U.S. CPI Report Preview: Dividend Stock Implications

Summary

- The March CPI report is due on Wednesday, April 12th.

- We preview what the report is likely to reveal.

- We then delve into the implications that it could have for dividend stocks and our investing approach.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

Ibrahim Akcengiz

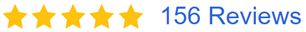

The U.S. March CPI report is due on Wednesday, April 12th and it will be an extremely important one. Inflation appears to have peaked, with every year-over-year reading declining since last July:

However, it still remains far too high at 6.04% year-over-year in the latest reading and the pace of deceleration has slowed in recent readings, implying that inflation is remaining stubbornly high.

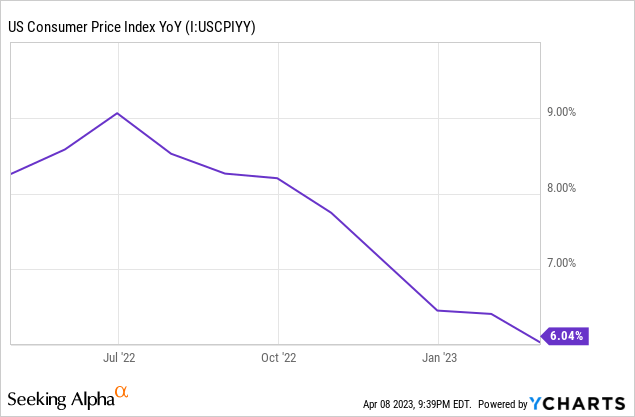

Moreover, month-over-month numbers have also remained stubbornly rangebound, and are in fact up year to date:

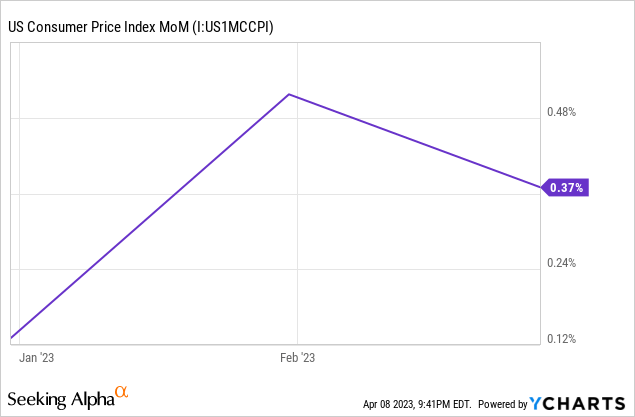

This - in combination with historically low unemployment numbers - appears to imply that the Federal Reserve still has a lot of work to do to finish the fight against inflation:

That said, there are also plenty of reasons for the Federal Reserve to wave the white flag on its war with inflation and pause on interest rate hikes at a bare minimum, and potentially even consider a cut in the near future. March's CPI numbers could go a long way in determining which direction the Federal Reserve ends up going.

In this article, we will preview what the report is likely to reveal and we then delve into the implications that it could have for the Federal Reserve's interest rate setting decisions as well as potential implications for dividend stocks and our investing approach.

March CPI Report Preview

US inflation has not been decreasing as quickly as expected, and the Consumer Price Index data for March, to be released on April 12th, may show estimated inflation of over 5% annually and a fairly modest 0.3% month-on-month increase (3.66% annualized rate) in prices according to some data-driven projections. However, the core inflation rate may be more concerning, with an estimated 0.45% month-on-month increase (5.54% annualized rate) once food and energy are excluded, as energy costs are expected to have fallen, which could help lower headline inflation numbers.

Shelter costs have a significant impact on the inflation calculation and rose over 8% year-on-year in February's CPI report, which could push up the U.S. inflation number. While home pricing is expected to eventually moderate, this has not yet been reflected in the CPI data due to statistical lags in how shelter costs are calculated. Once shelter costs begin to turn, inflation may move closer to the Fed's 2% goal, but it is unclear when this will happen as recent CPI releases show no sign of cooling in shelter costs.

Federal Reserve Implications

Given that the U.S. Federal Reserve will meet on May 3 to set interest rates, the soon-to-be-released March inflation numbers will not be the sole determinant of their decision as other important economic data is expected to be released between now and then. That said, these figures will definitely still have a significant impact given that the April CPI numbers won't be released before that next meeting.

As a result, if March inflation remains strong, the Fed may very well be prompted to consider a 0.25-percentage-point hike, especially if no other major recession warnings flash between now and then. However, if inflation shows real signs of declining and/or other major recession warning signs appear over the next four weeks, it is probable in our view that the Federal Reserve will pause. Already, fixed income markets are pricing in a 60% chance that rates could remain steady at the next meeting.

Dividend Stock Implications

If the Federal Reserve has to continue raising interest rates well into the second half of this year, things could get much more challenging for dividend stocks. For example, the weighted average interest expense coverage ratios among the counterparties in our BDC holdings (BIZD) is already hovering around 1.5x. While this in and of itself is not a problematic number, as the weighted average, it implies that there are quite a few businesses that are close to the 1.0x number. If interest rates continue to rise, we will likely see a noticeable jump in non-accruals from the current very low levels.

Moreover, many recession-sensitive stocks have slumped recently due to concerns of a cooling economy and a possible recession. The drop was exacerbated by evidence that the labor market was cooling, with U.S. job openings recently falling to the lowest level in nearly two years. Factory orders also fell for a second straight month. These data points combine with the recent banking crisis to indicate that the economy is not well.

On top of that, consumer excess savings are expected to be close to zero by the end of 2023, indicating that much of the firepower keeping the economy limping forward at present will be expended. This will be particularly true if inflation remains elevated and the Federal Reserve is forced to continue its current quantitative tightening program in place.

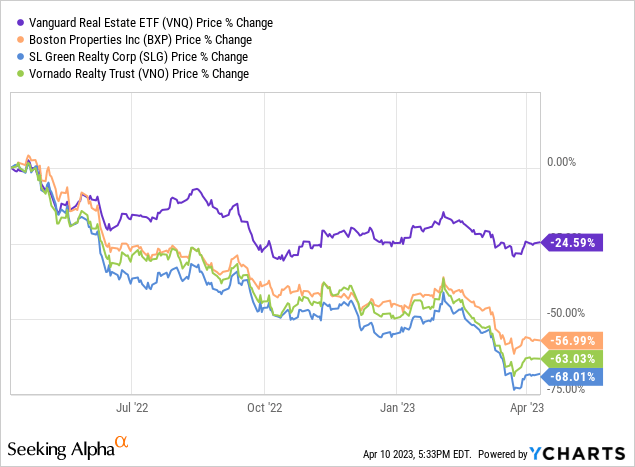

REITs (VNQ) are another sector that can ill-afford further interest rate hikes. With trillions of dollars in commercial real estate debt maturing over the next few years, the refinancing market could turn into a bloodbath for both borrowers and lenders as servicing this debt at current market interest rates will be untenable in many circumstances, especially if we slide into a serious recession. As a result, there will likely be a lot of CRE loan defaults and possibly even some landlord bankruptcies as the sector battles the combination of surplus supply, a very difficult refinancing environment, and an economic downturn. This concern is clearly visible across the sector, and in particular the office REITs like Boston Properties (BXP), SL Green (SLG), and Vornado (VNO):

This trend could also serve as a potential headwind for some of the leading real estate asset managers like Blackstone (BX) and Brookfield (BN)(BAM), as they have already defaulted on some substantial property-level loans.

A high yield sector that should hold up quite well is midstream (AMLP) thanks to the prudent capital allocation decisions made by sector participants in recent years. Leading players like Enterprise Products Partners (EPD), Magellan Midstream (MMP), and Enbridge (ENB) all have very conservative debt maturity schedules along with substantial free cash flow generation. This essentially liberates them entirely from the need to tap the debt markets over the next few years if they don't want to. Even among some of the players with lower credit ratings like Energy Transfer (ET), Antero Midstream (AM), and Plains All American Pipeline (PAA)(PAGP), they are all generating copious amounts of free cash flow and are using it to pay down debt aggressively. As a result, each of these businesses should have only minimal refinancing needs, if any in the coming years.

Of course, if the Federal Reserve pauses its rate hikes at the next meeting and stays there, the pressure on CRE and BDCs will likely not be quite as high, though we will still likely see some distress in both sectors given how high interest rates already are and the already weakening state of the economy. Only a fairly quick reversal towards meaningful interest rate cuts will likely be able to save CRE and BDCs from a meaningful uptick in loan defaults.

Investor Takeaway

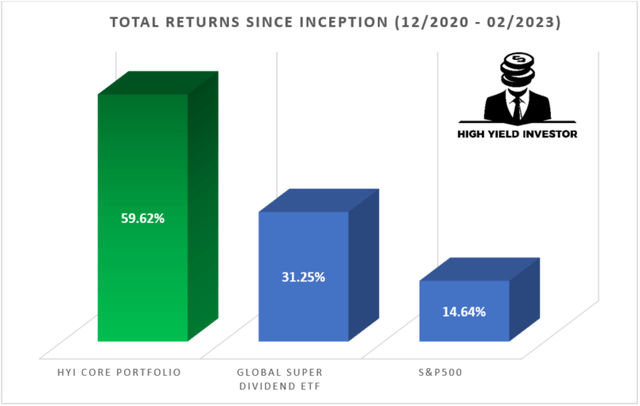

While we do have exposure to CRE and BDCs at High Yield Investor, our approach to both has been very cautious with a strong emphasis on quality assets/underwriting performance, strong investment grade balance sheets, and clear margins of safety in valuations.

Moreover, our exposure has been moderate to both sectors, with only ~7% exposure to each and 14% combined exposure. Meanwhile, we are investing much more aggressively in midstream, with 18% exposure to that sector as well as 8% exposure to precious metals and copper miners with net debt free balance sheets, 28% exposure to defensively positioned utilities and infrastructure businesses, and significant investments in other businesses that are positioned to profit from market crashes and/or defensive against recessions.

While we do expect a recession to hit in the very near future and expect the Federal Reserve to pause its interest rate hikes at the next meeting, we also believe that inflation will remain stubbornly high for the foreseeable future. As a result, we believe that businesses poised to thrive in deflationary environments - such as midstreams and gold miners (GDX) - are some of the best places to invest at the moment, especially given that they can still be purchased at attractive valuations.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a $251 discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAM, ET, EPD, VNO.PM, PAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.