March Madness Dividends/Q1 Update: Rose's Income Garden Portfolio Yield 4.65%

Summary

- March Madness had 41 of 80 companies pay including 7 raises, 1 cut and 1 special payment.

- RIG dividend yield is 4.65% keeping with the 4% goal while still having 13.7% cash.

- Transactions discussed were 2 buys and 1 sale to maintain RIG at 80 stocks to end March /Q1.

- All dividends are shown by date received, dividend/ share, forward yearly $ Dividend and yield, along with current price and comments.

- This idea was discussed in more depth with members of my private investing community, Macro Trading Factory. Learn More »

Richard Drury

Rose's Income Garden "RIG"

RIG is a defensive income-quality value-built portfolio with 80 stocks from 11 sectors. RIG contains investment-grade common stock along with high yield ("HY") business development companies ("BDCs") and real estate investments. The income goal is to keep 50% of it from defensive sectors/ stocks and hold a dividend income yield of 4% or more, which usually is easily over 4.5%.

The yield sits at 4.65% with 13.7% cash which means March finished with a nice even steady state portfolio for both value and income. The goal is for safe defensive income, with value investing being important along with diversity to hold it steady and have less beta than the overall market movements.

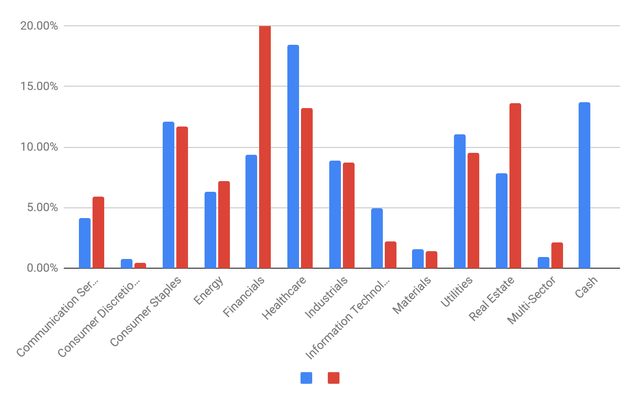

Its diversity by sector is shown in the chart below:

RIG Sector Value and Income %s. (Macro Trading Factory )

The chart does point to the financials and real estate providing high income, but healthcare, consumer staples and utilities follow as defensive stocks, as does cash provide defense for RIG.

March RIG Dividend Income

Dividend payments came from 41 out of the 80 companies in RIG or ~51% with 4 being monthly payers. The 7 raises and the special payment were appreciated and they are listed in bold print. The amounts and further information are noted in the comment section. The list is done in order of payment received date/Date Rec'd in the chart.

The following are the other abbreviations used:

$Div /share = US $ Dividend paid in March

$Yearly Dividend = US $ yearly forward dividend estimate

Div % Yield = Estimated dividend yield using current listed price and dividend

Curr $Price = US $Price at the close of the market April 11th, 2023.

More information on each company that raised follows this section.

| Forward | |||||||

| Stock | Stock | Date | div/sh | Yearly | Div% | Other Dividend | Current |

| Ticker | Name | Rec'd | $ Div | Yield | Comments | Price | |

| (PFLT) | PennantPark Float | 1 | 0.095 | 1.2 | 11.21% | Monthly Pay/ raise next | 10.7 |

| (V) | Visa | 1 | 0.45 | 1.8 | 0.79% | Raise from .375 | 227.91 |

| (WEC) | WEC Energy | 1 | 0.78 | 3.14 | 3.18% | Raise from .7275 | 98.83 |

| (SLRC) | SLR Investment | 1 | 0.1367 | 1.64 | 11.09% | Monthly Pay | 14.79 |

| (ENB) | Enbridge | 1 | 0.6654 | 2.64 | 6.67% | Canada exch rate | 39.6 |

| (MAC) | Macerich | 3 | 0.17 | 0.68 | 6.61% | 10.29 | |

| (SO) | Southern Co | 6 | 0.68 | 2.72 | 3.78% | raise due next | 71.9 |

| (JNJ) | Johnson & Johnson | 7 | 1.13 | 4.52 | 2.75% | raise due next | 164.54 |

| (AMGN) | Amgen | 8 | 2.13 | 8.52 | 3.38% | Raise from 1.94 | 251.99 |

| (CMI) | Cummins | 9 | 1.57 | 6.28 | 2.72% | 230.65 | |

| (CVX) | Chevron | 10 | 1.51 | 6.04 | 3.55% | Raise from 1.42 | 170.15 |

| (DNP) | DNP Select Inc Fund | 10 | 0.065 | 0.78 | 7.24% | Monthly Pay | 10.77 |

| (TGT) | Target | 10 | 1.08 | 4.32 | 2.53% | 170.5 | |

| (WBA) | Walgreens BA | 10 | 0.48 | 1.92 | 5.29% | 36.28 | |

| (XOM) | Exxon Mobil | 10 | 0.91 | 3.64 | 3.14% | 115.92 | |

| (LYB) | LyondellBasell | 13 | 1.19 | 4.76 | 4.96% | raise due next | 95.95 |

| (DAC) | Danaos Shipping | 14 | 0.75 | 3 | 5.30% | raise perhaps next | 56.6 |

| (SBLK) | Star Bulk Carriers | 14 | 0.6 | 2.4 | 11.13% | Cut from $1.25 | 21.57 |

| (MGEE) | Madison Gas & Elec | 15 | 0.4075 | 1.63 | 2.05% | 79.42 | |

| (HSY) | Hershey | 15 | 1.036 | 4.144 | 1.60% | 259.55 | |

| STWD bd | Starwood bond | 15 | 2.375 | 4.75 | 4.90% | bond pays 2x/yr | 97 |

| (MCD) | McDonald's | 15 | 1.52 | 6.08 | 2.13% | 284.93 | |

| (GOLD) | Barrick Gold | 15 | 0.1 | 0.4 | 2.05% | 19.47 | |

| (DUK) | Duke | 16 | 1.005 | 4.02 | 4.04% | 99.46 | |

| (TAP) | Molson Coors Brew | 17 | 0.41 | 1.64 | 3.03% | Raise from 38c | 54.13 |

| (VTRS) | Viatris | 17 | 0.48 | 0.48 | 4.81% | No raise | 9.97 |

| (ORCC) | Owl Rock Capital | 17 | 0.04 | Special | 12.65 |

| (D) | Dominion Energy | 20 | 0.6675 | 2.67 | 4.58% | No raise | 58.25 |

| (HD) | Home Depot | 23 | 2.09 | 8.36 | 2.84% | Raise from 1.90 | 294.56 |

| (LMT) | Lockheed Martin | 24 | 3 | 12 | 2.44% | 491.18 | |

| (TRTN) | Triton | 24 | 0.7 | 2.8 | 4.42% | 63.3 | |

| (SHEL) | Shell plc | 27 | 0.575 | 2.3 | 3.77% | early Raise from 0.5 | 60.95 |

| (AVGO) | Broadcom | 31 | 4.6 | 18.4 | 2.94% | 625.6 | |

| (ARDC) | Ares Dynamic Fund | 31 | 0.1075 | 1.29 | 10.79% | Monthly Pay | 11.96 |

| (TCPC) | BlackRock TCP Cap | 31 | 0.32 | 1.28 | 12.62% | 10.14 | |

| (NMFC) | New Mountain Fin | 31 | 0.32 | 1.28 | 10.71% | 11.95 | |

| (ARCC) | Ares Capital | 31 | 0.48 | 1.92 | 10.54% | no special | 18.21 |

| (PEP) | PepsiCo | 31 | 1.15 | 4.6 | 2.51% | 183.01 | |

| (PTMN) | Portman Ridge | 31 | 0.68 | 2.72 | 13.33% | 20.41 | |

| (SPG) | Simon Prop Grp | 31 | 1.8 | 7 | 6.36% | raise perhaps next | 110.13 |

| (UNP) | Union Pacific | 31 | 1.3 | 5.2 | 2.61% | raise perhaps next | 199.57 |

The Cut

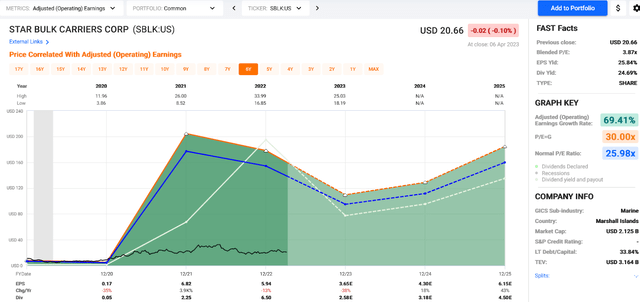

The cut from Star Bulk Carriers was expected and mostly only a bit annoying as it must be noted it still has a hefty 11.6% yield.

FASTgraph for SBLK is show below with the black line being price, blue line is normal P/E and white line is the dividend that was cut in 2022 and should rise again if the estimates or dotted lines hold true. Yearly prices are shown at the top of the graph for 3 years + part of 2023. Earnings are at the bottom of the graph along with dividends paid and future suggested are listed with an E after the number. It can be seen to have lower earnings but mostly it still is performing with estimates/ dotted lines showing continued future nice dividend payments that still are covered by the earnings.

Star Bulk Carriers Technical analysis chart (FASTgraphs April 10th 2023)

Raises-7

1- Visa = 20%

The raise to 45c from 37.5c = 20% was needed as the yield is 0.8% at its current price is an outlier for a dividend income portfolio. A little growth income is always welcome for older positions. Visa is considered a financial services data tech company and has a 5 year DGR of 15%.

2- WEC Energy Group / Wisconsin Energy = 7.2%

The raise of 5.25c continues a nice 5 year dividend growth rate of 6.95% for this utility and its steady reliable income.

3- Amgen = 9.8%

The 19c raise is actually below norm, but wonderful as it continues a 5 year DGR of 11% for a big pharma company.

4- Chevron = 6.3%

The raise of 9c is nicely above the 5 year DGR of 5.65% from this energy company.

5- Molson Coors = 7.9%

The 3c raise is making up for a big cut in 2020 from this consumer staple company, but it still has a 5 year DGR of 18.3%.

6- Home Depot = 10%

The raise of 19c was very welcome, yet is still below the 5 year DGR of 16.64%; but then the price is lower and the yield is sitting at 2.86% from a company in consumer discretionary sector.

7- Shell Plc = 15%

This raise was "magic" and just what I was looking for from this energy company and it even came earlier than expected. It now has 2 positive dividend growth years on top of -4.27% 5 year dividend growth rate record.

March Transactions -3

2 Buys

1- BXMT

Blackstone Mortgage Trust

Mortgage REIT with a big high now 14+% yield. A position was started and a trading alert given in The Macro Trading Factory service to do just that. The price seems to still remain quite rocky, but I am pleased with the yield and see it as being extremely undervalued and actually so do many other analysts.

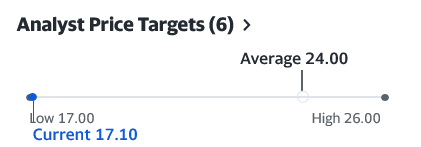

Below is what 6 Yahoo Finance analysts suggest for its price target:

Analyst Price Target for BXMT (Yahoo Finance April 11th, 2023)

Morningstar Analyst has a Fair Value for it at $28.77 and Buy cheaply price of $16.71. I agree and did start a nice position in RIG.

2- DBRG-H

Digital Bridge preferred shares H

Digital Bridge is an infrastructure investment real estate sector financial company. These preferred shares have actually already hit the call date. I paid quite a bit lower than the current price today, which has risen nicely. I will be pleased actually if it does get called at its $25 call price. This was also an idea and trading alert I made at Macro Trading Factory, but I must give credit to The Fortune Teller and his service The Wheel of Fortune for suggesting it first there.

Sold ZIM

ZIM Integrated Shipping Services

This is a marine shipping company that has announced it will pay its last dividend this year. The price rose up by the announced dividend amount and it became time to sell it and then not worry about any foreign dividend taxes that would be removed. The decision to move out was not easy, but as it was truly originally recognized as speculative in nature the good news was it was held to a smallish portfolio size in value. It was truly fun for a while with its huge dividend payments until now. I did believe the positive earnings would last longer, but it was not to be. It should do quite well in the future, but most likely not for some time, and I don't want to watch it. This purchase and sale became a huge lesson in how volatile shipping companies can be for pricing and dividends. It was an interesting ride, but turned out less than positive for RIG as it did take a hit in value when sold. Lesson learned, glad to be a smallish one.

Add on buys

There were 3 announced add on buys as trading alerts my myself in MTF service:

ARDC, RITM-D and RC.

These are all high yield financials or preferred shares.

Summary/Conclusion

Income is the primary focus goal of RIG, but retaining value is very important. It does so with having quality low debt/high credit rated companies all the while maintaining and growing safe income and the RIG portfolio continues to own 80 stocks.

The Rose portfolio/ RIG continues to outperform SPY by double digits from its Nov 2021 inception being up 19.9%. 2023 Q1 has been more of a struggle YTD with value ending almost even, but was down 0.54%, but acceptable for now! This is a marathon and not a race and I have confidence RIG will continue to perform well. The dividend income yield is 4.65% with nice cash on hand of 13.7%. The search continues for more dividend growers with a "WTB" /want to buy list of Non-RIG stocks available for subscribers to follow. Buy under prices and a deep value buy price is provided for those and all 80 current RIG stocks.

Happy Investing to All!

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: "Funds Macro Portfolio" & "Rose's Income Garden"; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

Macro Trading Factory for an Upward Trajectory!

This article was written by

I am a Promoting and Contributing author for Macro Trading Factory run by The Macro Teller / The Fortune Teller. The following list shows the # of stocks in each sector along with the % portfolio value and % income coming from the largest holding. All stocks listings and statistics are presented at The Macro Trading Factory service alphabetically with sector, credit ratings, current and forward dividend information, yield, x-dates, pay dates, charts and more. I also check chat daily for questions and present in real time my smaller trades in the chat. All bigger portfolio changes, major sells and buys get a larger Trading Alert and article. Smaller buys or changes to an existing position will get an alert only.

Goals:

- Quality, low debt companies with great credit ratings and selling at a fair or better price and with a safe and rising dividend.

- To keep defensive stocks/sectors at 50% Portfolio Income.

- Also needed is continued patience watching and waiting for it to happen. Doing nothing when others panic makes for success!

Update: Feb 4, 2023.

How to join Macro Trading Factory: explained here: https://seekingalpha.com/author/the-macro-teller/research.

Sectors and holdings are as suggested by Bloomberg. Some positions are large and some small ; The service has listings for all 79.

Consumer Staples (11 stocks): PM

Healthcare (9) : MRK

Communications- tele (5): BCE - Canada

Utility (8): DUK

Consumer Discretionary (2): HD

Energy (6): ENB

Tech/ "fin-tech" : (4): AVGO

Industrial- Defensive (2): LMT

Industrial (7): SBLK

Material (3) : LYB

Financial: (13): (9) BDCs/ ARCC, (1) bank, (1) ETF Fund , (1) BDC preferred and (1) mREIT

-Fixed Bond (1): STWD

REAL ESTATE (Healthcare REITs): (3) : OHI

REAL ESTATE Misc (5): SPG

Cash is ~15.6%

Happy Investing to ALL !!! Rose :))

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMGN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Rose owns all 80 stocks found in RIG

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.