Tupperware Brands Isn't Likely Long For This World

Summary

- The management team at Tupperware Brands came out with a really bad piece of news for investors.

- In short, the company's financial condition looks awful due to debt and a significant deterioration in its business.

- Tupperware doesn't seem to have much in the way of resources to fix or alleviate these issues, and investors should expect the worst.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Tohid Hashemkhani

It's not every day that a company that has been around for decades and that has enjoyed global fanfare, ends up going bankrupt or nearing that point. But such are the times we live in. The example I would like to point to in this instance is Tupperware Brands (NYSE:TUP), an enterprise that's dedicated to the production and sale of consumer products, most notably small storage containers that are used mostly, but not exclusively, for the storing, serving, and preparation of food. Recent financial performance reported by management shows that sales are plummeting and that bottom line results have contracted materially. And on April 7th of this year, the management team at the business announced that the company is seeking professional help to avoid collapse and that its top brass has substantial doubt about its ability to survive for the foreseeable future. In all likelihood, this marks the beginning of the end for this once-famous brand. But at this point, only speculators who don't mind accepting significant risk should consider banking on that. Instead, prudent investors should probably look elsewhere for opportunities at this time.

Recent developments are an issue

On April 7th of this year, the management team at Tupperware Brands announced that they were engaging financial advisors with the goal of utilizing their guidance to improve the company's capital structure and near-term liquidity. This process involves reviewing the firm's real estate portfolio to see whether there might be potential asset sales or sale-leaseback transactions that can be engaged in. They are also looking at cost-cutting initiatives, selling off non-real estate fixed assets, and various restructuring activities. Management did not make mention of a potential bankruptcy filing. However, they did stress the need to seek additional financing and even went so far as to say that a violation of the credit facility covenants it's a part of is likely to occur when they release their annual report.

Though not nearly as important as this warning, the company also said that on April 3rd of this year, it received a notice from the New York Stock Exchange that indicated it is not currently in compliance with the rules of the exchange and may be delisted if it does not regain compliance in approximately six months. It is worth mentioning that they could receive another six-month extension beyond this, but in all likelihood, the firm will not make it that long without some significant changes. It is because of these developments, combined with a continued deterioration in fundamental performance, that shares of the business are currently trading 93.8% below their 52-week high mark.

No real chance for improvement

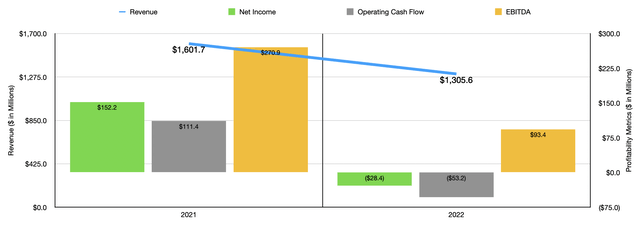

I don't want there to be a misunderstanding. At the moment, the picture for Tupperware Brands looks bad. Really bad. Any investor willing to put in any sort of capital at this moment should do so knowing that a complete loss of principle is highly probable. To understand why this is, we need only look at financial performance covering the 2022 fiscal year. Revenue during that time came in at $1.31 billion. That's 18.5% lower than the $1.60 billion the company reported for the 2021 fiscal year. Globally, almost every part of the company suffered materially during this time. This came about even in spite of the business benefiting from an extra week of operations during 2022. This extra week increased sales by about 1%.

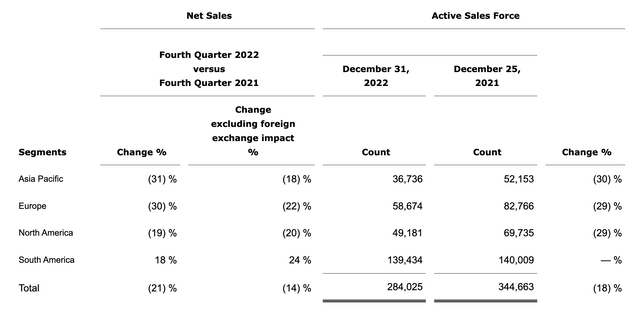

Impacted by COVID-19 restrictions, the company saw sales in Asia plummet about 24%, falling from $460.9 million to $352.3 million. In Europe, sales fell even more, dropping approximately 31% from $433.5 million to $297.6 million. This, management said, largely stemmed from declining consumer sentiment. The plunge in sentiment also affected results throughout North America. Revenue here declined 16% from $451.2 million to $379.9 million, even though the company raised prices in order to combat inflationary pressures. The only bright spot for the company was in South America. On a constant currency basis, some of its markets performed quite well, with management describing its presence in Argentina as being ‘strong’. Revenue from the continent was $275.8 million. That's about 8% higher than the $256.1 million reported one year earlier.

The core of the problem is not just a decline in consumer sentiment and COVID-19 restrictions. It's also a material drop in the size of the company's active sales force. At the end of 2022, this number totaled 284,025. That's down about 18% compared to the 344,663 that the company reported for 2021. Whether it's because of fewer customers buying, or better opportunities elsewhere, or something else entirely, the company saw a material decrease in the number of people actively trying to sell what it has to offer.

Unsurprisingly, this had significant negative consequences when it came to profitability. The firm went from generating a net profit of $152.2 million in 2021 to generating a net loss of $28.4 million last year. Operating cash flow declined from $111.4 million to negative $53.2 million. Normally, I would have liked to look at operating cash flow after accounting for changes in working capital. But since the company has not provided this and it won't be known until the company releases its annual report, this is out of my hands. During this same time, meanwhile, EBITDA for the company declined from $270.9 million to $93.4 million. On its own, this kind of degradation is awful to see. But when you add on top of this the fact that the company has net debt of $595.3 million, what looks bad now looks catastrophic.

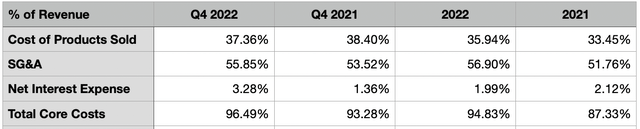

In the chart above, you can see the results for the final quarter of the 2022 fiscal year. I included these because it shows that the pain the company has experienced has not shown any real signs of getting better. Obviously, we already know the decrease in revenue that the company has experienced. But on the bottom line, the picture is more complicated than that. In the table below, I looked at the core cost categories of the company. These are its cost of goods sold, its selling, general, and administrative expenses, and its net interest expense. The table in question looks at these items as a percent of revenue.

First, we should start off with the good news. Even though cost of products sold rose relative to revenue from 2021 to 2022, we did see some improvement on this front in the final quarter of last year. Cost of products sold declined from 38.4% to 37.4%. Although this may not seem like a significant change, it does translate to $3.3 million of additional pretax profit that the company saw in the final quarter of last year compared to what it would have seen otherwise. According to management, this improvement was associated with price increases that were levered on customers. Or when you see sales falling already, the last thing you want to do is to try to increase how much you charge for your product.

Truth be told, there isn't much that the company can do on this side of the equation for now. The price increases might help moving forward. Sadly, there's not much that can be done on the net interest side of the equation either. The rise in net interest was driven not only by an increase in net debt year-over-year, but also by an increase in the weighted-average interest rate of the company from 2.08% at the end of 2021 to 4.39% as of the end of the third quarter this year (fourth quarter data has not been provided yet). Keeping debt the same, this would translate to an extra $16.3 million annually in gross interest).

The only thing that could be done is an asset sale that would pay down debt. But in all likelihood, nothing material will come on that end. Excluding the components of net debt, Tupperware Brands does have book value of assets exceeding book value of liabilities totaling about $407.8 million. We don't know the exact breakdown of these assets since management has not released additional data. But we do know that the two largest components in the third quarter of last year were deferred tax assets for the non-current side of the balance sheet, and inventories on the current side. In this kind of environment, inventories might require a rather significant haircut in order to monetize. Deferred tax assets, meanwhile, can be very tricky to monetize, and often are done so as part of a sale of the business. That aside, management even warned in their April 7th filing that their going concern status will require a write-down of these assets as well. In fact, when coupled with a write-down of goodwill and other intangible assets, the company said that financial results in the annual report will ‘differ significantly’ compared to what the business reported in its preliminary results for the fourth quarter.

So selling off assets or engaging in some other sort of transaction is unlikely to have a material impact on the company from a debt perspective. The absence of a significant reduction in debt means that interest expense is certain to remain elevated. There really is no glimmer of hope that I can see when looking at this picture. If we take net interest from the latest quarter, the cost of product sold from the 2022 fiscal year, and selling, general, and administrative costs, from the 2021 fiscal year, and assume that could be the picture for the company moving forward, it would translate to pretax income of roughly $118 million per year. It may seem simple to cut costs here. But management attributed the higher costs to lower fixed cost absorption that came about because of lower sales. So unless revenue can increase from here, which seems unlikely given all that we have covered, the overall picture for the company looks disappointing.

Takeaway

At this point in time, I do not have any real hope that things will turn out well for Tupperware Brands. A decline in active sellers, weak consumer demand, soaring production prices resulting from inflationary pressures, and other factors, have all been instrumental in all but signing the company's death warrant. I want to be very clear here about something else. While there were definitely were many factors that were outside of management's control, there were also instances that I feel could have been handled different. The most notable, in my opinion, is the company's decision to buy back $75 million worth of stock during 2022. Although it may have been impossible to predict exactly how things would have gotten at the start of the 2022 fiscal year, management knew that the company had a great deal of debt on its books. In fact, from the final quarter of 2021 through the end of the first quarter of 2022, net debt grew by $122 million, in large part because of the stock buyback.

With interest rates rising, reducing leverage should have been top of mind, not returning cash to shareholders. In addition to this, the company announced, during its fourth quarter earnings release, that it had identified misstatements in its financial reports, largely centered around the historical accounting of income taxes. And on top of this, the company admitted that it did not design and maintain effective internal controls for this part of the enterprise. Allocating capital toward making sure the books were correct might have made the difference between life and death. But alas, the likely outcome for the company is a rather rapid and painful demise.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.