MiX Telematics: More Growth Required

Summary

- Sales continue to grow but better earnings & free cash-flow trends required.

- Shares now appear rangebound with strong overhead resistance above the prevailing share-price.

- High payout ratio may lead to a further cut in the dividend before long.

LeoWolfert/iStock via Getty Images

Intro

We wrote about MiX Telematics Limited (NYSE:MIXT) (Mobile Asset Management Firm) back in May of last year when we stated that a dividend cut may be a likely outcome over the near term. Although there was a minor decrease of roughly 3% in the quarterly payout last September, the major ADS dividend cut came in December when the quarterly payout dropped from $0.06 to $0.04 per share. As a result, shares are down roughly 14% since our most recent commentary which is a sizeable number considering the S&P rallied roughly 3% over the same timeframe.

In terms of the fiscal 2023 Q2 numbers which finally led to the dividend cut, net profit actually came in negative at $1.2 million despite the company reporting growth in specific areas for the quarter. Subscription revenues increased by 10% in Q2 to almost hit $31 million & Annual Recurring Revenue (ARR) jumped by 17% surpassing $128 million. Then in Q3, the company bounced back into profit ($2.8 million of net profit for the quarter) and once more reported growth in ARR, subscription revenues, and the all-important subscriber base which grew to 959k in the quarter. The company continues to report customer wins but we are not seeing these wins being reflected in shareholders' returns as of yet.

More Growth Needed

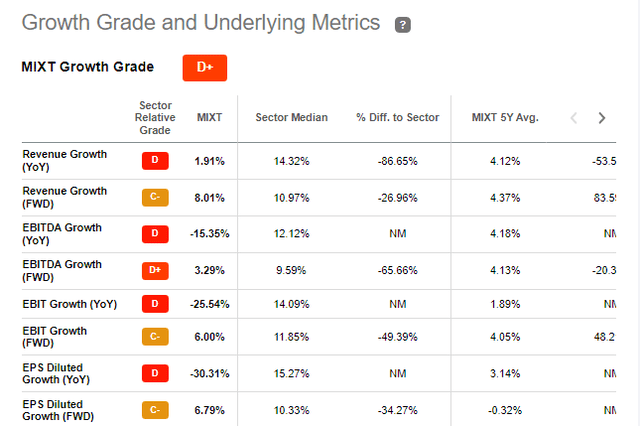

However, not enough growth is being realized in order to significantly move the needle with respect to bottom-line profitability as we see in the company's broader growth metrics below. Although forward growth numbers regarding top-line sales as well as EBITDA have been improving, they still trail the sector in general by some distance, especially on the profit side.

MIXT Growth Metrics (Seeking Alpha)

Technicals

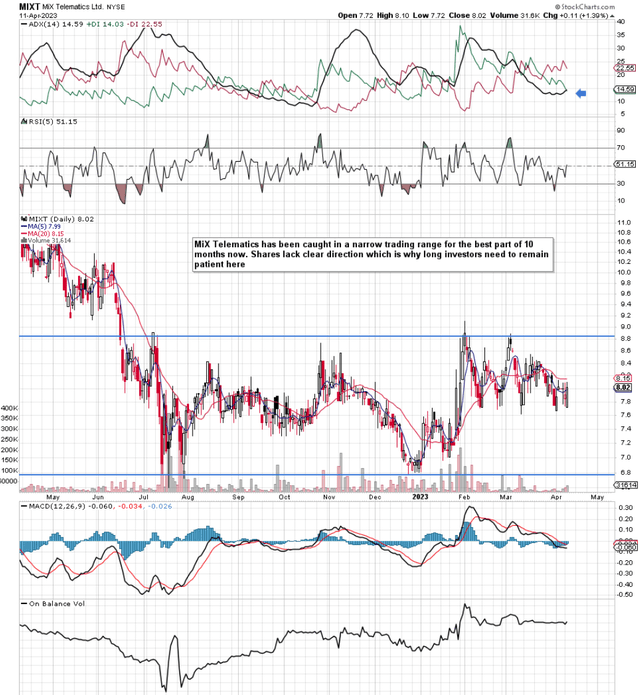

Then you have the technicals as we see below which show that MiX Telematics has been caught in a $2 per share trading range for the best part of 10 months now. Suffice it to say, it stands to reason that the longer consolidation periods persist, the more difficult it will be for shares to break out above overhead resistance. Furthermore, recent consolidation has seen the popular ADX trend indicator come right back down below the 15 level which basically means that shares lack a clear trend at present. This points to more consolidation which is why we would not put capital to work in MiX Telematics at this present moment in time.

MIXT Telematics Technical Chart (Stockcharts.com)

Dividend Worries Persist

MiX Telematics has been averaging more than $5 million in its capital spending budget in recent times. Therefore, the company's operating cash flow ($17.5 million over the past four quarters) has not been high enough to cover this spending which means positive free cash flow generation has been absent in this timeframe. In fact, even from an earnings standpoint, the trailing GAAP payout ratio currently comes in at a very elevated 86%. This means at least over the near term, MiX Telematics will find it very difficult to grow the payout which really is what investors need at present. Why? Because if stagflation in the share price persists (Which will result in little capital gain appreciation in the stock), investors need a thriving dividend in order to protect their respective purchasing power. With inflation running at approximately 6%, a slow growing 2.74% dividend yield from MiX Telematics will not be enough to produce real returns in a stagnating environment.

Return On Equity

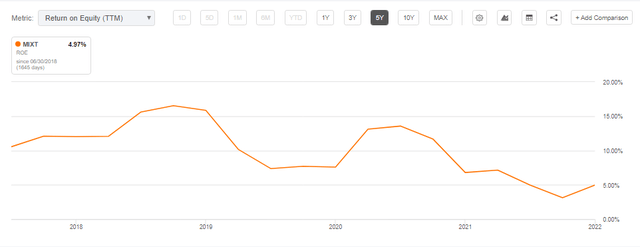

Bulls will obviously point to the very keen valuation MiX currently trades at as well as the company's strong balance sheet but the market will only reward MiX correspondingly if the company can prove it can grow its earnings consistently. The return on equity profitability metric enables us to see the earnings power of MiX when derived from the company's equity on the balance sheet. Suffice it to say, having plenty of equity on the balance sheet is one thing but if this equity is not being productive in generating earnings, then the market will take notice quickly. If we plug the company's numbers into the formula where

ROE = Trailing 12-Month Net Profit / Shareholder Equity

Return On Equity = 5.7 / 111.8 = 5.1%.

Now although the company's most recent quarter (when we average out the quarterly net profit number) saw an increase in the company's ROE, we continue to see a below-average ROE trend which is obviously not what shareholders wants to see.

MiX Telematics ROE Trend (Seeking Alpha)

Conclusion

Therefore to sum up, although MiX Telematics has been growing, this growth has not been coming as fast as the market would like. Furthermore, with the company's strong overhead resistance on the technical chart, high payout ratio, and below-average ROE percentage, we deem MiX Telematics a hold at this stage. We look forward to continued coverage.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.