THD: Tourism Rebounding However Thai Equities Not Compelling As Exports Slow

Summary

- Emerging Market stocks look cheap in general, although Thai stocks are not particularly cheap versus their historical valuation range.

- Investors rationally are acknowledging the strong tourism rebound for Thailand. The country in recent years also has been relatively stable politically and doing ok keeping inflation in check.

- The global economic backdrop is worrying however, Thai stocks could come under pressure as their exports slow.

- If Thai stocks drift lower, the iShares MSCI Thailand ETF could be a good way to play a tourism rebound. For now, some other alternative emerging markets look more attractive.

kitzcorner/iStock via Getty Images

iShares MSCI Thailand ETF overview and performance

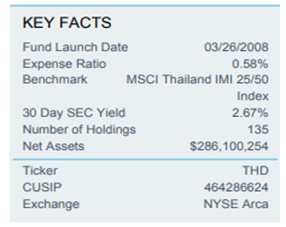

The iShares MSCI Thailand ETF (NYSEARCA:THD) has a reasonable enough management expense ratio, AUMs and liquidity to consider as a way to get exposure to Thai equities.

This ETF is approximately $350 million in size, with an expense ratio of 0.58%. It was launched in 2008 and tracks the MSCI Thailand IMI 25/50 Index. This index spans large, mid and small sections of the Thailand market. There are over 130 constituents, and it covers approximately 99% of the free float-adjusted market capitalization in Thailand.

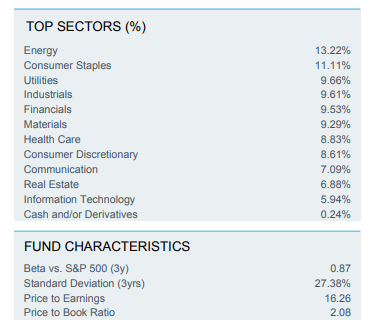

This means your exposure is quite diversified across companies. The ETF holds more than 130 stocks, and the largest weight to an individual position is about 6%. Sectors wise it also has plenty of diversification, with the largest weight being approximately 13% in the energy sector.

THD factsheet December 31, 2022.

The Stock Exchange of Thailand's history dates back to 1975. In terms of dividend yields across various country's stock markets, you can expect Thailand to rank near the middle. The current yield of THD is approximately 2.7%.

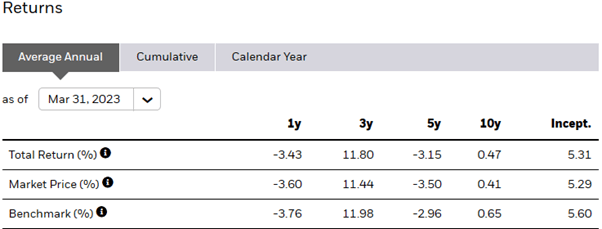

Here is the historical performance of THD.

ishares.com, THD returns to March 31, 2023.

The last decade has been a poor one for the Thailand stock market, like it has been for many emerging markets for that matter.

Are Thai stocks cheap?

I became curious about this question as recently I observed various valuation charts suggesting emerging market equites as an asset class was relatively cheap. We began the year with EM stock valuations looking as cheap as they have been since 2007 relative to the US.

EM forward PE / US forward PE ratio (Bloomberg Jan 24, 2023)

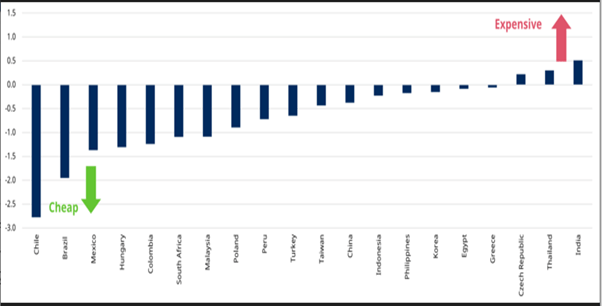

Drilling down further, it is more to do with Latin America valuations being historically cheap rather than Asia.

Average of trailing PE, forward PE & P/B ratios. Data as at Jan 31, 2023. (Schroders, Refinitiv Datastream, MSCI, IBES, Schroders Strategic Research Unit. )

Within Asia, Thailand along with India are markets that are more on the expensive side versus history on various quantitative measures. That wouldn't necessarily make me avoid such relatively expensive markets altogether. Improving confidence politically and economically may explain the richer valuations compared to what some may expect.

Is Thailand a safe investment in 2023 with the election looming?

Global investors when pondering this question may well have a picture in their mind of political instability. One could be forgiven for overlooking the country as an investment option due to past instances of widespread protests, military coups and complicated political system.

With the Thailand election approaching next month though, it is shaping up as a catalyst for potentially improving political stability. A change in government to a coalition that is receiving strong support from the public is likely. Such a change should be less likely to be unsettled from military influence, in theory anyway. Those prospective Thai stock market investors who remember the political turmoil over the last couple of decades may still sit on the sidelines until then.

Leaving politics aside for the moment, the safer strategy to play for the rest of 2023 may well be in having exposure to an economy more reliant on tourism given China's reopening. There is pent up demand from China's outbound tourism, which is one of the rare pockets of the global economy where prospects for growth seem bright.

Is it time to invest in Thailand's tourism rebound?

It is now becoming clear that Thailand is finally experiencing a big rebound in post pandemic tourism. We can see from their Q4 GDP, that there are two key stories within Thailand's economy. The positive is that tourism is picking up strongly even before the eventual effects of China's reopening, and that tourism is incredibly important to Thailand's economy. The problem they are facing and why GDP came in lower than expected, is due to weakening exports.

To quote directly from that article on Thailand's Q4 GDP number "Before the Covid-19 pandemic, about 28% of Thailand's 40 million annual visitors were from China. Tourism typically accounts for at least 12% of the economy and a fifth of jobs while private consumption, which also benefits from travellers spending, makes up 50% of GDP."

With such a large portion of Thailand's visitors prior to the pandemic coming from China, that alone should make them well placed to capture good growth from this segment this year. An additional reason why the Chinese may choose Thailand as a travel destination this year is because Thailand was better prepared for China's re-opening. Some countries, unlike Thailand, were slow to accommodate Chinese tourists on matters such as visas for example. Also, a post pandemic trend is emerging that the Chinese are looking for more relaxed, outdoor, family holiday destinations. This is a shift away from the usual famous sightseeing attractions.

Similar trends are emerging from India's outbound tourism. In February this led the Tourism Authority of Thailand to significantly upgrade their 2023 target for Indian arrivals.

In total in 2022 Thailand welcomed a little under 12 million foreign visitors. Compared to the 40 million they were getting annually before the pandemic there is plenty of room for further growth.

How can a foreigner invest in stocks in Thailand?

For investors outside of Thailand, in all likelihood taking on exposure to Thai stocks will be a relatively small weight in one's overall portfolio. For various emerging markets you can often find closed end funds ("CEFs") that trade on the US exchange, and trade at discounts to NAV. One did exist for Thailand for almost three decades but was wound up in 2018.

Investing directly in the Thai stock market is not that simple or efficient for most. Brokers that have a global presence and access to other Asian markets like Japan, HK and Singapore often don't have access to Thailand. If they do, brokerage / FX rates can be uncompetitive.

As a foreigner you would also have to navigate the Thai stock exchange rules. You need to be careful which "type" of shares you trade, the type will determine whether you have dividend / voting rights.

If you are thinking of simply opening a Thai bank and brokerage account within Thailand on a holiday, then this is difficult nowadays. A more permanent visa and address will be required.

Trying to find an active open ended fund manager dedicated to Thailand that you can be confident will outperform also looks like a difficult task. If you are optimistic on Thai stocks, overall THD with its AUMs and expense ratio is a reasonable way to consider getting your exposure.

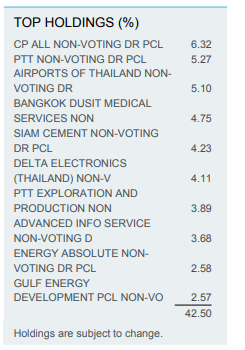

iShares MSCI Thailand ETF holdings summary

THD will give you quite broad exposure to Thai equities both in terms of concentration to individual companies and also from a sector point of view.

THD factsheet December 31, 2022. THD factsheet December 31, 2022.

I wouldn't describe the valuations data above as particularly compelling. Given my upbeat comments earlier relating to the importance of the rebound in tourism for Thailand, the P/E might end up looking attractive. Also bear in mind the above factsheet data is a little stale at end of 2022, current P/E as I write is close to approximately 14.

I see the relatively large weights to energy and financials as a positive. The larger bank stocks in Thailand have tended to pay consistent dividends over the long term. They are perceived as reliable and conservative, and many held up reasonably recently amidst the global volatility in bank stocks in March. THD has a low weight in technology so might suit investors who believe value will outperform growth in the years ahead.

Risks for Thai stocks in 2023

Aside from next month's election, I would have some concerns currently over the weak global economic backdrop and its effect on Thailand. Some of the country's key exports such as related to autos, computers, other machinery / equipment are faced with challenges in 2023. This was notable in the recent weaker than expected Q4 GDP print.

Such concerns relating to the global growth outlook however are not just a risk factor for Thai equities alone, but global equities as an asset class.

Thai baht forecast 2023

Investors looking for exposure to Thailand's stock market would also weigh up the potential currency risks. I thought it would be interesting to look at the Thai baht's relationship with the USD over the last 5 years. It is a period of relatively good performance for the USD (despite the weakness seen in the last 6 months). It is also an interesting timeframe as global financial markets have experienced plenty of volatility. The tourism dependent Thailand has also had to navigate the effects of the pandemic.

Despite all this the USD has strengthened against the Thai baht by less than 10% over the last 5-year period. The USD has strengthened by more than that when observing the USD index over that timeframe.

For a US investor, I wouldn't let concerns over currency risk persuade oneself from investing in THD. There are reasons to argue that weakness of the USD in 2023 can be more of a medium-term trend. In a recent article of mine outlaying a bullish case for a gold and silver closed end fund, I explored in more detail the risks for the USD in 2023.

Overall, I would describe the Thai baht as a lot more resilient than many might have expected given what has unfolded in the world over the last 5 years. Thailand is making efforts to capitalize on this with various incentives to attract foreign investment. The strategy hopes to establish Thailand as a regional hub known for new technology and attracting foreign talent. It already is a major manufacturer of conventional vehicles, so also wants to build a reputation as a regional EV hub.

In terms of inflation, whilst inflation statistics provoke plenty of skepticism, Thailand has kept inflation lower than the US in the last year.

Conclusion

The weaker global economic backdrop deters me from buying THD at the present time, as I don't regard the overall valuations of Thai equities as particularly cheap. There are other markets in the emerging / frontier category that I prefer. In the last year I have discussed closed end funds at hefty discounts to NAV as a way to gain exposure to South Korea and Vietnam for example.

I'll be watching the election in Thailand with interest though in May to see if we get some sort of political stability out of this. If at the same time Thailand stocks still weakened on the back of broader global stock market weakness, THD could become very interesting to me. I could see the positive factors of tourism rebounding and the China reopening helping Thai stocks heading into 2024.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.