Automatic Data Processing: An Excellent Company At A Lower Price

Summary

- ADP has become a global leader in human capital management and offers excellent customer service, but its valuation is too expensive.

- ADP is also growing strongly with 9% revenue growth and 19% growth in adjusted earnings per share last quarter.

- Looking at the outlook, ADP will grow strongly with revenue growth expected between 8% and 9% in fiscal 2023. Adjusted EPS is expected to increase between 15% and 17%.

- ADP's dividend payouts plus share repurchases exceed its free cash flows, which is unsustainable in the long run.

- Also, ADP's valuation is too expensive in this high interest rate environment, which is why I give ADP stock a hold rating.

portishead1

Introduction

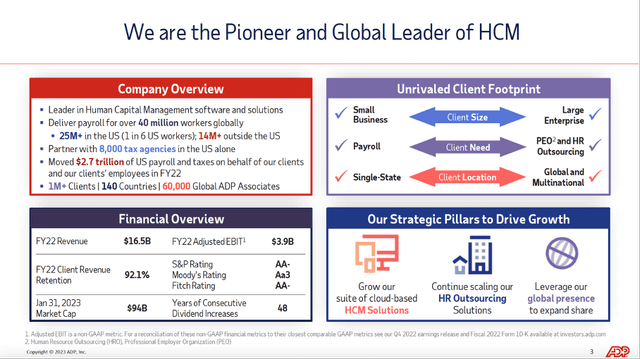

Automatic Data Processing (NASDAQ:ADP) provides cloud-based human capital management solutions, offering companies worldwide payroll, benefits administration, talent management, HR management, and so on.

Global Leader of HCM (ADP Investor Presentation)

Through international expansion, investments in technology and acquisitions, ADP has grown significantly to a worldwide leader and has become a pioneer in the human capital management market. The company also provides excellent customer service. This core value is highly valued by both consumers/businesses and shareholders.

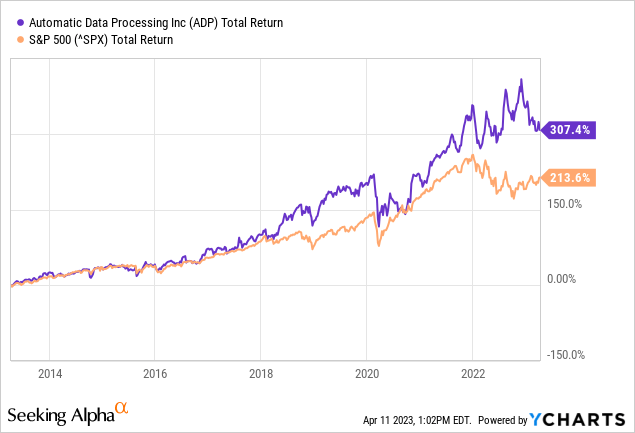

The stock appears to have been a good investment, as the annual total return is about 15% over the past ten years. The stock seems to be popular with investors because the valuation of the stock did become very expensive in recent years. Although the share price has dropped recently, I still believe it is too high.

Strong Quarter, Strong Outlook

ADP is growing strongly and expects the human capital management market to continue to grow 5% to 6% from 2022 and beyond. And with a total addressable market of some $150 billion, the market is big; Automatic Data Processing can still grab quite a bit of market share, as annual revenue in fiscal 2022 was $17 billion (11% market share).

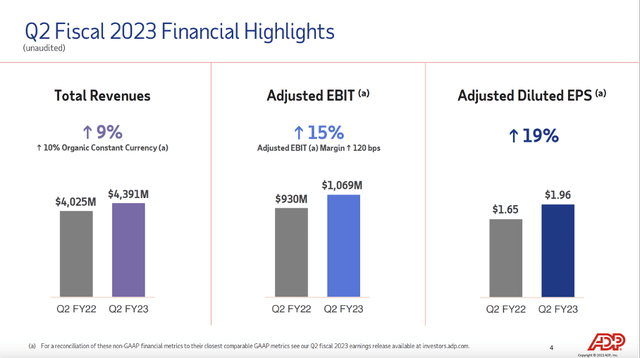

ADP's fiscal 2022 ended in June 2022, and the second quarter of fiscal 2023 was strong. Some highlights included a 9% increase in revenue, 19% growth in adjusted earnings per share and an improvement in Employee Services retention to near record levels in the quarter.

Financial Highlights (2Q23 Investor Presentation)

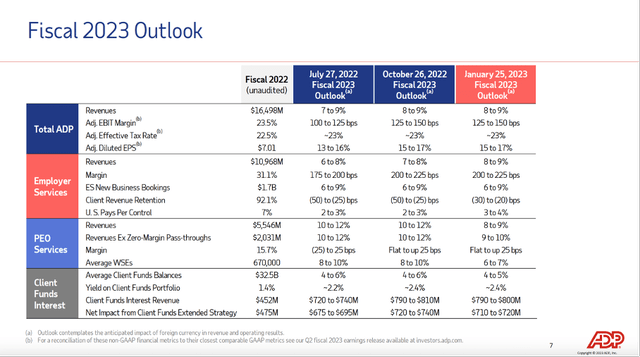

The Employee Services segment is the largest segment with a revenue contribution of $2.9 billion last quarter. The EBIT margin is very high at 32.3% due to growth in interest income from customer funds. For FY 2023, Employee Services segment revenues are expected to grow to 8% to 9% due to strong bookings, higher retention, continued strong growth in fees per check and higher interest income from customer funds.

Revenue from the PEO Services segment contributed $1.5 billion to total revenue, up 11% year over year. EBIT Margin also increased to 17% in this segment due to revenue growth and disciplined cost management. Revenue from this segment is expected to grow 8% to 9% in 2023, down slightly from the previous forecast.

Consolidated, revenue projections for fiscal year 2023 are very strong. ADP expects annualized growth of 8% to 9% and an increase in EBIT margin between 125 and 150 basis points. This will increase adjusted earnings per share between 15% and 17%. In the medium term, ADP expects strong revenue growth between 7% and 8%, EBIT growth between 10% and 12%, and adjusted earnings per share between 11% and 13%.

Fiscal 2023 Outlook (2Q23 Investor Presentation)

Dividends and Share Repurchases

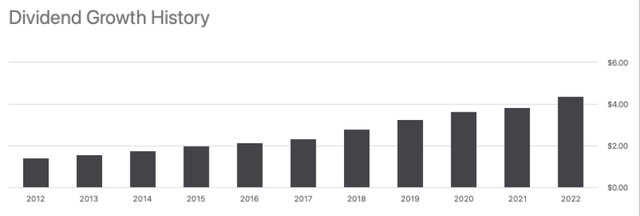

ADP is a long-term dividend compounder, ADP has increased its dividends for 48 consecutive years. In addition to a solid dividend payout, ADP also repurchases its own shares. This combination is ideal because buying back shares reduces the number of shares outstanding; this increases the dividend per share. It will also boost the share price when the shares are purchased in the open market. The buyback yield at the end of fiscal year 2022 is 2.3%.

Dividends per share have increased by an annualized rate of 13.3% over the past 5 years, resulting in a dividend yield of roughly 2.3% at present. About 11 analysts expect the dividend to rise about 8.2% in fiscal 2024.

Dividend Growth History (ADP ticker page on Seeking Alpha)

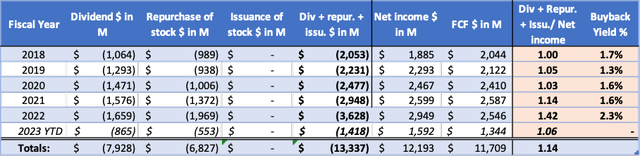

Automatic Data Processing pays out more cash to shareholders than the company generated in free cash flow. Cumulatively, this was about 14% more over the past 4 years. This year, the company is cautious and has paid out "only" 6% more than it generated in free cash flow. However, this is not sustainable in the long run because it grows net debt. Net debt in fiscal 2018 was -$168 million, so the company had more cash that debt. Currently, net debt is $1.6 billion, but that is not a major problem because the free cash flow in fiscal 2022 was strong at about $2.5 billion (net debt to FCF ratio is 0.64). In the short term, they can maintain the shareholder return, but I expect that after 5 years they will have to cut their share repurchase program.

ADP's Cash flow highlights (Annual Reports And Analyst' Own Calculations)

Valuation Is Too Rich

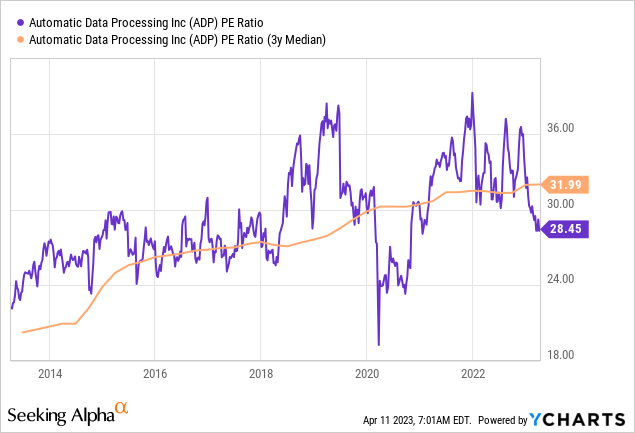

I chart the valuation by comparing the ratio of enterprise value to free cash flow with the past. From the chart from YCharts, we see that the trend of this ratio has risen sharply since the past decade. Whereas the EV/FCF ratio was below 20 in 2014, it is now around 31. Pretty expensive in my opinion.

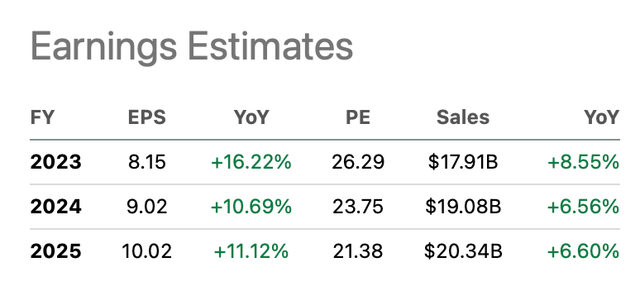

The PE ratio also shows a similar picture. The GAAP PE ratio is now at 28, while the 3-year average is at 32. I really think both ratios are way too high in this current interest rate environment. However, earnings will grow strongly in the coming years.

Many analysts expect solid EPS growth of 10+% annually for fiscal 2024 and 2025. Hereby the non-GAAP PE ratio is 24 for fiscal 2024. That sounds a lot cheaper. However, I still think ADP is a bit overvalued because the EV to FCF is also quite expensive. The enterprise value increases if they continue the current share repurchase policy (more debt and less cash). Automatic Data Processing is growing steadily and I would like to see this company in my portfolio, but only at a more favorable valuation.

ADP's earnings estimates (ADP ticker page on Seeking Alpha)

Conclusion

ADP has become a global leader in human capital management and offers excellent customer service, but its valuation is too expensive.

The human capital management market is expected to grow between 5% and 6% on the long run. ADP is also growing strongly with 9% revenue growth and 19% growth in adjusted earnings per share last quarter. ADP's Employee Services segment contributed $2.9 billion in total revenue, with an EBIT margin of 32.3%. The PEO services segment brought in $1.5 billion and the EBIT margin improved to 17%.

Looking at the outlook, ADP will grow strongly with revenue growth expected between 8% and 9% in fiscal 2023. Adjusted EPS is expected to increase between 15% and 17%.

ADP's dividend payouts plus share repurchases exceeds its free cash flows, which is unsustainable in the long run. Also, ADP's valuation is too expensive in this high interest rate environment, which is why I give the stock a hold rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.