UNG: Bullish Opportunity Grows As Energy Producers Race To Cut Output

Summary

- Since 2020, natural gas has gone from extreme lows to unsustainable highs and back to extreme lows.

- Huge volatility in gas prices should spur output reductions, as most drillers failed to hedge after the price spike last year.

- UNG still faces significant contango risk, but prices are so low today that a bullish position may be worth taking.

- The re-filling season delay (due to colder March weather) may cause storage levels to return to seasonal averages by June.

- Potentially significant US gas output cuts could cause the market to fall back into a shortage by next year, justifying higher futures prices.

deepblue4you

The natural gas market has faced tremendous volatility over the past year. Last spring, US natural gas prices were the highest in many years as growing low domestic production levels and a surge in European import demand created a significant shortage. Natural gas was near $10/MMBTU through the summer of 2022 but is now down to around $2.10/MMBTU, a staggering ~80% decline in only a few months. Today, natural gas prices are floating around the lows set in 2020. They are well-below breakeven prices for most producers, causing many to reduce drilling levels and lowering future output potential. Looking forward, we may see a buying opportunity developed in the popular natural gas futures ETF (NYSEARCA:UNG).

Around the end of last summer, I took a bearish outlook on UNG as it seemed likely that natural gas prices would not sustain extreme highs as US production grew and Europe's market turmoil normalized. The ETF declined by around 76% as the market shifted sharply from a shortage to a glut. I covered the fund again in February, indicating that natural gas prices were likely near the bottom. However, UNG was still best avoided due to its immense contango risk - or futures being priced above the spot price (causing futures to lose value as they expire). UNG has formed a bottom since, although it is down around 20% as gas continued to slide, and contango caused UNG to decay faster. Today, I believe the fund is reaching a firm bottom where it may be a speculative buying opportunity despite its existing contango risk.

Natural Gas Producers' Race To Lower Output

In the US, natural gas drilling becomes unprofitable as the commodity falls below $3/MMBTU. The breakeven price has risen considerably over recent years due to the sharp increases in labor, materials, and financing costs. Most gas drillers are not using hedges today due to immense losses on such contracts in 2021-2022, meaning some are losing a great deal of cash today and are likely struggling with financing issues. Earlier, higher oil prices offset low gas prices, but crude oil is also back near breakeven levels, so energy producers cannot profit from new drilling.

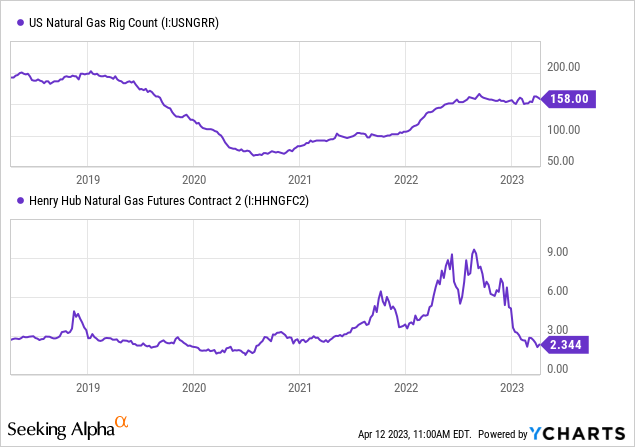

As you can see below, the natural gas rig count has leveled off following the recent declines in prices:

I expect the natural gas rig count will fall faster over the coming months if gas remains below ~$3.5/MMBTU. Over time, this will likely drive production levels much lower; however, US natural gas output is much higher today than it was in 2019 (before the 2020 crash), while demand is equal if not lower (due to rising household energy rates), meaning it may take time for the market to fall back into a net shortage.

Of course, there's the outstanding wildcard factor from European demand, which was largely overestimated by many investors last year due to LNG output and import limitations. The recent reopening of the large Freeport LNG export plant is likely a factor that has caused natural gas producers to maintain drilling levels in expectation of increased demand. However, after its recent reopening, the Freeport LNG plant has received relatively low volumes amid lower-than-expected demand in Europe.

Crucially, natural gas storage levels in Europe are high today by seasonal standards despite the loss of Russian fuel sources. Europe's natural gas prices are now around $11.5/MMBTU (or 43 EUR per MWH), making LNG importing largely unprofitable, dragging US prices as export demand falters. Many speculators expected immense increases in US prices as the US "offset Russian gas"; however, that is impossible mainly because there are insufficient LNG tankers to offset the volume from Russian pipelines. That said, Europe did manage to secure immense volumes from Norway and the Middle East (which, more often, ship toward Asia), while Asia bought more from Russia. Thus, the supply cuts from Russia to Europe did little besides causing prices to drive through inefficient trade routes.

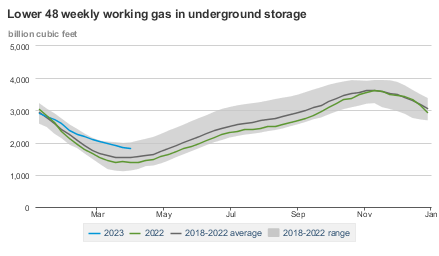

Additionally, Europe and North America used far less natural gas over the winter due to the highly abnormal warm conditions that lowered heating demand. This is likely one of the most critical factors in assessing the market today, as spot prices are not expected to sustain today's extreme lows as the re-filling season begins this month. As you can see below, US storage levels are very high by historical levels on a seasonal basis:

E.I.A natural gas underground storage 2023 vs. Historical Average (Energy Information Administration)

While the US has a significant storage glut, the level is drawing longer than usual. Storage usually bottoms around mid-March but has not bottomed by mid-April due to abnormal cold conditions in most of the US (particularly the West Coast). This is mainly due to the "Sudden Stratospheric Warming Event" that sent cold polar air (which was "trapped" over winter) down toward North America and Europe. Looking forward, natural gas demand should still decline as warmer spring weather returns; however, it may push gas storage levels back toward the normal seasonal range by May.

Natural gas is likely underpriced today, even with the primary storage surplus. See below:

E.I.A Natural Gas Stocks vs. Henry Hub Price (Energy Information Administration)

Over the past eight years, natural gas ranged from ~$1.7/MMBTU to ~$3.1/MBTU when gas storage levels had a ~370 BCF storage surplus. However, a $2 to $3 range is more typical due to the outliers created in 2019. At $2.1, the spot price for natural gas is on the shallow end of that range today, particularly considering gas production costs have risen considerably over the past eight years, meaning prices "should" sustain higher levels. Based on slightly abnormal cold spring weather today and the decline in drilling activity, we will likely see the market shift back toward a normal range by May-June, implying a fair-value spot price of around $3.

Taking a longer-term outlook through the end of 2023, I believe we may see the natural gas market swing much higher. In my view, natural gas drillers overreacted to the Russian conflict catalyst by over-anticipating US demand and causing prices to rise to unsustainable levels. However, the fact remains that even if Russia's conflict ends, Europe will have limited access to its natural gas due to the destruction of Nord Stream 1, creating a (relatively) permanent rift in the market. While this is not a huge demand driver for the US, it may become more critical as European prices collapse, meaning it may not receive sufficient volumes during the re-filling season. The same issue may occur in the US, where prices are far too low for energy companies to sustain output, causing them to reduce production with little thought to future demand changes.

This issue can be summarized as an "overreaction to underreaction" issue. The US and European leaders pleaded with energy producers to increase gas output dramatically last year due to lost Russian resources. Energy producers delivered and are now paying a steep price as gas plummets below breakeven levels. Looking forward, I believe energy companies may underestimate this demand issue due to significant financial losses this quarter, potentially creating a large production decline during the re-filing season and spurring a more considerable shortage by next year. Of course, this is a speculative outlook, and drillers may maintain output levels due to a bullish outlook; however, historically, energy producers usually overreact to lower prices by slashing production too quickly (see 2020).

Understanding Contango Risks Today

If UNG were indexed directly to the natural gas spot price, it would be a no-brainer buying opportunity today. Natural gas appeared relatively cheap at $2.5 two months ago but is unbelievably cheap at $2.1. Prices seem low due to potentially excessive short-selling volumes that have artificially lowered front-month prices. Gas has popped higher over the past week as traders raced to cover short positions, indicating this factor may not negatively impact prices going forward. This coincides with the beginning of the re-filling season, which often creates strong price floors or ceilings.

Unfortunately, unless you can buy and physically store natural gas in tanks, there is no way to invest directly in natural at spot prices. Each month, UNG purchases front-month contracts that lose value as they reach the expiry. Looking six months out, Henry Hub's October contract is priced at $2.67 today, or 26% above the spot price. The April 2024 contract is $3.37, or 60% above today's spot price. As such, natural gas's spot price must rise by 26% (to $2.67) by October for UNG to sustain its current value and 60% by next year. If spot prices fail to rise, then UNG will decay in value as contracts decline as they expire.

Of course, the immense contango in the natural gas market is a double-edged sword. In the immediate term, it creates substantial decay risk for UNG, which is why the fund has lost nearly all of its value since its inception. However, contango also implies the market is in a near-term glut that is expected to end quickly. Put simply, the futures market is anticipating normalizing natural gas supply and demand by next year. If either high production levels or weather abnormalities cause the glut to remain, then UNG will decline as normalization fails.

Of course, the more extended gas remains this cheap, the more likely gas producers will overreact by slashing production excessively. Importantly, it is easier for natural gas drillers to reduce production than to increase it. For example, in 2020, many halted wells when prices collapsed, taking around 18 months to re-start most (causing the shortage in 2022). Accordingly, today I believe it is more likely that the natural gas market will normalize by summer, potentially falling back into a shortage by year-end if the re-filling season goes as expected with production cuts. If so, then I believe natural gas spot prices will rise faster than anticipated in the future curve, potentially causing UNG to appreciate considerably.

The Bottom Line

Overall, I am slightly bullish on UNG and believe it may be a good time to dip my toes back into the ETF. When I covered the fund last, most of the chaos in the natural gas market appeared to be settling, but not enough to offset the large contango priced into the futures curve. Today, I would be quite surprised for natural gas spot prices to continue declining below $2, which could cause bankruptcy for many drillers if sustained. Looking at the weather pattern, it also seems possible that the more excellent March and April weather may cause the storage glut to normalize by June. Accordingly, at the least, I expect natural gas spot prices to rise at the pace priced-in to the futures curve, likely limiting the contango decay potential in UNG.

In an ideal scenario, US natural gas producers will aggressively reduce drilling over the next two months due to low prices and, more importantly, low LNG demand from Europe. Of course, by next winter, I expect Europe's LNG demand will rise again due to the loss of Russian sources. While natural gas appeared overvalued last fall, it would be much higher today across the Northern Hemisphere if it were not for the exceptionally abnormal winter weather, which saved Europe from an expected energy crisis. I believe natural gas would still be well-above $5 if winter weather were more typical. As such, I think there is a decent possibility that gas will rise back to that range by next year, potentially spurring double-digit returns for UNG.

The chief risk in UNG is the immense contango in the natural gas futures curve. While I expect prices to rise faster than the future curve suggests, that largely depends on a decline in US production, which has not yet occurred. Thus, while I am bullish on UNG, it is far from a "perfect opportunity" today, and position sizing will remain low until we see a sharp decline in output, ideally with normalization in the seasonal storage level.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in UNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.