Energy Transfer: A Winner Due To Natural Gas

Summary

- Energy Transfer LP is one of the largest and most well-diversified midstream partnerships in the United States.

- The company derives a significant portion of its cash flows from natural gas, which positions it well for forward growth.

- The demand for natural gas from the LNG export industry is expected to grow substantially over the coming years and the company is well-positioned to supply this demand.

- Energy Transfer has one of the strongest balance sheets in the industry and should have no trouble carrying its debt.

- The company currently pays a 9.71% distribution yield, which it should easily be able to sustain.

- This idea was discussed in more depth with members of my private investing community, Energy Profits in Dividends. Learn More »

redtea

Energy Transfer LP (NYSE:ET) is one of the largest midstream master limited partnerships in the United States. The company boasts a network of infrastructure that stretches across much of the Central and Eastern regions of the nation.

This is a good place to be in, as a significant part of this infrastructure is dedicated to natural gas, which makes this likely to be a growth area for the company as demand for natural gas is growing rapidly. This is important as the demand for natural gas is growing rapidly across both regions due to a number of liquefied natural gas plants coming online and utilities switching from coal to natural gas for the production of electricity.

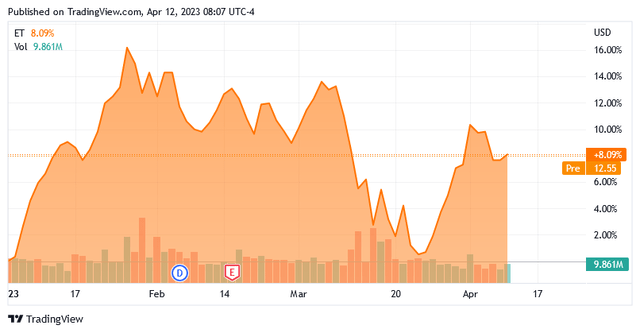

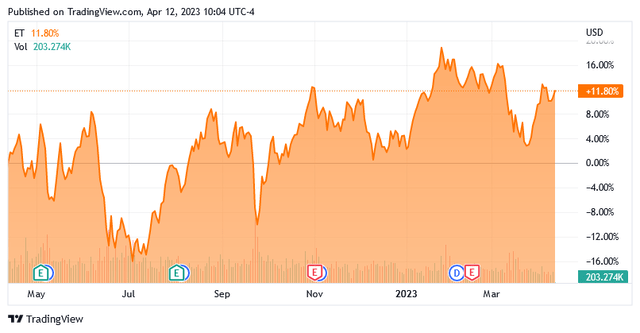

In addition to these growth prospects, Energy Transfer enjoys remarkably stable cash flows regardless of resource prices, so fortunately the decline of natural gas prices that we have seen so far this year is unlikely to have much of an impact on the company. The market appears to agree, as the company’s unit price is up 8.09% year-to-date:

This is in stark contrast to what many other midstream companies have delivered over the same period, and it reinforces the fact that Energy Transfer should prove to be a solid investment for the next several years. When we combine this with the company’s very attractive 9.71% distribution yield, Energy Transfer LP looks like a winning investment today.

About Energy Transfer

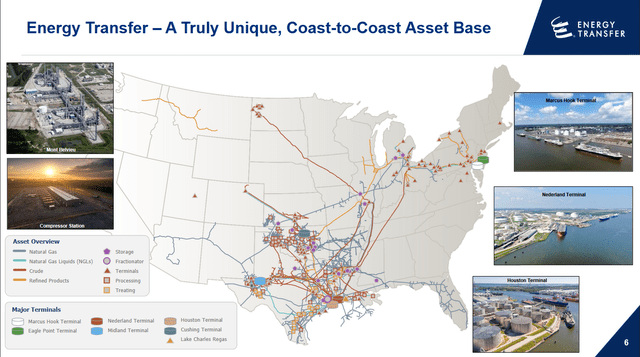

As stated in the introduction, Energy Transfer is one of the largest midstream master limited partnerships in the United States. The company’s infrastructure stretches across most of the central region of the country, as well as out to the East Coast:

One thing that we immediately see here is that the company’s footprint includes just about every major resource-producing basin in the United States. This is a nice situation because of the diversification benefits that it provides. After all, each of these basins has different fundamental dynamics that can affect the company’s business. For example, it is much cheaper to produce hydrocarbons in the Permian Basin than in the Bakken Shale. Thus, upstream producers will usually cut back production in the Bakken Shale before they do so in the Permian during periods in which energy prices are extremely low. We saw this occur back in 2020. Bakken Shale production did rebound late that year when energy prices started increasing again though, which was one of the reasons why Crestwood Equity Partners (CEQP) reported very strong fourth-quarter 2020 results.

There are also some resource production differences. For example, the Marcellus Shale is usually targeted by producers seeking natural gas, while the Bakken Shale is preferred by those that are interested in the production of crude oil. The fact that Energy Transfer offers exposure to all of these regions thus gives it some diversification benefits as it is protected against events that negatively affect one individual region while still being able to benefit from any positive developments.

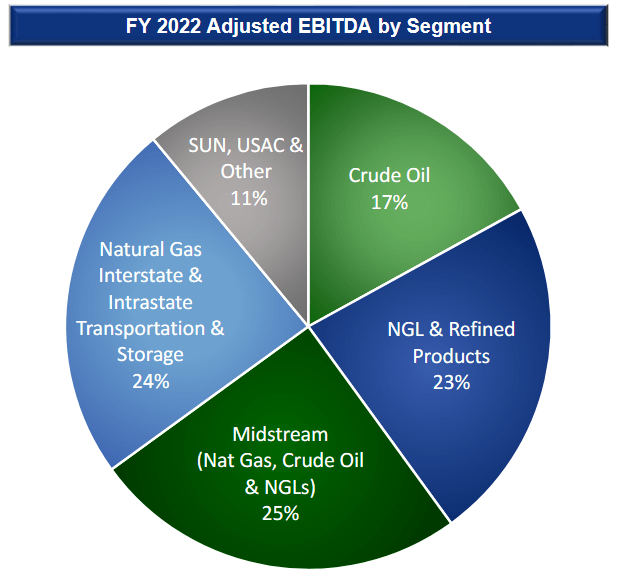

As mentioned in the introduction to this article, Energy Transfer has significant exposure to natural gas. This is something that we could probably guess from the fact that it is one of the few midstream companies that has operations in the Marcellus Shale. In fact, we can see here that the transportation and storage of natural gas accounts for 24% of Energy Transfer’s adjusted EBITDA:

Energy Transfer

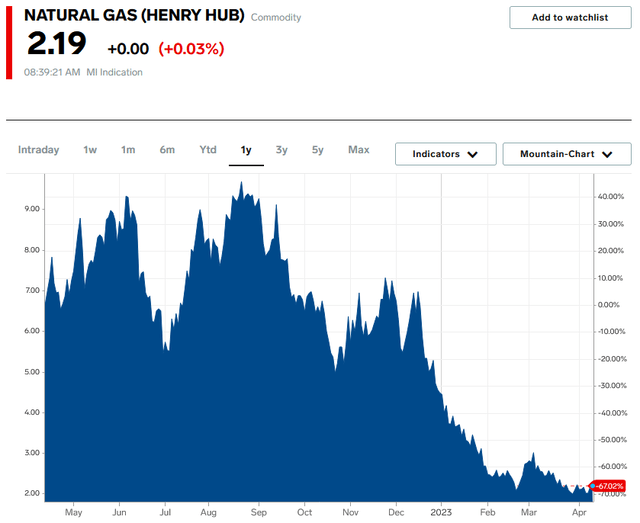

The company also has exposure to natural gas via its midstream segment, which is primarily gathering & processing operations. In short, we can see that natural gas accounts for a larger portion of Energy Transfer’s cash flow than any other resource, although the company is quite well diversified across the different hydrocarbon products. This is something that may be concerning to some readers considering that natural gas prices have performed quite poorly so far this year. As we can see here, natural gas prices have generally been declining since the middle of last year and are down 67.02% over the trailing twelve-month period:

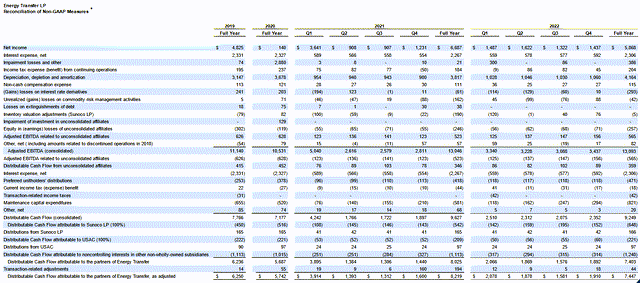

Fortunately, Energy Transfer is not particularly affected by commodity price fluctuations. This is due to the business model that the company employs. In short, Energy Transfer enters into long-term contracts with its customers under which the company transports natural gas, crude oil, and other petroleum products for the customer. In exchange, the customer compensates Energy Transfer based on the volume of resources that the company transports, not on their value. This provides Energy Transfer with a great deal of protection against changes in energy prices and provides the company with remarkably stable cash flow regardless of changes in energy prices. This is clearly apparent by looking at the company’s financial performance over the past four years. Here is a detailed breakdown:

Here is a more concise summary:

FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

Net Income | $4,825 | $140 | $6,687 | $5,868 |

Adjusted EBITDA | $11,140 | $10,531 | $13,046 | $13,093 |

Distributable Cash Flow | $6,250 | $5,742 | $8,219 | $7,447 |

(all figures in millions of U.S. dollars.)

We do see that the company’s net income exhibited considerable variation over the period. However, as I have pointed out in numerous previous articles, net income is not really a good measure of performance for companies like this because this figure is affected by depreciation and numerous other measures that do not give us an accurate picture of how much cash actually came into and left the business. The company’s adjusted EBITDA and Distributable Cash Flow actually give a much better idea of how much money the company generated and how much it produced for its common equity holders.

As we can clearly see above, these figures were generally pretty stable despite the fact that resource prices were all over the place during this four-year period. This is a very good thing because of the support that the stable cash flows provide for the distribution. After all, it is much easier for management to pay out a large portion of the company’s cash flow if it can be certain that the company will generate just as much next year. This is the same concept that allows a consumer to more easily budget for a mortgage when they earn a salary as opposed to a sales commission.

With that said, though, Energy Transfer is not actually paying out a substantial portion of its cash flow via its distribution. We will discuss that later in this article.

Natural Gas Growth Opportunity

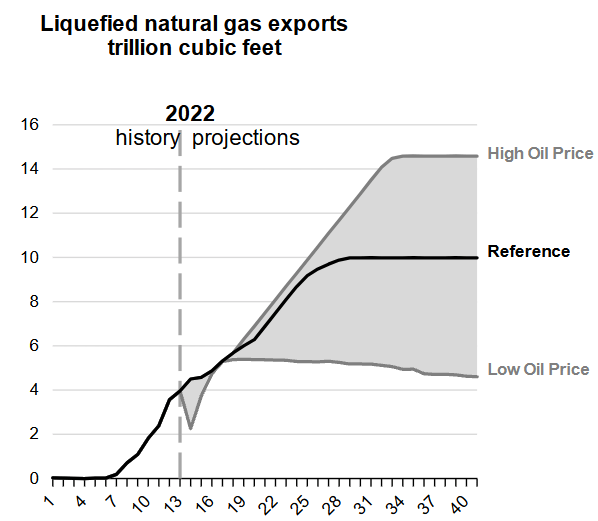

As mentioned in the introduction to this article, Energy Transfer could have a growth opportunity with respect to its natural gas transportation business. This is because of the growing demand for natural gas from liquefied natural gas producers, which purchase the natural gas and turn it into a liquid so that it can be exported to regions such as Asia and Europe. According to the Energy Information Administration, the consumption of natural gas for this purpose will grow substantially even in the worst-case scenario:

U.S. Energy Information Administration

There are two locations where most of the liquefied natural gas plants that will drive this demand growth are being constructed. The first is on the East Coast, where we have seen projects announced or constructed for both the Philadelphia area and Georgia. We are also seeing a number of projects situated around the Gulf Coast in Texas and Louisiana. That second location makes a lot of sense because Texas and Louisiana have been the central hub of the traditional American energy industry for decades and already have much more infrastructure in place to handle the additional volumes of natural gas that will be required for supplying these plants than any other area of the country. Energy Transfer itself already has significant infrastructure in place in this region:

In total, Energy Transfer has 11,385 miles of natural gas pipelines located in Texas and Oklahoma, with a total throughput capacity of 24 billion cubic feet of natural gas per day. The company also has 88 billion cubic feet of natural gas storage capacity in the region. The company is working to increase this capacity in response to the expected demand growth for the new liquefaction plants that are expected to come online over the next five to ten years. For example, late last year, Energy Transfer completed a project that increased the capacity of its Oasis Pipeline by 60 million cubic feet of natural gas per day. As already discussed, Energy Transfer’s revenue and cash flow directly correlate to the company’s volumes of resources transported. Thus, it should be pretty obvious to see how new plants resulting in more resources being moved through the company’s infrastructure should position it well for forward growth.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. The usual way through which this is accomplished is by issuing new debt and then using the proceeds to repay the existing debt. This can cause a company’s interest expenses to go up following the rollover depending on the conditions in the market. That is something that could be very important today as market interest rates are at close to the highest levels that we have seen in a decade. In addition to this risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline could push it into insolvency if it has too much debt. While midstream companies like Energy Transfer typically have remarkably stable cash flows over time, this is still a risk that we should not ignore.

One metric that we can use to evaluate a midstream partnership’s debt level is its leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how many years it would take the company to completely repay its debt if it were to devote all its pre-tax cash flow to that task. As of December 31, 2022, Energy Transfer had a net debt of $48.850 billion and a trailing twelve-month adjusted EBITDA of $13.093 billion. This gives the company a leverage ratio of 3.73x today. This is a very reasonable ratio that is well below the 5.0x that Wall Street analysts usually consider to be reasonable. However, as I have mentioned before, most of the best-financed companies in the midstream industry are now below 4.0x leverage. It is quite good to see that Energy Transfer is below even this more stringent ratio. Overall, the company’s financial structure appears to be fine today.

Distribution Analysis

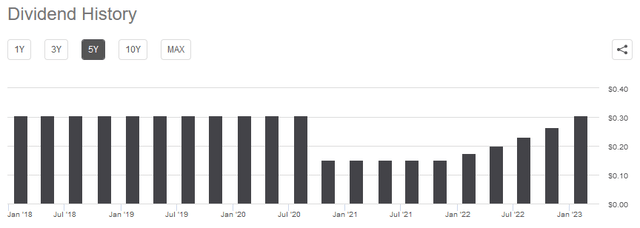

One of the primary reasons why we purchase units of midstream master limited partnerships is because of the incredibly high distribution yields that these companies typically possess. Energy Transfer is certainly no exception to this as the units yield 9.71% at the current price. This is substantially higher than the 1.58% yield of the S&P 500 Index (SP500) as well as being much higher than a money market fund or any other fixed-income fund will provide. Unfortunately, Energy Transfer’s distribution history leaves something to be desired, as the company slashed its distribution back in 2020 and has only just recently restored it to the previous level:

This is something that certainly earned the ire of many income-focused investors over the period, although it is not nearly as bad as many other master limited partnerships that have yet to restore their distributions following a 2020 cut. The fact that Energy Transfer has been fairly good above raising its distribution since the start of 2022 is probably one reason why the company has performed much better than its peers since that time. Indeed, the company is not only up year-to-date, but it is up over the past twelve months:

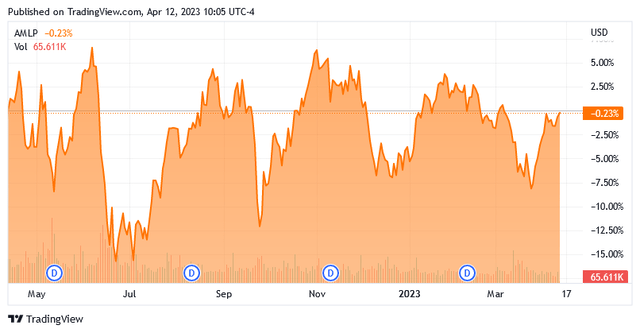

This compares quite favorably to the ALPS Alerian MLP ETF (AMLP), which is down slightly over the same period:

However, as I have mentioned many times before, the company’s past record is not really the most important thing to new investors. After all, anyone buying the company’s partnership units today will receive the current distribution at the current yield and does not really have to worry about the firm’s past performance. Thus, the most important thing for someone today is the company’s ability to maintain its current distribution.

The usual way that we judge a midstream company’s ability to maintain its distribution is by looking at its distributable cash flow. This is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. In the fourth quarter of 2022, Energy Transfer reported a distributable cash flow of $1.910 billion. The company had a weighted average of 3.0903 billion basic common units outstanding, so its declared distribution of $0.305 per common share costs the company approximately $942.54 million per quarter. That gives the company a distribution coverage ratio of 2.03x, which is quite acceptable.

Wall Street analysts usually consider anything above 1.20x to be reasonable and sustainable. I am somewhat more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the investment. As we can clearly see, Energy Transfer easily beats even this more stringent requirement handily. Overall, the company should have no difficulty covering or maintaining its distribution.

Conclusion

In conclusion, Energy Transfer LP is a good holding for an energy-income portfolio, despite the fact that some investors are a bit upset about the distribution cut a few years ago. Energy Transfer has now managed to restore its distribution, which has caused it to be one of the better-performing partnerships over the past year. The company continues to have a great deal of growth potential, especially considering the growing demand for natural gas. When we combine this with a strong balance sheet and a very high and sustainable yield, Energy Transfer LP certainly looks like a winner.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CEQP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends during the morning of April 12, 2023. Subscribers to the service have had since that time to act upon it.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.