XLI: Taking Profits On Our Tactical Relative Value Short

Summary

- The Industrial Select Sector SPDR ETF is up by 2.2% while the SPY has gained 7.8% since we initiated our tactical relative value short on the XLI.

- Our relative value short on the XLI has thus delivered a 5.6% gain, well within our target time frame of 12-18 months.

- Recent geopolitical events have spurred increased defense spending by NATO member countries. However, we see limited scope for defense spending growth to accelerate in the coming years.

- Unless we see a further escalation in tensions between China and the U.S. or fresh geopolitical conflicts in other parts of the world, we see little reason to justify the lofty valuations of defense companies on the XLI.

- However, given that the valuation gap has narrowed in recent months, the risk-reward for maintaining our tactical relative value short on XLI versus the SPY has become less attractive in our view. Accordingly, we are unwinding our relative value short on XLI and we are assigning a "Hold" rating on XLI.

MicroStockHub

The Industrial Select Sector SPDR ETF (NYSEARCA:XLI) has underperformed the broader SPDR S&P 500 Trust ETF (SPY) in recent months. Since we initiated our coverage with a tactical relative value short on XLI versus the SPY on 19 December 2022, the XLI is up by 2.2% while the SPY gained by 7.8%. Our relative value short on the XLI has thus delivered a 5.6% gain, well within our target time frame of 12-18 months.

This article reassesses our view on the industrial sector over the medium term as we consider our next move for our profitable relative value short on XLI.

Taking Stock Of The XLI's Underperformance

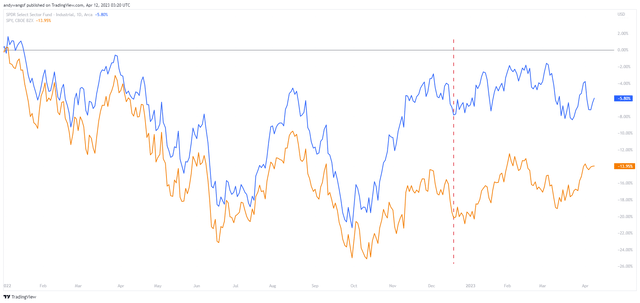

When we initiated our view for the XLI to underperform back in December 2022, the main factor driving our thesis was that valuations on the XLI were becoming stretched versus the broader SPY. As the accompanying chart shows, the XLI held up really well in 2022 and as of 19 December 2022 (marked by the red dashed line), the XLI was outperforming the SPY by a wide margin of around 13.2 percentage points since the beginning of 2022. That gap in performance has since narrowed to around 8.2 percentage points.

TradingView.com, Stratos Capital Partners

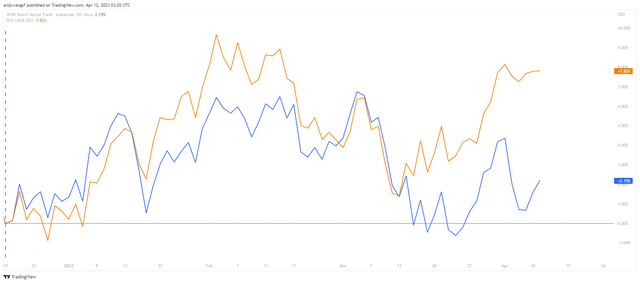

This underperformance of the XLI versus the SPY is more visible when measured with reference to the date on which we initiated our view on 19 December 2022.

TradingView.com, Stratos Capital Partners

We also explained that valuations on the XLI were stretched partly as a result of the Russia-Ukraine war, which began on 24 February 2022 when Russia initiated a special military operation aimed at the demilitarization of Ukraine. The geopolitical event not only created an immediate surge in demand for weapons to defend Ukraine, but it also prompted the Biden Administration and its NATO allies to increase defence budgets to bolster their armed forces.

These developments boosted the valuations of aerospace and defence companies such as Lockheed Martin (LMT), Northrop Grumman (NOC), Raytheon Technologies (RTX), and to a moderate extent The Boeing Company (BA). At the time, LMT, NOC, and RTX were trading at TTM P/E of 17.9x, 22.0x, and 21.4x, respectively, while BA is still struggling to turn profitable. Combined, these four companies also constituted around 15.6% of XLI's portfolio.

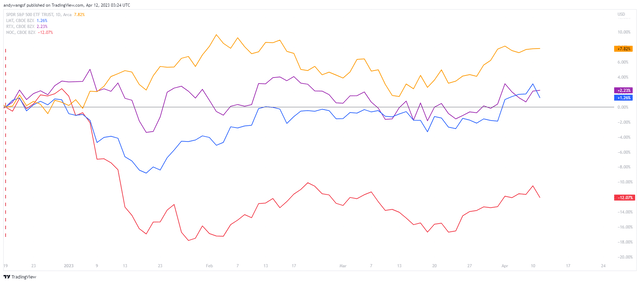

As the accompanying chart shows, three of the defence companies have since underperformed the SPY as expectations for increased military spending have moderated, despite the ongoing conflict. Boeing was the sole outperformer versus the SPY, and the better-than-expected performance was justified by a sharp jump in airplane orders as world economies reopened to international travel and tourism.

TradingView.com, Stratos Capital Partners

Outlook For Defence Companies

Recent geopolitical events have undeniably played a significant role in spurring increased defence spending by NATO member countries. However, we see limited scope for defence spending growth to accelerate even further in the coming years.

China's economic recovery is likely to face a bumpy ride ahead due to the structural weaknesses associated with the growing indebtedness of its local governments and a stifled technology sector, which should discourage Beijing from expanding its defence budget aggressively. We also reiterate our view that the condemnation of Russia's invasion of Ukraine by the international community, China's ambiguous stance on the war, and the U.S.'s renewed push to counter China's economic clout and military presence in South East Asia - should result in a less assertive China in the coming years.

Having said that, we do acknowledge the risk that economic considerations may be secondary to President Xi Jinping's political aspirations for China. The conclusion of China's National People’s Congress, with Xi Jinping cementing his control of the Communist Party of China (CPC) and securing an unprecedented third term as president, may see an emboldened Xi taking an even more aggressive stance on the 'peaceful reunification' with Taiwan. The Western world may in turn face growing pressure to boost defence spending in a bid to counter China's growing military threat.

The Russia-Ukraine war has dragged on for more than a year and exacted a heavy toll not only on economic resources but also on human lives. At the time of writing, a ceasefire is still nowhere in sight, although as each week passes, there is increasing evidence that both sides of the conflict are being exhausted by war.

How much of a necessary boost in defence spending has been adequately priced into the current valuations of defence companies, and how much this increase in spending is likely to last, are difficult variables to estimate. But unless we see a further escalation in tensions between China and the U.S. or fresh geopolitical conflicts in other parts of the world, we see little reason to justify the lofty valuations of defence companies.

Nonetheless, recent evidence of China's increasingly assertive stance on Taiwan, partly in response to equally assertive actions from the Biden administration, presents significant risks for a further deterioration in relations between the two countries. Such tensions continue to fuel expectations that defence companies will benefit from further increases in military spending, sustaining lofty valuations in the near term.

Given that the valuation gap between XLI and SPY has narrowed in recent months, the risk-reward for maintaining our tactical relative value short on XLI versus the SPY has become less attractive in our view.

Underperformance Reduces Defence Stock Weightings On XLI

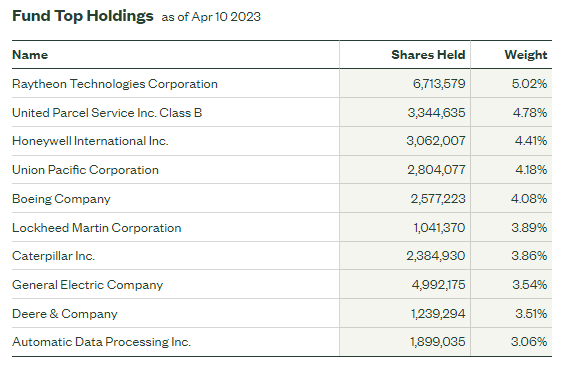

The underperformance of defence companies has led to reduced portfolio weightings on some of these companies. According to fund information provided by the issuer State Street Global Advisors, NOC has been dropped from the portfolio's top ten holdings while weightings of both LMT and RTX have decreased, albeit slightly.

State Street Global Advisors

Nonetheless, defence companies continue to constitute a substantial portion of the portfolio making XLI the weakest link among U.S. equity sectors due to stretched valuations in our view. At the time of writing, LMT, NOC, and RTX continue to trade at lofty valuations of 22.9x, 14.9x, and 28.4x TTM P/E, respectively.

SeekingAlpha.com

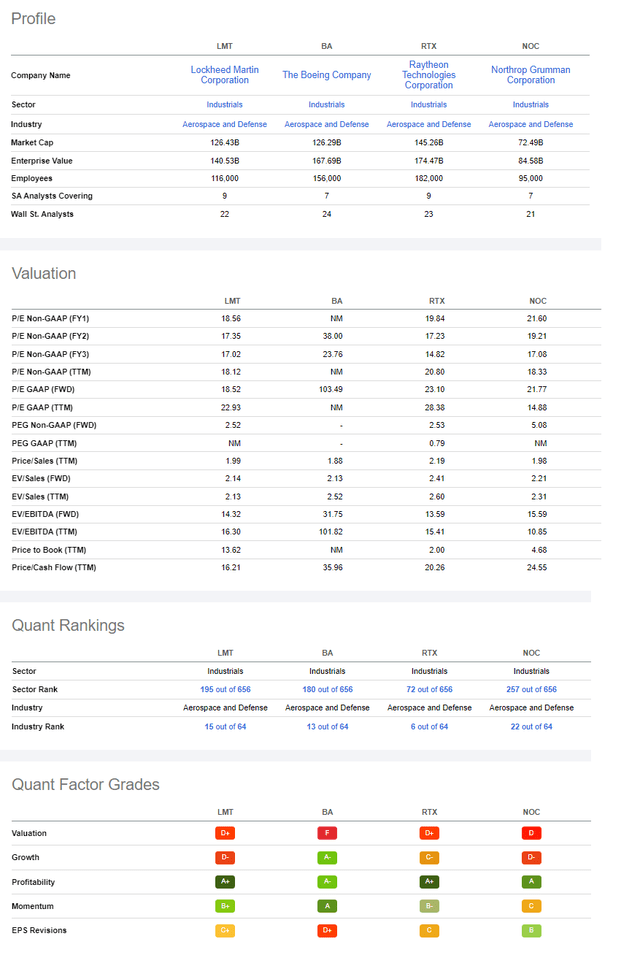

Seeking Alpha's proprietary Quant Ratings currently rate LMT, BA, and NOC as a "Hold", and RTX as a "Buy" with Factor Grades ranging from "D" to "F" for valuation.

In Conclusion

Despite our bullish view on the SPY, we continue to view XLI as the weakest link among U.S. equity sectors due to stretched valuations, especially for aerospace and defence stocks.

However, given that the valuation gap has narrowed in recent months, the risk-reward for maintaining our tactical relative value short on XLI versus the SPY has become less attractive in our view. Should the valuation gap widen again in the coming months, we would consider re-establishing our relative value trade.

Accordingly, we are unwinding our relative value short on XLI and we are assigning a "Hold" rating on XLI.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of XLI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.