KBWB: I See Value In U.S. Banks (Rating Upgrade)

Summary

- The Financials sector as a whole, and banking in particular, has been hammered in 2022. This comes on the heels of bank failures.

- Readers should remember that banks do fail. While never a positive for the sector, they are not as uncommon as they seem.

- The recent failures could continue to encourage more depositors and businesses to move to the largest, systemically important institutions. That plays right into the hands of KBWB.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

scanrail/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco KBW Bank ETF (NASDAQ:NASDAQ:KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, it is heavily weighted towards the biggest banking names, and it is managed by Invesco.

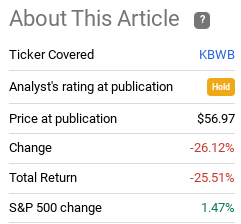

At the end of January, I suggested investors lock in some gains from the banking sector and take some chips off the table. Boy, was I right about that call! While I will admit I did not foresee the upcoming bank failures, it did not surprise me that negative news had a disproportionate impact on funds like KBWB because they had been running very well going into that news cycle. Looking back, we see caution was completely rewarded:

Fund Performance (Seeking Alpha)

With this kind of a move in just under three months, it was clearly time to reevaluate if I should change my rating on the fund. After some thought, I do see a buy case developing and will explain why in detail below.

Sector Weakness Suggests Relative Value

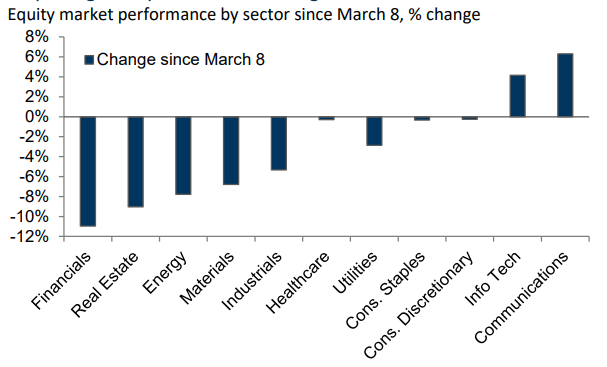

As I mentioned above, KBWB has dropped in a big way. But it is important to remember this fund tracks the broader banking sector - so it is not alone in its poor performance. While this is not really "good" news for current investors, it does open up a window of opportunity for new positions. Simply put, this is an unloved sector at the moment and that suggests a bit of a contrarian play. My followers know that is precisely what I look for day in and day out - and I think it is at work again here.

To understand why I will show recent sector performance below. Not surprisingly, Financials are the biggest drag. Of note, a couple of sectors (Tech and Communications) are up handsomely over the same time period. Rather than chase returns there, I think buying beaten-down plays like Financials and banks is the right move at this juncture:

Sector Performance (Fidelity)

Again, there is some merit to this drop. By now I am sure readers are very familiar with the string of bank failures and volatility in the sector - both here and in Europe. This makes this type of loss very justifiable. I am not suggesting the negative headlines have not played an important role in getting where we are today. What I am suggesting is the drop seems a bit of an overreaction and that this sector is due for a recovery. While it may be bumpy along the way, there is value here I cannot ignore.

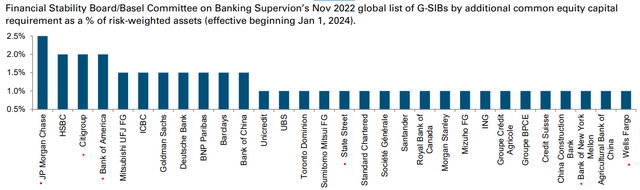

Part of the reason for this line of thinking - and why I like KBWB in particular - is that the biggest banks may actually see some benefits from this sector fallout. What I mean by this is consumers, households, and businesses may be unnerved from the news and volatility and look to put their deposits and otherwise give their business to the largest institutions. The logic being the bigger the bank, the safer it is.

There is support for this view. To understand why, let us take a look at who are considered the "systemically important" banks around the world. Of note, six of those listed happen to be top holdings in KBWB:

Global Banks Considered Systemically Important (Goldman Sachs) Top Holdings of KBWB (Invesco)

The takeaway here is that the top holdings in KBWB are some names that could actually see an inflow of fresh cash as a result of recent bank failures. Further, they remain important from the government's point of view - which means support will be there when they need it. Both of these factors convince me that buying in after such a big drop makes a ton of sense.

Top Banks Are Seeing Margin Improvements

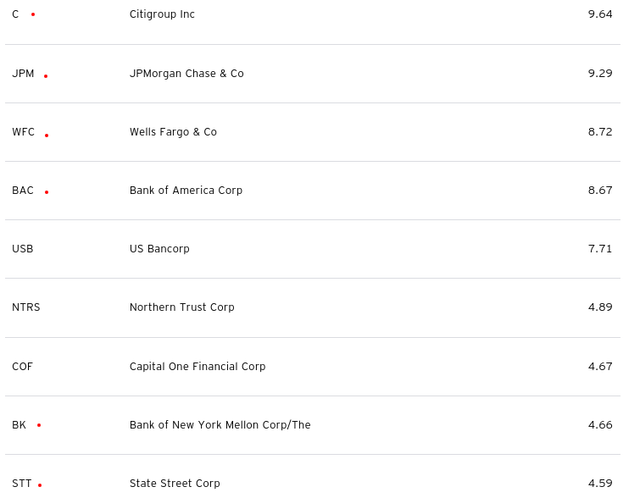

There are other reasons besides a correction and relative value that make me like this sector (and KBWB by extension). A key point is that the largest banks are actually benefiting from this higher rate environment. While the bank failures of First Republic and Silicon Valley Bank rattled the sector, let us not forget how the largest banks have been improving their interest margins as a result of higher rates courtesy of the Federal Reserve. For perspective, consider the year-over-year (expected) rise in net interest margins at the nation's largest banks:

Top Banks' Interest Margins (Est.) (Yahoo Finance)

To reiterate, these four companies collectively make up roughly 36% of total fund assets for KBWB. So to see them perform well is absolutely critical to understanding if this ETF is a good investment. For the time being, I see strong underlying fundamentals for these companies and want to continue owning them going forward. Using the bear market to buy them seems like an opportune way to go about it!

This Has Merit As A Dividend Play

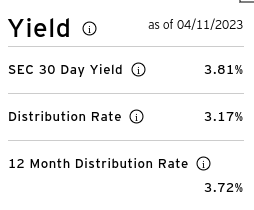

My next thought is a simple one so I won't spend much time on it. The topic is, however, dear to my heart. That is dividends, and KBWB has a reasonable yield at this juncture. This makes this is reliable income play for the moment in my opinion:

KBWB's Current Yields (Invesco)

While we can debate if this is really "high" or not, it does give investors some downside protection if the fund languishes or continues on a downward trend. It is pumping out a reasonable income stream, and that also supports the thought that this can be a longer term hold while we wait for a banking sector turnaround to materialize.

There Are Risks

Of course, KBWB is not a risk-free alternative. Quite the contrary. Recent performance should highlight that quite well! So I am not suggesting investors move all-in here or take unnecessary allocation risks. Do I see value? Absolutely. But buy selectively and don't get carried away due to the heightened risks in the sector. These include continued volatility with smaller, regional institutions, higher costs of deposits (which can pressure profits and earnings), a tightening credit environment, and lack of consumer confidence in the system. All this adds up to a more difficult investing environment. To be fair, however, this appears baked in to prices in my view given the 25% drop KBWB has experienced in the short-term.

Still, investors are likely to read a lot of negative banking sector stories going forward. That will cloud the investment landscape. But I generally subscribe to the notion that credit agencies and regulators are late to the game and are reactive, rather than proactive. That makes their "warnings" quite useless, in my view.

As an example, recently we saw Moody's downgrade the banking sector after the recent bank failures from First Republic and SVB. I'm not saying a downgrade is not justifiable - it very well could be. What I mean by saying is listening to Moody's isn't really that useful when they said nothing about potential for regional bank failures before these events happened!

Notice the date and realize what I am saying is probably true. These agencies almost never spot or prevent a crisis until it unfolds and the damage is done. Everyone is aware of the risks posed by under-capitalized regional banks now. Blasting out a headline like this may generate views, but it doesn't provide a lot of helpful insight.

My conclusion here is that I don't expect investor or regulatory confidence in the banking sector to shoot up overnight. But that is where the opportunity is. As long as there is a sentimental overreaction, we have the potential for a contrarian play. And that is precisely why I am a buyer here.

Bottom-line

The banking sector has come under some justifiable pressure and it has taken KBWB down with it. This has been a big loser for investors in the short-term, and undoubtedly is making many people cautious.

But in this environment, I see contrarian opportunity. The drop seems a bit too far, too fast, for what are some of the biggest brands in banking. They are not going away any time soon, and many top banks are seeing meaningful improvement in margins under the current rate environment. Furthermore, readers should note that while there is a lot of talk about "uninsured deposits", depositors are actually better off now - as a whole - then they have been in the past few years. This is in the sense that a lower proportion of total deposits are uninsured now than in 2020 and 2021:

Uninsured Deposits (US only) (S&P Global)

The overall view from me is the hysteria over large U.S. banks is disproportionate to the risks facing them. While smaller institutions are in real jeopardy of a loss of public trust (and by extension deposits!), the largest banks can benefit from this environment by attracting new dollars. KBWB fits in nicely with this thesis in that it holds the biggest names in a top-heavy allocation. Further, net margins are improving and the public really isn't at risk in terms of uninsured deposits in the way one might think by reading the headlines.

With all this considered, I see a buy case emerging here. KBWB has seen a sharp drop since my last article and looks much more appealing at these levels. Therefore, I am upgrading the fund to "buy", and suggest readers give the idea some thought at this time.

This article was written by

I've been an investor since 2008, which was an invaluable and humbling experience. This is central to my strategy of looking for quality, value, and diversification - generally staying away from risky/over-hyped ideas. I won't pump any investment nor discuss a topic I don't genuinely follow / research. In that spirit, I list my portfolio here for transparency.

I'm a native New Yorker and I work for a major U.S. bank. I escaped to North Carolina for graduate school and I don't see myself ever leaving. I was a D1 athlete in college (men's tennis) and compete competitively to this day. My Bachelor's and MBA are both in Finance.

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PCK, VCV, PML, BGT, PDO

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 25%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KBWB, VFH, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.