Battalion Oil: Debt Reduction Hampered By Interest And PIK Dividend Costs

Summary

- Battalion recently issued $25 million in preferred shares, with a PIK dividend rate of 16% per year.

- It also had (at the end of 2022) $235 million in credit facility debt at an interest rate that was expected to be 12.2% in Q1 2023.

- Battalion ended up with over $200 million in combined realized hedging losses in 2021 and 2022.

- Continued hedging losses and interest/dividend costs hamper its ability to generate a large amount of free cash flow.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

guvendemir

Battalion Oil (NYSE:BATL) is in a challenging position due to its relatively high amount of debt and its limited liquidity. It has also lost a lot of money on hedges (prompted by creditor requirements) over the past couple years, with derivative settlements costing it over $200 million combined during 2021 and 2022.

I believe that Battalion's assets are worth more than its debt. However, its ability to generate free cash flow is limited due to its high interest costs and ongoing hedging losses. Battalion's 2023 development plans are currently uncertain and it will likely end up with lower production than what I had modeled before. I am now neutral on BATL stock since the company hasn't made as much progress on reducing its debt and/or growing production as I had hoped for before.

Preferred Stock

Battalion issued 25,000 shares of redeemable convertible preferred stock in March 2023 to some (Luminus Management, Oaktree Capital Management and LSP Investment Advisors) of its existing common shareholders. Each share initially has a liquidation preference of $1,000 and is accruing PIK dividends at a 16% annual rate (compounded quarterly) currently. There is also a 14.5% cash dividend rate, but Battalion is not allowed to pay cash dividends at this time due to its term loan agreement.

The preferred stock can be converted into common shares at a conversion price of $9.03 per common share. Battalion received approximately $24.4 million in net proceeds from the preferred stock deal. It indicated that the proceeds would help address concerns around future covenant compliance and improve its liquidity.

Change In Management

There have recently been significant changes with Battalion's senior management. Richard Little resigned as CEO and was replaced by Matt Steele, formerly CEO of Bruin E&P Partners. Kevin Andrews earlier left his position as EVP, CFO and Treasurer and was replaced by Kristen McWatters.

The new management team faces the same challenges, which involve figuring out how to reduce Battalion's net debt while dealing with negative value hedges and significant interest (and now PIK dividend) costs.

Reserves And Valuation

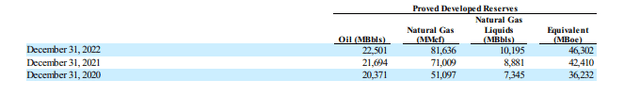

Battalion's proved developed reserves increased by 9% overall in 2022, mainly due to its 2022 development program, which converted 8.3 MMBOE in proved undeveloped reserves into proved developed reserves. Battalion's proved developed oil reserves increased by 4%, as the oil cut of its proved developed reserves went down to 49% from 51%.

Battalion's Reserves (battalionoil.com)

Battalion reported proved developed reserves with a PV-10 of $558 million at the end of 2022. This was with mid-to-high $60s WTI oil. That reserve valuation is probably pretty close to Battalion's current PD PV-10 at $70 WTI oil and with some cost inflation. I estimate Battalion's PD PV-10 at $575 million with $70 WTI oil and $650 million with $75 WTI oil.

A 0.7x multiple to that would give Battalion a total value of $403 million at $70 WTI oil and $455 million at $75 WTI oil.

At the end of 2022, Battalion had a $29 million working capital deficit (excluding derivatives) and $235 million in credit facility debt. Battalion received $24 million in net proceeds from its issuance of preferred shares, so that reduces its net debt (including working capital deficit) to $240 million.

Battalion's hedges are also worth negative $28 million at $70 WTI oil and negative $58 million at $75 WTI oil. Thus at a 0.7x multiple to PD PV-10 at $70 WTI oil, Battalion may be worth approximately $7 per share. At a 0.8x multiple, this would rise to approximately $10 per share, while at a 0.6x multiple, Battalion would only be worth around $4 per share. This assumes that Battalion's preferred shares are converted to common shares at the current liquidation preference amount.

| PD PV-10 Multiple At $70 Oil | 0.6x | 0.7x | 0.8x |

| Asset Value ($ Million) | $345 | $403 | $460 |

| Less: Net Debt ($ Million) | $240 | $240 | $240 |

| Less: Hedges ($ Million) | $28 | $28 | $28 |

| Equals: Estimated Value ($ Million) | $77 | $135 | $192 |

| Value Per Share | $4.01 | $7.02 | $9.99 |

In a $75 WTI oil scenario, Battalion's estimated value increases modestly, to a bit over $8 per share with a 0.7x PD PV-10 multiple. The increase in asset value is partially offset by increased hedging losses.

| PD PV-10 Multiple At $75 Oil | 0.6x | 0.7x | 0.8x |

| Asset Value ($ Million) | $390 | $455 | $520 |

| Less: Net Debt ($ Million) | $240 | $240 | $240 |

| Less: Hedges ($ Million) | $58 | $58 | $58 |

| Equals: Estimated Value ($ Million) | $92 | $157 | $222 |

| Value Per Share | $4.79 | $8.17 | $11.55 |

Hedges And Interest Costs

Battalion has suffered significantly from its below market value hedges over the last couple years. It reported $208 million in realized losses on its hedges during 2021 and 2022. Without those hedging losses, it would have a relatively minimal amount of net debt. It is also projected to lose around $15 million on its 2023 hedges at current strip.

Battalion's interest costs are also a serious issue. It indicated that its term loan interest rate was expected to be around 12.23% during Q1 2023. It is also paying a 16% PIK dividend on its preferred shares. Battalion is now paying around $30 million to $35 million per year in interest costs and PIK dividends.

The interest/dividend costs and hedging losses are a large impediment to Battalion's attempts to generate significant free cash flow and pay down its debt. Battalion expects its gathering and other expenses to be reduced by several dollars per BOE once its acid gas treatment facility enters service (expected in Q2 2023). However, its interest/dividend costs per BOE may be around $7 in 2023 and that is a bigger issue.

Conclusion

Battalion's assets may be worth around $400 million to $450 million in a long-term $70 to $75 WTI oil environment without further development. This is well above its net debt of $240 million (proforma for its preferred share issuance). However, Battalion also has negative value hedges to deal with and it has now added preferred shares that rank ahead of the common and that are accruing PIK dividends at 16% per year (compounded quarterly).

I am now neutral on Battalion at its current share price due to the high risk that its very large amount of term loan interest and preferred share dividends prevents it from doing much other than staying afloat. While the preferred share dividends are not being paid in cash currently, the PIK dividends still add to the amount of liquidation preference ahead of the common shares in Battalion's capital structure.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.