Louisiana-Pacific: Sum-Of-The-Parts Valuation Reveals Deep Value Opportunity

Summary

- Louisiana-Pacific is one of the largest providers of building solutions in North America and its OSB business has historically been considered as highly cyclical.

- However, with its siding segment, I believe the market overlooks a non-cyclical hidden asset that is likely worth as much as the entire business today.

- My intrinsic value analysis shows that the company is highly undervalued and that the LPX stock has an upside potential of 40-100%.

Editor's note: Seeking Alpha is proud to welcome Second Level Thinking as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

anatoliy_gleb

Introduction

Louisiana-Pacific (NYSE:LPX) is a rather boring manufacturing business at first glance, specializing in the production of building materials. To better understand the business, it can be broken down into three segments: OSB, Siding, and South America. Since the segments differ significantly in their underlying economics, I believe it makes little sense to value the segments uniformly. In this article, I will value the individual segments using a sum-of-the-parts analysis and, through that, explain that the company is significantly undervalued today.

OSB Segment

Let's start with the cyclical part of the business. OSB is the largest segment of Louisiana-Pacific, accounting for around 54% of sales, and comprises LPX's North American OSB business. The business is not very attractive by nature, as OSB is a very cyclical commodity product. Since OSB is primarily installed in new construction, selling prices are very sensitive to U.S. housing starts, which are known to vary widely across different stages of the economy. Historically, the industry has been dominated by classic boom and bust cycles, where producers generate high profits in times of high demand and undersupply, and in some years have to record very high losses in times of low demand or oversupply.

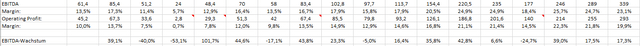

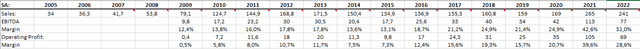

The table below very strongly demonstrates the segment's results of the last 15 years.

Compiled by Author using data from annual reports

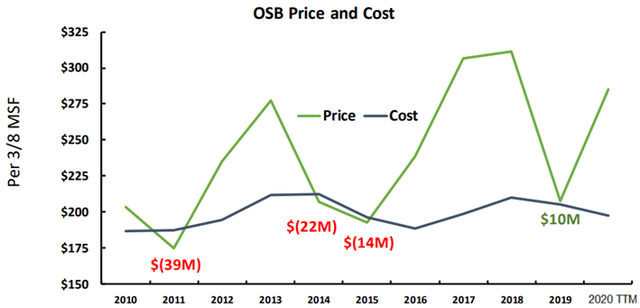

I good times, such as the last three years, LPX was able to achieve EBITDA margins of up to 64%, while in bad times (such as the 2008 financial crisis) losses of up to $200 million had to be booked. The normalized EBITDA is around $300 million. How should one therefore think about the business? Will the trend of boom and bust cycles continue in the future? Let's get to the first piece that I think the market misunderstands about LPX.

The market itself has developed into an oligopoly in recent years, what I think the market is overlooking. LPX, as the second largest player with a market share of around 16%, competes with nine other companies, with the four largest accounting for 70% of the market (of which West Fraser Timber Co. (WFG) represents around 30%, Georgia-Pacific and Weyerhaeuser (WY) 12% each) and the rest six the remainder. This is in contrast to 2005, where the largest four companies accounted for only about 50% of the market and the industry as a whole was more fragmented. Clearly, the industry is extremely consolidated and this trend is likely to continue.

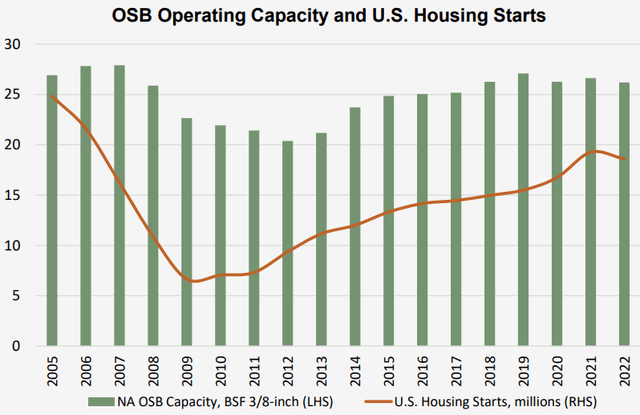

This becomes important when looking at production capacity, which has been basically flat for over a decade.

WFG - Q4 2022 Investor Presentation

It should be noted that this is a distorted picture, as OSB producers historically produced below capacity most of the time which means that the actual production volume is even lower. Lower volume and fewer competitors causes two benefits for the industry. First, companies on the downside can respond more quickly to price declines through indirect coordination, making down cycles less painful and shorter. This is supported by past improvements in OEE, the shift to Structural Solutions (a value-added OSB product that currently generates >50% of OSB and is expected to increase to 75% long-term, vs. 25% during the financial crisis) and conversions from low-return facilities to siding facilities (I'll get to that point later).

So the downside becomes less and less painful over time, as you can see below.

LPX 2020 Investor Day Presentation

My estimates indicate that LPX can produce profitably at 800-900k new housing starts after a relatively short time.

The second advantage lies in the upside. Companies have learned from the past and have made almost no effort to increase their production capacity significantly in the last peak over the past three years. The production capacity that has been added has merely compensated for capacity lost elsewhere. This is a significant shift in an industry that has historically tended to create overcapacity during peaks, and is a critical point that I believe is being ignored by the market.

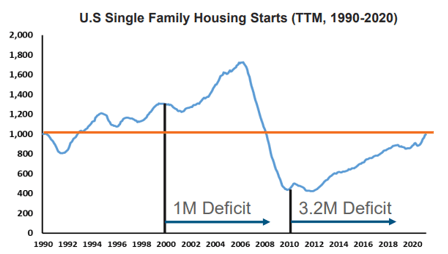

Less capacity and no effort to expand means quicker price hikes, higher profits and longer lasting peaks. According to Brad Southern, the CEO of LPX, the capacity of the industry today is only designed for 1.5-1.7 million new housing starts, while it was designed for 2.2 million housing starts at the time of the financial crisis. West Fraser even believes that supply shortages can be reached with as little as 1.4-1.5 million new housing starts. In contrast, the long-term historical average for new housing starts is around 1.4-1.5 million, while over the past decade it has been significantly lower, partly due to the overheating before the financial crisis. For 2023, new housing starts are estimated at around 1.3 million (vs. 1.6 million in 2022, so 20% down).

Both companies argue that there is a structural undersupply of new housing construction in the industry and that there is currently a deficit of several million houses (the graphic shows only the single-family housing starts).

LPX Investor Presentation May 2021

So the bull case is that in the medium term we'll get back to a situation where houses reach the historical average (undersupply can't last forever), resulting in abnormal cash flows for the entire industry. If you look a few years into the future, despite near-term headwinds it is very likely that this point will be reached again in the medium term, driven by: 1) undersupply, and 2) population growth.

Okay, if the upside is attractive and the downside gets more limited, shouldn't new competitors get the idea to enter the market? The industry structure is protected by high barriers to entry, which makes it unattractive for new competitors to enter the market. The construction of a new production facility takes around 3-5 years + around 12-18 months additional to ramp up the plant and costs around $400 million. According to statements made in personal conversations, the reasons for this are primarily long delivery times, labor constraints, and permitting challenges at some locations. At the same time, there are significant execution and construction risks. So a new competitor effectively burns 4-7 years of cash hoping that after the ramp-up the economy is at a peak and he can amortize the facility. The likelihood of entry is for each to determine, but I think it is highly irrational to attempt entry. There is currently an attempt with One Sky Forrest, but it remains to be seen if the project will be successful, as construction has not yet begun, although the project was announced in 2021 already.

At the same time, imports are only marginally economical (too much volume for too little price) and the risk of disruption is very low (OSB has been replacing plywood since the 1970s and is basically a pure play).

Thus, the North American industry is very well protected overall. Also there is a similar margin structure within the industry, which means that none of the major competitors has a low-cost provider advantage.

So all in all, with the business you are buying an oligopoly with high upside potential in good times, less painful and shorter downside cycles, and very high barriers to entry. So how can the business be valued?

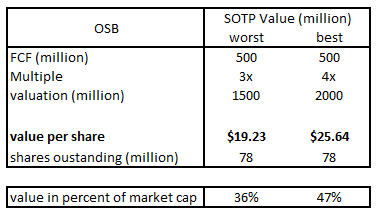

Assumptions

In my SOPT valuation of the OSB segment, I will use the peak FCF based on the historical results of the segment and apply an appropriate multiple to it. Looking at the annual reports of 2005-2022, the OSB segment stand-alone has been able to generate around $300-$700 million FCF at peak times. I will use $500 million for the SOTP valuation, as this represents the average peak FCF. I will also use a peak FCF multiple of 3x in the "worst case" and a multiple of 4x in the "best case". I consider this to be appropriate due to the high cyclicality of the business.

OSB segment valuation

Based on the inputs above, I obtained the following value for the OSB segment.

Author's Calculations

This should be a very conservative valuation considering potential future tailwinds and the fact that the business is perfectly capable of generating over $800 million of FCF in very good years that are increasingly likely going forward. With this valuation in mind, let's now move on to Siding, the hidden asset that I mentioned earlier.

Siding

The siding segment is the second important part of LPX and currently accounts for around 40% of sales. Within this segment, LPX sells engineered wood products that are primarily used for lap, trim, fascia, soffit and sheds, but also in other smaller markets. The business itself shows significant differences in the underlying economics compared to the OSB business.

On the one hand, the segment is significantly less cyclical in terms of the end market. The share of revenue for new construction is only 40%, while the remaining 60% is split between the reconstruction & repair (R&R) market (40%) and sheds and other ancillary markets (20%). The R&R market and the market for sheds is obviously much less volatile than the new construction market and accordingly more stable in times of crisis. Secondly, the pricing is much more stable. LPX has consistently implemented annual price increases of 3-6% in recent years without being subject to major fluctuations (resulting from pricing power and shift to higher priced products, which I will come to later).

This is reflected in the historical results of the segment.

Compiled by Author using data from annual reports

EBITDA has grown at a CAGR of 15% over the past decade, while the EBITDA margin has increased from around 17% to 23% over the same period. The EBITDA growth is even higher if you exclude less profitable and declining businesses within the segment, which will play an increasingly smaller role in the future, and if you take into account businesses that were divested in the past or that were reallocated to other segments. The segment is thus a rapidly growing part of LPX.

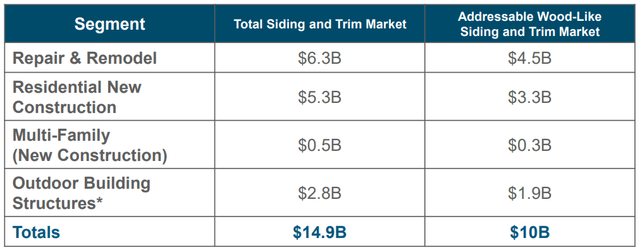

So how to think about the business? Within the engineered wood industry (which is a part of wood), LPX is by far the largest supplier with an estimated market share of >80%. Looking at the overall siding industry, LPX's main competitor is James Hardie (JHX). James Hardie offers fiber cement as a siding alternative and, as the market leader, has a market share of around 17% of the ~$15 billion total market.

Investor Presentation August 2022

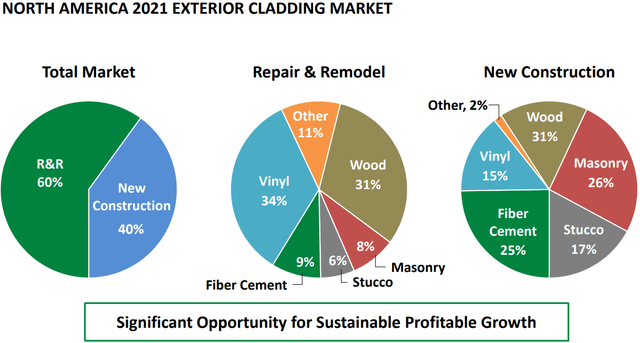

Both companies mainly compete with the substitutes vinyl and wood.

JHX Investor Day 2022 - Day 1 Presentation

Stucco and masonry play a rather minor role in competition due to the low level of comparability of the products.

Over the past decade, engineered wood and fiber cement has gained significant market share from vinyl and wood siding. Wood has been losing market share for several decades because it simply cannot compete with vinyl, engineered wood and fiber cement (due to lower cost, easier installation and easier maintenance). Vinyl had its heyday in the mid 2000s and at that time had about 40% market share. Since then, engineered wood and fiber cement have become increasingly popular and have over time replaced vinyl, meaning that vinyl now accounts for only about 20% of the market according to various estimates. While vinyl has a right to exist as the lowest cost product, engineered wood and fiber cement deliver a better overall value proposition. However, the price competitiveness of vinyl has decreased significantly in recent years, since oil prices have historically been very high and oil as a basis is an important input for vinyl. This may change if oil prices reach lower levels in the future.

As a result, LP and JH offer the most attractive options on the market. Both companies have been subject to a competition for several years as to who can secure the largest share of the pie from wood and vinyl. The leadership even goes so far that some industry experts are drawing comparisons to Coke and Pepsi in the battle between LPX and JH. Either you're there for team Hardie, or for team LPX. In the competition between the two companies, I believe LPX's products offer an advantage over JH's because, on the one hand, the company's products are easier for builders to use and, on the other hand, engineered wood siding is closer to the wood look that is relevant to sales for both products (why should a home builder opt for a fiber cement solution when they could use a more closely engineered wood alternative?). Also, engineered wood siding is more environmentally friendly, but that's another discussion.

The possibility for penetration still exists for a considerable time. With the already-mentioned total market of around $15 billion, vinyl with around $3 billion (20%) of the market and wood (excluding LPX) also with around $3 billion (20%) still offer a potential of several billion USD to penetrate for both companies. To put that in context, LPX currently has a market share of around 10% or USD $1.5 billion in revenue.

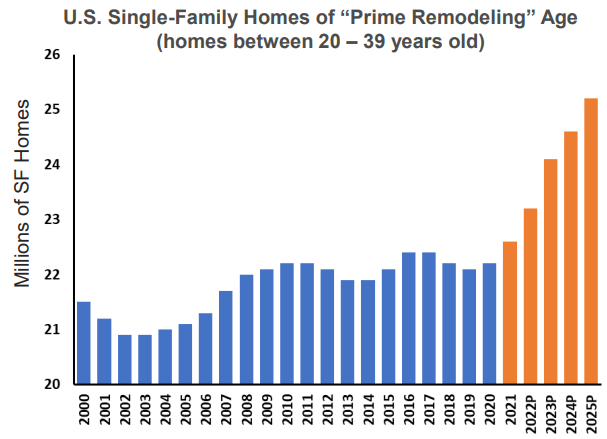

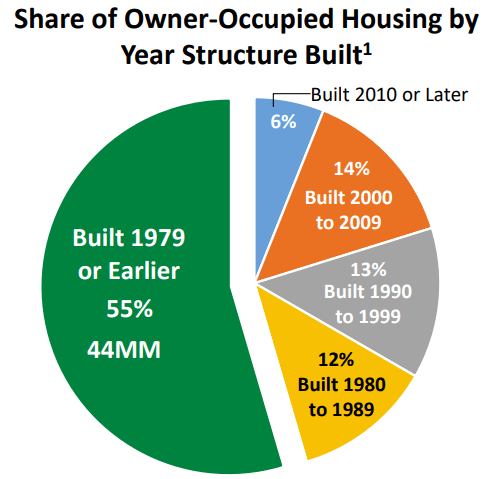

At the same time, in the top-line R&R activity is expected to grow in the low to mid single-digit range, supported among other things by the aging of the North American house inventory, leading to the overall market being subject to structural tailwinds in the coming years.

LPX Investor Presentation August 2022

This graphic also shows this very well.

JHX Investor Presentations

So top down the business is not very cyclical, has a structural advantage and a long path for growth. But what are the underlying economics and how is capital allocated to the business?

Brad Southern recognized the potential of the siding segment very early on. Since taking office as CEO in 2017, he has communicated very clearly in earnings calls that the focus is on the siding segment. This is also reflected in the investment decisions. The siding segment has accounted for 73% of CAPEX spend over the last three years (~$500 million), much of which has gone into expanding the business. The main strategy in recent years has been to convert OSB facilities into siding facilities and thus create capacity. Despite the opportunity costs, this is the economically most attractive option compared to greenfield projects and capacity expansions (e.g. through an additional press).

With a current capacity of around 2.3 billion sqf towards the end of 2023 (spread across 9 facilities), the capacity is currently being expanded by a further 300 million sqf through an expansion of the facility in Houlton in order to increase the capacity to 2.6 billion sqf by mid-2024. The project is being carried out with a rate of return of 30%, which means that at costs of $400 million, an EBITDA of around $120 million is expected. With a capacity of the described 300 million sqf, this means an EBITDA margin of around 50%, with which the facility can operate exclusive of SG&A, marketing costs and other fixed costs. I think that describes the economic underlyings of the segment quite well. LPX currently has two facilities left where a conversion would be economically worthwhile.

Overall, the siding business is currently operating with an ROIC of >30%, so I strongly assume that management will continue to invest heavily in the business.

The profitability of the segment is further enhanced by the relatively recent introductions of new products (between 2019-2022), such as ExpertFinish and the BuilderSeries, but also smaller product groups such as Shakes and ArchForm, as these products are both higher-priced and have higher margins than the existing products. ExpertFinish in particular represents an attractive growth opportunity for the company, since the projects have also a high IRR (the construction of new lines incrementally requires low costs, while the product itself has a very high margin). The product is currently growing at around 60% and is a pre-painted siding variant, which means that the house builder no longer needs a costly painter. The company is very focused on the product and in the long term wants to get the product at 30% of the total capacity of siding (by mid-2024 they will probably be at 15-20%). Accordingly, there is also very heavy investment in this area, with two new siding finishing facilities currently being built (Bath and Washington) and several capacity expansions of existing finishing facilities having recently been carried out. In total, the company currently owns 3 facilities with a total capacity of 170 million sqf, which will be expanded by the new buildings by a further 190 million sqf of capacity, probably by the end of 2024, so a double in increase. The capacity is then planned to be doubled again.

The current EBITDA margin of 23% should therefore increase over time if further projects of this kind are executed and the business is very well positioned to have enough capacity available to meet additional demand.

How about competition? It's very unlikely that other OSB producers will come up with the idea of entering the market. According to statements made by the two largest competitors (West Fraser and Weyerhaeuser) in personal conversations, the main reason is the lack of expertise (siding involves a complicated technology). In addition, there are opportunity costs and project risks (including brand building). The same factors also apply to non-OSB competitors.

So you buy a business with a high ROIC, high pricing power and a high moat that can still grow conservatively in the mid double-digit range in the bottom line for many years to come (resulting from the aforementioned annual mid single digit price increase + expected high single digit to low double digit volume increase + shift to higher margin products).

So how do you value the business?

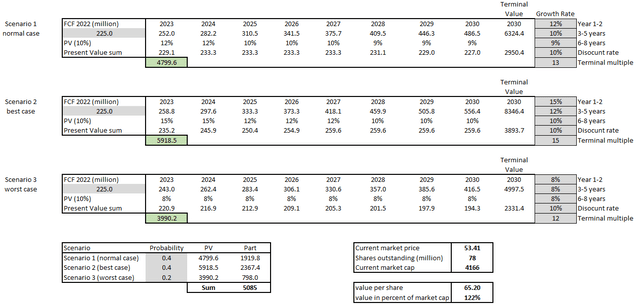

Assumptions

I will value the siding segment based on a DCF model using a three case scenario. Currently the business is able to generate around $200-$250 million FCF. I will use $225 million FCF as a starting point for my calculation, as this represents the average.

Regarding the growth value in the "best case", I use a 15% CAGR in the first two years and assume that growth will slow down over the years. I consider the growth rate to be very reasonable due to the factors mentioned above. In the "worst case", I use a CAGR of 8%. This is based on the assumption that I believe the business is capable of high single-digit growth even in a worst-case scenario due to its structural advantages and TAM opportunity.

Last but not least, I use a FCF multiple of 15x in the "best case" and 12x in the "worst case". Since usually companies with the corresponding growth rates will be valued with an even higher multiple, I consider this to be reasonable.

Siding segment valuation

Based on the inputs above, I obtain a value between $4billion and $6 billion.

So you effectively get the rest of the company for free.

Why do I think this is conservative? Even in an optimistic case, this would mean that LPX would "only" achieve a market share of around 20% in the long term. This is under the assumption that the market stagnates at $15 billion (which I think is very unlikely like I described above) and the FCF margin increases to 18% (from the current estimated 15%), which makes sense due to the shift to higher margin products. So $3 billion in topline sales or just 2x from current sales in 2030 (which means 7% topline CAGR vs. 11.2% CAGR in the last ten years). The segment is a typical hidden asset that has fallen under the radar of investors due to the historical dominance of the OSB segment and has historically received little or no attention. However, this will very likely change in the future as the segment's share of total sales increases and the value of the siding segment becomes more apparent.

South America

The segment is rather insignificant with a sales share of <10%. Based on conservative assumptions, I estimate the value of the business to be around $400-$500 million with a FCF result of around $50 million (2022) and a FCF-multiple of 8-10x:

Author's Calculations

Without going into more detail about the segment, I think this is conservative. Although the segment has only grown at a CAGR of 2.2% in the top line over the last ten years due to political and economic problems in the countries LPX operates, it has been able to achieve EBITDA growth of around 10% CAGR in the bottom line thanks to operating leverage.

Compiled by Author using data from annual reports

LPX Valuation

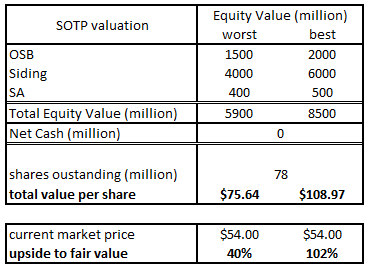

If we put all parts together, we get a sum of the parts valuation of $5.9-$8.5 billion.

Author's Calculations

The valuation implies a margin of safety of around 30-55% at the current market price (or a 40-100% potential upside).

Risks

New housing starts continue to fall (perhaps even to <1 million levels) and remain at low levels for an extended period of time. This would invalidate my thesis, at least in the short term, but would not change the attractiveness of the business in the long term. In the OSB segment, LPX has historically been able to operate profitably with as little as 800k restarts. So even in this case, the company should be able to remain profitable after responding to changes in price and demand.

A competitor is launching a product that will disrupt LPX's siding products or OSB products. I think this point needs to be followed closely. I consider the risk in both segments to be possible, although not very likely in the medium term (especially in OSB as the product has been the standard for the last 50 years). However, this would definitely invalidate my thesis!

Other OSB producers are entering the siding market with competitive engineered wood products. This could pose a greater risk. Even if the barriers to entry are extremely high and its very unlikely, this nonetheless needs to be monitored.

And finally an overestimation of the siding segment. If the siding segment turns out to be less attractive than expected, this also invalidates my thesis.

Conclusion

I think that the market is clearly underestimating the ability of the business to generate cash in the future and also grossly overestimating its cyclicality. The market currently values LPX as a purely cyclical business, although it is relatively clear that this is only the case today to a limited extent. The company is far less susceptible to a bust cycle than in previous periods (Siding and SA are significantly larger, unattractive businesses have been sold or closed and the efficiency of OSB has been increased), while the siding segment in particular offers massive growth potential in the years to come. So you have a very limited downside risk with an attractive upside potential.

In addition, the management makes very good capital allocation decisions (sale of EWP business, very aggressive buyback policy and very good investment and de-investment choices) and acts very strongly in the interests of shareholders, which should further increase shareholder value.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LPX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.