FTF: Poorly Performing Low-Duration Credit Fund

Summary

- Franklin Limited Duration Income Trust is a low-duration credit fund that aims to provide investors with high current income.

- The fund pays an attractive 12.0% distribution yield. However, with total returns of only 1-4% p.a., the FTF fund is simply returning investors' own principal through the distribution.

- The FTF fund also has large exposures to the 'marketplace loan' asset class that has not been tested in economic downturns.

- I recommend investors seek their credit exposures elsewhere.

BalkansCat

The Franklin Limited Duration Income Trust (NYSE:FTF) is a low-duration credit fund that aims to provide investors with high current income. Unfortunately, my analysis indicates the fund is yet another amortizing 'return of principal' fund that is funding its 12.0% distribution by liquidating its NAV. Long-term investors in 'return of principal' funds end up with losses in both principal and income.

The FTF fund also had a poor 2022 performance that cannot be explained by interest rates alone. In addition, the fund has large exposures to unsecured consumer loans in the form of 'marketplace loans' that are largely untested in economic downturns.

I recommend investors avoid the FTF fund and seek their credit exposures elsewhere.

Fund Overview

The Franklin Limited Duration Income Trust is a closed-end fund ("CEF") that aims to provide investors with high current income from high yield corporate bonds, senior loans, and other fixed income securities while maintaining a low portfolio duration.

The FTF fund may use leverage to enhance returns. As of February 28, 2023, the FTF fund had $430 million in gross assets against $289 million in net assets for 32.8% effective leverage. The fund charged a 2.68% net expense ratio in 2022.

Portfolio Holdings

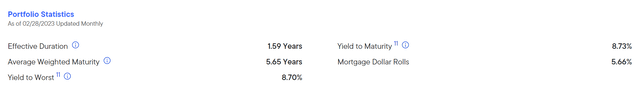

The FTF portfolio has close to 600 positions with an effective duration of 1.6 years and 8.7% yield to maturity (Figure 1).

Figure 1 - FTF portfolio statistics (franklintempleton.com)

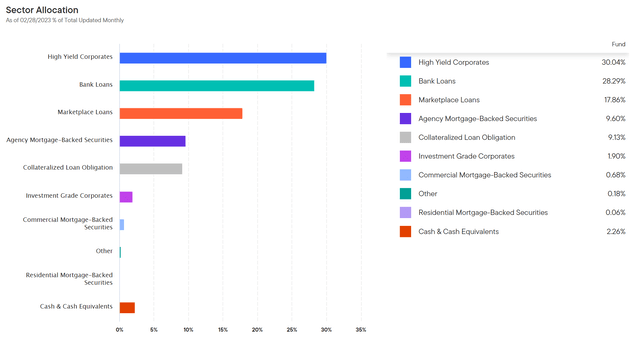

Figure 2 shows the FTF fund's asset allocation. The fund has 30.0% allocation to high yield ("junk") bonds, 28.3% allocated to senior bank loans, 17.9% allocated to marketplace ("peer-to-peer") loans.

Figure 2 - FTF sector allocation (franklintempleton.com)

What Are Marketplace Loans?

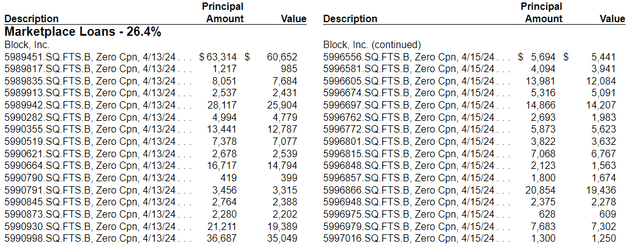

Marketplace lending uses an online platform to connect consumers and businesses who want to borrow money with investors willing to lend. In this case, the FTF fund acts as the investor and lends small amounts to thousands of borrowers through online platforms like Block, Inc. (SQ), Freedom Financial Asset Management, LendingClub Corp. (LC), and others (Figure 3).

Figure 3 - Illustrative marketplace loans held in FTF fund (FTF 2022 annual report)

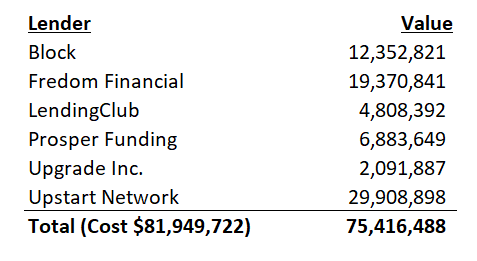

In total, the FTF fund has $75.4 million outstanding in marketplace loans with varying yields and maturities ranging from zero-coupon loans made to Block Inc. customers to 30% 5 year loans made to Upstart customers (Figure 4).

Figure 4 - FTF marketplace loan exposures (FTF 2022 annual report)

Given the market's infancy and the fact that marketplace lending has primarily existed in a zero-interest rate environment for the past decade, credit loss ratios for this lending product are largely untested. How will they perform in an economic downturn? How do the platforms prevent fraud and ensure compliance with KYC rules and regulations?

Returns

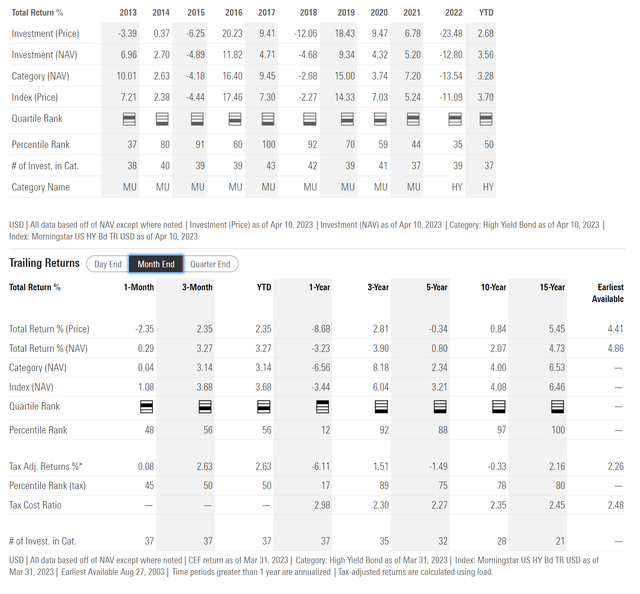

Figure 5 shows the FTF fund's historical returns. The fund has generally delivered modest returns, with 3/5/10/15Yr average annual total returns of 3.9%/0.8%/2.1%/4.7% respectively to March 31, 2023.

Figure 5 - FTF historical returns (morningstar.com)

Interestingly, despite the fund's low duration of 1.6 years, the FTF fund returned a disappointing -12.8% in 2022. Investors should note that fixed income funds poor performance in 2022 was primarily interest rate driven, and funds with low duration, like the Invesco Senior Loan ETF (BKLN), generally performed well with only a -1.7% decline in 2022.

Using first order approximation, the FTF fund's 1.6 years duration should have contributed to 6.8% in negative returns if the Fed's 425 bps of interest rate increases was applied across the yield curve. This first order approximation does not take into consideration the yield FTF's portfolio should have generated, which would have offset some of the price declines. Therefore, it is puzzling as to the driver of FTF's poor 2022 returns.

Unfortunately, the fund's annual report did not shed much insight into the poor performance, except to compare the FTF fund to various treasury and corporate bond benchmarks which were down 10-15% respectively in 202. Investors should note that the treasury and corporate bond benchmarks cited by the manager often have much higher duration exposures, so it is understandable they suffered more price declines in 2022 due to interest rate increases.

Distribution & Yield

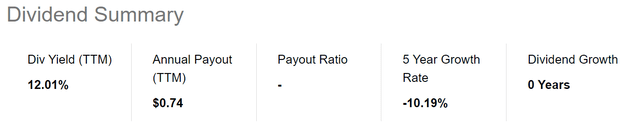

The FTF fund has a managed distribution policy that pays unitholders a minimum of 10% of average monthly NAVs. In the trailing 12 months, FTF's distribution has amounted to $0.74 or a 12.0% distribution yield. FTF's distribution is paid monthly (Figure 6).

Figure 6 - FTF distribution (Seeking Alpha)

While a 10%+ distribution looks attractive at first glance, investors are cautioned that funds that do not earn total returns exceeding their distribution rates will have to liquidate NAV in order to fund their distributions. Over time, this leads to amortizing NAVs and market price.

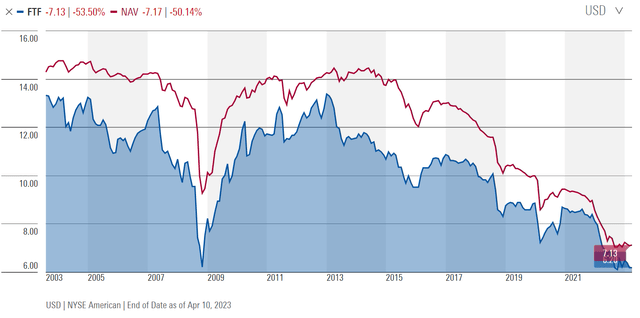

In fact, looking at FTF's price and NAV history since inception, the fund has seen its NAV cut in half from $14.68 in 2003 to $7.13 currently (Figure 7).

Figure 7 - FTF's NAV has shrunk by half since inception (morningstar.com)

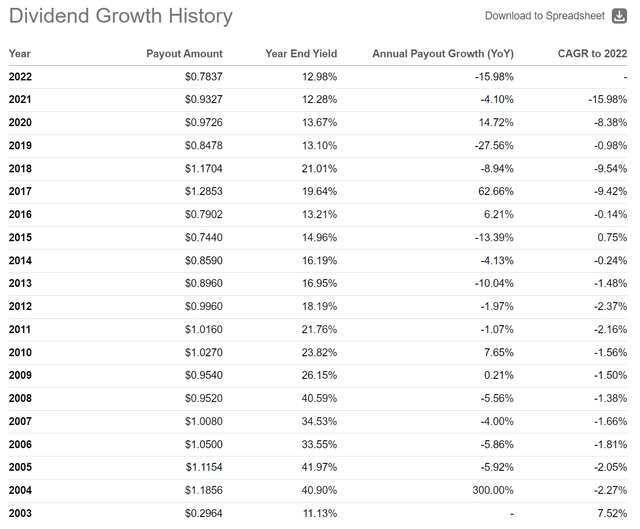

Since its distribution is linked to its NAV, FTF's distribution has likewise declined from an annual $1.18 in 2004 to $0.78 in 2022 (Figure 8).

Figure 8 - FTF's distribution has likewise declined (Seeking Alpha)

Therefore, long-term investors have suffered a loss in both 'principal' and 'income'. The FTF fund is once again another classic example of amortizing 'return of principal' funds that I have written extensively about in the past few months.

Conclusion

The Franklin Limited Duration Income Trust is a low-duration credit fund that aims to provide investors with high current income. Unfortunately, with the fund paying a minimum 10% of NAV distribution but only earning annual returns of 1-4%, the FTF fund is another classic 'return of principal' fund that entices long-term investors with high yields, but instead delivers amortizing principal and income.

The fund also has a large exposure to the untested 'marketplace loans' asset class that may suffer large losses in an economic downturn.

I recommend investors avoid the FTF fund and seek their credit exposures elsewhere.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.