Representative image.

Bulls seem to be unstoppable as the benchmark indices continued their upward journey for the eighth consecutive session and closed at a more than seven-week high on April 12, ahead of CPI inflation numbers which came in at 5.66 percent for March against 6.44 percent in the previous month.

The BSE Sensex jumped 235 points to 60,393, while the Nifty50 climbed 90 points to 17,812, the highest closing level since February 21 and formed a bullish candlestick pattern on the daily charts. The index has also made higher highs and higher lows for the eighth day in a row.

The Nifty seems to have gathered strength recently by surpassing crucial hurdles like the previous opening downside gap of March 10 at 17,600 levels, downsloping significant trendline at 17,700 and now it has surpassed another hurdle of the previous lower top of March 6 at 17,800 levels.

This is a positive indication, and it signals the negation of larger degree bearish setup like lower tops and bottoms of the last 3-4 months, Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, he believes that any downward correction from here is likely to be a higher bottom formation and that could open a bullish chart pattern like higher tops and bottoms in the near term. The next upside level to be watched is around 18,200, whereas immediate support is at 17,700 levels, he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,744, followed by 17,718 and 17,677. If the index advances, 17,827 is the initial key resistance level to watch out for, followed by 17,852 and 17,894.

The Bank Nifty extended gains for yet another session, rising 191 points to 41,558 and forming a bullish candlestick pattern on the daily timeframe.

"Supports are gradually shifting higher and now it has to hold above 41,500 levels to make an up move towards 41,750 and then 42,000 levels, whereas on the downside support is expected to be at 41,250, followed by 41,000 levels," Chandan Taparia, Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

Per pivot point calculator, the Bank Nifty may take support at 41,394, followed by 41,328 and 41,222. Key resistance levels are expected to be 41,606, 41,672, and 41,778.

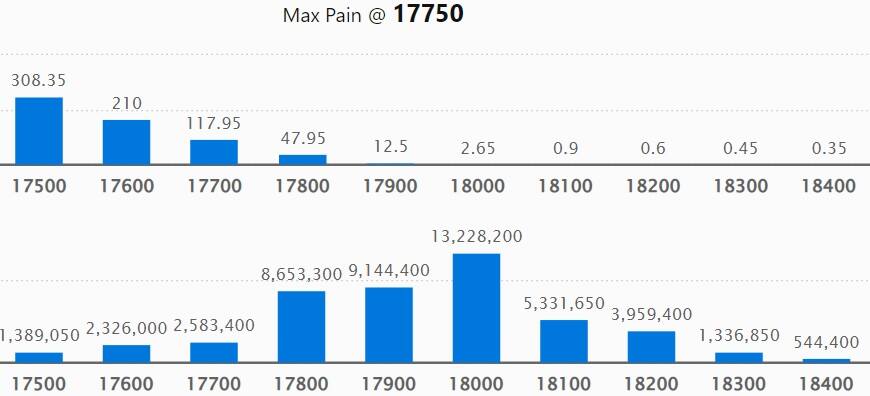

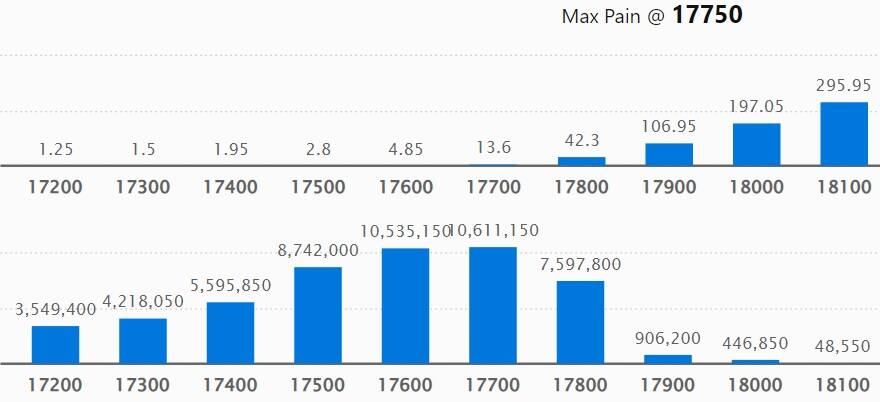

On the weekly options front, the maximum Call open interest (OI) was at 18,000 strike, with 1.32 crore contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,900 strike, comprising 91.44 lakh contracts, and 17,800 strike, with more than 86.53 lakh contracts.

Call writing was seen at 18,000 strike, which added 38.06 lakh contracts, followed by 17,900 strike, which accumulated 22.77 lakh contracts, and 17,800 strike which added 11.8 lakh contracts.

Call unwinding was at 17,700 strike, which shed 66.01 lakh contracts, followed by 18,600 strike, which shed 15.79 lakh contracts, and then 17,600 strike, which shed 14.11 lakh contracts.

The maximum Put open interest was at 17,700 strike, with 1.06 crore contracts, which is expected to act as support in the coming session.

This was followed by the 17,600 strike, comprising 1.05 crore contracts, and the 17,500 strike where there were 87.42 lakh contracts.

Put writing was seen at 17,800 strike, which added 57.14 lakh contracts, followed by 17,600 strike, which added 12.26 lakh contracts, and 17,400 strike, which added 8.04 lakh contracts.

We have seen Put unwinding at 17,300 strike, which shed 12.26 lakh contracts, followed by 17,700 strike, which shed 7.77 lakh contracts, and 17,200 strike, which shed 5.54 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Marico, Pidilite Industries, HDFC, Torrent Pharma, and Colgate Palmolive, among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 50 stocks, including Bajaj Auto, Alkem Laboratories, Divis Laboratories, IndiaMART InterMESH, and Granules India, saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 26 stocks, including Honeywell Automation, Kotak Mahindra Bank, Siemens, PFC, and ITC, saw a long unwinding.

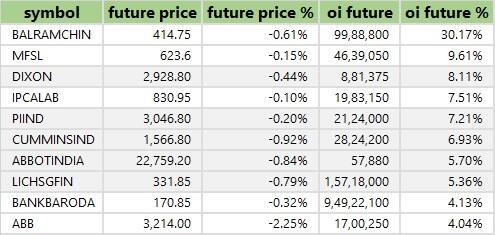

38 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 38 stocks, including Balrampur Chini Mills, Max Financial Services, Dixon Technologies, Ipca Laboratories, and PI Industries, saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 64 stocks were on the short-covering list. These included Delta Corp, Apollo Hospitals Enterprise, Vedanta, Laurus Labs, and HDFC AMC.

Bombay Dyeing & Manufacturing Company: Foreign institutional investor Nexpact Limited has bought 11 lakh equity shares or 0.53 percent stake in the company via open market transactions at an average price of Rs 76.87 per share.

Edvenswa Enterprises: Ace investor Porinjuv Veliyath has purchased 1.3 lakh equity shares in the information technology solutions provider via open market transactions at an average price of Rs 52.18 per share. However, Anjana Bhutna sold 2.55 lakh shares in the company at an average price of Rs 50.18 per share.

(For more bulk deals, click here)

Infosys: The software solutions provider will be in focus ahead of its March FY23 quarter earnings scheduled to be announced on April 13. Amalgamated Electricity, Avantel, Roselabs Finance, and Thirdwave Financial Intermediaries will also announce quarterly earnings on the same day.

Stocks in the news

Tata Consultancy Services: The country's largest IT services exporter has reported slightly lower than expected earnings for March FY23 quarter with consolidated profit growing 5 percent sequentially to Rs 11,392 crore led by other income. Consolidated revenue grew by 1.6 percent QoQ to Rs 59,162 crore with revenue in dollar terms rising 1.7 percent to $7,195 million and topline growth in constant currency 0.6 percent. On the operating front, consolidated EBIT rose 1.4 percent to Rs 14,488 crore with margin flat at 24.5 percent for the quarter. The company has announced a final dividend of Rs 24 per share. Meanwhile, the board has appointed K Krithivasan as MD and CEO of the company with effect from June 1, 2023 after the resignation of Rajesh Gopinathan.

HDFC Bank: The country's largest private sector lender has signed a Master Inter Bank Credit Agreement with Export Import Bank of Korea for a $300 million line of credit. The pact was signed at GIFT City, Gujarat. This will help HDFC Bank raise foreign currency funds which it would extend to Korea-related businesses.

Rail Vikas Nigam: The company has received a Letter of Award (LOA) from North Western Railway for the provision of automatic block signalling on Madar-Sakhun section (51.13 Kms) of Jaipur division. The order worth Rs 63.08 crore will be executed in nine months.

RITES: The state-owned company has received an order worth Rs 72 crore from Kerala Infrastructure Investment Fund Board. It will provide project management consultancy work to KIIFB.

AU Small Finance Bank: The Reserve Bank of India has approved the reappointment of Sanjay Agarwal as Managing Director and CEO, and Uttam Tibrewal as Whole Time Director of AU Small Finance Bank. Both are reappointed for three years with effect from April 19.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 141 crore from National High Speed Rail Corporation for the construction of training institute buildings at Vadodara. The total order book as on date stands at Rs 2,522 crore.

Anand Rathi Wealth: The wealth solution firm has recorded a 23.4 percent year-on-year growth in consolidated profit at Rs 42.7 crore for the quarter ended March FY23. Consolidated revenue grew by 27 percent to Rs 143 crore in the same period. For FY23, profit increased by 33 percent to Rs 168.6 crore and net revenue grew by 31 percent to Rs 549 crore compared to the previous year.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,907.95 crore, whereas domestic institutional investors (DII) sold shares worth Rs 225.22 crore on April 12, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has added Balrampur Chini Mills and retained Delta Corp to its F&O ban list for April 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.