March Inflation Report: Disinflation May Have Finally Arrived

Summary

- Disinflation is defined as a reduction in the rate of inflation, not to be confused with deflation (reduction in prices or negative inflation).

- March's inflation report finally showed notable progress on headline inflation.

- Two sectors came off of business cycle highs, but one area remained there.

- The Fed should continue to stay the course and not cut as they're finally starting to get results.

Ibrahim Akcengiz

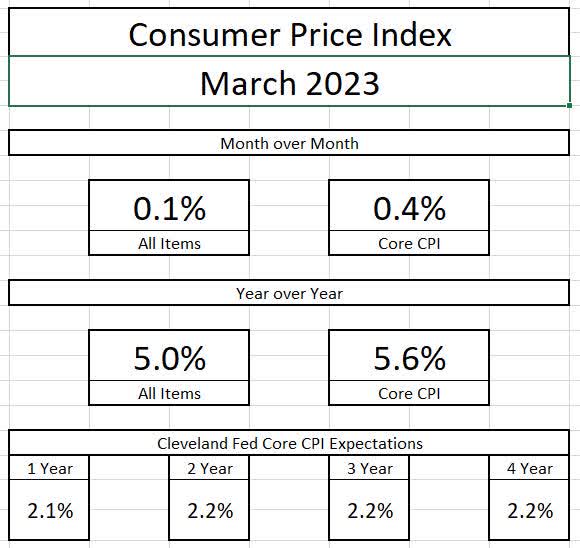

Earlier today, the Bureau of Labor statistics released the Consumer Price Index for March. Headline inflation rose 5.0% year over year, which was notably better than the 6% reading of a month ago. Core CPI, which is inflation without food and energy, was at 5.6%, a tick higher than the 5.5% recorded last month. Due to the 100-basis point drop in headline inflation, combined with headline dropping below core, I believe the Fed has finally achieved disinflation, but several sticky pricing items remain.

Bureau of Labor Statistics

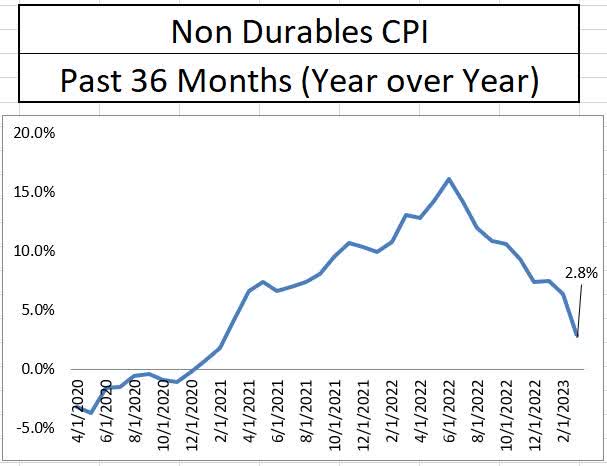

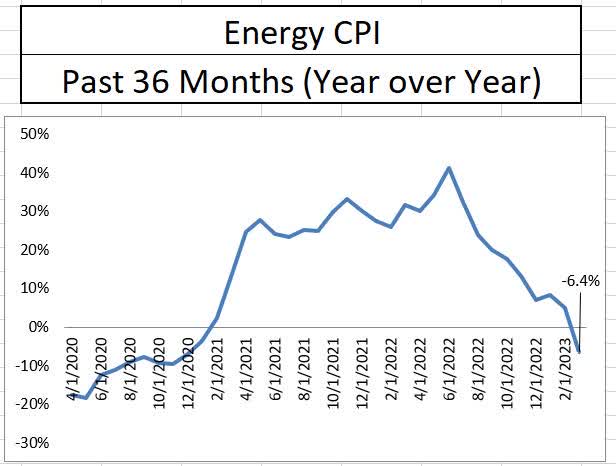

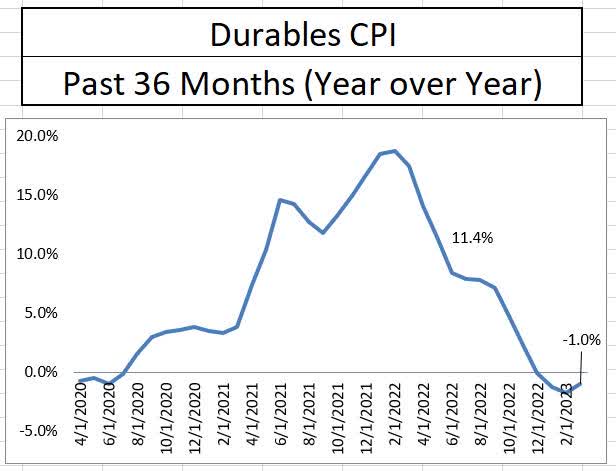

The drive to lower headline inflation was led by non-durable goods, which went from a 6.4% year-over-year increase to 2.8% in just one month. Energy, a component of nondurable goods, declined by 6.4%. While these may be considered by some to be one-off type numbers, it's important to note that the year over year price declines in durable goods have remained for four straight months, also helping to push inflation down.

Bureau of Labor Statistics Bureau of Labor Statistics Bureau of Labor Statistics

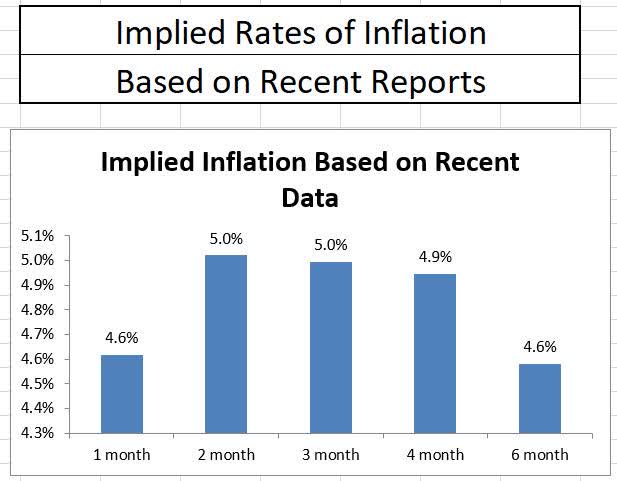

It also appears as if inflation will continue to decline in the near term as the 0.9% month over month reading of last May and 1.2% reading last June will roll off the annual inflation calculation over the next three months. By looking at nearer-term data, it appears as if recent reports would suggest inflation heading toward 4.6% with core inflation staying at or slightly above those levels.

Bureau of Labor Statistics

While the progress being made shows that the Federal Reserve rate hikes are working, it does not mean the Fed should reverse course anytime soon. There are still sectors of the economy that are contributing significantly to inflation. These sectors would become impossible to achieve price stability within should the Federal Reserve decide to reverse course.

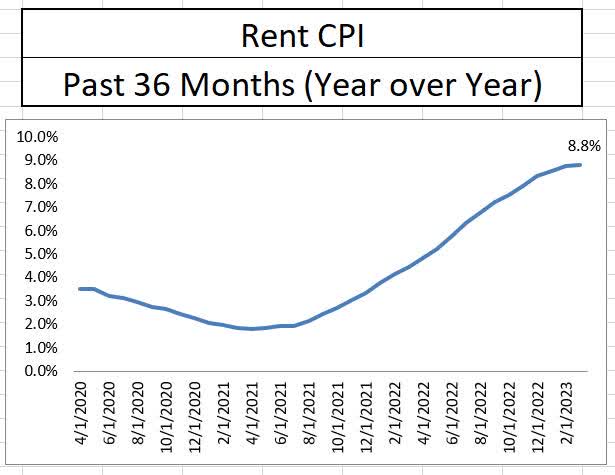

One area is housing, which despite a slight drop to 7.8% in March, remains above 7% for the tenth consecutive month and only 50 basis points off the business cycle high. Rent remains at a business cycle high of 8.8%. Should the Fed reverse course, it would make an already inflated asset bubble in the housing sector far worse.

Bureau of Labor Statistics Bureau of Labor Statistics

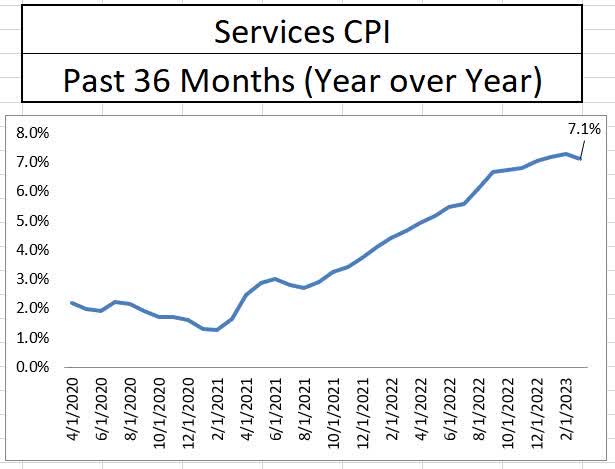

Like housing, pricing in the services sector remain stubbornly high. After recording a business cycle high of 7.3% last month, the sector finally saw a decline to 7.1% in March, breaking a streak of 18 consecutive months where inflation rose in the sector. Housing and services will be the two sectors I will continue to watch in future months as their direction will determine whether disinflation is in full effect.

Bureau of Labor Statistics

The market continues to hold onto the belief that the Fed will cut rates before the end of the year. Currently, the December contract for Fed fund futures implies between 1 and 2 rate cuts (of 25 basis points each) between now and the end of the year. This is almost 100 basis points higher than where it was at the height of the regional banking crisis, but the markets are still irrationally pricing in Fed easing.

Overall, I think we have finally turned the corner in the battle against out-of-control inflation. I think the Fed's forecast of one more rate hike, then hold is prudent to monitor the progress of overall pricing, but also to see if services and housing start to stabilize. While inflation stalling at 4% to 5% per year is a better scenario than 8% or 9% and rising, the Fed remains committed to the long term rate of 2% and policy will continue to be centered around that goal.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.