Essex Property Trust: The Best Time To Buy Apartment REITs Since 2008

Summary

- Apartment REITs have traded sharply lower due to the rising interest rate environment.

- Valuations for many are as attractive as they ever have been since the Great Financial Crisis.

- Essex Realty is a strong performer with a focus on the West Coast markets.

- Trading at a 4.4% dividend yield, Essex Realty stock looks like a buy.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Sviatlana Zyhmantovich/iStock via Getty Images

Essex Property Trust (NYSE:ESS) is an apartment REIT focused on the West Coast markets. ESS stock has traditionally traded at nosebleed valuations due its seemingly unstoppable business model, but the stock has slid amidst the rising interest rate environment. The stock price weakness may also be due to the potential for an increase of housing supply from a conversion of office real estate. Yet that pessimism looks overdone considering that cost to own versus cost to rent is already so much higher in ESS markets than others. The better argument might be whether or not ESS can reliably beat the market from here, but I can see the strategic case for owning the stock. I rate ESS a buy as the dividends make it easy to hold over the long term.

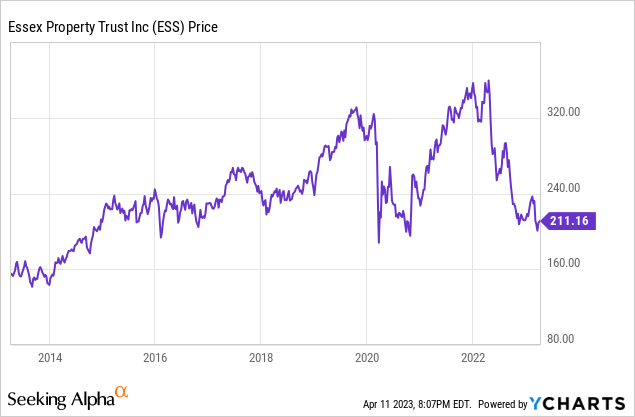

ESS Stock Price

After rebounding strongly from pandemic lows, ESS has now found itself trading back to those levels as rising interest rates took its toll on its valuation.

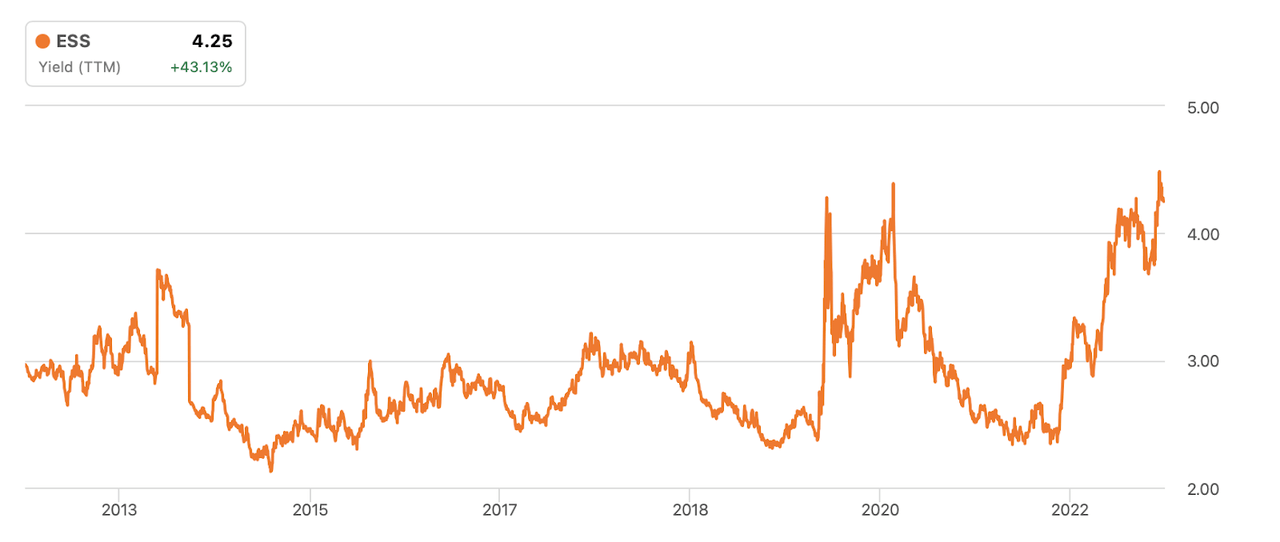

I last covered ESS in September of 2020 where I rated the stock a buy on account of its 4% dividend yield. The stock has since returned 8%, greatly underperforming the 22% return of the broader market. With the stock now yielding around 4.4%, this is as good time as any to buy.

ESS Stock Key Metrics

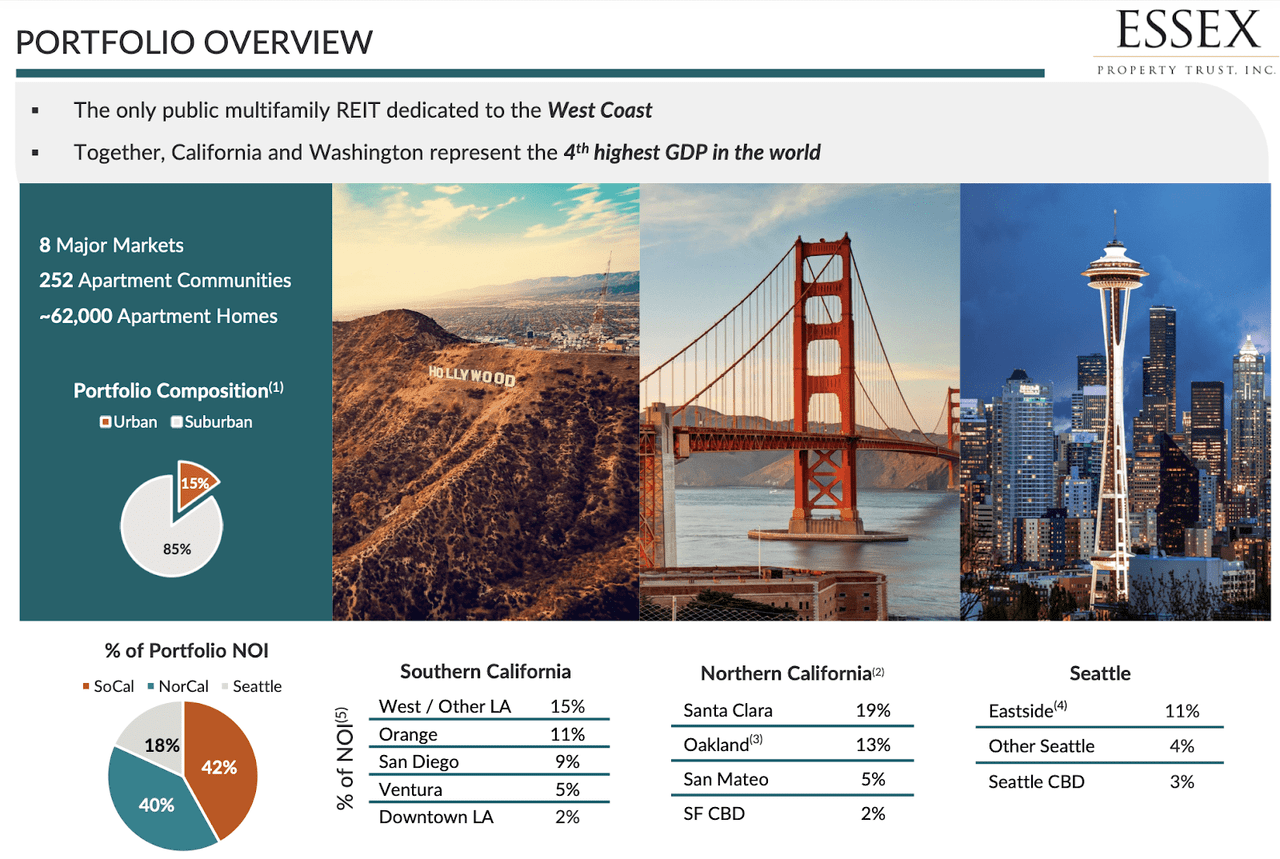

ESS is an apartment REIT focused on the West Coast with 82% of its portfolio being based in California and the remainder in Seattle.

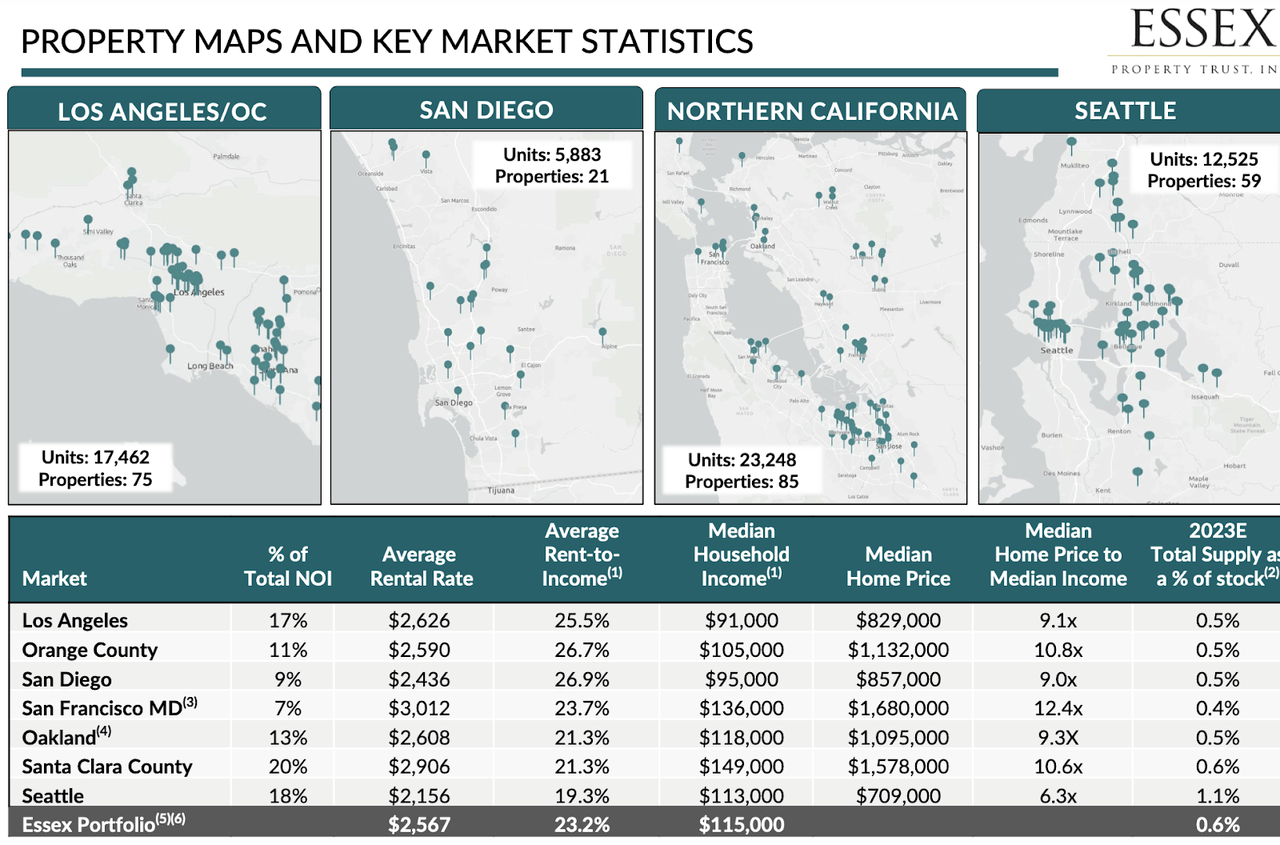

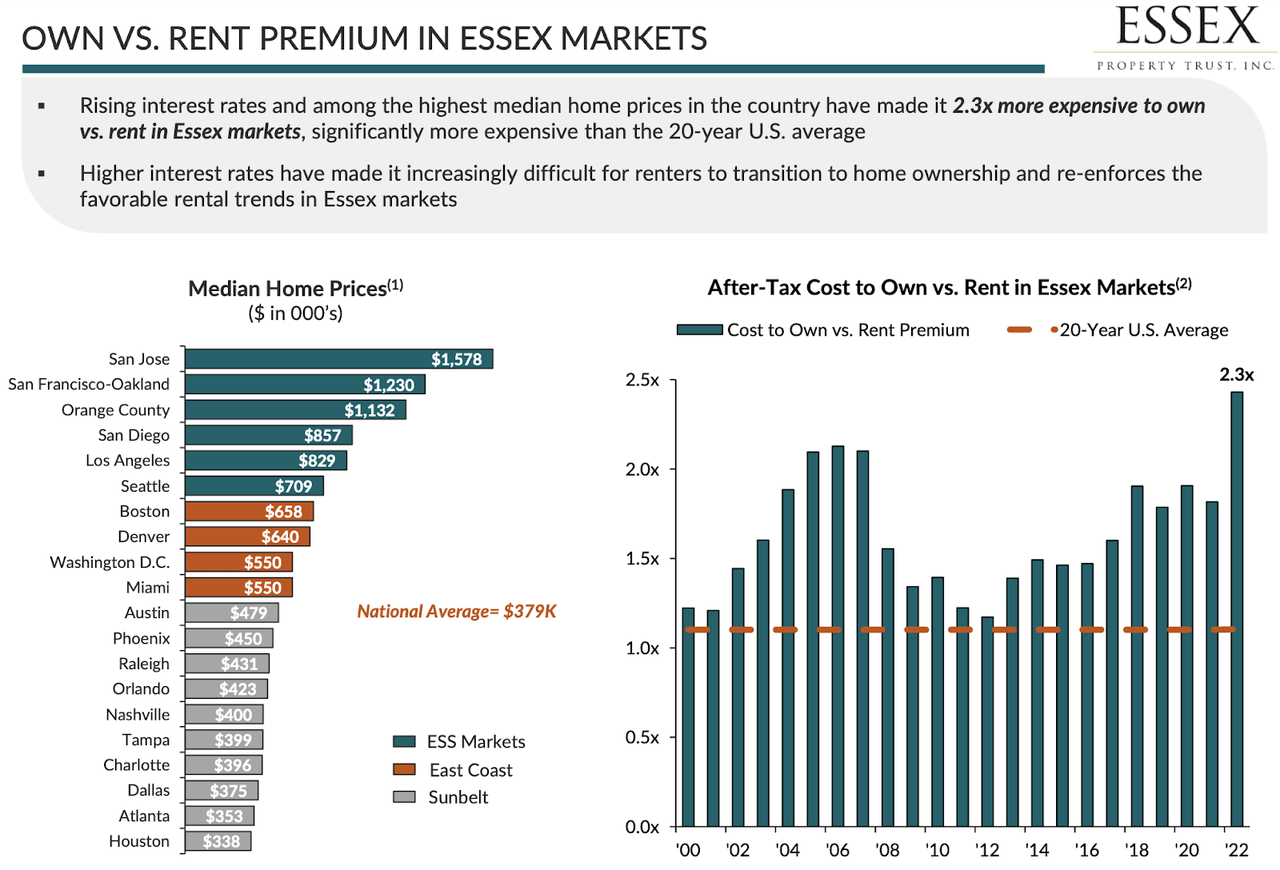

We can see below that ESS has intentionally focused on regions where the cost to rent is highly competitive relative to the cost to own. The rising interest rate environment has only improved that dynamic.

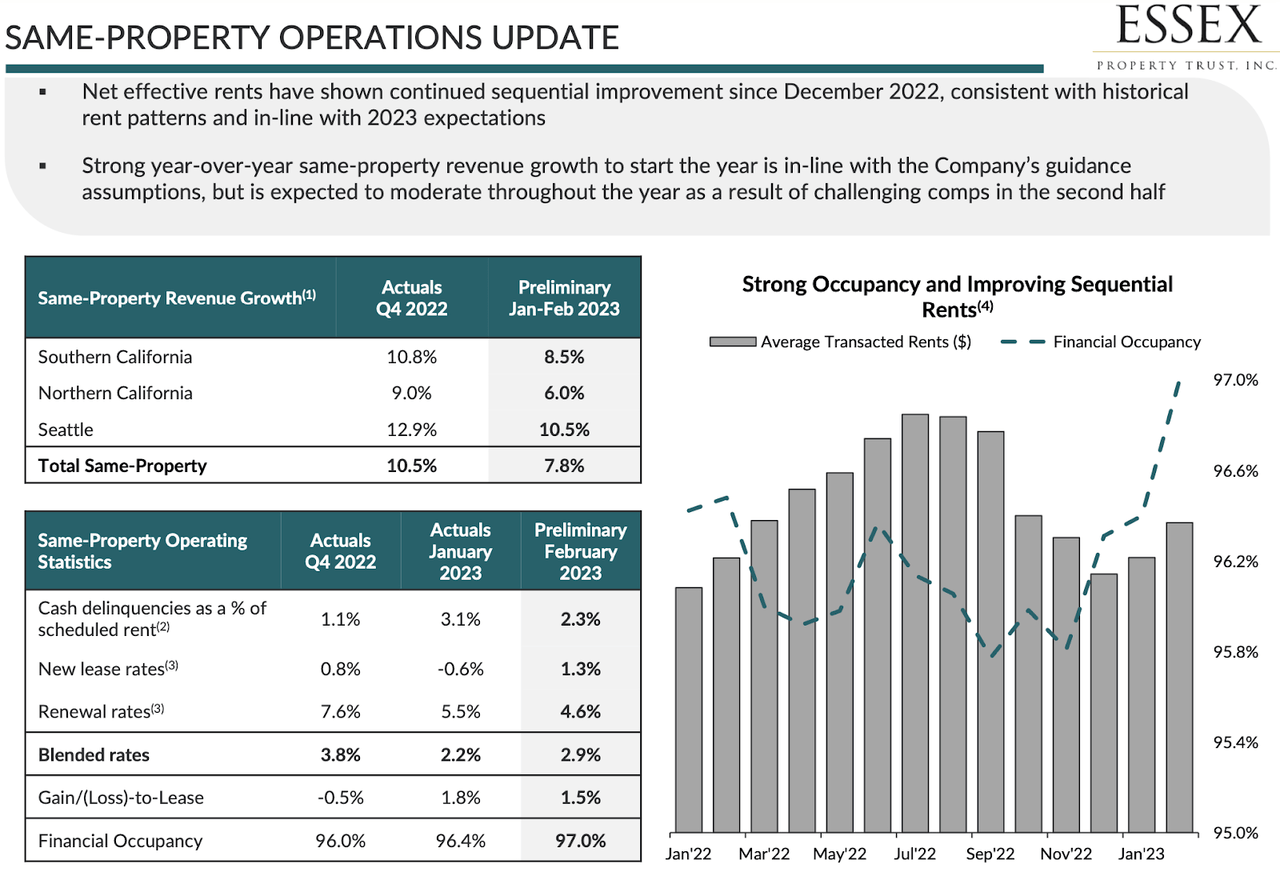

While ESS’ stock price has seen great weakness over the past year due to rising interest rates, the fundamental performance remains quite strong. ESS continues to drive solid rent increases with financial occupancy also trending higher.

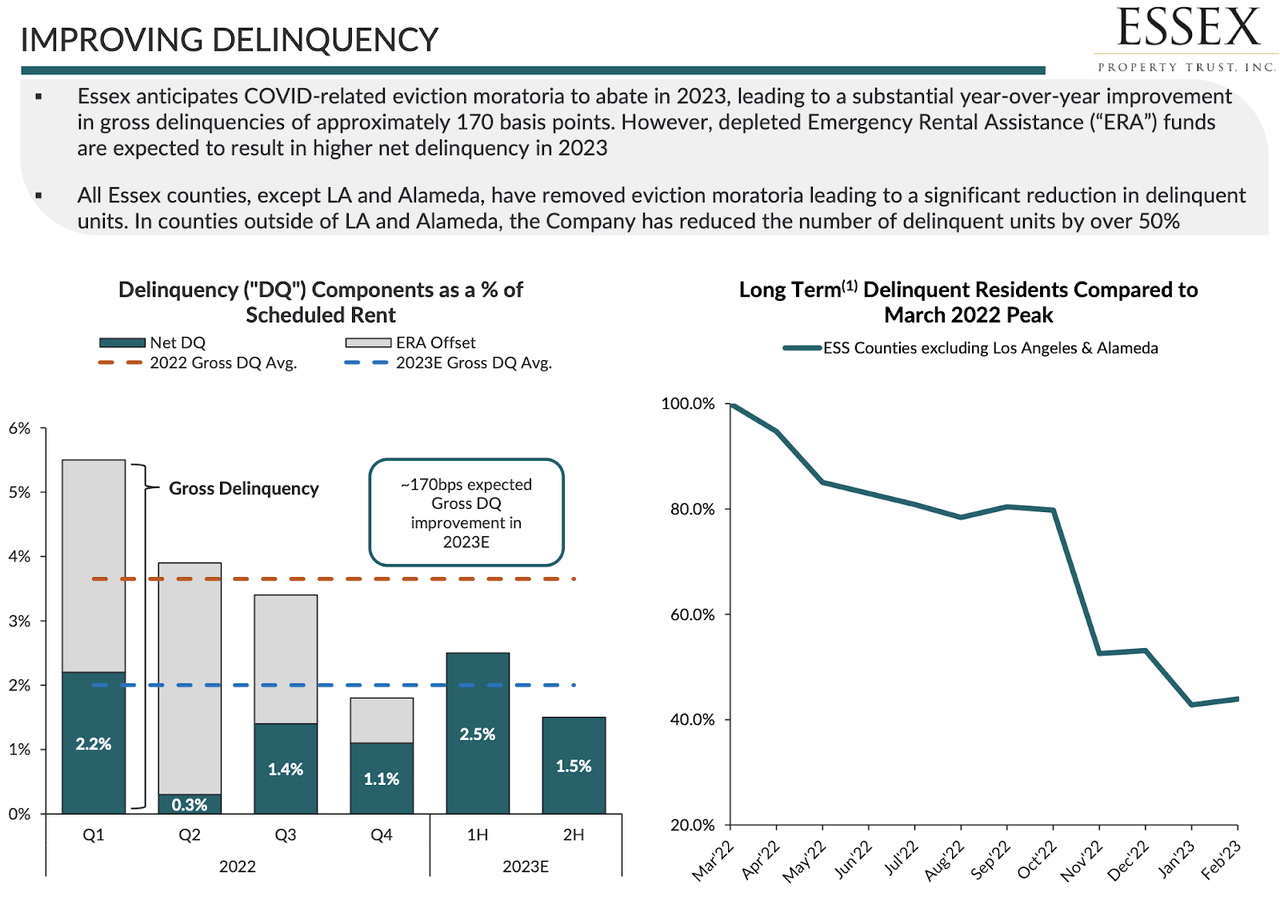

Some investors may be wondering about how the expiration of COVID-related eviction moratoria will impact ESS. ESS expects that expiration to reduce gross delinquencies by around 170 bps but for some of those gains to be offset by depleted Emergency Rental Assistance (‘ERA’) funds, leading to higher net delinquencies for this year. I expect these headwinds to prove near term in nature considering that apartment leases are typically 1 year or less.

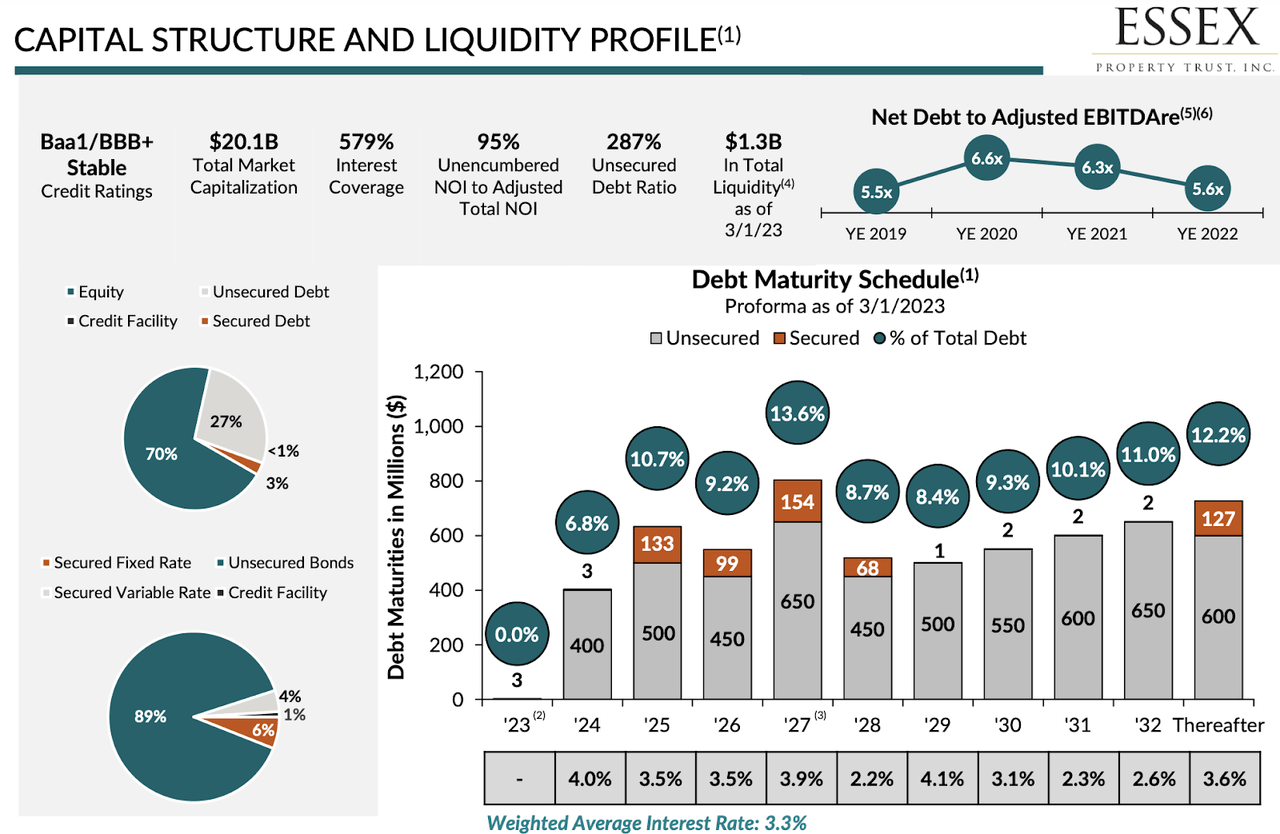

ESS has a solid balance sheet rated BBB+ or equivalent by the credit rating issuers. The debt maturities are well staggered, meaning that the rising interest environment will not lead to an immediate increase in the overall cost of capital. It is worth noting that the 5.6x debt to EBITDA ratio is notably higher than the 4.0x to 4.4x ratio seen at some peers.

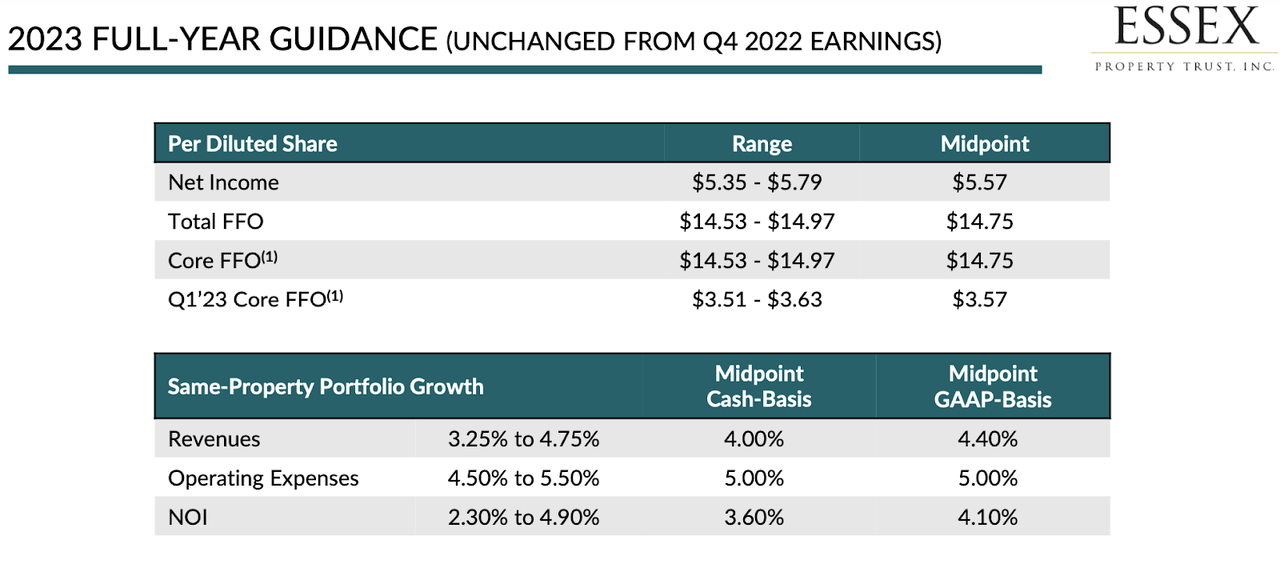

Looking ahead, ESS has guided for up to 3% growth in core FFO per share in 2023, as strong same-property portfolio growth is expected to be offset by inflationary pressures and the rising interest rate environment.

Is ESS Stock A Buy, Sell, or Hold?

This might be an amazing time to buy ESS, if you are one to care about historical valuation. ESS is trading at its highest dividend yield over the past decade inclusive of the pandemic crash.

Many apartment REITs are actually trading just around where they did in 2007. ESS is one of the few trading at materially higher stock prices, but it should be noted that the valuation has improved greatly. Whereas ESS was trading at around 26x FFO in 2007, that multiple has compressed to around 14.2x today.

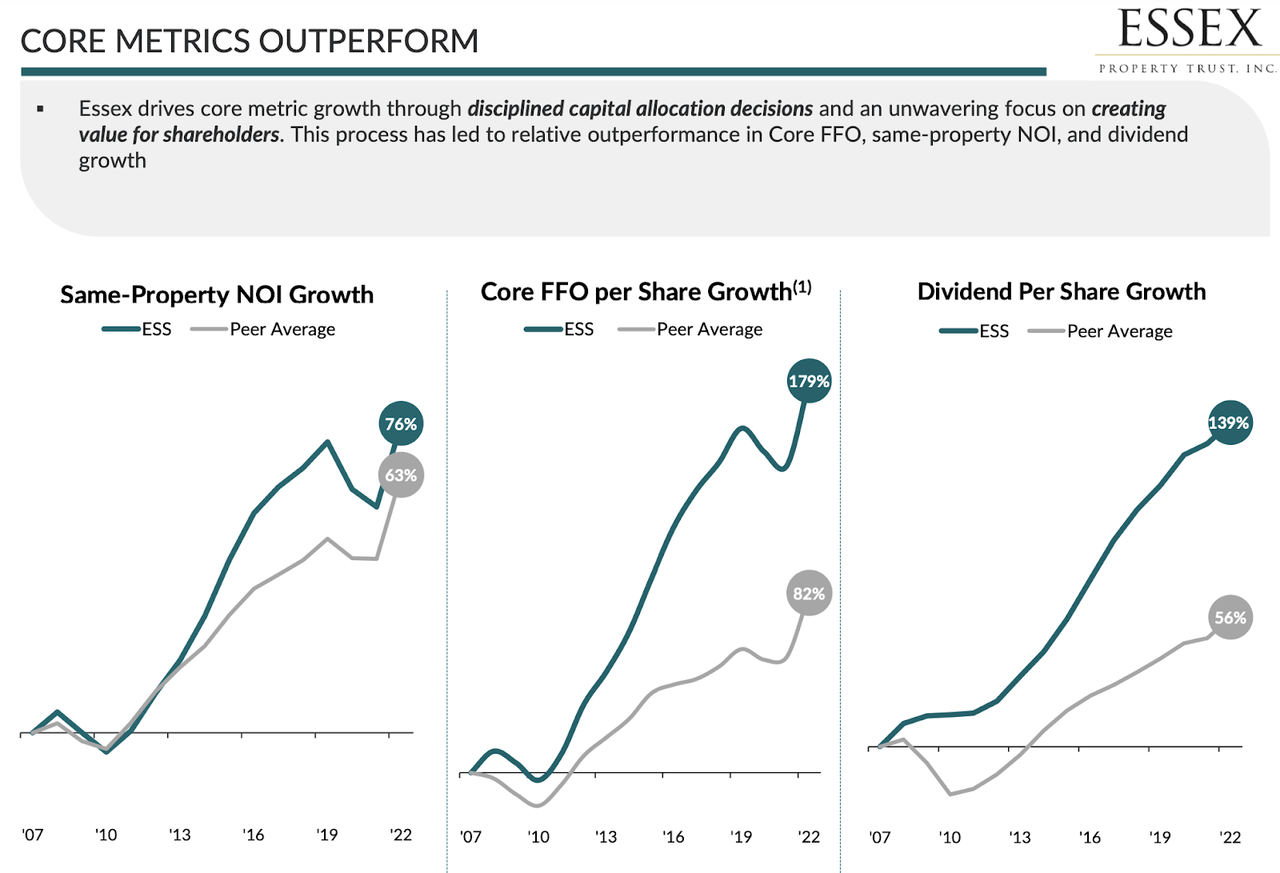

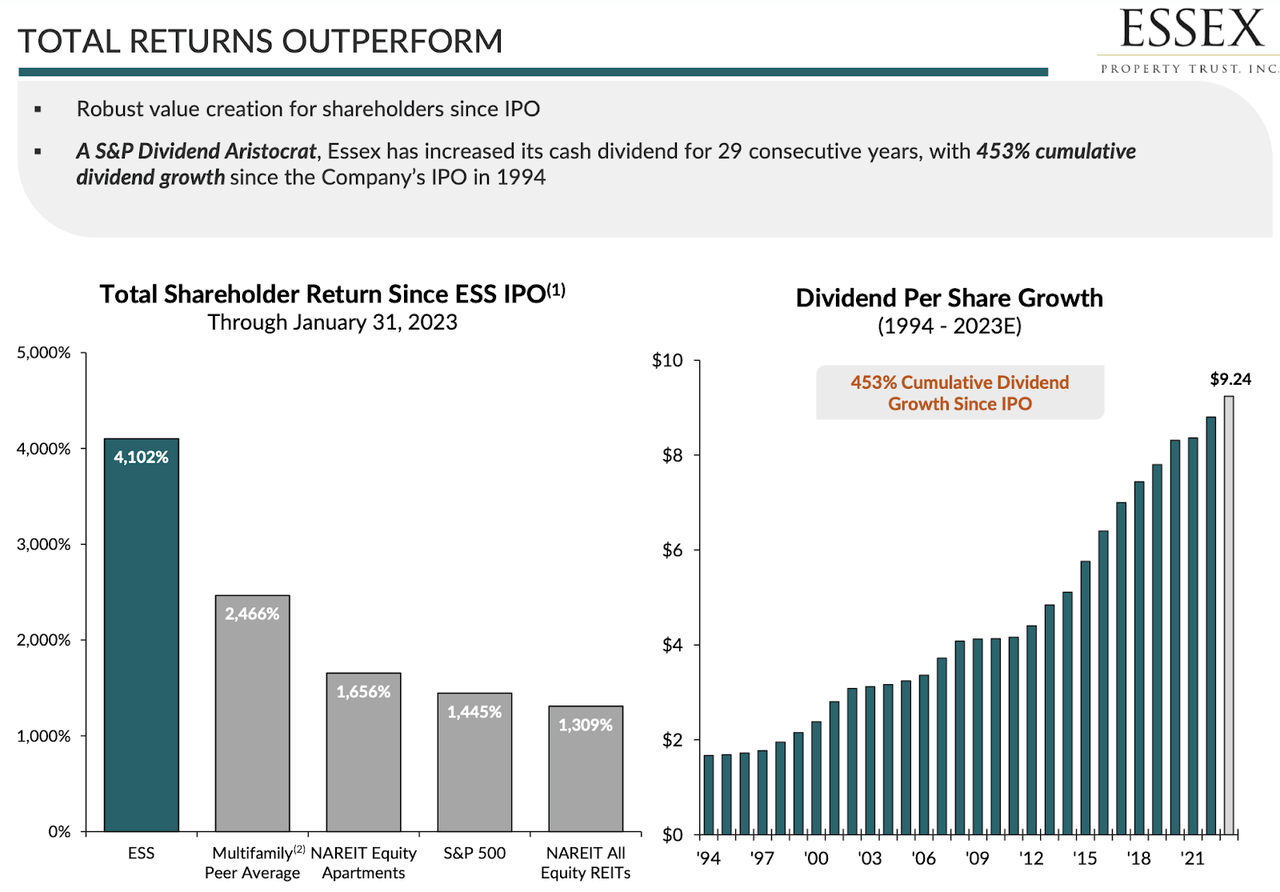

The outperformance relative to peers is mainly due to the fact that ESS has delivered substantially stronger cash flow and dividend growth.

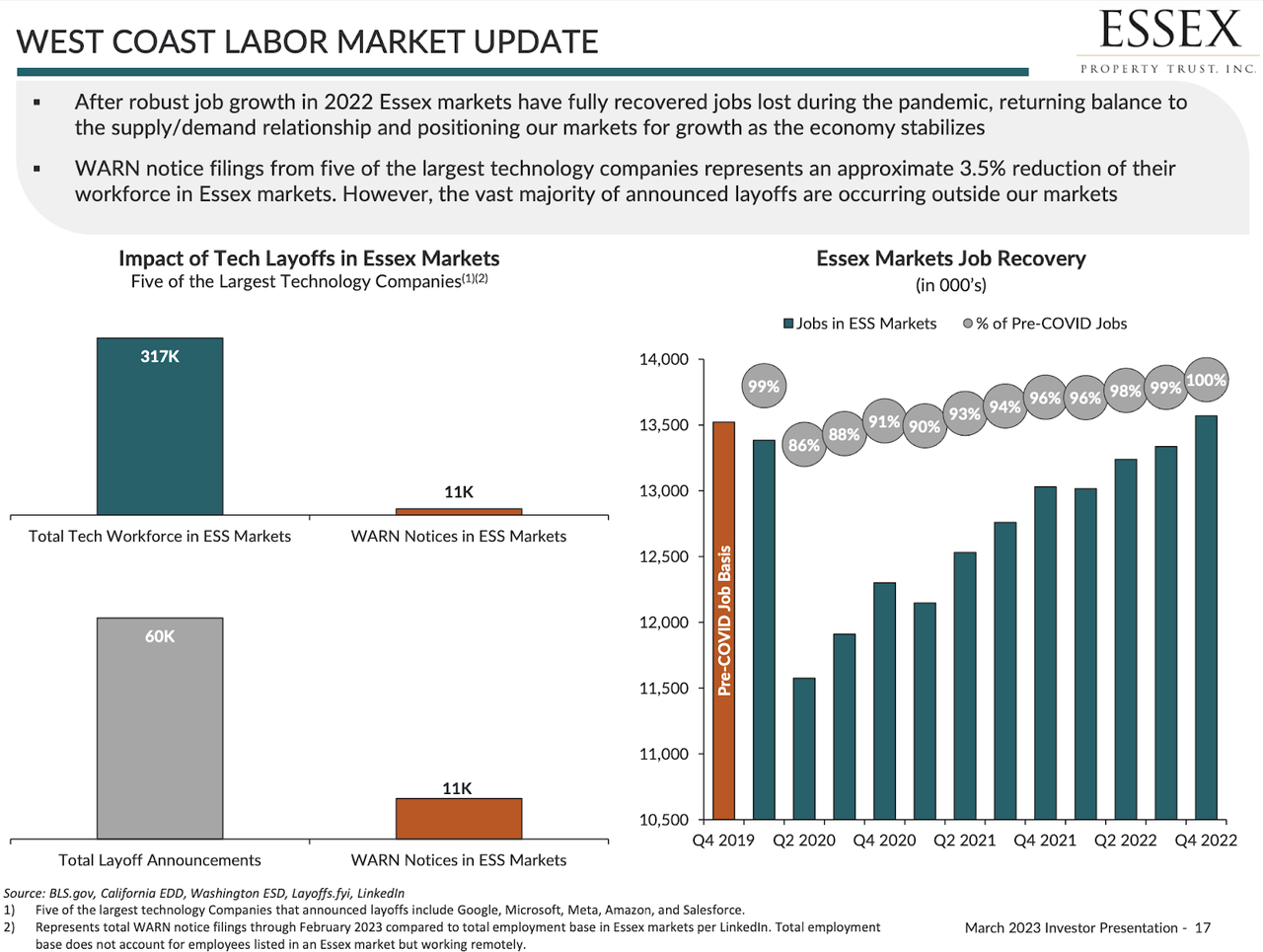

Let’s now discuss the key risks. I have already discussed the rising interest rate environment and how that may lead to rising interest expenses over time as the company refinances maturing debt. A risk that has emerged in recent quarters has been the potential for downside surprises due to ongoing tech layoffs. ESS, however, notes that its markets have experienced a strong recovery in job growth, fully recovering the jobs lost during the pandemic, and the tech layoffs have not yet led to a material impact to ESS markets.

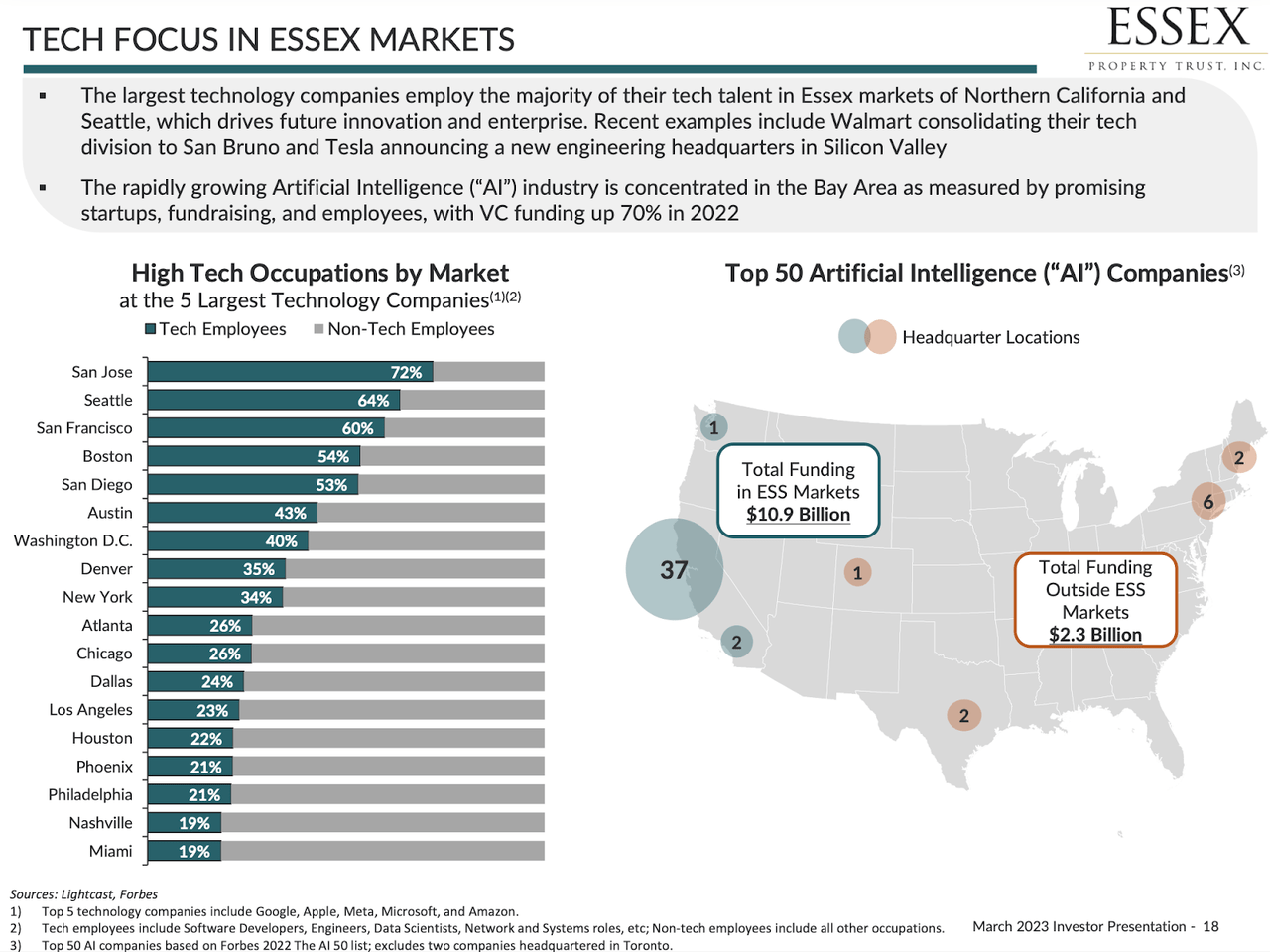

I can believe that narrative, as I find it likely that laid off employees will aim to find new employment around the same region to avoid moving their families around. That said, ESS has also issued the following slide which seems to tout the company’s exposure to artificial intelligence.

Investors may have grown wary of companies trying to ride the artificial intelligence craze of 2023 and ESS is definitely a surprising participant in such an endeavor. But alas, I may be nitpicking.

It bears repeating that ESS is focused on markets where the cost to own is very high, so much so that the cost to own versus renting in ESS markets is 2.3x more expensive than the US average.

A crash in real estate prices will obviously do much to reduce that discrepancy, but as someone in the market to buy in these regions, I can say that such an event may be nothing more than a pipe dream due to the low housing supply in California.

It is possible that the valuation remains elevated in spite of the vicious underperformance over the past year. ESS has a long track record of dividend growth and that may be positively impacting valuations.

In particular, I wonder if ESS should be trading at a greater discount to apartment REIT peers considering that it has materially more leverage on its balance sheet.

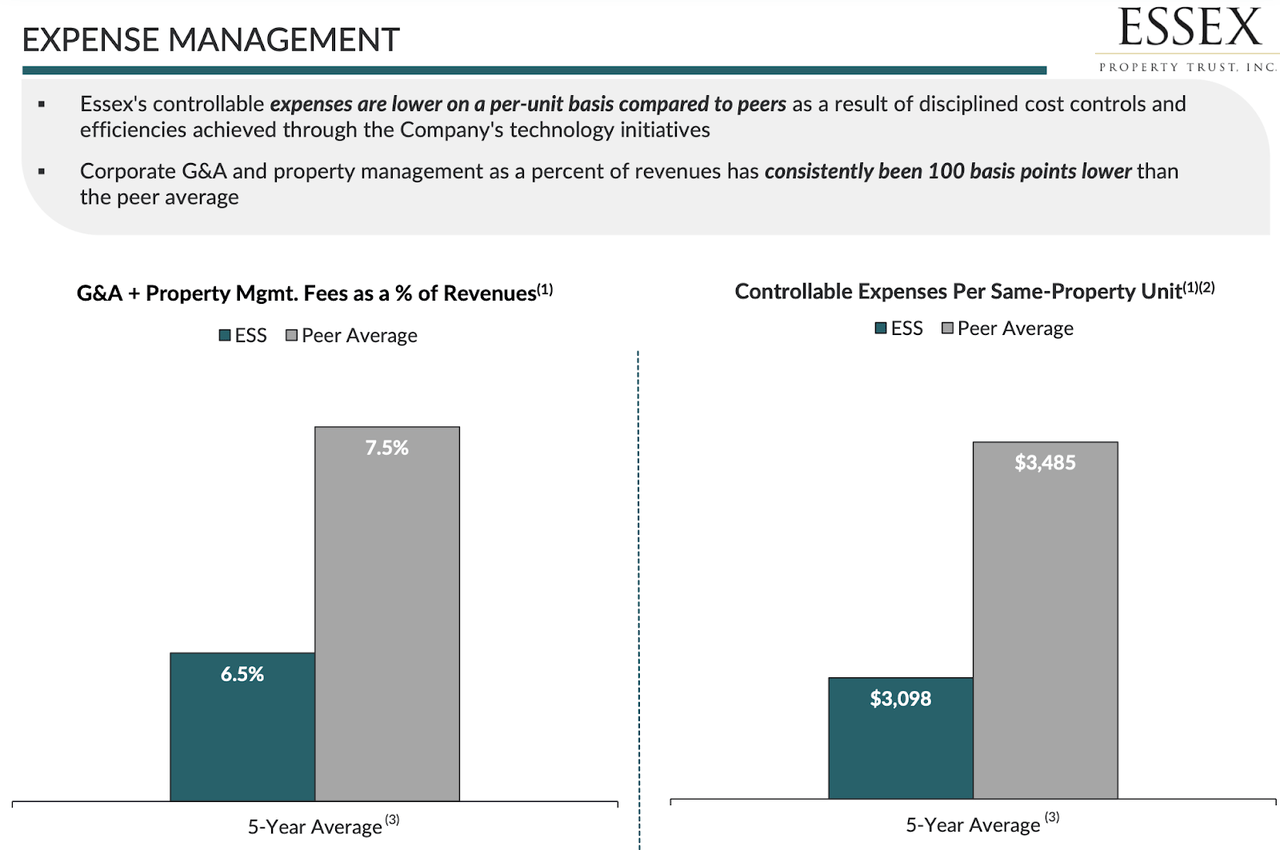

A final risk lies in the driver of ESS’ outperformance relative to peers. It is possible that ESS is running too lean of an operation. ESS touts its expense management relative to peers as being a positive, but this might simply be a sign of underinvestment.

A quick Google search of reviews for ESS properties was not promising, but that is anecdotal evidence and I am admittedly not an expert by any means on assessing the relevance of apartment reviews. ESS has sustained high occupancy in spite of apparently negative reviews and that is arguably most important.

On a closing thought, one could make the argument that ESS might not beat the S&P 500 from here. In the absence of multiple expansion, the 4.4% dividend yield might lead to only 7% to 8% total returns inclusive of dividend growth. That might be enough to only keep up with the S&P 500 in normal years, but the S&P 500 has pulled back significantly from recent highs and may surprise to the upside. There is however the possibility that ESS delivers unique upside as part of a “flight to quality” trade, which might occur if economic conditions worsen. I can see ESS trading up to 22x FFO or higher, representing 50% upside from multiple expansion alone. One might also be considering to own ESS as part of a fixed-income strategy which might not be comparable to the S&P 500.

Due to the high likelihood of positive forward returns, I rate ESS a buy as the historically low valuations appear to set up an attractive entry point.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ESS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.