Is Intuitive Surgical An Intuitive Buy?

Summary

- Intuitive Surgical is the market leader for minimally invasive robotic-assisted surgery.

- The stock has retained a very high valuation even through the stock market troubles of 2022.

- We believe Intuitive is in the early innings of capturing market share.

MARHARYTA MARKO/iStock via Getty Images

An Intuitive Buy?

Intuitive Surgical (NASDAQ:ISRG) is an industry leader--arguably the industry leader--in robotically assisted minimally invasive surgery. The company offers two main systems, known as the da Vinci Surgical System and the Ion Endoluminal system. While the da Vinci can be configured into several models (the Xi, X, and SP, for example) and is used for a wide array of procedures, the Ion is largely used for lung biopsies.

The company's position as an industry leader and the quality of its robotics has propelled the stock to dizzying highs over the past several years.

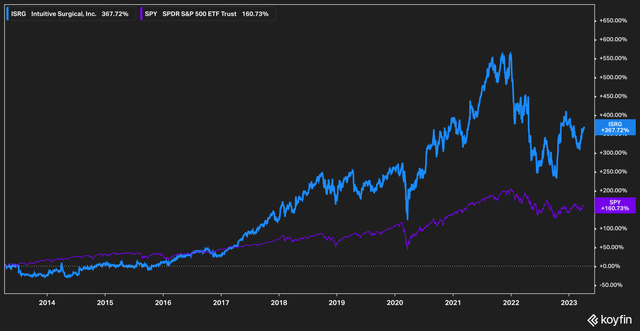

Over the last ten years the stock has handily beat the S&P 500 (SPY), delivering more than 350% versus the broader index's return of 160%.

This precipitous rise in price has also assigned the stock nosebleed valuations--the stock currently has a forward PE of 48x, which, in the current high-inflation, high-interest rate regime feels... precarious.

Understandably, investors are torn on how to approach Intuitive. Is the massive valuation justified? Does it pose too much of a risk for investors to buy in at these levels? These are the questions we want to address today.

Let's dive in.

Valuations

Prior to 2022 and the 'tech-wreck' that decimated the high-PE tech market, Intuitive's valuation would hardly have raised an eyebrow. The environment, after all, was incredibly growth stock friendly, and Intuitive, with its high multiples and strong growth prospects, seemed to fit right in.

In a way, though, it was unfair for Intuitive to be lumped into this bucket, given that so many other high-growth companies were flat out unprofitable. Intuitive, on the other hand, has been profitable for several years. The company also operates virtually debt-free, with total liabilities (liabilities, not debt) of $1.8 billion against total assets of $12.9 billion reported in 2022.

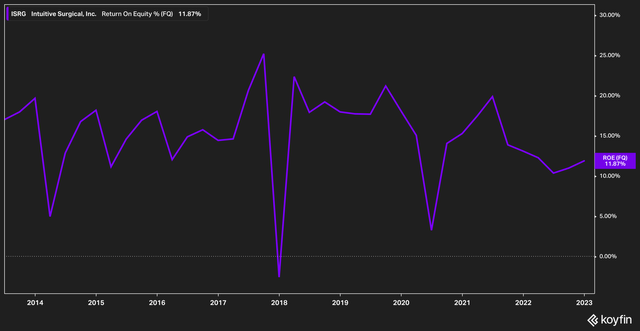

Against this capital structure, the company has been able to consistently deliver double-digit returns on its substantial equity.

This, to us, indicates a level of discipline uncommon among the ranks of corporate management. It also presents an analytical challenge because the company is such an outlier. It's quite unusual, after all, to find a company with a market capitalization approaching $100 billion that has zero debt and seemingly no appetite to take any on, which is also the clear market leader in its category.

For all this, the market has indeed ascribed the stock a massive premium.

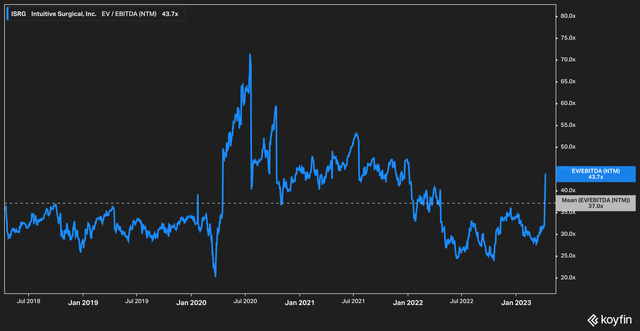

Over the last five years, Intuitive has traded hands at an average forward EV/EBITDA valuation of a whopping 37x. Today shares can be bought at just over 43x forward EV/EBITDA, just slightly higher than the average.

Assessing The Future

It is completely understandable that investors who, having watched their otherwise well-performing portfolios of growth stocks crumble over the last eighteen months, would similarly expect that some air is likely to be let out of Intuitive's balloon, so to speak.

However, in addition to a robust capital structure, we point out that Intuitive is indeed a profitable company, a leader in its field, and, importantly, has revenue expectations that have not diminished. Analyst expectations currently model low double digit growth for Intuitive over the next two consecutive years.

Moreover, while the competitive landscape is developing, it is still far behind Intuitive. In its 10-K, the company lists traditional, non-minimally invasive surgery as its greatest competitor. It does list companies that have begun to enter or have made explicit promises to enter the robotic surgery field, but by all indications Intuitive is the current leader in the field.

Intuitive's addressable market also does not seem to be at risk of decline. As populations age around the world while the number of doctors continues to decline, demand for telesurgery (a.k.a. remote surgery) is likely to grow exponentially, in our view. Options for remote surgery are slim, at best, and Intuitive's da Vinci is one of the only solutions currently available for this problem.

At the J.P. Morgan Healthcare Conference in January, CEO Gary Guthart noted that while China and the continued opening and health of its economy is very important to Intuitive's overall success, that the company has done quite well through the pandemic, posting an annual compounded growth rate of 15%.

What's more, Guthart stated that the company is focused on recurring revenue streams. Large, high-cost items like da Vinci machines (which can cost up to $2.5 million) are typically capital expenses for hospitals which results, naturally, in a one-time payment to Intuitive. Leasing those machines instead allows hospitals greater access to cutting edge technology while creating recurring revenue for Intuitive.

In 2022, 492 of the 1,264 da Vinci units that were sold worldwide were purchased under lease arrangements. While this opens up Intuitive to some credit risk, we believe that it's a very helpful way to gain market share and adoption of the da Vinci and Ion platforms.

Risks & The Bottom Line

The major risk to Intuitive is that a competitor product is launched which poses a somewhat immediate threat to either the da Vinci or the Ion's market share. We feel that this risk is limited however (or would at least take quite a bit of time to materialize) as it takes a long time for medical equipment to reach the level of adoption and familiarization that Intuitive's products have. The second risk we see is credit risk, as mentioned before. If Intuitive does not accurately assess the credit risk of the hospitals and organizations that it enters into lease agreements with, it could leave the company open to significant revenue shortfalls.

While the company retains a high valuation, we believe that investors with a long-term approach may find Intuitive Surgical appealing even at these levels. With no debt, a very large addressable market, and an industry leading position, we believe that Intuitive Surgical is worth a strong look from investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.