Federal Reserve Weekly Commercial Bank Report: Good Resource For Q1 Bank Earnings

Summary

- The Federal Reserve releases a weekly report on the balance sheet of all commercial banks in the United States.

- The report has been very helpful at analyzing trends since the failure of SVB and SBNY.

- The financial ratios generated out of the report can also serve as benchmarks for individual bank's Q1 earnings.

Sakorn Sukkasemsakorn

For the first time since SVB and Signature Bank failed, banks are slated to release quarterly earnings with four big banks leading off on Friday. While investors are interested in the health of the banking sector, they don’t have to wait until all bank earnings are out to see what is happening. Each Friday, the Federal Reserve releases report H.8 covering the assets and liabilities of commercial banks in the United States. Last Friday’s report covered March 29th, which was essentially the end of the first quarter.

The trends of this report can help determine how the banking sector is performing and establish benchmarks for bank earnings. While the large bank failures certainly exacerbated problems, there have been headwinds forming in the banking sector since the Federal Reserve began its aggressive push to stamp out inflation through aggressive rate hikes.

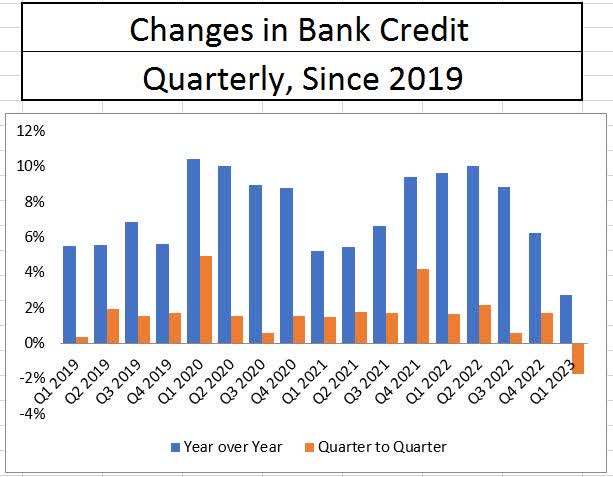

The largest asset item that the Federal Reserve follows is bank credit. Bank credit is essentially a catch all for all loans a bank initiates whether it is to the private sector via real estate or credit cards or to the public sector with the purchase of US Treasuries and agency backed mortgage securities. I use bank credit as a sentiment indicator essentially communicating the sector’s willingness to lend at all.

In the first quarter of 2023, bank credit increased by 2.70% year over year and decreased by 1.7 % from the prior quarter. Each of these indicators is a marked pullback with the quarter to quarter retraction being the worst since the Great Recession. The banking sector’s willingness (or lack thereof) to lend is creating an economic headwind that is likely signaling a recession.

Federal Reserve Assets and Liabilities of Commercial Banks

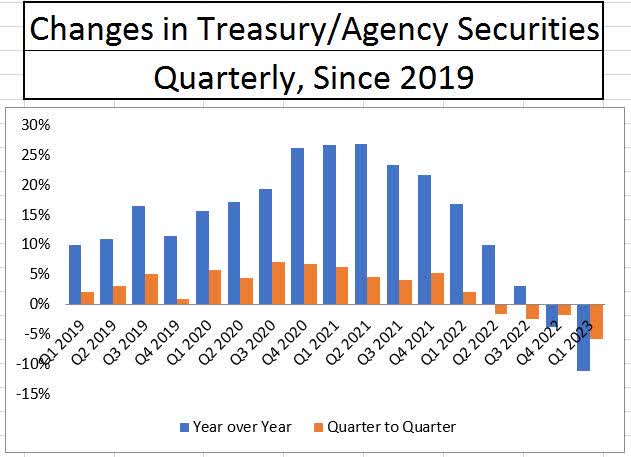

Fortunately for the private sector, not all lending is distributed equally. A major source of the bank credit headwind comes from the banking sector’s pullback in treasuries and agency securities. These are considered the safest investments for a bank to make, but they have also created large unrealized losses as banks purchased many of these securities at record low interest rates (thus record high prices). Lending in treasury and agency securities declined by more than 11% year over year and nearly 6% quarter to quarter in the first quarter of 2023. Some of this is due to the unwinding of SVB and Signature Bank, but the quarter to quarter trend has been negative for four quarters in a row. Investors may panic hearing that a bank sold treasuries during the first quarter, but this has been a trend in the sector for the past year.

Federal Reserve Assets and Liabilities of Commercial Banks

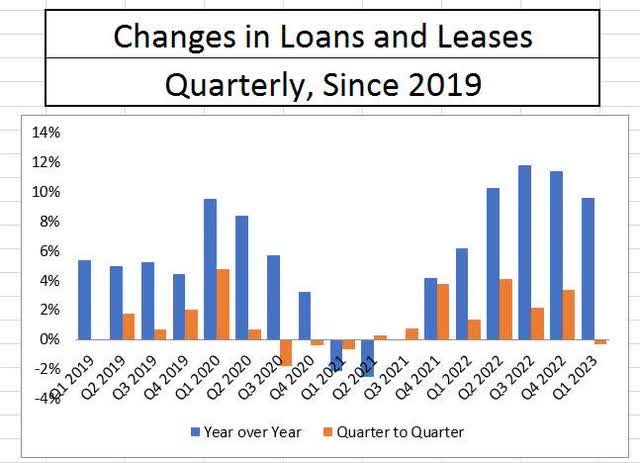

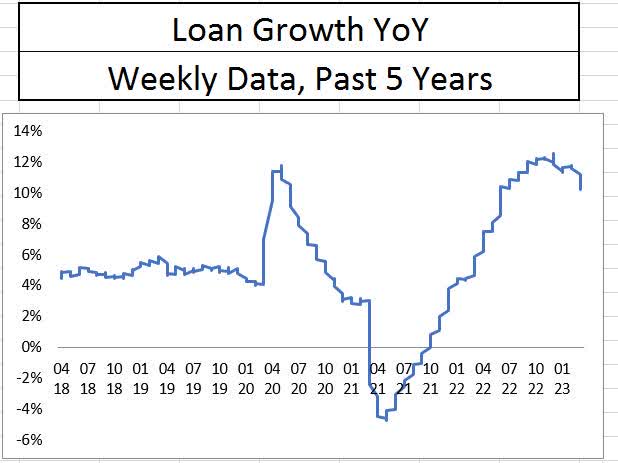

On the private side of lending, there is evidence of a slowdown as well. Loans and leases, which cover everything from real estate (commercial and residential) to credit cards and car loans, saw the first quarterly decline since PPP forgiveness. While loans and leases grew by more than 9% year over year, the 0.3% decline quarter to quarter combined with the recent pullback in year over year lending growth data suggest that a credit slowdown in the private sector is underway.

Federal Reserve Assets and Liabilities of Commercial Banks Federal Reserve Assets and Liabilities of Commercial Banks

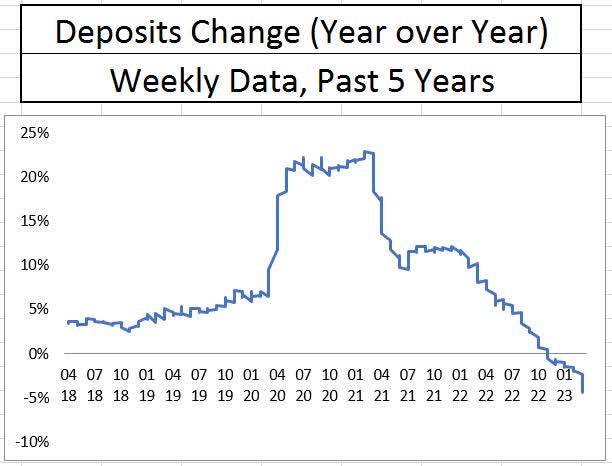

As for the outlook of the credit markets, investors should keep an eye on deposit growth. For the first time in the 50-year history of tracking financial data of banks, deposits have declined year over year and are now down 5% from the same time a year ago. Deposits are the easiest source of capital for banks, but they are also the shortest in duration, meaning they can be called at any time. The sector has substituted the drop in deposits with short term borrowing, either from the Federal Reserve or the Federal Home Loan Bank (FHLB).

Federal Reserve Assets and Liabilities of Commercial Banks

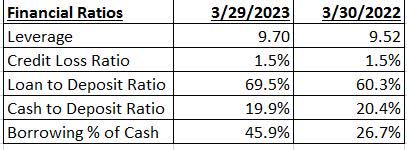

We will likely not know the impact of short-term borrowing until we see the net interest margins during second quarter earnings (because the data will encompass the entire quarter), but we can monitor the sector’s leverage in the meantime for changes. If short term borrowing becomes excessive, the costs associated with it will begin to lower a bank’s net assets (assets less liabilities) therefore leading to an increase in leverage. While leverage is currently manageable in the sector, it’s important to note that it remains elevated from pre-pandemic levels.

Federal Reserve Assets and Liabilities of Commercial Banks

There are other ratios investors should watch when matching up their bank’s earnings against the industry. The loan to deposit ratio will show how much depositor funding is tied up in loans to the private sector. It’s important to note that loans are not eligible collateral under the Fed’s new facility, therefore a high loan to deposit ratio would highlight less financial flexibility for the bank. Also, the cash to deposit ratio becomes important as it shows how much cash a bank has on hand to cover total deposits.

Federal Reserve Assets and Liabilities of Commercial Banks

The Federal Reserve’s weekly report of assets and liabilities of commercial banks has been helpful in monitoring the health of the banking sector. While the banking sector is stronger than before the Great Recession, fears of runs have led the sector to scale back lending. I believe banks that outperform these benchmarks can expect to see quicker recoveries when the rate environment becomes more favorable.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own several preferred shares in the banking sector that may or may not be components of the banking sector ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.