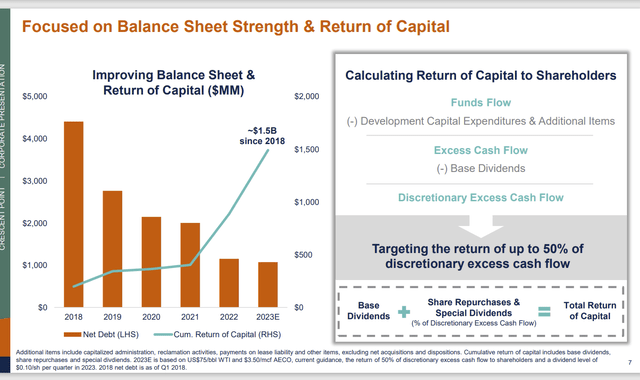

Crescent Point Energy History Of Increasing Shareholder Returns (Crescent Point Energy March 2023, Corporate Presentation)

The good news for shareholders is the increasing shareholder returns as shown above. Even though net debt will change after the Spartan Delta acquisition, the general storyline remains the same (at least so far) according to management. There has been a relentless drive by management to reduce debt and to reduce the corporate breakeven in the process. This is still a very cyclical industry. But management's efforts mean that shareholder returns will cycle at a higher level in the future than in the past. Lower debt levels mean declining debt payments and less interest expense which will combine to accelerate the process.

Most likely, the future will continue to be a combination of opportunistic acquisitions at irregular intervals combined with slow organic growth. This company is one of the few Canadian companies with operations in the United States as well as Canada. As the industry recovery proceeds, the recognition of some United States operations combined with the NYSE listing could well lead to a higher valuation than some of the peers that have strictly Canadian operations.

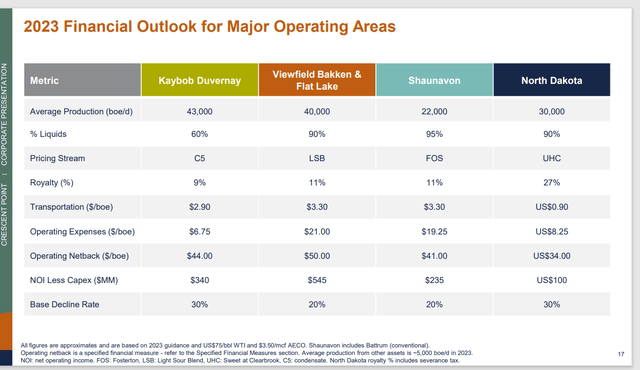

Crescent Point Energy Guidance By Leasing Area (Crescent Point Energy March 2023, Corporate Presentation)

With the secondary recovery costs shown above, the company is a relatively low-cost operator with those secondary recovery projects. However, secondary recovery almost by definition is higher cost. What makes that secondary recovery is a combination of the valuable production stream of mostly oil and a cheaper Canadian dollar.

Like the other parts of the presentation, this will be adjusted for the Kaybob Duvernay and Montenay properties acquired when the Spartan Delta acquisition closes.

Offsetting those characteristics is the very low decline rate of secondary recovery. Oftentimes, the decline rate is as low as 5%. The current environment allows such an operation to be adequately profitable (or better).

The worry with any high-cost operation, even a well-run one, is that when the next cyclical decline comes, the production may have to be shut-in (if that is even possible). So, the other operations shown above are excellent "insurance policies" during a cyclical downturn.

Now the Kaybob Duvernay has a lot of natural gas production, therefore the recent rally of natural gas prices has made that particular set of leases more profitable than has been the case in some time. As exporting capabilities increase in North America, those leases could see still more profitability improvement.

The Kaybob Duvernay leases also produce a lot of condensate. Condensate in Canada often trades at a premium to oil because there is usually a shortage of it. Condensate is often mixed with heavy oil and thermal oil to get those products to flow through pipelines to the refineries. Since Canada has a lot of heavy oil and thermal oil production, it will be needing condensate for some time. But this product is unusually profitable due to the Canadian demand for condensate.

Management has been offsetting increasing costs through production improvements and operating improvements. The net result is that any well production improvements are heading "straight to the bottom line" with only minimal amounts subtracted from those improvements.

The Future

Management is attempting to set up a base dividend which is currently C$.10 a quarter. That is a hefty yield on the current stock price because Canadian companies are often valued lower than their United States counterparts. However, this Canadian company also has United States operations in North Dakota. That could lead to a future differentiation from other Canadian companies to result in a higher valuation. The NYSE listing should also raise visibility.

This is a fairly large company. They generally do not grow as fast as smaller companies. What will aid the growth rate is the opportunistic acquisitions that management makes from time to time. Probably a reasonable expectation is a combined dividend return and growth rate in the teens for the long-term.

The finances here are better than they have been in years, and they are going to improve more. That should lead to a higher base dividend all by itself. This management appears to be taking a more United States view of dividends in that it intends to have a dividend that gets paid throughout the business cycle combined with an occasional bonus announcement.

This Crescent Point Energy Corp. management has done well turning prospects around. Now let us see what they can do with a healthy company. I would bet there will be a lot of upside surprises in the future.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I analyze oil and gas companies like Crescent Point and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPG PRMRF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.