Taseko Mines: Further De-Risking At Florence

Summary

- Taseko Mines published an updated Technical report on Florence, indicating robust economics.

- The project was not spared by inflation, but maintains its low cost profile.

- The available liquidity mix appears sufficient to fund construction once the EPA permit is granted.

- Taseko remains at deep discount to the indicated NPVs of its two main projects.

mabus13

Taseko Mines (NYSE:TGB) has released an updated Technical report on its Florence copper project. I consider this an important step towards de-risking the project, as the most recent data on its economics was from 2019, which put considerable uncertainty around cost inflation and its impacts. In this article, I’ll take a closer look to the 2023 Technical report and compare it to the 2019 Competent person’s report. Overall, Florence maintained a low cost profile and robust economics, despite cost inflation. At the same time Taseko is still trading at a deep discount to the combined indicated NPVs of the operating Gibraltar mine and Florence, presenting a buying opportunity.

The updated Technical report

Taseko had gone a long way advancing its Florence copper project. The company is construction-ready and is waiting for the US Environmental Protection Agency to issue a final Underground Injection Control ('UIC') permit before beginning building activities. However, the latest data regarding capital needs in order to bring Florence into operation was dating back to 2019. In the meantime, inflation was elevated, which put considerable uncertainty around the costs and their impact on the economic profile of the project.

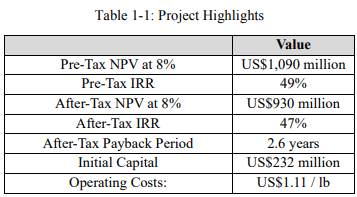

Florence project economic highlights (Taseko Mines, 2023 Technical report)

The newly released Technical report addresses that issue and gives a fresh perspective on the costs and economics of Florence. Obviously, the company put a very positive title to the news release, mentioning improved economics. So I decided to do a head-to-head comparison between the 2019 and 2023 data.

| Units | 2019 Competent person's report | 2023 Technical report | Change | |

| LOM Avg. Head Grade | % Cu | 0.36 | 0.36 | 0.00% |

| Proven reserves | Mlbs Cu | - | 1 812 | |

| Probable reserves | Mlbs Cu | 2 472 | 503 | |

| Proven and probable reserves | Mlbs Cu | 2 472 | 2 316 | -6.31% |

| Total production costs | US$/lbs Cu | 1.13 | 1.32 | 16.81% |

| Initial capital costs* | US$M | 227 | 232 | 2.20% |

| LOM sustaining CAPEX | US$M | 788 | 925 | 17.39% |

| Copper price assumption | US$/lbs Cu | 3.1 | 3.75 | 20.97% |

| After tax NPV (8% discount) | US$M | 667 | 930 | 39.43% |

| After tax IRR | % | 40.2 | 47 | 16.92% |

*The 2023 data excludes already incurred costs for long-lead items

The first thing many investors probably noticed is that the estimated after-tax NPV jumped considerably to US$930M (+39.4%) and the after-tax IRR also improved to 47%. However, there’s a good reason for this – the assumed average copper price was lifted by 21% from US$3.10/lbs in 2019 to US$3.75/lbs in the 2023 Technical report. Another important note should be made towards the initial capital required. While the recent figure of US$232M is just 2.2% higher than the previous estimate of US$227M, it doesn’t include the procurement of long-lead items for the project to date as they’re considered sunk costs. According to the Q3’22 earnings call more than US$80M were already spent.

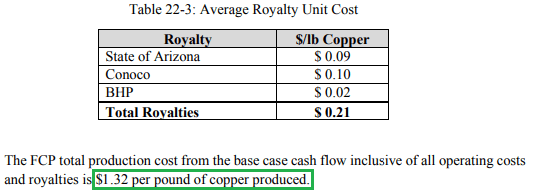

Total operating costs/lbs (2023 Technical report)

The other important element – operating costs also market an increase, although at first it seems otherwise. The reason is that the US$1.11/lbs operating costs figure in the news release doesn’t include royalties, so it’s not directly comparable to the US$1.13/lbs from 2019, which includes everything. When royalties are added, the 2023 figure amounts to US$1.32/lbs or 16.8% higher than in 2019.

The proven and probable reserves were reduced by 6.3% to 2,316Mlbs of copper, but it has to be noted that the 2019 figure was entirely consisting of probable reserves, while the 2023 Technical report includes 1,812Mlbs of proven reserves. The modest decrease is not so bad, given that the recent figures are of higher certainty, and therefore de-risk the project.

Available liquidity seems sufficient

Now that there’s an updated number on the initial capital requirement, let’s assess how it measures against available liquidity.

| Cash as of 2022 year-end | US$M | 90 |

| Undrawn credit facility | US$M | 80 |

| SX/EW plant financing | US$M | 25 |

| Mitsui deal | US$M | 50 |

| Total available liquidity | US$M | 245 |

Overall, the total available liquidity seems sufficient to cover initial capital needs. In addition, at current copper prices, the operating Gibraltar mine has serious cash flow generating capabilities, providing internally generated cash for the construction. As Taseko has hedged the majority of its production with a floor of US$3.75/lbs, the company seems protected even in a negative copper price scenario.

The valuation picture

The estimated after-tax NPV of Florence copper of US$930M is quite close to the US$1B of value, which the Mitsui deal implied. In addition now that the company owns 87.5% of the Gibraltar mine it should worth around US$950M based on the 2022 Technical report. The combined estimated value of the two projects of nearly US$1.9B is much higher than the current EV of Taseko of US$825M, leaving room for considerable share price appreciation. The granting of the final UIC permit by the EPA could be a serious upside trigger as it will clear the last hurdle before construction.

Risks

The company has hedged the majority of its 2023 production, reducing its sensitivity to negative copper price developments. Based on that, the uncertainty regarding the UIC permit emerges as the biggest risk. The EPA doesn’t have an established timeline for taking a final decision, so it may get dragged down in time. Meanwhile, inflation, which still remains high may deal a further hit on costs. Still, I remain optimistic that a decision will be made in H1’23 and construction could begin in H2’23.

Conclusion

The new Technical report sheds light on the effects that inflation had on estimated initial, sustaining and operating capital costs. Not surprisingly, all these categories were hit by increases. However, higher assumed copper price of US$3.75/lbs helped to not only offset these negative effects, but to improve the economic profile of the project. Meanwhile, Taseko remains heavily discounted to the combined indicated values of the operating Gibraltar mine and the advanced Florence project.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.